Types Of Coins You Can Own With Your Gold Ira

Depending on the fineness standard, you can own certain types of gold and other precious metals like silver or platinum coins with your Gold IRA, in compliance with the Internal Revenue Code.

Few examples of the coins you can own in an IRA are:

- American gold Eagle coins

- American Platinum Eagle coin

- Canadian gold maple leaf coin

These coins are tested to have a fineness of 99.9% or more. Anything with a fineness below that will not be allowed, no matter how popular or in-demand the coin is.

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

Are You A Us Citizen Or A Us Person For Tax Purposes

If yes, your client will likely have a bigger tax bill from collapsing a retirement plan than someone whos not. But it depends.

While Canadian residents are only taxed 15% on 401 and IRA withdrawals, withdrawals for U.S. persons are taxed as ordinary income at their marginal rate, which is usually higher than 15%. So, a 60-year-old U.S. person in the 33% bracket would only net $67,000 when collapsing a $100,000 IRA. If he transferred his IRA to an RRSP, his FTC would be $33,000 and he would need to owe $33,000 in Canadian tax to be in a tax-neutral position. The larger the FTC, the more unlikely it is that the person has enough Canadian tax owing to offset the entire FTC.

In the Go Public case mentioned earlier, the couples bank overlooked the fact that the husband was a U.S. citizen. Which brings us to

You May Like: How To Transfer Roth 401k To Roth Ira

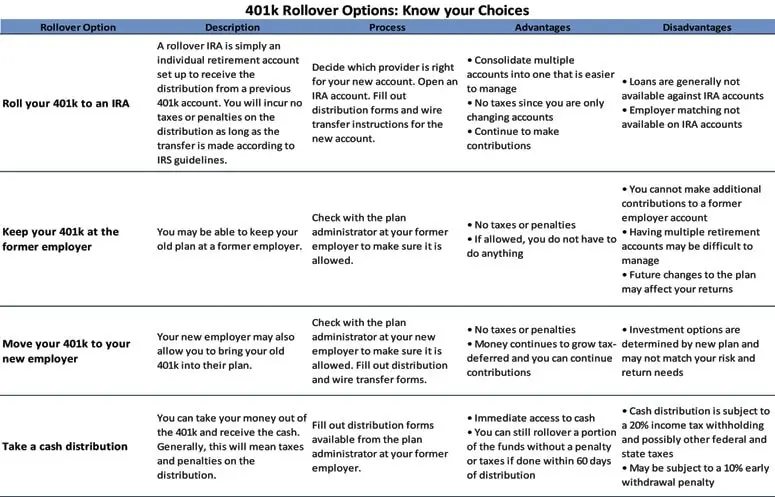

Choose Your 401 Rollover Destination

Consider whether a traditional IRA or Roth IRA makes the most sense for your 401 rollover.

401 Rollover to Traditional IRA: If you want to maintain the same tax treatment, this can be a good choice, Henderson says. You avoid extra hassle, and you just see the same RMD and tax treatment as you would with your current 401.

401 Rollover to Roth IRA: For those with high incomes, the 401 rollover to a Roth IRA can serve as a backdoor into a Roth tax treatment. But dont forget about the taxes, Henderson says. In addition, remember the five-year rule when it comes to Roth accounts: Even at 59 ½, you cannot take tax-free withdrawals of earnings unless your first contribution to a Roth account was at least five years before. Those close to retirement, therefore, may not benefit from this type of conversion. Talk to a tax professional if youre rolling into an account with different treatment, says Henderson.

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

Recommended Reading: How Do I Find My 401k Account Number

Delay Required Mandatory Distributions

Workers with traditional IRAs and 401s both face the same reality when it comes to taking mandatory distributions. The IRS requires that you begin taking distributions by April 1 of the year following your 72nd birthday. However, you may delay taking RMDs from your 401 if youre still working and own less than 5% of the company that sponsors the plan.

Cash Out Current 401k Assets To Invest In Real Estate

It is true! QDROs are one of the exceptions where you are able to use to get at your money without a penalty. If you want to invest in after-tax real estate from your current employers 401k, use a QDRO and cash out to your spouses bank account. Of course, ordinary taxes are due when cashing out, but as the funds were accessed via a QDRO, there is no 10% penalty.

