How To Transfer An Ira From Vanguard Brokerage Account To A Self

With the popularity of the self-directed solo 401k exploding in recent years, those who qualify for a solo 401k will often initially fund the plan by transferring their Vanguard brokerage IRA.

The following information will be helpful when working with your solo 401k provider to process the non-taxable IRA direct-rollover.

NOTE: If you use My Solo 401k Financial as your solo 401k plan provider, they will fill out the Vanguard IRA brokerage transfer-out form for you.

How To Fill Out The Vanguard Brokerage Ira Distribution Form

Invest Your Newly Deposited Funds

Youâll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

Don’t Miss: How To Diversify 401k Portfolio

Start Your Transfer Online

Youâll get useful tips along the way, but you can call us if you have a question.

Youâll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so weâll ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if youâre already a Vanguard client, confirm the information that weâve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

What States Do Not Tax Tsp Withdrawals

While most states tax TSP distributions, these 12 do not: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Illinois, Mississippi and Pennsylvania.

What state does not impose your 401k? Some of the states that do not impose 401 include Alaska, Illinois, Nevada, New Hampshire, South Dakota, Pennsylvania and Tennessee. You can save a lot of money if you live in these states, since your retirement income will be tax-free.

You May Like: Where Do I Go To Withdraw My 401k

Choose Which Type Of Ira Account To Open

A 401 rollover to an IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you wont incur taxes if you roll to a Roth IRA.

Advantages And Disadvantages Of Doing A 401 Rollover

Weve already discussed some of the benefits of doing a 401 rollover from an old employer plan to a new one. In this section, lets focus on the advantages and disadvantages of doing a 401 rollover into an IRA.

Advantages:

- Youre an experienced investor, and would prefer to manage your own retirement assets.

- The benefits and costs of using a robo-advisor to manage your money are better than those of the current plan.

- Youre not happy with the investment options in your current plan.

- You have several 401 plans from previous employers, and you want to consolidate them into a single IRA.

- Your new employer either doesnt permit a rollover of an old 401 plan, or doesnt provide the investment options youre looking for.

Disadvantages:

- Youre satisfied with the current plan and the returns its providing.

- By moving retirement funds from a 401 plan to an IRA, youll be giving up certain protections 401 plans provide from creditors and lawsuits.

- You have an immediate need for the funds, due to disability, medical costs, or other distributions that will exempt you from the 10% early distribution penalty.

Recommended Reading: How To Move 401k To Cash

Why Rollover A 401k

For me the decision was simple. I prefer the low cost Vanguard funds over Fidelity funds. Fidelity does offer some really low cost index funds, but Vanguard offers a wider variety of funds with rock-bottom expense ratios.

In addition, by moving funds over to Vanguard, I can qualify for even lower fees and more exclusive customer service. In addition to a standard account, Vanguard offers what it calls Voyager, Voyager Select and Flagship accounts. To qualify, however, you must have minimum account balances. By moving more money over to Vanguard, its easier to qualify for a higher level of service. Here are the requirements of each account type and what they offer:

Dont Miss: How To Know If You Have A 401k

Moving Money From Vanguard 401k To Transamerica 401k

I worked at a company for the last year where they provided a vanguard 401k savings plan where they would match a static percentage which I guess is pretty typical for most corporate jobs. I just accepted a new job offer though that does not use vanguard for their 401k matching but instead uses transamerica. Now I know since I only worked at this company for a year their minimum vesting year requirement is 3 years, so I think once I am completely done working there they will automatically pull out all the money they matched. My question is what do I do with the vanguard 401k? I’m honestly pretty uneducated/ignorant on how 401ks work and the like so I’m just looking for advice what to do with it. Is there a way for me to move the money to transamerica without getting taxed? Or should I just leave it and let it do its thing? Thanks.

You May Like: How To Do Your Own 401k

Not Sure How To Transfer Your Assets

Most account transfers are convenient to do online. Follow the 3 easy steps in our guide to learn more about account transfers and get started.

All investing is subject to risk, including the possible loss of the money you invest. Diversification does not ensure a profit or protect against a loss.

