Can I Cash Out My 401 Without Quitting My Job

You donât need to quit your job to cash out a 401. Most plans allow access to a 401 to their current employees. Knowing your options will help you choose the best one.

Cashing out a 401 may be tempting, especially if youâre facing financial difficulties or a significant medical emergency or repair. Most 401 participants only access their 401s when they leave a job.

Normally you can’t cash out your 401 without quitting your job. However, some plans allow participants to cash out their 401s via a 401 loan or through a hardship withdrawal. A 401 loan will prevent you from having to pay taxes and penalties, but the loan plus interest will need to be repaid into the account. Hardship withdrawals are categorized by the IRS. Youâll still need to pay taxes however, youâll be exempt from the 10% penalty tax.

Retirement accounts are built and intended to help you save a nest egg to last throughout your retirement years. The best advice is to simply leave it to grow. But if you need access to your 401, it may not be necessary for you to quit your job to do so.

When Can I Withdraw From My 401 Before Retirement But Without Tax Penalties

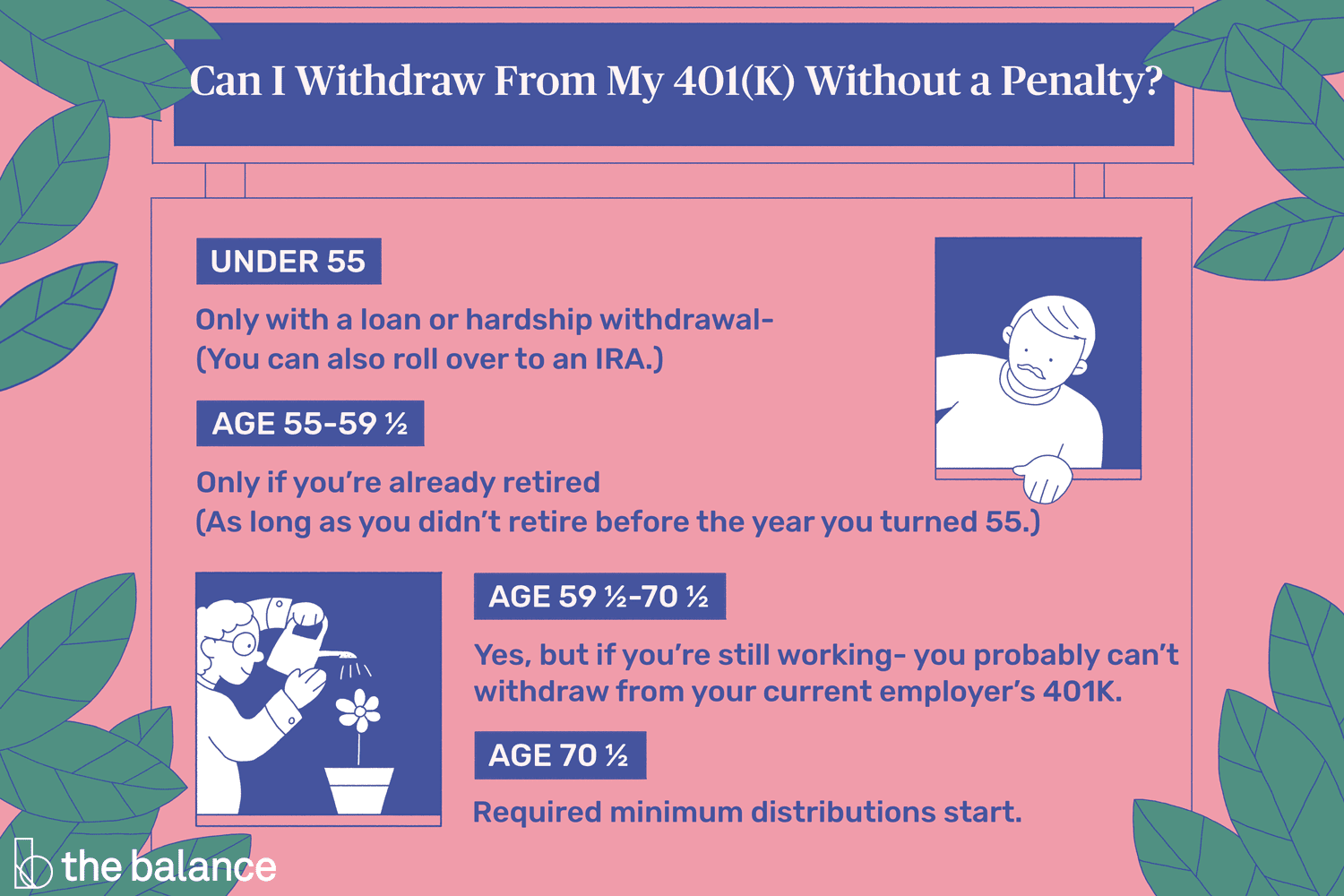

You don’t have to be in retirement to start withdrawing money from your 401. However, there are penalties involved depending on your age. If you wait until after you are 59 1/2, you can withdraw without any penalties. If you can’t wait until you are 59 1/2, then you will experience a 10% penalty on the amount withdrawn.

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal., but only from a current 401 account held by your employer. You can’t take loans out on older 401 accounts.

However, you can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

You May Like: How To Use Your 401k To Invest In Real Estate

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Who Should Withdraw From Their 401 Early