Also Check: How To Invest 401k With Fidelity

Topic No 413 Rollovers From Retirement Plans

A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan. This rollover transaction isn’t taxable, unless the rollover is to a Roth IRA or a designated Roth account from another type of plan or account, but it is reportable on your federal tax return. You must include the taxable amount of a distribution that you don’t roll over in income in the year of the distribution.

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Don’t Miss: What Is The Tax Penalty For Early 401k Withdrawal

Decide On Your New Investments

Once you have completed your direct or indirect rollover, you can determine how you want to use your money. You can invest in physical gold, or you can look at index mutual funds. Diversifying your portfolio can protect it from market fluctuations.

Many people buy gold coins and bullion, but there are some drawbacks to these investments. You may have to pay broker commissions and fees for storing the gold. If you want to diversify your gold portfolio, you can invest in gold using other techniques as well.

- Gold futures and options: These contracts are essentially agreements to buy or sell gold at a set price in the future. Because these contracts are traded on commodity exchanges, they are tightly regulated by the federal government.

- Stocks in gold mining: If you want to invest in gold mining and refining businesses, you can buy stock in a mining company. You should always research the company beforehand to see if they are financially stable. To reduce your risk, you can also buy shares in a mutual fund that invests in gold mining.

- Gold exchange-traded funds : An ETF is a basket of other assets. A gold ETF may own gold options, futures and physical gold. While mutual funds can only be exchanged after the market closes for the day, an ETF can be traded when the market is open.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: How Do I Cash Out My 401k Early

What Is A Gold Ira Rollover

A rollover IRA is a term for an individual retirement account that is funded by moving funds from a 401, 403, TSP, or similar retirement account into an IRA. The main difference between a 401 and an IRA is that an IRA is normally opened by the individual rather than being offered by an employer.

With a rollover IRA, investors can use existing retirement funds to take advantage of a broader range of investments than are available through 401 investments alone. And by investing in a self-directed IRA, you have even more options for investments, such as a gold IRA rollover.

Rollover IRAs are most often created when changing jobs or retiring, as they allow employees to move their current 401 or other retirement account balances into an IRA account that will offer a better array of investments and superior performance.

When performing an IRA rollover, funds from existing tax-advantaged accounts can be rolled over into a new IRA tax-free. You can even roll over funds from multiple retirement accounts into a single self-directed IRA, making it easier for you to consolidate and manage your retirement savings.

Youll Lose Control And Flexibility

The most significant benefit of an IRA is the power and flexibility to invest your money how you want. By rolling over your IRA, youll be forfeiting a lot of that control and freedom. Your 401 plan likely offers a limited number of mutual funds and exchange-traded funds, so you may feel restricted by those offerings if you value greater diversification and oversight.

Recommended Reading: Can I Borrow From My 401k Without Penalty

Tread Carefully With Company Stock

Some retirement savers hold company stock in their 401 alongside their other investments. In that situation, if you roll over all your 401 assets to an IRA, you lose the potential to get a more favorable tax treatment on any growth those shares had while in your 401.

It gets a bit confusing, but the idea is that if the company stock has unrealized gains, you transfer it to a brokerage account instead of rolling it over to the IRA along with your other 401 assets. Upon transferring, you are taxed on the cost basis .

It’s a complex transaction, and if done incorrectly, the strategy loses its tax advantage.Melisssa BrennanFinancial planner with ARS Private Wealth

However, when you then sell the shares from your brokerage account whether immediately or down the road any growth the stock experienced inside the 401 would be taxed at long-term capital gains rates . This could be less than the ordinary-income tax treatment you’d face if the stock went into a rollover IRA and then were withdrawn.

Here’s an example: If the cost basis of your company stock is $10,000 and the gains on it were $20,000, you would pay ordinary taxes on the $10,000 when you transfer the shares to a brokerage account.

The $20,000 in gains, however, would be taxed at long-term rates once the stock is sold. Any further growth from the point of transfer to sale would be taxed as either short- or long-term gains, depending on how long you held it before selling.

