Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Start Your Own Retirement Plan

When youre an employee, you can only use a 401 plan if your employer establishes a plan and youre eligible to contribute. All too often, thats not the case. But you still have options.

Ask for a 401: Your employer might be willing to set up a 401 they just havent done it yet. Start the conversation by asking why there isnt one, why you want one, and that there are potential tax benefits for employers. Explain that valuable employees like yourself would be even more valuable with excellent benefits. Offer to do some of the legwork required to get the plan up and running. In some cases, especially with small organizations, your employer simply doesnt have time to set up a plan. Cost is another factor companies and small nonprofits might be hesitant to pay plan costs . If cost is the primary concern, discuss less-expensive options like SIMPLE plans. Only time will tell if itll actually happen, but it never hurts to ask.

IRAs: If you dont have a 401, you may still be able to save in an individual retirement account , and you might even receive tax benefits similar to a 401. Unfortunately, the IRS sets maximum annual limits much lower for IRAs. Still, something is better than nothing. Evaluate traditional IRAs for potential pre-tax saving, and Roth IRAs for possible tax-free withdrawals . Another drawback of IRAs ) is that you may need to qualify to make contributions or receive a deduction. Speak with a tax expert before you do anything.

Making The Most Of Your 401

If youâve started putting money into your 401, congratulations! You already made it past the hardest part, which is getting started. But donât just set it and forget it. Youâve also got to keep your money growing. These tips can help.

Commit to raising your contribution periodically. Even just raising your contribution by 1 percent every six months or year can help, and itâs unlikely youâll miss that amount from your paycheck, especially if you up your contribution whenever you get a raise. Some 401 plans even let you schedule an increase automatically.

Earmark portions of your raise or bonuses for retirement. If you receive a promotion that bumps your pay by, say, 5 percent, consider raising your contribution amount by the same percentage. Or if youâre expecting a big year-end bonus, consider sending some of that to your 401 for a one-time boost. Your future self will thank you.

No investment strategy can guarantee a profit or protect against loss. All investing carries some risk, including loss of principal invested.

This article is not intended as legal or tax advice. Northwestern Mutual and its financial representatives do not give legal or tax advice. Taxpayers should seek advice regarding their particular circumstances from an independent legal, accounting or tax adviser.

This article was updated May 7, 2019.

Recommended Reading

Recommended Reading: How To Find 401k From Previous Employer

There Are Contribution Limits For 401s

The IRS sets an annual limit on how much money you can set aside in a 401. That limit can change because it is adjusted for inflation. For 2021, you can put away $19,500. Those 50 or older by year-end can contribute an extra $6,500. Check out the Financial Industry Regulatory Authority’s 401 Save the Max Calculator, which will tell you how much you need to save each pay period to max out your annual contribution to your 401. If you cannot afford to contribute the maximum, try to contribute at least enough to take full advantage of an employer match .

You Can Roll Over A 401 Account

Workers generally have four options for their 401 when they leave a company: You can take a lump-sum distribution you can leave the money in the 401 you can roll the money into an IRA or, if you are going to a new employer, you may be able to roll the money to the new employer’s 401.

It’s usually best to keep the money in a tax shelter, so it can continue to grow tax-deferred. Whether you roll the money into an IRA or a new 401, be sure to ask for a direct transfer from one account to the other. If the company cuts you a check, it will have to withhold 20% for taxes. And whatever money isn’t back in a retirement account within 60 days will become taxable. So if you don’t want that 20% to be considered a taxable distribution, you’ll have to use other assets to make up the difference.

Recommended Reading: Can An Llc Have A Solo 401k

How Much Money Can You Use

One of the major differences between a 401 loan and a ROBS is the amount of money you can use. With a 401 loan, $50,000 is the maximum you can borrow. With a ROBS, on the other hand, $50,000 is the minimum you have to take out of your retirement account. Therefore, your choice between these two 401 business financing options will largely depend on the amount of money that you have in your retirement account and the percentage that youre willing to put toward your business.

