Can I Max Out A 401k And An Ira In The Same Year

The limits for 401 plan contributions and IRA contributions do not overlap. As a result, you can fully contribute to both types of plans in the same year as long as you meet the different eligibility requirements.

How much can I contribute to an IRA if I also have a 401k?

If you participate in an employers retirement plan, such as a 401, and your adjusted gross income is equal to or less than the number in the first column for your tax return status, you can claim a traditional IRA contribution. up to the maximum of $6,000, or $7,000 if you are 50 years of age or older, in

How much can I contribute to my 401k and IRA in 2021?

16 For 2021, the combined 401 contribution limits between you and the employer-matched funds are as follows: $58,000 if you are under 50 $64,500 if you are 50 years of age or older

Contribution Limits For 401 403 And Most 457 Plans

| 2021 | ||

| Employee pre-tax and Roth contributions1 | $19,500 | |

| Employee after-tax contributions and any company contributions2 | $38,500 | |

| Maximum annual contributions allowed3 | $58,000 | |

| Additional employee pre-tax and Roth contributions1 | $6,500 | |

| Maximum annual contributions allowed3 | $64,500 | $67,500 |

1. If you have contributed to more than one qualified retirement plan during the calendar year, it is your responsibility to ensure that you have not exceeded these limits.

2. Company contributions include any employer matching, profit-sharing, and non-elective contributions.

3. Amount typically not to exceed the lesser 100% of your compensation or this number. Your employer’s retirement plan might limit the compensation to something less than 100% please refer to your plan’s Summary Plan Description or plan document for other applicable limits.

The annual compensation limit is $305,000. You can make contributions up to the IRS contribution limits noted above up to $305,000.

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

Also Check: Should I Rollover My 401k When I Retire

You May Like: What Is Ira And 401k

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

Get Schooled With Fidelitys Tools

The 401 features many investment options, plus access to planning tools and calculators, education, and guidanceall from industry leader Fidelity.

Fidelitys eLearning tools help you set financial goals to make the right plan for you. Register on Fidelitys website, and after you log in, select Tools from the menu.

And thats not all: Fidelity Investor Centers are located nationwide and available free of charge to all Fidelity account holders. You can meet with a financial advisor who will work with you to review and analyze your 401 account and answer your questions.

Also Check: What Is The Difference Between 401k And 403b

Benefits Of Maxing Out Your 401k

- A 401k is a tax-advantaged account. If you choose a traditional 401k, you wont pay taxes until retirement. If you opt for a Roth 401k, youll pay taxes now but not on withdrawals in retirement.

- 401ks offer opportunities for automated savings. Often, 401k contributions are automatically withheld from your paycheck and deposited in a retirement account. This means you never miss the money in your paycheck.

- The 401k sometimes comes with an employer match. This means that in addition to your contributions, your employer contributes a certain amount to your retirement savings. If youre not able to max out your 401k, consider at least contributing enough to get your employer match. This money represent a risk-free return on investment its the closest thing there is to a free lunch.

Also Check: What Is The Difference Between Annuity And 401k

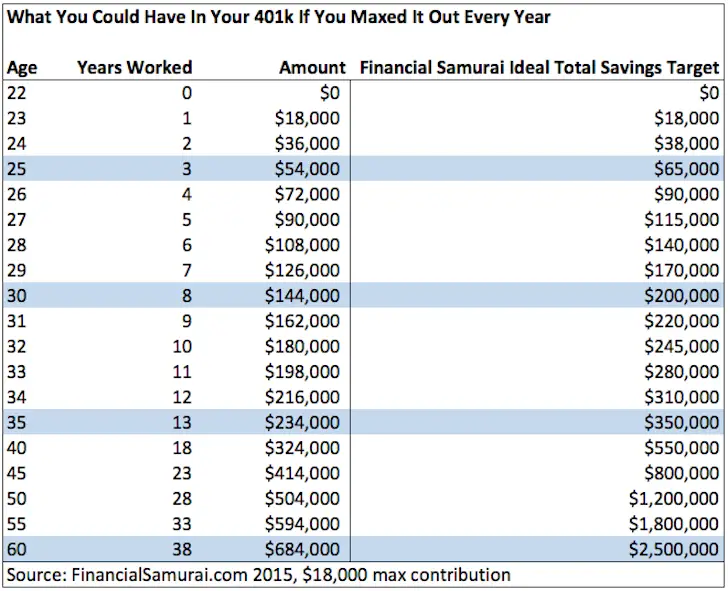

How Much Will I Save If I Max Out My 401k

- If a 25-year-old invests $19,500 per year, their account will increase to $4.48 million by the time they reach 70.