Vanguard is investor-owned, meaning the fund shareholders own the funds, which in turn own Vanguard.

Advice services are provided by Vanguard Advisers, Inc., a registered investment advisor, or by Vanguard National Trust Company, a federally chartered, limited-purpose trust company.Advice services are provided by Vanguard Advisers, Inc., a registered investment advisor, or by Vanguard National Trust Company, a federally chartered, limited-purpose trust company.

The services provided to clients who elect to receive ongoing advice will vary based upon the amount of assets in a portfolio. Please review Form CRS and the Vanguard Personal Advisor Services Brochure for important details about the service, including its asset-based service levels and fee breakpoints.

There are important factors to consider when rolling over assets to an IRA. These factors include, but are not limited to, investment options in each type of account, fees and expenses, available services, potential withdrawal pepenalties, protection from creditors and legal judgments, required minimum distributions, and tax consequences of rolling over employer stock to an IRA.

How Do I Find My 401 Plan Administrator

All 401 plans involve several different parties.

The employer is the plan sponsor that established the plan and encouraged its employees to participate in it.

The custodian holds the funds that are contributed into the plan and keeps them safe.

And the administrator handles the day-to-day nuts and bolts operations of the plan.

The administrator handles tasks such as issuing loans from the plan, moving money around from one investment to another within the plan at the request of a participant and sending account statements to each participant, among other things.

Administrators have a long list of responsibilities related to administering the plan that typically go unnoticed by the vast majority of participants.

For this reason, many employers outsource this important function to a third-party administrator that is in the business of managing 401 plans.

Dont Miss: Who Are The Top 401k Providers

You May Like: What Is The Phone Number For 401k

Vanguard Vs Fidelity Iras: The Biggest Differences

When it comes to IRAs, Vanguard and Fidelity are neck and neck in many areas. Both offer traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and many other retirement accounts for individuals and small businesses. The two platforms also give investors the option to manage eligible IRAs on their own or utilize automated portfolios and/or advisor assistance.

Fidelity, however, has a wider range of IRA options. Unlike Vanguard, Fidelity offers a Roth IRA account for minors. The brokerage could also suit those in search of lower costs, mainly because most of its index mutual funds have no minimum requirements .

Vanguardâs advisor-assisted, automated investing account has Fidelityâs equivalent account beat when it comes to advisory fees, but Fidelity is still hard to pass up on the account minimum end.