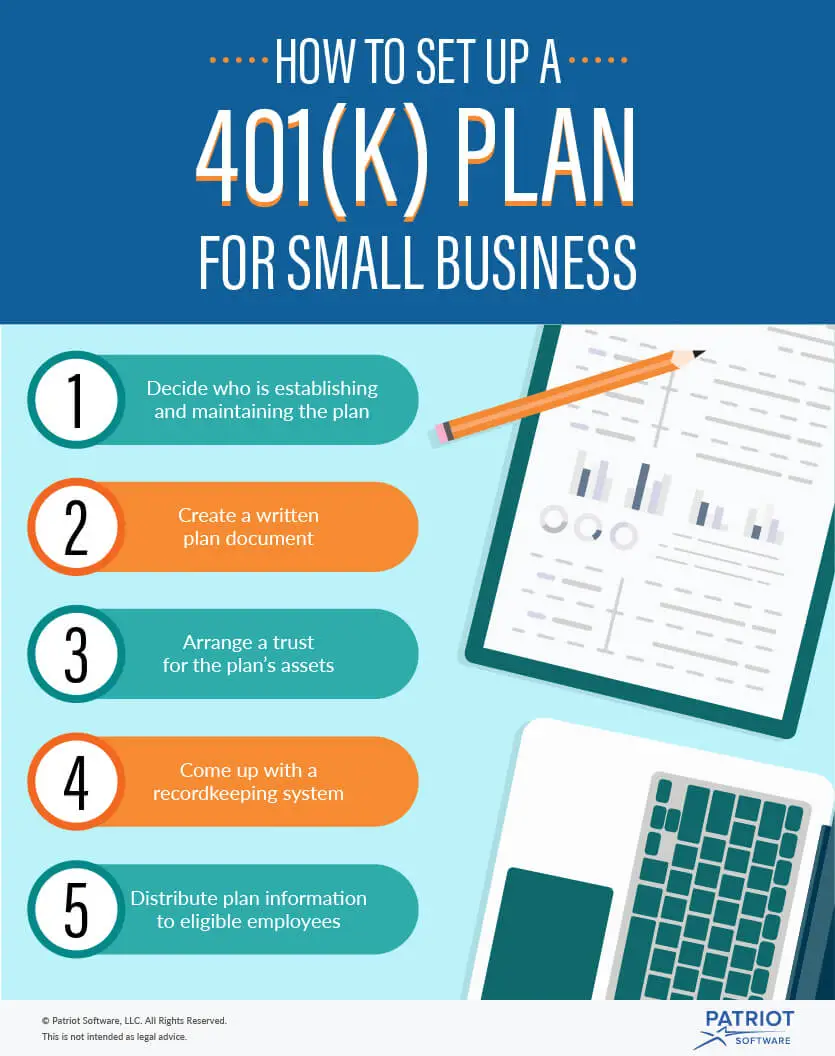

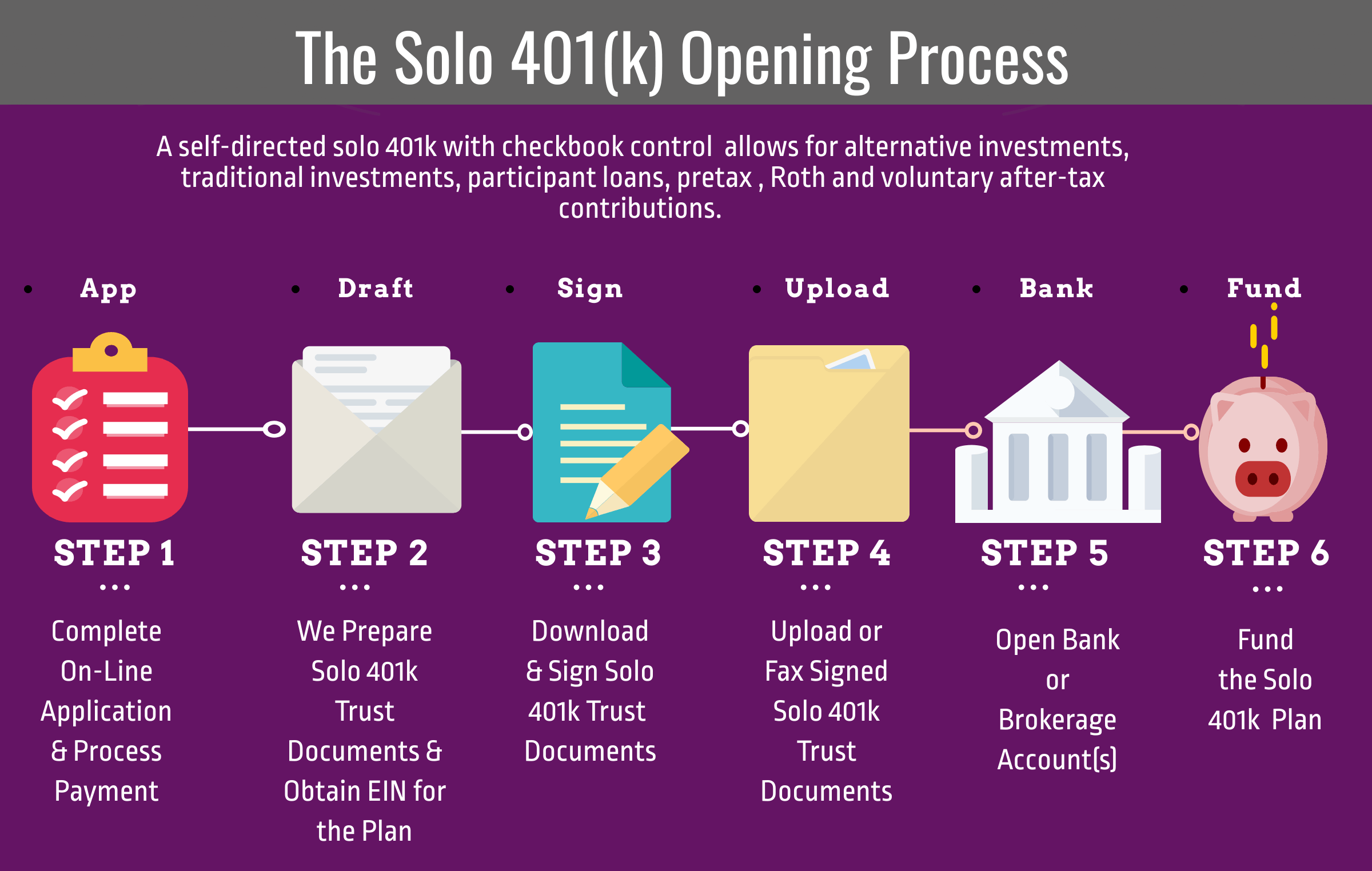

Research Retirement Options For Your Business

It’s important to do your due diligence in researching firms that provide recordkeeping and third-party administration services for 401 plans. As you assemble your list, include a range of established, reputable mutual fund companies, brokerage firms, and insurance companies. Focus on providers that can serve you and your employees long-term with extensive resources and excellent customer service.

You may also want to hear from owners of businesses that are similar to yours, as they may be able to offer insights from their own experiences selecting 401 plan service providers.

Also Check: How Does A 401k Retirement Plan Work

What To Watch Out For With Solo 401s

Consider the following drawbacks of solo 401s to see if its the right retirement account for you:

- No employer contributions. With employer-sponsored 401s, some employers will match your contribution. But solo 401s dont have this option for these extra savings all the money comes directly from your paycheck.

- Continual compliance. To maintain your solo 401, youll always need to demonstrate profit or the potential to earn income. And youll never be able to hire employees, which may impact a growing business.

- Contribution limits. Even if you have a solo 401 for a side gig separate from your full-time job, you cant max out your 401 contributions twice.

- High fees. Total plan fees can range anywhere between 0.37% to 1.42%, which can eat into the tax benefits of a 401.

