Matching Contributions For A Roth 401

If you choose to save money in a Roth 401, matching contributions must be allocated to a separate traditional 401 account. This is because IRS rules require you to pay regular income tax on employer contributions when they are withdrawnand Roth 401 withdrawals arent taxed in all but a few cases.

Remember, with a traditional 401 account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth 401 account, your contributions are made using after-tax dollars, and qualified withdrawals are generally tax free.

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Read Also: Can I Buy Individual Stocks In My 401k

S To Max Out A 401 & What To Do After Maxing Out

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

There are a number of retirement accounts that allow you to save and invest toward your retirement goals, but one of the most common in the U.S. is the 401. As of September 2020, 401k plans in the U.S. held an approximate $6.5 trillion in retirement assets, according to the Investment Company Institute.

An employer-sponsored 401 retirement account allows both you and your employer to make contributions. When you set up a 401k, you can opt to have a certain amount of your paycheck go directly to your 401k, and sometimes an employer will match employee contributions up to a certain percentage or dollar amount.

To max out a 401 for 2021, an employee would need to contribute $19,500 in salary deferralsor $26,000 if theyre over age 50. Some investors might think about maxing out their 401 as a way of getting the most out of this retirement savings option. Heres what you need to know about the benefits of maxing out a 401, any potential drawbacks, and exactly how to do it.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Recommended Reading: Where Can I Cash A 401k Check

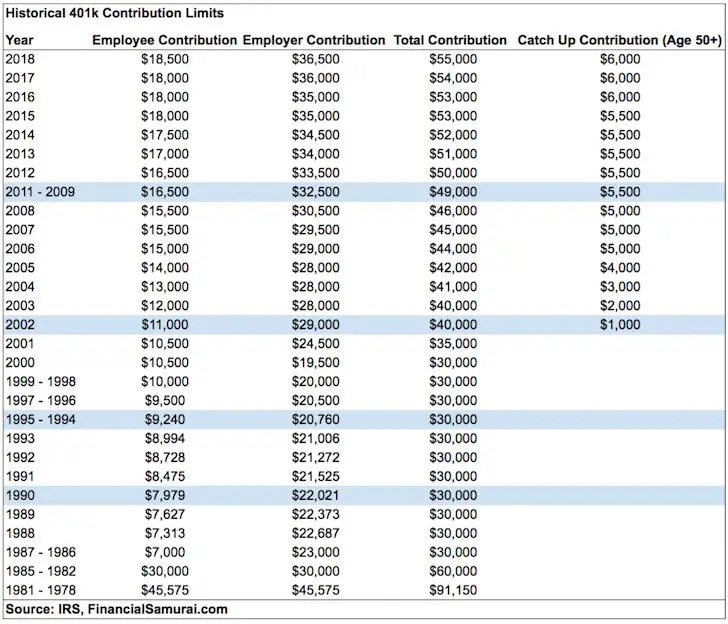

And 2018 401k Contribution Limits

In the 2017 tax year, the contribution limit per year per person was $18,000, meaning you could not contribute more than that total in the year 2017 to your 401k. The figure went up to $18,500 for 2018, and it may increase again in the future to account for inflation.

For example, if you make $200,000 per year and contribute 10 percent of each paycheck’s pretax dollars, you’ll be over the limit, as your contributions would reach $20,000 for the year. Your plan will stop taking contributions after you reach $18,500. However, if you turned 50 during the calendar year or you are over 50, you may be able to make additional contributions depending upon the type of 401k plan and how much you’ve already contributed. These “catch up” contributions are $6,000 for traditional and safe harbor 401k plans or $3,000 for SIMPLE 401k plans.

Importantly, your 401k contribution limit only applies to your contributions, not to your employer’s matching contributions. If you contribute the max $18,500 from your pay in 2018, your employer’s additional contributions are still permitted.

References

Plan Compensation For A Self

To calculate your plan compensation, you reduce your net earnings from self-employment by:

- the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and

- the amount of your own retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

You use your plan compensation to calculate the amount of your own contribution/deduction. Note that your plan compensation and the amount of your own plan contribution/deduction depend on each other – to compute one, you need the other . One way to do this is to use a reduced plan contribution rate. You can use the Table and Worksheets for the Self-Employed to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself.

Read Also: How To Transfer 401k From Fidelity To Vanguard

Contribution Limits For Employer Matching And Highly Compensated Employees

Some employers will match contributions to a 401 account, up to a certain point. For instance, your employer may match 50% of your contributions up to 5% of your total salary. These matching contributions dont factor into the $20,500 standard contribution or $6,500 catch-up contribution limits, though. However, there is an overall limit for matching contributions. In 2022, that ceiling is the lesser of $61,000 or 100% of the employees salary.

The IRS has a specific tax status called highly compensated employee, or HCE. According to the IRS website, the 2022 requirements for an HCE go as follows:

- Over the previous year, the employee earned $135,000 or more OR

- The employee owns more than 5% of the interest in the business at any point during the current or preceding year, regardless of compensation

While there are no explicit differences in the way the IRS limits the 401 contributions of HCEs, the 401 plan they utilize must meet some standards. The IRS determines this by testing the plan to ensure that it does not favor HCEs in any way. Should this process uncover that the plan is, in fact, treating HCEs and non-HCEs differently, there may be limits placed on the contributions of those HCEs.