| Vanguard |

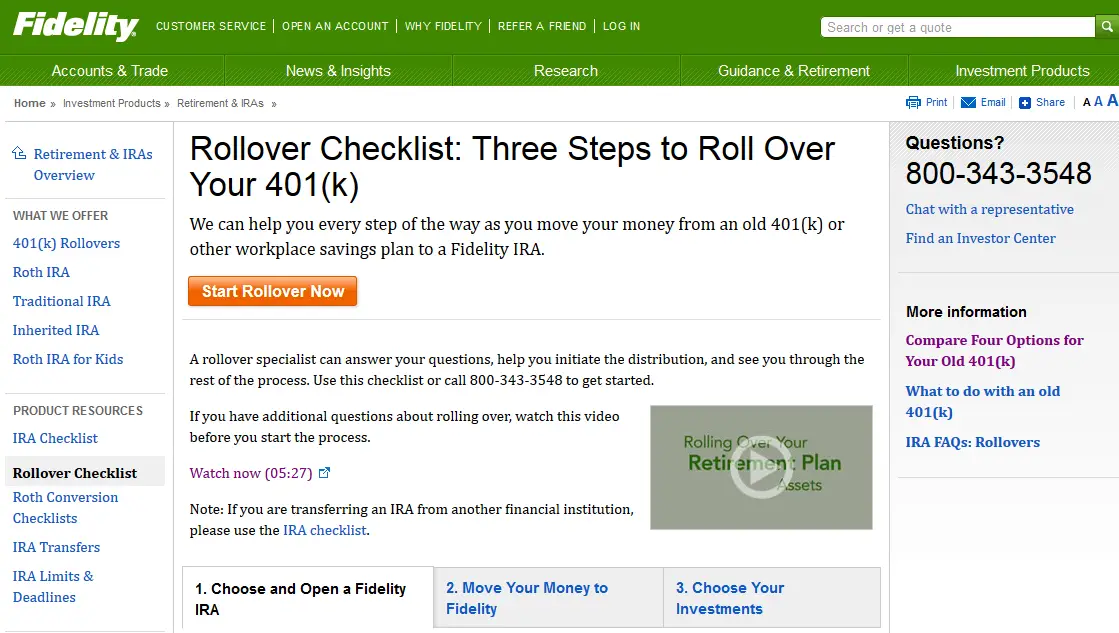

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

Don’t Miss: Can A 401k Be Used To Purchase A Home

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers below all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list below offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Contact Your Current 401 Provider And New Ira Provider

Ideally, you want a direct rollover, in which your old 401 plan administrator transfers your savings directly to your new IRA account. This helps you avoid accidentally incurring taxes or penalties. However, not every custodian will do a direct rollover.

In many cases, youll end up with a check that you need to pass on to your new account provider, Henderson says. Open your new IRA before starting the rollover so you can tell the old provider how to make out the check.

The goal, Henderson says, is to avoid having to ever put the money into your personal bank account.

You only have 60 days to complete the transaction to avoid it being a taxable event, and its best to have everything set up before getting that check, Henderson says.