- If a 30-year-old invests $19,500 per year, their account will increase to $3.24 million by the time they reach 70.

- If a 35-year-old invests $19,500 per year, their account will increase to $2.32 million by the time they reach 70.

- If a 40-year-old invests $19,500 per year, their account will increase to $1.63 million by the time they reach 70.

- If a 45-year-old invests $19,500 per year, their account will increase to $1.13 million by the time they reach 70.

Because of the power of compound interest, time is on your side when youre young, as the data illustrate. The sooner you start investing your money, the less youll have to save each month to meet your retirement target of $1 million, for example.

Youd have to save roughly $1,625 every month, or nearly $750 per paycheck if you get paid every other week, to max out your 401 in 2020. . Calculate what proportion of your salary this translates to and begin contributing that amount.

Thats a significant amount of money to save, and it may not be feasible for everyone. If youre only comfortable putting aside 1% of your income, its preferable to start small and progressively raise your contributions rather than not begin at all. Auto-increase, a useful option provided by your firm, allows you to set the percentage increase.

Also Check: How To Direct Transfer 401k To 403b

What Is A Mega Backdoor Roth Ira

As well see later, : takes it to the next level. Its for folks who have a 401 plan at work they can contribute up to $38,500 in post-tax dollars in 2021 and $40,500 in 2022, and then roll the money into a massive backdoor Roth. The caveat: Creating a huge backdoor Roth is tricky, with many moving components and the risk of unanticipated tax costs, so seek advice from a financial advisor or tax professional before attempting it at home.

What Should You Do After Maxing Out Roth Ira

- If youve exhausted your Roth IRA contributions, you can still save for retirement through 401s, SEP, SIMPLE IRAs, or health savings accountsas long as youre eligible.

- Even before you deposit money into a Roth IRA, be sure youve fully loaded your 401 to receive the maximum workplace match.

- Investment-only annuities are free of the exorbitant fees associated with traditional annuities.

Recommended Reading: Can You Keep Your 401k In A Chapter 7

Would It Be Possible To Exceed E Maximum In My Ira

For 2020, taxpayers in the 50-plus age group can open up to $6,000 in traditional or Roth IRAs. A 50-year-old can invest up to $7,000. A retirement fund cannot exceed your earnings from a job in addition to a job. Its actually a capped figure, says Nancy Montanye, a certified public accountant based in Williamsport, Pennsylvania.

How Can I Buy Stocks

If youre not into robo-advisors and want to choose your own stocks, I recommend the following companies.

You can also open an account with a financial services company like Vanguard or Fidelity and choose your stocks there.

I personally prefer investing in index funds but if trading motivates you to save more money, than go for it.

Do whatever motivates you to save more.

Don’t Miss: How Do I Start A 401k For My Business

Your Employer’s Contribution Limit

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employer’s limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If you’re maxing out your employer’s contribution limit but you still worry that it’s not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that you’re taxed on when you make withdrawals in retirement, you contribute after-tax dollars and won’t pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if you’re under age 50, and $7,000 per year if you’re age 50 or older.

What Is The Biggest Advantage Of A Roth Ira

Roth IRAs offer several key benefits, including tax-free growth, tax-free withdrawals in retirement, and no minimum distribution required, but they also have their drawbacks. One major drawback: Roth IRA contributions are made on an after-tax basis, meaning there is no tax deduction in the year of contribution.

Are there any tax advantages to a Roth IRA?

There are many advantages to keeping your money in a Roth IRA. Roth IRAs offer tax-free growth on both contributions and income earned over the years. If you play by the rules, you will not pay taxes when you take the money.

What is the main advantage of a Roth IRA?

A Roth IRA is a retirement savings account that allows your money to grow tax-free. You fund Roth with after-tax dollars, meaning youve paid taxes on the money you put in. In return for no upfront tax deductions, your money grows and grows tax free, and when you withdraw in retirement, you pay no taxes.