We Tell You When It Makes Sense To Move Your 401 Account To An Ira And When Its Smart To Stay Put

www.peopleimages.com

When you leave a job, you pack up your family photos, the spare pair of dress shoes stashed under your desk, your I Love My Corgi coffee mug and all your other personal items. But what do you do with your 401 plan?

Most people roll the money over to an IRA because they gain access to more investment options and have more control over the account. Some brokerage firms sweeten the deal with cash incentives. TD Ameritrade, for example, offers bonuses ranging from $100 to $2,500 when you roll over your 401 to one of its IRAs, depending on the amount. Plus, moving your money to an IRA could help you streamline your investments. Amy Thomas, a 43-year-old clinical trial coordinator in Lakewood, Colo., has rolled over 401 plans from three former employers into one place, which makes everything a lot easier, she says. Now she doesnt worry that shell lose track of an account that might have been left behind.

Read Also: How To Start A 401k Account

Open Your New Account

The easiest way to set up your account is by going online. Many people set up an IRA using a robo-advisor or an online broker. If you do not want to deal with the hassle of picking your investments, you can use a robo-advisor to automatically invest in a balanced portfolio.

With an online broker, you can get more control over your investments. You can choose which investments you buy, and you can divest whenever you want. Because fees and commission costs can quickly add up, you should find a provider that charges low fees. You also need to pick a provider that specializes in precious metals.

Can I Move My 401k To Ira And Then Withdrawal Money Without Penalty To Pay For Education

If your 401 permits distributions, say, because you are no longer working for that employer, you can transfer the 401 to an IRA to take advantage of the higher education-expense exception to the early distribution penalty available for a distribution from an IRA that is not available for a distribution from a 401. There is no minimum time that the funds must remain in the IRA before making a distribution from the IRA. You are not required to “pay back” any money withdrawn from an IRA. If you choose to, the only way to put money back into an IRA is to roll over some or all of the money to another IRA or back to the original IRA within 60 days, and only one IRA distribution from any of your IRA accounts can be rolled over in a 12-month period.

When you make the distribution, the Form 1099-R will show an early distribution. After entering the Form 1099-R into TurboTax, TurboTax will give you the opportunity to indicate the amount paid for qualified higher education expenses in the same year as the distribution. TurboTax will show this amount on Form 5329 line 2 with code 08 as an amount exempt from the early-distribution penalty. Be sure to retain records showing the amount paid for education expenses in case the IRS questions the exception.

Read Also: Is A 401k Worth It Anymore

Todays Tip Will Cover Can You Roll A 401k Into An Ira Without Penalty

The short answer is Yes. If you recently changed jobs or are no longer working with your previous employer due a career change or retirement and if you have reviewed all your options for your 401k and decided to move money into your IRA, then you have to take several steps to make sure your 401 rollover is coded correctly.

Moving money from an old retirement plan such as a 401K to an IRA can be easy. Here are a few steps tips to consider.

For your specific tax related questions consult with your tax advisor.

For more information regarding 401 rollovers, check out our 401 FAQs video playlist.

If youre struggling with not knowing what to do or where to start when it comes to managing your finances and investing. I have a great video that will help you accomplish more with your money, without giving up lattes or any of that nonsense. You can get the video at savvyupnow.com/money101.

P: 760-692-5700

Converting A Traditional 401 To A Roth Ira

Youll still owe some taxes in the year you make the rollover because of the crucial difference between a traditional 401 and a Roth IRA:

- A traditional 401 is funded with the salary from your pre-tax income. It comes right off the top of your gross income. You pay no taxes on the money you deposit or the profit it earns until you withdraw the money, presumably after you retire. Then, youll owe taxes on the entire amount as you make withdrawals.

- The Roth IRA is funded with post-tax dollars. You pay the income taxes upfront before it is deposited in your account. You wont owe taxes on that money or on the profit it earns when you withdraw it.

So, when you roll over a traditional IRA to a Roth IRA, youll owe income taxes on that money in the year you make the switch.

The total amount transferred will be taxed at your ordinary-income rate, just like your salary. 3 The brackets did not change for 2022.

You May Like: When Leaving A Job What To Do With 401k