Calculate 401 Future Value And Retirement Income

This 401 Retirement Calculator will calculate how much your 401 will be worth by the time you reach the age you plan to retire.

The calculator includes options for factoring in annual salary increases and employer matching contributions. You can also print out printer-friendly reports for any number of what-if scenarios.

Finally, the calculated results include a year-by-year salary, contribution, and balance chart, plus a written summary.

If you want to see how your 401 fits within your overall retirement needs I suggest you visit the comprehensive Retirement Plan Calculator.

Save Your Raise? What a Great Idea!

What led to the creation of this calculator was the following excerpts from an email I received from a visitor to the site.

I have searched the web over for something I thought would be there but isnt. I work at a large company where we are encouraged to save our raise by upping the % we contribute to our 401K each year. With save your raise being such a common slogan, I would think that a calculator that helped you realize the benefits of doing that would be out there. I would love to see one. Trey

Of course, the first thing I realized after receiving the email is that I didnt have a 401 calculator on the site, much less have one with a Save Your Raise feature.

Thank you, Trey, for taking the time to submit your valuable and enlightening request.

Recommended Reading: How Much Can I Put In A 401k A Year

Is 401k Worth It With Matching

Savers can meet their retirement goals with the help of employer matching. Experts recommend saving 15% or more of your pre-tax income for retirement, and the average employer 401 match reached 4.7% of an employees salary last year, according to Fidelity. But some experts still think 401s are overrated.

How Can I Take Advantage Of 401 Matching

401 matching is designed to be easy to take advantage of. All you have to do is make contributions to your 401 and youll get extra money from your employer automatically.

If you want to max out the benefit, make sure that youre contributing enough to get the full match that your employer offers. If you get a 50% match, thats like earning a 50% return on investment immediately and with no risk. Youll be hard-pressed to find a better deal elsewhere.

Even if your employers 401 has high fees, it is worth contributing up to the matching limit for the immediate return. Once youve hit the matching limit you can consider whether other savings strategies, such as opening an IRA may be better for you.

If youre concerned about how fees will affect your retirement plans, take a look at Personal Capitals Retirement Fee Analyzer.

401 matching is like getting more money from your employer for free. Taking full advantage of this benefit can make a huge difference in the size of your nest egg and the security of your retirement.

You can run your own numbers on InvestmentZens 401 calculator to see how 401 matching can help your retirement.

Also Check: How To Borrow Money From 401k Fidelity

Also Check: How To Find My 401k From Previous Employer

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Benefits Of Maxing Out Your 401k

- A 401k is a tax-advantaged account. If you choose a traditional 401k, you wont pay taxes until retirement. If you opt for a Roth 401k, youll pay taxes now but not on withdrawals in retirement.

- 401ks offer opportunities for automated savings. Often, 401k contributions are automatically withheld from your paycheck and deposited in a retirement account. This means you never miss the money in your paycheck.

- The 401k sometimes comes with an employer match. This means that in addition to your contributions, your employer contributes a certain amount to your retirement savings. If youre not able to max out your 401k, consider at least contributing enough to get your employer match. This money represent a risk-free return on investment its the closest thing there is to a free lunch.

Also Check: What Is The Difference Between Annuity And 401k

How Do I Maximize My Employer 401 Match

Many employees are not taking full advantage of their employer’s matching contributions. If, for example, your contribution percentage is so high that you obtain the $20,500 limit or $27,000 limit for those 50 years or older in the first few months of the year then you have probably maximized your contribution but minimized your employer’s matching contribution.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

How Solo 401 Contribution Limits Work

If youre a self-employed individual, you must calculate the maximum amount of elective deferrals and nonelective contributions you can make. When figuring out your contribution, your compensation is your earned income, or, your net earnings from self-employment after deducting both:

-

Contributions for yourself

-

One-half of your self-employment tax

Keep in mind that self-employed individuals must often pay the employer costs associated with 401 plans, typically including a one-time start-up fee, as well as a monthly account maintenance fee. You must also pay fees on the specific stocks and bonds you purchase with your 401 investments .

For more information, refer to the IRS table and worksheets found in Publication 560, Retirement Plans for Small Business.

Also Check: How To Do Your Own 401k

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

Also Check: How Do You Take A Loan Out Of Your 401k

Put Bonus Money Toward Retirement

Unless your employer allows you to make a change, your 401 contribution will likely be deducted from any bonus you might receive at work. Many employers allow you to determine a certain percentage of your bonus check to contribute to your 401.

Consider possibly redirecting a large portion of a bonus to 401k contributions, or into another retirement account, like an IRA. Because this money might not have been expected, you wont miss it if you contribute most of it toward your retirement.

You could also do the same thing with a raise. If your employer gives you a raise, consider putting it directly toward your 401. Putting this money directly toward your retirement can help you inch closer to maxing out your 401 contributions.

Can I Have A 401 And An Ira

Yes. IRAs make a great supplement to retirement savings in addition to a 401 if youre contributing enough to receive a full match from your employer, or youre planning on maxing out your 401. If you dont receive a match on your 401 or it has narrow investment options or high fees, it may be a good idea to invest primarily in an IRA. The annual contribution limit for an IRA in 2021 and 2022 is $6,000, or $7,000 if youre 50 or older.

» Ready to try an IRA? Check out our list of the best IRA accounts

You May Like: How To Find Your Lost 401k