Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

How Are Withdrawals Of Roth 401 Deferrals Taxed

Because Roth 401 deferrals are contributed to your account on an after-tax basis, they are never taxable upon withdrawal. Their earnings can also be withdrawn tax-free when theyre part of a qualified withdrawal. A qualified withdrawal is one that occurs 1) at least five years after the year you made your first Roth deferral and 2) after the date you:

- Attain age 59½

- Become disabled

- Die

If you withdraw Roth 401 deferrals as part of a non-qualified withdrawal, their earnings are taxable at applicable Federal and state rates and may be subject to the 10% premature withdrawal penalty.

Additional answers to Roth questions can be found in our Roth FAQ.

Understanding Taxable Brokerage Accounts Vs Irayour Browser Indicates If You’ve Visited This Link

The most notable difference between a 401k or IRA and a taxable brokerage account can be seen when Uncle Sam comes knocking. With taxable brokerage accounts, you pay taxes every year. In contrast, tax-sheltered accounts only involve paying taxes oncewhen you make your contribution,

Mediafeed on MSN.com

Also Check: How Can I Borrow From My 401k Without Penalty

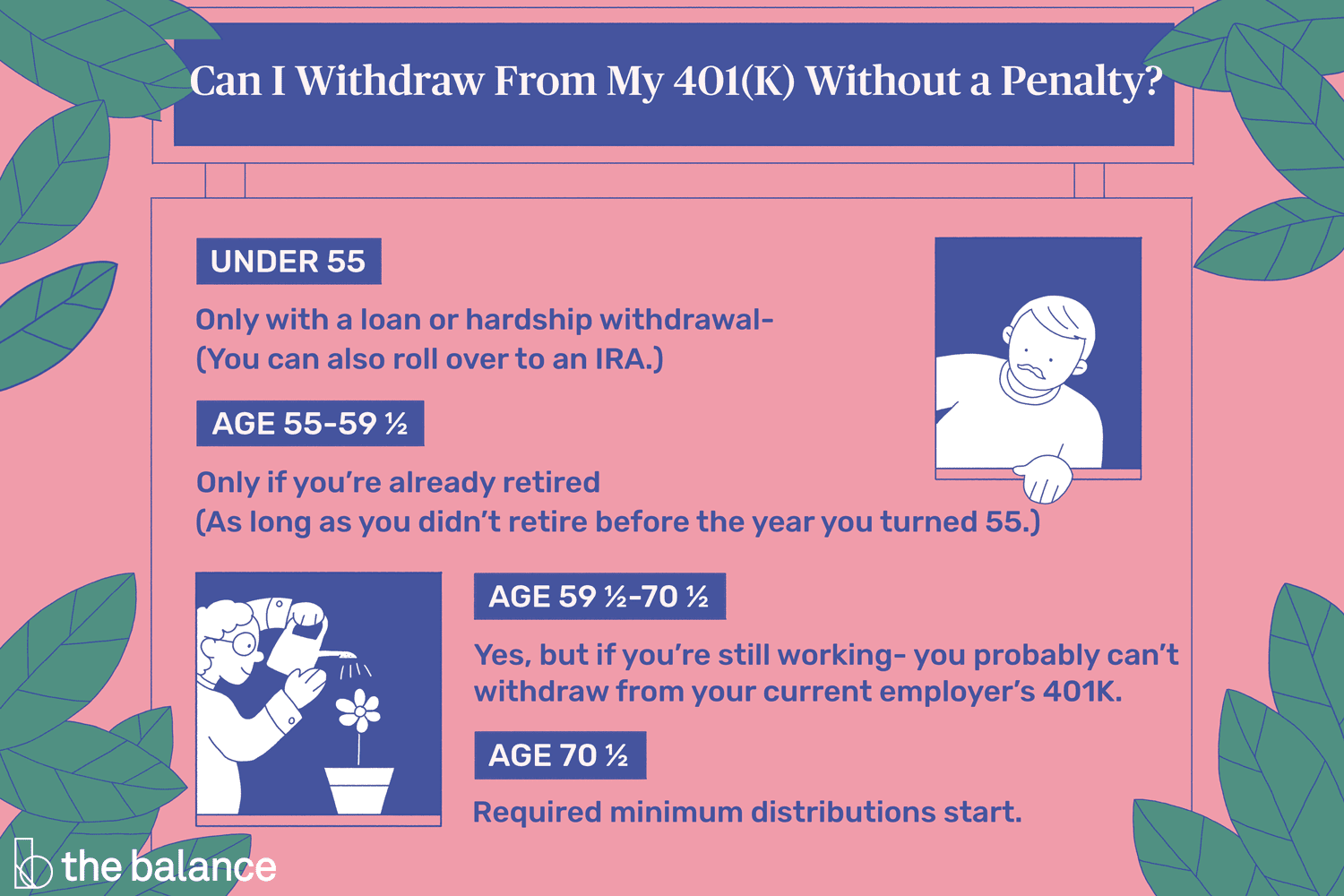

Withdrawals Before Age 59 1/2

Any withdrawal made from your 401 will be treated as taxable income and subject to income taxes in the year in which you made it, before or after retirement. But you’ll also be subject to a 10% early distribution penalty if you’re younger than age 59 1/2 at the time you take the withdrawal.

These taxes and penalties can add up and can nearly cut the value of your original withdrawal in half in some cases.

You can avoid these taxes and the penalty with a trustee-to-trustee transfer. This involves rolling over some or all of your 401 assets into another qualified account. You might consider a 401 loan if you want to access your account’s assets because of financial hardship.