Just because you qualify for a hardship-related withdrawal doesnt mean you should take one without weighing all your other options.

The experts we spoke with were all in agreement that withdrawing from your 401 shouldnt be your first move. However, they also indicated that if youre truly in need, then you should take advantage of the CARES Acts allowances.

It should be a last resort option. People shouldnt get carried away and start using their 401 assets just because they can, Pfau says.

Read Also: Can I Withdraw Money From 401k

Withdrawing After Age 595

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Also Check: How To Withdraw From 401k

How Much Tax Do You Pay On 401 Distributions

A withdrawal you make from a 401 after you retire is officially known as a distribution. While youve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw. If you withdraw $10,000 from your 401 over the course of the year, you will only pay income taxes on that $10,000. Its possible to withdraw your entire account in one lump sum, though this will likely push you into a higher tax bracket for the year, so its smart to take distributions more gradually.

The good news is that you will only have to pay income tax. Those FICA taxes only apply during your working years. You will have already paid those when you contributed to a 401 so you dont have to pay them when you withdraw money later.

State and local governments may also tax 401 distributions. As with the federal government, your distributions are regular income. The tax you pay depends on the income tax rates in your state. If you live in one of the states with no income tax, then you wont need to pay any income tax on your distributions. So depending on where you live, you may never have to pay state income taxes on your 401 money.

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

- Cash out your 401.

