Think About How Much Youll Need In Retirement

When you think about saving for retirement, start with how much you currently spend each month. If you spend 10% of your money on clothes, theres a good chance youll want to spend about that much on clothes in the future. Also think about your monthly bills. Many people underestimate how much money they will need to spend in retirement. Some financial experts, like Nicole Lapin tell people that they should expect their retirement expenses to be at least 60% of what they are currently. And thats assuming you live very frugally. Most people will probably want to spend 70% 80% of what they currently spend. Look at your spending habits to get an idea whats important to you.

Many people have specific things they want to spend money on in retirement. Maybe you want to travel, learn a language or volunteer more. Think about the lifestyle you might want to live. You should also think about where you might want to live. Many retirees move to warm, sunny locales.

Consider all these current and potential expenses. Once you have an idea how much youll spend each month in retirement, you can calculate how much youll need in savings.

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

What Is An Ira

While there are a number of benefits to 401ks, they’re not the only retirement plan in the game. An IRA is an individual retirement account. Where a 401k can only be offered through an employer, an IRA account can be opened up by an individual whether they’re associated with an employer or not. That means they’re the best option for independent contractors without an employer or anyone who wants to do some extra retirement planning on top of their 401k.

You May Like: How To Check Your 401k Balance

S For Young Adults To Open And Maintain A 401

In your 20s and even in your 30s, retirement seems like a long time away, but the fact is, someday you may want to stop working as hard as you do and relax and enjoy your life in your 60s, 70s, and beyond. And for young adults who take great care of themselves, living a long and healthy life is not only a possibility but quite likely.

You don’t want to run out of money before you run out of time. Saving for the future should start the day you begin working at a full-time job. A 401, if offered by your employer, is the best way to get started with planning for the future.

Choose An Account Type

Traditional 401s are standard at workplaces, but more employers are adding the Roth 401 option, too.

As with Roth IRAs versus traditional IRAs, the main difference between the two types of plans is when you get your tax break:

-

The regular 401 offers it upfront since the money is automatically taken out of your paycheck before the IRS takes its cut . Youll pay income taxes down the road when you start making withdrawals in retirement.

-

Contributions to a Roth 401 are made with post-tax dollars , but qualified withdrawals are tax-free

-

Investment earnings within both types of 401s are not taxed

Another upside to the Roth 401 is that, unlike a Roth IRA, there are no income restrictions to limit how much you can contribute.

The IRS allows you to stash savings in both a traditional 401 and Roth 401, which can add tax diversification to your portfolio, as long as you dont exceed the annual maximum contribution limits .

Read Also: Can You Pull From Your 401k To Buy A House

What Is The Maximum 401k Contribution For 2021

That depends on your employer’s plan. The maximum the IRS allows for 2021 stayed the same as 2020. Currently, the cap sits at $19,500 but your employer may cap the amount below that. For people over 50 the maximum increases to help them “catch up” before their retirement. They can contribute an additional $6,500 a year.

What Is A 401 Plan And How Does It Work

A 401 Plan is a retirement savings vehicle that allows employees to have a portion of each paycheck directly paid into a long-term investment account. The employer may contribute some money as well.

There are immediate tax advantages for the employee if the account is a traditional 401 and tax advantages after retiring if it is a Roth 401.

In either case, the money earned in the account will not be taxed until it is withdrawn during retirement if it is a traditional 401. If it is a Roth 401, no taxes will be due when the money is withdrawn.

Read Also: How To Look Up An Old 401k Account

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you won’t run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

Take The Guesswork Out Of Small Business Retirement Plans With Fisher Investments

Starting a retirement plan doesn’t have to be hard. Just look at some of the ways our solution takes on the heavy lifting:

- Hassle-free plan administration

- With our transparent and fair pricing, we make offering a retirement plan an affordable choice

- In just three steps, we help you build a plan thats right for your businessgetting started is easy and fast

Ready to get your new small business retirement plan off the ground in time for the New Year? Contact us today to speak with an experienced retirement specialist and start saving by next months payroll.

1 Source: 19th Annual Transamerica Center for Retirement Survey

2 Certain restrictions apply. Please visit for more information.

Also Check: Can You Roll Over 401k To Roth Ira

How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employer’s matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Recommended Reading: Which Investments Should I Choose For My 401k

Contributing To Both A Traditional And Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