- Early withdrawal penalties. Unlike brokerage accounts, a 401 plan charges an extra 10% tax if you withdraw before age 59 1/2. The only exception is if you can demonstrate financial hardship.

Do Not Get Carried Away With Your Companys Stock

While its smart to take advantage of discounted employee stock purchase plans, you shouldnt dedicate more than 10% to your retirement portfolio.

In fact, your portfolio should not be heavily concentrated in any one particular stock. But if you lean too heavily on employer stock, you could suffer a significant investment loss if your company goes bust.

You May Like: How To Contribute To 401k Without Employer

Employer Matching Contributions May Be Limited

Many people think they can still take full advantage of an employer match late in the year, by contributing larger sums of money in just a few months. But many 401 plans calculate matching on a per-pay-period basis. For these plans, your matching contribution is calculated based only on that pay periods contributionnot the whole year.

Lets look at an example:

Adams Apples sets up a 401 plan to start November 1, with 4 pay periods left. They provide a dollar-for-dollar match up to 5% of an employees pay. Adam makes $250,000 and contributes 5% of his pay, $12,500. It seems like Adam should get $12,500 in employer matching as well. But if its a per-pay-period match, Adam will only get a match during the pay periods he contributes. Since there are only 4 pay periods, he would only get $2,083 in matching contributions.

If you start your plan on January 1, you can generally avoid this confusion for your employees and prevent a lot of unintended miscommunication. Most employees tend to spread their contributions throughout the year to keep things manageable. Be sure to also inform your employees of how the per-pay-period match works, even if its January, so that the certain strategic employees understand not to front or backload their contributions for the full year!

How Much Should An Employer Contribute To The Plan

The amount you as an employer decide to contribute is entirely up to you. As you make this decision, consider the tax savings you can receive for making employer contributions. Employer matches are tax-deductible on federal corporate income tax returns, and some administrative fees associated with managing a 401 plan are tax-deductible as well.

You can match as much as you want as long as it stays within the IRS limitations, which combine both employer and employee contributions. According to the IRS, this combined total is the lesser of 100 percent of an employee’s compensation or $61,000 for 2022, not including “catch-up” elective deferrals of $6,500 for employees age 50 or older.

Also consider factors such as the positive impact a matching contribution can have on employee morale and worker retention strategies. Given the steep costs of hiring and training new employees, an employer match offers the opportunity to truly invest in your workforce. These considerations may help guide your decisions about how much to contribute to the 401 plan.

You May Like: How Much Should I Put In 401k

Use A 401 Business Loan To Finance A Business

If youre looking into using a 401 to start a businessâor finance an existing oneâyou might consider getting a 401 business loan, especially if you need less than $50,000 in financing and plan to stay employed for the time being. What is a 401 loan?

If your 401 or other eligible retirement plan allows loans, then the IRS permits you to borrow up to half of your vested balance, or $50,000âwhichever is less. This amount you borrow, therefore, is your 401 loan, which can be used for any eligible purpose, including business purposes. With this loan, you will be charged interest, however, since youre borrowing from your retirement plan, youre actually paying the principal and interest back to yourself.

The key with this type of 401 business financing, though, is that you have to remain employed and enrolled in your employer-sponsored retirement plan while the loan is outstanding. If you lose your job or decide to leave, youll have to pay back the full loan within two months. This being said, for most entrepreneurs, a 401 loan isnt practical unless theyre considering starting a business as a side gig for a while. In fact, most people use 401 loans not for business, but for personal expenses, such as medical bills or home renovation costs.

Changing With Other Benefits Keeps Things Clean

Finally, sometimes it just makes sense to start a new benefit at the start of the new year. Many companies switch benefits providers or start new benefits on January 1 of any given year. Your employees will appreciate being able to learn about their health, retirement, and other benefits all at once, and not have to remember different start dates for different benefits.

There are many reasons why a January 1, start to your 401 makes sense, but that doesnt mean you have to wait until the last minute to set one up. Guideline can help you with all the details several weeks before the plan starts, so that you wont be rushed through the process. Contact us at or 228-3491 to get started.

