S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

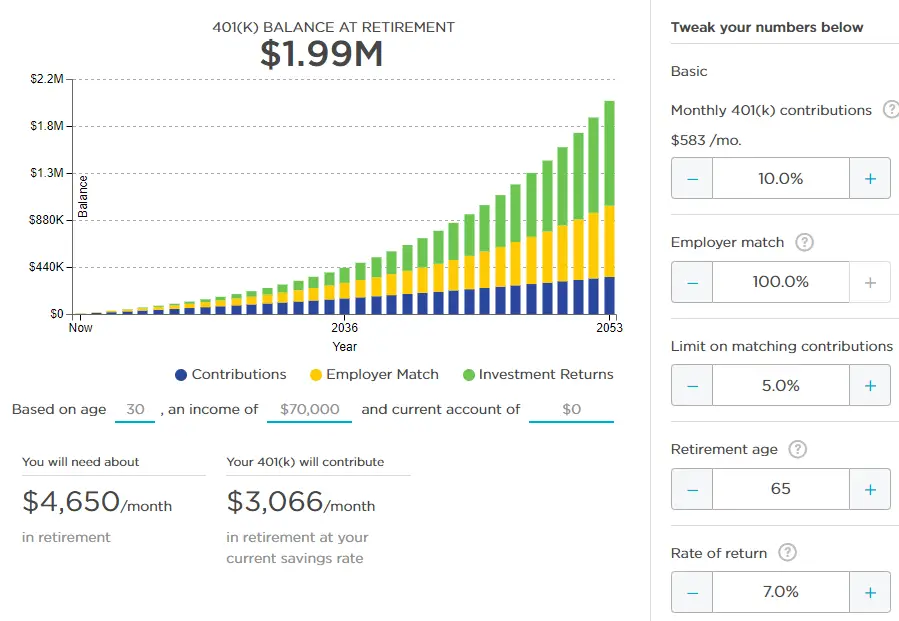

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the “Calculate” or “Recalculate” button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

- Years invested

- Your initial balance

You may change any of these values.

Using the calculator

In the following boxes, you’ll need to enter:

Salary

- Your expected annual pay increases, if any.

- How frequently you are paid by your employer.

Contribution

- The amount of your current contribution rate .

- The proposed new amount of your contribution rate. Be sure to verify the maximum contribution rate allowable under your plan. Also, pre-tax contributions are subject to the annual IRS dollar limit.

Pre-tax Contribution Limits 401, 403 and 457 plans |

|

|---|---|

| 2020 | |

| After 2020 | May be indexed annually in $500 increments |

Employer Match

Investment

- The length of time that you anticipate you will invest this money.

- The amount of your current account balance.

- Your hypothetical assumed annual rate of return.

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employerâs plan. Amounts that are retained in a former employerâs 401 plan or transferred to another employerâs plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Also Check: How To Set Up 401k Without Employer

Perks For Older Investors

If you happen to be at least 50 years old, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $27,000 in 2022. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $67,500 in 2022, or $6,500 more than the $61,000 maximum for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

Read Also: Can I Transfer My Work 401k To A Roth Ira

Max 401 Contribution Limits

A 401 is a common type of retirement account in which you contribute savings that come out of your paycheck before you pay income tax. Most commonly, employers sponsor an employees 401. However, sole proprietors, independent professionals, and other small business owners with no employees except for a spouse may qualify for a self-employed 401.

Even if youre new to investing, a 401 offered through your employer is a powerful, simple way to put money away for your retirement. And each year, participants in these plans can save up to the max 401 contribution established by the Internal Revenue Service . The IRS increased contribution limits in 2022 for 401 plans and more. Heres what you need to know.

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Read Also: How Much Should I Have In My 401k At 60

Traditional 401s Vs Roth 401s

A 401 works best for someone who anticipates being in a lower income tax bracket at retirement than they’re in now. For example, someone currently in the 32% or 35% tax bracket may be able to retire in the 24% bracket.

Employers have been increasing tax diversification in their retirement plans by adding Roth 401s. These accounts combine features of Roth IRAs and 401s. Contributions go into a Roth 401 after you have paid taxes on the money. You can withdraw contributions and earnings tax- and penalty-free if you’re at least age 59 1/2 and have owned the account for five years or more. You’ll also be required to take minimum distributions from a Roth 401 once you turn age 72. However, you might be able to avoid RMDs if you can move the money from a Roth 401 into a Roth IRA, which isn’t subject to required minimum distributions.

and a Roth 401, the total amount of money you can contribute to both accounts can’t exceed the annual limit for your age, either $20,500 or $27,000 for 2022. If you do exceed it, the IRS might hit you with a 6% excessive-contribution penalty.)

Your 2022 Roth Ira Contribution Plan

Before you go all in with your Roth IRA, make sure you are not leaving money on the table anywhere else. For instance, if you have a 401 and your employer matches contributions, you should consider contributing enough money to get the full match.