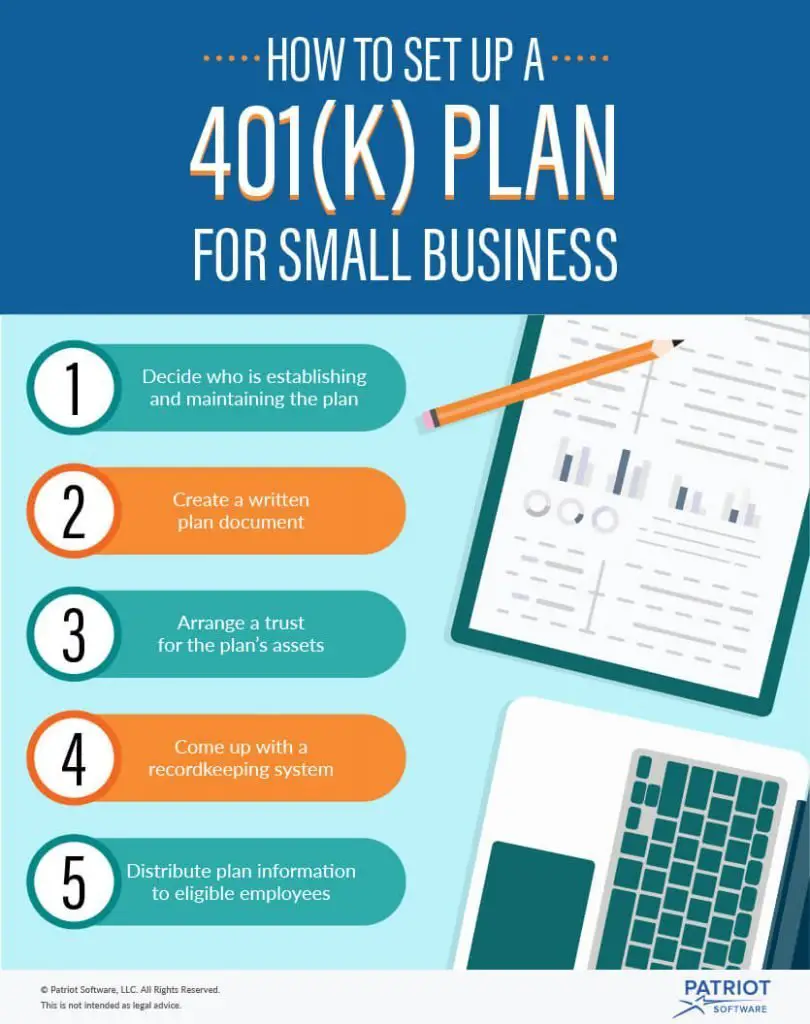

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

Recommended Reading: What Should My 401k Contribution Be

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Keep Your Money Where It Is

Keep your savings invested in your former employer’s retirement plan.

- Your savings stay invested, with the same tax advantages

- You continue with the plan’s investment options

- You can’t make additional contributions

- Your past employer may decide to make changes to the plan that impact your account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

Don’t Miss: What To Do With 401k When You Quit Your Job

Pick Your Investments And Review Fees

There will be a few investment options to select from within your 401 plan, typically index funds, like the following:

- Stock funds. Your options here may include companies of different sizes or from different geographic regions .

- Bond funds. Options might range from funds representing a large portion of the bond market to specific regions.

- Target-date retirement funds. These are made up of a mix of investments that changes over time, depending on when you plan to retire.

When selecting investments, also known as determining your asset allocation, you have two options: The do-it-yourself route, in which you select individual investments from that list of funds, or the hands-off approach of allocating all your funds into one already-mixed target-date fund. Regardless, the goal is to have a variety of assets to balance out potential risks, what’s known as diversification.

If you take the DIY approach, you’ll need to decide what portion of your portfolio is invested in bonds versus stocks. The Baltimore-based money managers at T. Rowe Price suggest these goals:

- 20s and 30s: 90% to 100% in stocks , with up to 10% remaining in bonds.

- 40s: 80% to 100% in stocks, with up to 20% remaining in bonds.

- 50s: 60% to 80% in stocks, 20% to 30% in bonds, and up to 10% in cash.

- 60s: 50% to 65% in stocks, 25% to 35% in bonds, and 5% to 15% in cash.

What Is A 401k

A 401k is an employer-sponsored retirement account. It allows an employee to dedicate a percentage of their pre-tax salary to a retirement account. These funds are invested in a range of vehicles like stocks, bonds, mutual funds, and cash. Oh, and if you’re curious where the name 401k comes from? It comes directly from the section of the tax code that established this type of plan specifically subsection 401k.

Also Check: Why Roll 401k Into Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

You May Like: How Does 401k Work If You Quit

How A Roth 401 Works

Like Roth IRAs, Roth 401s are funded with after-tax dollars. You don’t get any tax benefit for the money you put into the Roth 401, but when you begin to take distributions from the account, that money will be tax-free, as long as you meet certain conditions, such as holding the account for at least five years and being 59½ or older.

Traditional 401s, on the other hand, are funded with pretax dollars, providing you with an upfront tax break. But any distributions from the account will be taxed as ordinary income.

This basic difference can make the Roth 401 a good choice if you expect to be in a higher tax bracket when you retire than when you opened the account. That could be the case, for example, if you’re relatively early in your career or if tax rates shoot up substantially in the future.