Recommended Reading: When Can You Start Withdrawing From 401k

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

Take Advantage Of Professional Advice

In a 2014 Schwab Retirement Plan Services survey, 70% of participants said theyd be very or extremely confident in making 401 investment decisions with professional help. That compares to only 39% who felt that same confidence in making decisions on their own.

But its not just a matter of feeling safeits being safe as well. Weve also found that nine out of 10 advice takers stayed the course during the 2008 financial crisis, says Catherine Golladay, Schwabs Vice President of 401 Participant Services. As a result they were well positioned to take advantage of the market recovery.

You can find advice in different places. You can start by attending seminars put on by your 401 plan administrator or using a free app like Personal Capital to screen your portfolio and get suggestions.

As your savings grow, you might consider hiring your own financial advisor who can help you plan your financial future as well as making investment recommendations. Or, again, consider the affordable 401k optimization tool, blooom.

is another great option if you want to balance the advantages of personalized investing strategies with the cost-saving features of robo-advisors. Wealthfront will automatically build you a personalized portfolio with diversified, low-cost index funds. You can also customize your portfolio yourself and invest in socially responsible funds, healthcare, technology, clean energy, and more.

Don’t Miss: How To Select 401k Funds

Why Should I Open A 401 Account

Lets start with this major question. Whats the purpose of a 401 and why should we open one? 401 plans are a great way to save for retirement because of the tax advantages. They have higher contribution limits than an Individual Retirement Account , and they dont have income limits like IRAs have. Often, 401 plans offer a Roth option, which allows you to grow your retirement savings tax-free regardless of your income.

There are so many benefits to 401 accounts. If you have access to one or can open one, it is a great tool to use! Read here for 8 401 benefits you might not know about to learn more about the many benefits 401 plans offer.

My Business Is My Nest Egg

The second most popular way small business owners secure funding to start their business is through a retirement account rollover as a business start-up . But its not enough to rely solely on your business to meet your retirement goals. Consider the following:

-

According to the U.S. Small Business Association , business owners over the age of 50 are less likely to have well-funded retirement funds than their employees: the majority of their wealth remains invested in their business.

-

What if the business doesnt sell? Some studies show that 12 million business owners nearing retirement entered the market looking to sell their business. However, 75% of these could not sell at the asking price, forcing business owners to sell at a discount or close and find employment elsewhere.

Dont leave retirement to a what if? Business owners now have options that allow them to build their retirement savings while they build their business. Theres no need to compromise either.

Recommended Reading: Can You Roll Over 403b To 401k

Read Also: Can I Transfer 401k To Roth Ira

Choose A Plan For Your Employees

Once you’ve chosen a retirement services provider, it’s time to decide on a plan that fits both your business and your employees’ needs. Options available to employers regardless of size, including businesses with only one employee, include:

1. A traditional 401 plan, which is the most flexible option. Employers can make contributions for all participants, match employees’ deferrals, do both, or neither.

2. The safe harbor 401 plan, which has several variations and requires the company to make a mandatory contribution to the plan participants. The contributions benefit the company, the business owner, and highly compensated employees by giving them greater ability to maximize salary deferrals.

3. An automatic enrollment 401 plan, which allows you to automatically enroll employees and place deductions from their salaries in certain default investments, unless employees elect otherwise. This arrangement encourages workers to participate in the company 401 plan and increase their retirement savings, which also benefits business owners. Automatic enrollment plans may also contain a safe harbor provision.

Always Maximize Your Employer Match

In theory, no one would turn down free money. But thats exactly what many Americans do when they drop the ball on matching retirement funds when an employer offers them.

Many employers will match 50% of money that you, the employee, puts into your 401, up to a specified maximum percentage of your salary.

Ignoring this benefit by either not opting into your 401 or failing to contribute the maximum your employer will match is literally leaving a portion of your salary on the table.

Read Also: How To Borrow Money From 401k To Buy A House