After you’ve assessed your full financial situation, determine your contribution amount to your Roth IRA. You can break that amount up into several months to make your goal more digestible. If you decide to contribute $6,000, you can contribute $500 to your account for 12 months to achieve your goal.

Before you set your contribution goal, check to ensure your income for the year falls within the allowed range.

Don’t Miss: How To Get Money From My 401k Plan

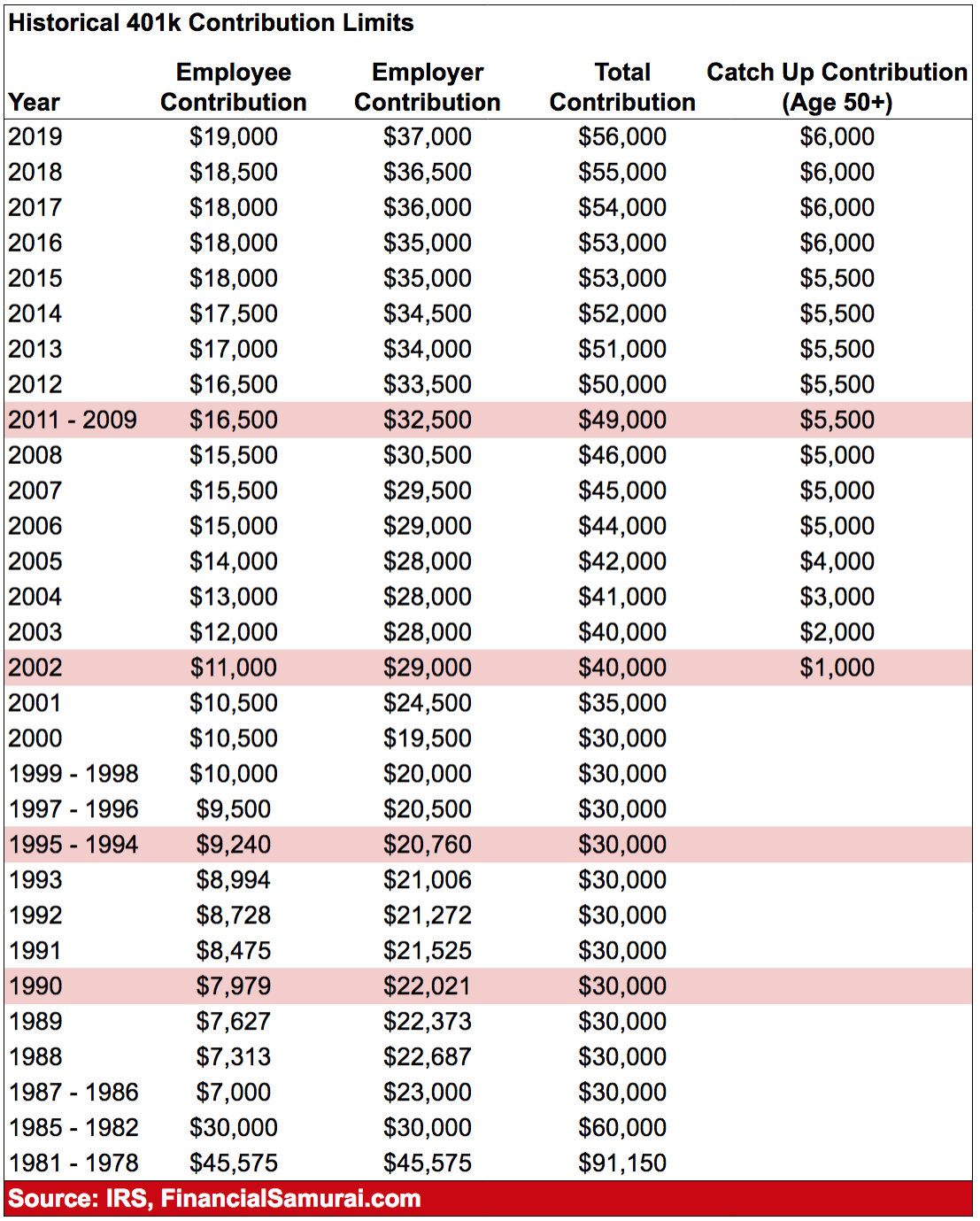

New 401 Contribution Limits For 2022

Retirement savers are eligible to put $1,000 more in a 401 plan next year. The 401 contribution limit will increase to $20,500 in 2022. Some of the income limits for 401 plans will also increase.

Heres how the 401 plan limits will change in 2022:

The 401 contribution limit is $20,500.

The 401 catch-up contribution limit is $6,500 for those age 50 and older.

The limit for employer and employee contributions will be $61,000.

The 401 compensation limit will climb to $305,000.

The income limits for the savers credit will increase to $34,000 for individuals and $68,000 for couples.

Pay attention to these new 401 rules when making retirement savings decisions for 2022.