You May Like: How Much Do You Get From 401k

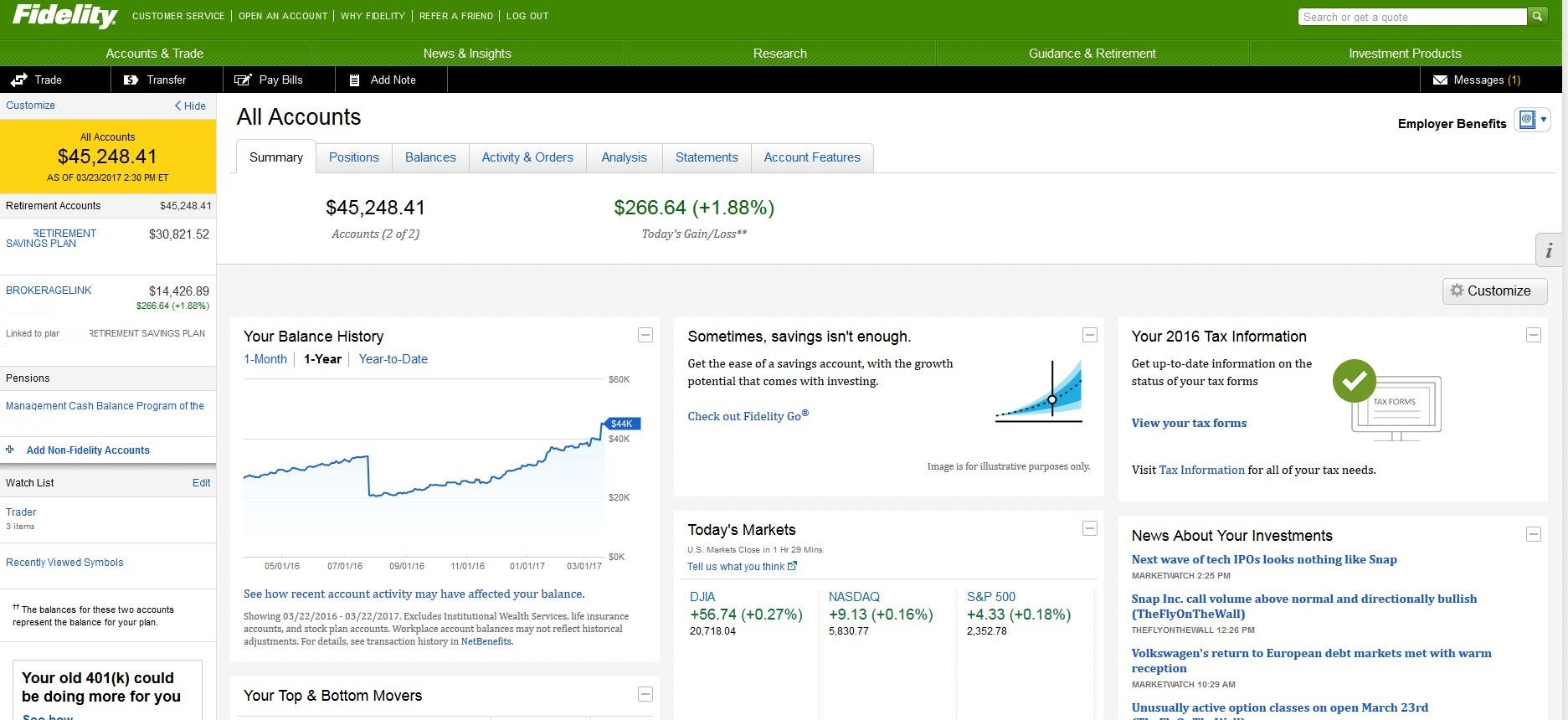

Can I Check My 401k Online

To determine your 401K balance, allocation, and contribution history, you should first contact your Human Resources Department. They will most likely direct you to an online portal for your Plan Sponsor. Upon receiving a log-in and Password, you should be able to track your 401K information as often as you like.

Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether youre a manage it for me type or a DIY type.

-

If youre not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

Also Check: Should I Borrow From My 401k

How Do I Avoid Tax On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Confirm A Few Key Details About Your 401 Plan

First, get together any information you have on your old 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following three items:

Read Also: Is It Better To Have A 401k Or Ira

Where Are All These Fees Coming From

All $260,000 in fees came from one source: expense ratios. Expense ratios are the cost for the administration of the investment fund. Investment funds are those options you select when you first setup your account, such as the Retirement 2050 fund. Each investment fund has an expense ratio thats charged annually as a percentage of the total amount in the fund. They are calculated with a simple equation:

Total investment amount * expense ratio = Annual fee

Lets say for instance I had $10,000 in my 401k and the expense ratio is .45%. That means each year I pay a $45 fee to the broker. That doesnt seem so bad, does it? But lets remember that a retirement account like a 401k is intended to grow over time. And because you cannot withdraw until age 59.5, its an account that most people have for decades. For all of these reasons, that seemingly small annual fee is likely to become a very large amount.

Lets take that same $10,000 401k and account for 10% average stock market growth over 30 years.

| Year |

| $15,863.09 |

| $174,494.02 |

Incredibly, that $10,000 401k is estimated to be worth $174,494 after 30 years assuming a stock market average 10% return rate. This is due to the power of compound interest, and it is the reason why everyone emphasizes saving for retirement asap. The sooner you start saving, the more time you have for your savings to multiply in value.

You Might Want A Roth Account

If your 401 plan doesnt provide a Roth 401 option, you might choose to roll your retirement savings into a Roth IRA. Advantages of a 401-to-Roth IRA rollover include:

Avoiding Roth IRA income restrictions. Even if your annual income is above the thresholds for Roth IRA contributions, youre still allowed to roll your 401 savings into a Roth IRA. This move is commonly referred to as a backdoor Roth IRA conversion, and it can grant you the benefits of tax-free withdrawals in retirement.

No required minimum distributions . With a 401or even a traditional IRAyoure subject to RMDs, or the mandated annual withdrawals from your retirement savings once you reach age 72. Roth IRAs are free of RMDs, providing you with more control over your retirement savings.

Tax-free withdrawals in retirement. When you roll over a traditional 401 into a Roth IRA, youll probably end up paying some taxes on the amount youre converting. But these taxes may be less than what youd pay if you took regular withdrawals from a traditional 401 in retirement.

Access to additional death benefits. Because there are no lifetime distribution requirements, you can pass down your Roth IRA to your heirsalthough beneficiaries need to draw down the account within 10 years.

Henderson cautions that you must be aware of the immediate tax consequences when you roll your money from a 401 to a Roth account, however.

Also Check: When Can I Withdraw From 401k