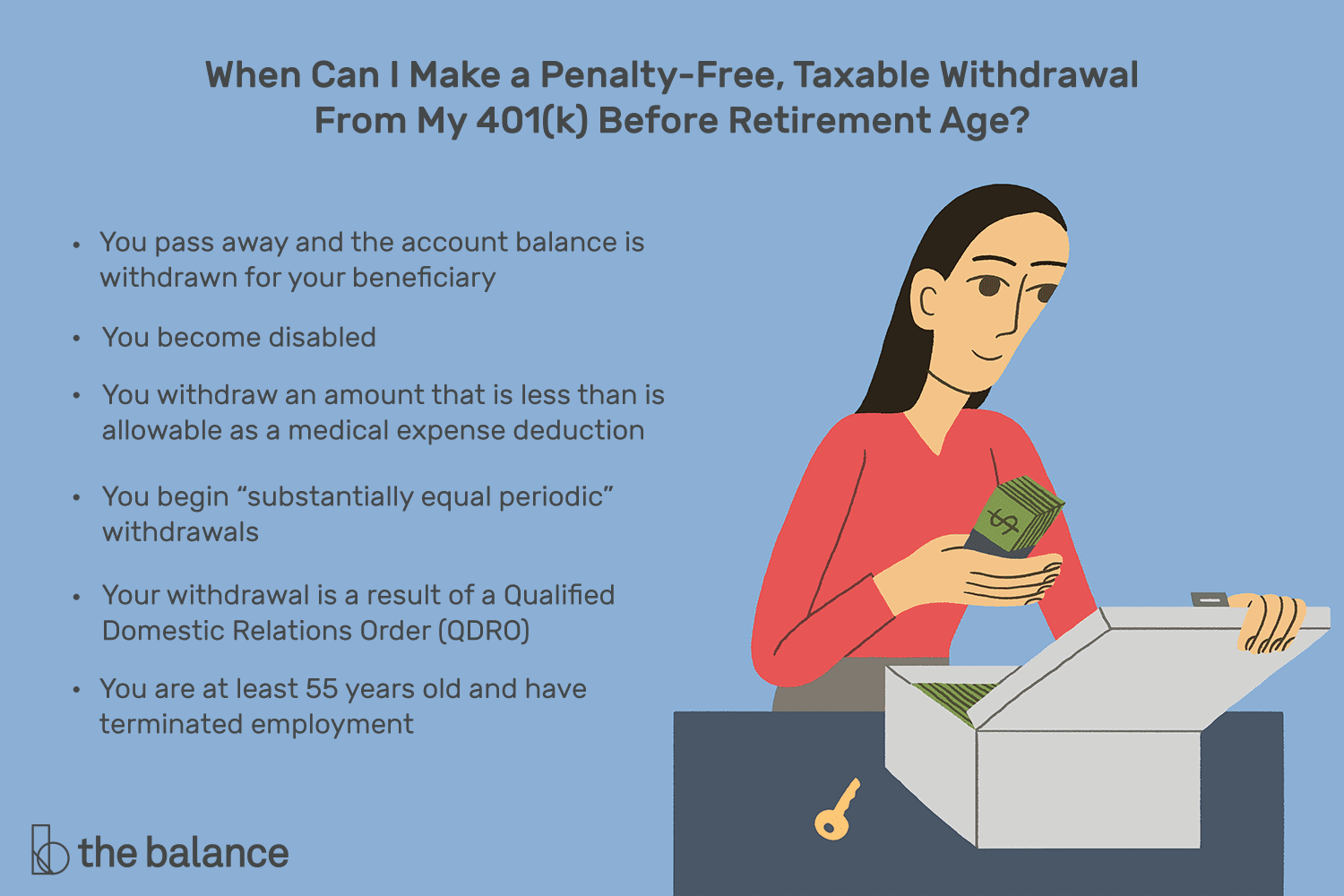

You can take a penalty-free withdrawal from your 401 before reaching age 59 1/2 for a few reasons, however:

- You pass away, and the account’s balance is withdrawn by your beneficiary.

- You become disabled.

- Your unreimbursed medical expenses are more than 7.5% of your adjusted gross income for the year.

- You begin “substantially equal periodic” withdrawals.

- Your withdrawal is the result of a Qualified Domestic Relations Order after a divorce.

- You’re at least 55 years old and have been laid off, fired, or quit your job, otherwise known as the “Rule of 55.”

Your distributions will still be taxed if you take the money for any of these reasons, but at least you’ll dodge the extra 10% penalty.

Planning Out The Timing Of Your Withdrawals

The timing of your early withdrawals is important, says Dave Lowell, certified financial planner and founder of Up Your Money Game.

If you were employed for most of the year and had a relatively high income, then it makes sense to not withdraw money under the rule of 55 in that calendar year, since it will add to your total income for the year and possibly result in you moving to a higher marginal tax bracket, Lowell says.

The better strategy in that scenario may be to use other savings or take withdrawals from after-tax investments until the next calendar rolls around. This may result in your taxable income being much lower.

Also Check: Can You Invest 401k In Bitcoin

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

New Stimulus Bill Allows Penalty

The $900 billion stimulus bill that Congress passed Monday allows workers to take money from their 401s without being hit with a tax penalty a slight change to a rule passed in the Coronavirus Aid, Relief, and Economic Security Act last March.

Anyone can take up to $100,000 from their account through a loan or withdrawal as long as they live in an area where a major disaster has been declared, according to the bill. The provision excludes areas affected only by the COVID-19 disaster. The CARES Act gave Americans financially hurt from the pandemic an opportunity to withdraw without penalty, but that exception ended in 2020.

But although withdrawing funds from a 401, IRA or any other retirement account is penalty-free for now, financial planners say raiding that account should be a last resort. Withdrawals will ultimately put someone on “an exit ramp to eternal financial sadness,” said Paul Ruedi, a retirement planner in Illinois.

“If you took out $100,000 from your account during the end of March this year, you would have missed the 66.88% gain in the broad stock market,” he said. “That’s a loss of opportunity of $66,880 that you never get back.”

Even before the pandemic many workers have needed to dip into their retirement account to make ends meet, Transamerica CEO Catherine Collinson said. It will take years for those people to recover those losses and some many never recover, she added.

Also Check: Should I Transfer 401k To New Employer

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

Should You Use Your 401 To Buy A House

There are good reasons for not using your 401 to buy a house. Even if youre comfortable with the 10% early withdrawal penalty, you will still be incurring long-term consequences by reducing your savings. That, in turn, will damage your future growth potential.