The 2022 401 Contribution Limit

The contribution limit for 401s, 403s, most 457 plans and the federal governments Thrift Savings Plan is $20,500 in 2022, up from $19,500 in 2021. You can take advantage of the higher contribution limit by contributing up to about $83 more per month to your 401 plan beginning in 2022.

The main thing for employees to know at the beginning of the year is what their maximum allowable contribution is, says Eric Maldonado, a certified financial planner for Aquila Wealth Advisors in San Luis Obispo, California. Then update your percentage or dollar-based employee deferrals to automatically fund your 401 each pay period.

The 2022 401 Catch-Up Contribution Limit

The 2022 401 Limit for Employer Contributions

The 2022 401 Compensation Limit

More from U.S. News

Change In Business Name Affect On Contributions Question:

You can still setup the solo 401k in 2021 under your sole proprietor business. Next year in 2022, we can update the plan to list the new self-employed business. All else would remain the same . The 2022 annual solo 401k contributions would be based on your new self-employment income and you would have until 2023 to make those contributions.

Also Check: What Happens With 401k When You Quit

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Also Check: How Much In 401k To Retire

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Recommended Reading: How To Find 401k From Previous Employer

How Much Can Married Couple Put In 401k

How much can married couple put in 401k? If you and your spouse are both working and the employer provides a 401, you can contribute up to the IRS limits. For 2021, each spouse can contribute up to $19,500, which amounts to $39,000 annually for both spouses.

What is the maximum 401k contribution for 2020 for married couple over 50? For taxpayers 50 and older, an additional $6,500 catch-up amount brings the total to $27,000. The $20,500 limit also applies to 403 and most 457 plans. Contributions to IRAs remain limited to $6,000. Also unchanged: the $6,500 catch-up limit on 401 plan contributions for those 50 and older.

Can married couple combine 401k? No, spouses cannot combine retirement accounts. However, a spouse can be named as a beneficiary of your account, which can be rolled into their own IRA in the event of your death.

What is the max 401k contribution for 2020? The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal governments Thrift Savings Plan is increased from $19,000 to $19,500. The catch-up contribution limit for employees aged 50 and over who participate in these plans is increased from $6,000 to $6,500.

Calculate Your Future Earnings Potential

Let’s say you start contributing to a Roth IRA in 2022 and consistently contribute $4,000 every year. If you’re 21 years old and earn an average investment rate of return of 8%, you’ll have a little over $1.03 million in your account before you turn 62 .

However, if you consistently contribute at least $6,000 to your Roth IRA, you could end up with $1 million sooner. By the time you reach 57, you would have accumulated $1.03 million.

Play around with different investment return percentages and time frames to see what it would take to get to $1 million. If you contribute the maximum amount to a Roth IRA every year, you’ll increase your chances of success. You’ll also have more money available in your account to invest in your favorite assets, such as growth stocks, dividend-paying companies, or low-cost index funds.

Read Also: How Much Can You Put In 401k

Real Estate Investing Suggestions

In addition to aggressively investing in your 401k, I highly recommend investing in real estate. Real estate is my favorite asset class to build wealth. Real estate provides shelter, produces income, and is a tangible asset. You cant live in your stocks, but you can in your properties.

If youre interested in a hands off approach to real estate investing, consider investing in a publicly traded REIT or in real estate crowdfunding.

My favorite two real estate crowdfunding platforms are:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Which Is Better A 401k Or 457

For most, the answer is your 401k. This is because employers usually do not match funds that are contributed to a 457 plan. Also, most people plan to retire after the age of 60. Therefore, the is no penalty for withdrawals from their 401k.

With 457 plans you may have limited investment options, which might also carry higher fees compared to your 401k choices. However, 457 plans have a unique option to take early withdrawals, penalty-free.

For us in the FIRE community, this means having access to your money a lot sooner. We dont plan to work until we are 60 or older, so the 457 plan benefits may outweigh the benefits of a 401k.

This is also highly dependent on the investment options that are available in both accounts. I would suggest carefully considering the investment options and fees of both accounts, then making a decision that makes sense for you and your family.

Lastly, take a look at how the IRS explains it if you want to go directly to the source!

If you qualify for both a 401k and 457 you can now create your scenario, but first I highly recommend reading Using a 457b Plan: Advantages & Disadvantages.

In that article, I detail exactly how to take full advantage of a 457 plan and how to avoid some of the pitfalls.

If you are still unsure, it might be time to reach out to a fee-only advisor for professional advice.

The peace of mind knowing you have a professional on your side helping you can significantly outweigh the costs.

Don’t Miss: How To Transfer 401k After Leaving Job

Should I Have Both A 401k And Roth Ira

Investing in both a 401 plan and a Roth IRA offers the perfect combination of tax savingssome now and some in the future. Roth IRA contributions are made with after-tax dollars, so theres no conflict between this type of plan and a 401, which is funded with pre-tax dollars.