You May Like: How Much Can I Convert From 401k To Roth Ira

Other Options For Getting 401 Money

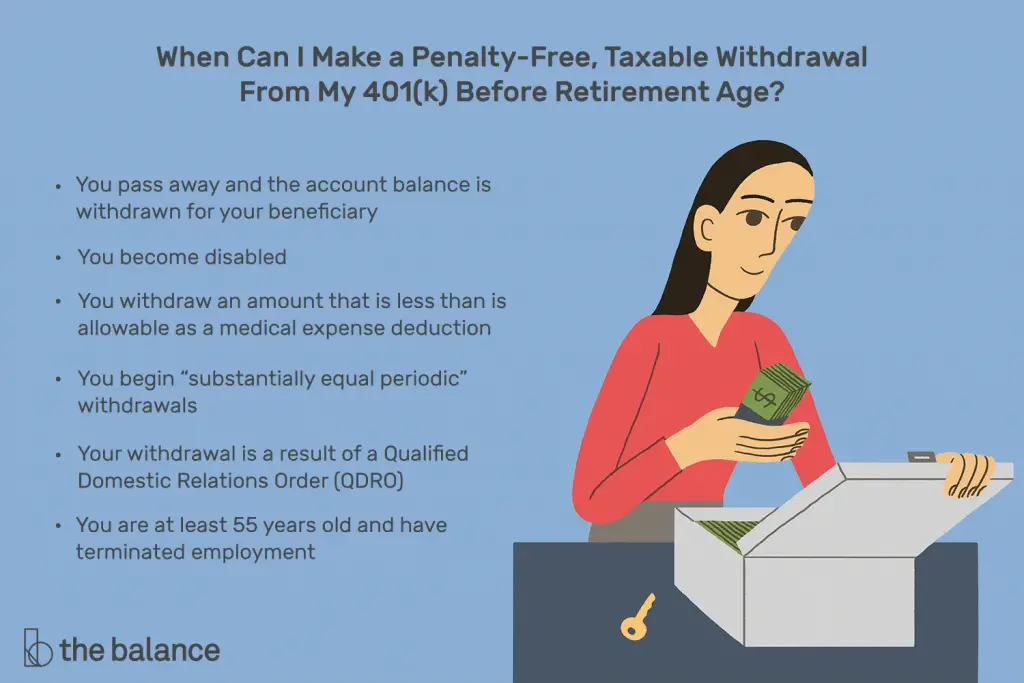

If you’re at least 59½, you’re permitted to withdraw funds from your 401 without penalty, whether you’re suffering from hardship or not. And account-holders of any age may, if their employer permits it, have the ability to loan money from a 401.

Most advisors do not recommend borrowing from your 401 either, in large part because such loans also threaten the nest egg you’ve accumulated for your retirement. But a loan might be worth considering in lieu of a withdrawal if you believe there’s a chance you’ll be able to repay the loan in a timely way s, that means within five years).

Loans are generally permitted for the lesser of half your 401 balance or $50,000 and must be repaid with interest, although both the principal and interest payments are made to your own retirement account. It is also worth noting that the CARES Act raises the borrowing limit from $50,000 to $100,000. If you should default on the payments, the loan converts to a withdrawal, with most of the same consequences as if it had originated as one.

401 loans must be repaid with interest in order to avoid penalties.

About two-thirds of 401s also permit non-hardship in-service withdrawals. This option, however, does not immediately provide funds for a pressing need. Rather, the withdrawal is allowed in order to transfer funds to another investment option.

How To Calculate Required Minimum Distribution

Required minimum distributions are withdrawals you have to make from most retirement plans when you reach the age of 72 . The amount you must withdraw depends on the balance in your account and your life expectancy as defined by the IRS. If you have more than one retirement account, you can take a distribution from each account or you can total your RMD amounts and take the distribution from one or more of the accounts. RMDs for a given year must be taken by December 31 of that year, though you get more time the first year you are required to take an RMD. If youre not sure whether to return the RMD or you need help with other retirement decisions, a financial advisor could help you figure out the best choices for your needs and goals.

Also Check: Can I Convert My 401k To A Roth Ira

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

Also Check: Do Employers Match Roth 401k

What Happens If I Quit My Job And Have A Loan On My 401k

If you quit your job with an outstanding 401 loan, the IRS requires you to repay the remaining loan balance within 60 days. Fail to repay within that time, and the IRS and your state will deem the balance as income for that tax year. You’ll need to pay income tax and face a 10% penalty tax in addition.

How To Make A 401 Hardship Withdrawal

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

If you need a significant sum of money and don’t expect to have the means to repay it, one option that may be available is a hardship withdrawal from the 401 at your current employer. Without the hardship provision, withdrawals are difficult at best if you’re younger than 59½. A hardship withdrawal, though, allows funds to be withdrawn from your account to meet an immediate and heavy financial need, such as covering medical or burial expenses or avoiding foreclosure on a home.

But before you prepare to tap your retirement savings in this way, check that you’re allowed to do so. Employers don’t have to offer hardship withdrawals, or the two other ways to get money from your 401loans and non-hardship in-service withdrawals.

Also Check: How To Find 401k Account Number

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

A Troubled Retirement System

That theres trouble brewing in the U.S. retirement system, which requires most workers to supplement Social Security with personal savings, has been widely acknowledged.

According to data from the U.S. Bureau of Labor Statistics published in 2020, only 55% of the civilian adult population participates in a workplace retirement plan. And even those who do are often woefully behind when it comes to investing part of their paycheck.

The wealth management giant Vanguard, for instance, revealed early in 2019 that the median 401 balance for those ages 65 and older is just $58,035. The SECURE Act aims to encourage employers who have previously shied away from these plans, which can be expensive and difficult to administer, to start offering them.

Read Also: How Much Can You Invest In 401k

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.