Taking out $10,000 from a $20,000 401 account, for instance, leaves you with only $10,000 that will continue accruing interest. With a 7% annualized rate of return, that $10,000 could become $54,000 over 25 years compared to $108,000 had you not withdrawn $10,000.

Withdrawing from your 401 account is essentially taking out a loan against yourself. If you want to pay it back, you also need to pay interest, and the time spent paying it back is time that could have been spent on growth.

Read Also: How To Transfer 401k From Old Job To New Job

Options For Borrowing From A 401 While Still Working

If youre still in the workforce and need to access your 401 funds for one reason or another, you may still have options. These pre-retirement withdrawal options include in-service distributions, hardship withdrawals, and plan loans.

In-service distributions allow you to withdraw your vested money before retirement and are sometimes referred to as an early retirement option in the plan. This is generally allowed at age 59 ½ because distributions of your 401 deferrals before that age are subject to a 10 percent penalty tax.

Hardship distributions are allowed for special reasons such as medical care, purchase of your home, tuition, funeral expenses, payments to prevent eviction, and damage to your principal residence. The distribution is limited to the amount you need, and your employer will need to see some proof of the hardship. Hardship distributions are subject to income tax and the 10 percent penalty tax for distribution before 59 ½.

Plan loans occur when you borrow money from your 401 balance, but the amount you can withdraw is limited to the half of your vested balance and cannot be more than $50,000. The loan will have to be paid back to the plan with interest, and the loan period cannot exceed five years in most cases. That being said, loans taken out for principal residence can be longer than five years.

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Recommended Reading: Can You Use Your 401k To Start A Business

Why You Should Consider A 401 Loan Instead Of Hardship Withdrawal

If youre in need of extra funds and have no other options outside of your 401 plan, consider taking a plan loan. First, check out your 401 plan document to see if it allows for plan loans. If allowed, you can borrow up to 50 percent of the vested portion of your 401 balance. Youll pay interest as youre paying the loan off, but it is credited back into your account. And as long as you pay the loan back, its not taxable. In addition, you can still contribute to the 401 plan and pay back the loan at the same time, although it may be wiser to put that additional money toward the principal to get it paid off in a shorter time saving on interest charges.

A loan is better than a hardship distribution because with a loan, you can restore your 401 balance by paying the loan back. But there are no payback provisions for hardships once the hardship distribution is made, its out your 401. You will need to make other arrangements to cover any shortage in your retirement savings objective due to the hardship distribution.

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

Read Also: How To Borrow From Your 401k

Hardship Withdrawals Allowed With Taxes And Penalty:

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Recommended Reading: How Much Tax On 401k Withdrawal

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Read Also: Is 401k The Best Way To Save For Retirement

When Do I Have To Start Making Withdrawals From My Ira

You cant keep your funds in a retirement account indefinitely. Generally, youre required to start taking withdrawals from your traditional IRA when you reach age 70 ½ . Roth IRAs, however, dont require withdrawals until the owner of the account dies.

The amount that youre required to withdraw is called a required minimum distribution . You can withdraw more than the RMD amount, but withdrawals from a Traditional IRA are included in your taxable income. If you fail to make withdrawals that meet the RMD standards, you may be subject to a 50% excise tax. Roth IRAs do not require RMDs. Your money grows tax-free, since contributions are made from after-tax dollars, and your withdrawals in retirement aren’t taxed.

What Is A Systematic Withdrawal Plan

In a systematic withdrawal plan, you only withdraw the income created by the underlying investments in your portfolio. Because your principal remains intact, this is designed to prevent you from running out of money and may afford you the potential to grow your investments over time, while still providing retirement income. However, the amount of income you receive in any given year will vary, since it depends on market performance. Theres also the risk that the amount youre able to withdraw wont keep pace with inflation.

Potential advantages: This approach only touches the income not your principal so your portfolio maintains the potential to grow.

Potential disadvantages: You wont withdraw the same amount of money every year, and you might get outpaced by inflation.

For illustrative purposes only.

You May Like: How To Take Out 401k Money For House