Also Check: How To Lower 401k Contribution Fidelity

Recommended Reading: Am I Able To Withdraw Money From My 401k

Can I Have A 401 And An Ira

Yes. IRAs make a great supplement to retirement savings in addition to a 401 if youre contributing enough to receive a full match from your employer, or youre planning on maxing out your 401. If you dont receive a match on your 401 or it has narrow investment options or high fees, it may be a good idea to invest primarily in an IRA. The annual contribution limit for an IRA in 2021 and 2022 is $6,000, or $7,000 if youre 50 or older.

» Ready to try an IRA? Check out our list of the best IRA accounts

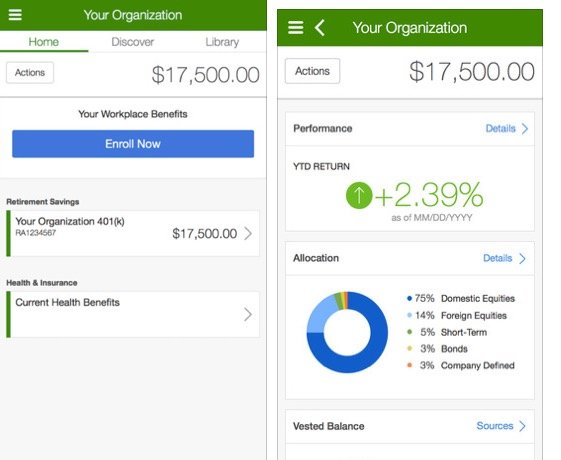

The First Thing To Do: Track Your Money

Do you know your net worth? I used to be afraid of adding up all of my debts, and savings, and credit cards but its important to know where you stand.

I use the free app Personal Capital to track my net worth.

It works by aggregating all of your accounts and adding them up and giving you this pretty chart.

Tracking your balance is so important and the first step to getting ahead with your money.

Personal Capital tracks your spending too which is super helpful in budgeting.

In addition, Personal Capital is able to analyze how much youre paying in fees in all of your investment accounts, which means you can identify where youre paying too much and potentially switch out your current investments into lower-fee funds. This allows you to save even more money.

Recommended Reading: How To Find Out If I Have Old 401k

What Is A Brokerage Account

It sounds fancy but this is just another investment account that you set up yourself with money from your bank account.

Unlike traditional IRAs, all of your contributions to a brokerage account are with money that you have already paid taxes on.

You can withdraw the money and earnings much easier than IRAs and 401s.

The Benefits Of Having A 401k And An Ira

Your 401k can serve as the backbone of your retirement plan. After all, its easy to save because your contributions are automatically taken out of your paycheck and your employer hopefully matches some or all of your contributions. However, having just a 401k might not be enough to help you reach your retirement goals.

Thats where having an IRA to contribute to in addition to your 401k comes in with an assist. An IRA gives you another way to save, plus it provides you with more investment choices. The two combined make your retirement plan that much stronger.

Also Check: How To Opt Out Of 401k Fidelity

What If You Contribute Too Much

If you discover that you contributed more to your IRA than youre allowed, youll want to withdraw the amount of your overcontributionand fast. Failure to do so in a timely way could leave you liable for a 6% excise tax every year on the amount that exceeds the limit.

The penalty is waived if you withdraw the money before you file your taxes for the year in which the contribution was made. You also need to calculate what your excess contributions earned while they were in the IRA and withdraw that amount from the account, as well.

The investment gain must also be included in your gross income for the year and taxed accordingly. Whats more, if you are under 59½, youll owe a 10% early withdrawal penalty on that amount.

How Much Should I Have In My 401k At Age 39

To help you know if you’re on track, retirement-plan provider Fidelity set benchmarks for how much you should have saved at every age. By 40, Fidelity recommends having three times your salary put away. If you earn $50,000 a year, you should aim to have $150,000 in retirement savings by the time you are 40.

Also Check: What’s Better Than 401k

Things To Do Before Maxing Out Your Retirement Savings

Here’s what you should consider before you funnel all your spare cash toward retirement.

- 08/20/2021

- 526

Contributing as much money as possible to retirement savings is essentialespecially with so many people having too little saved for the future.

But while you need to invest for your later years, you may not want to devote all your spare cash to this goal if you haven’t checked a few other items off your to-do list first. In particular, there’s two tasks you may want to undertake before you max out your retirement accounts.

Open A Health Savings Account

An HSA is a type of savings account that works with your health insurance. It allows you to save money for medical, dental, and vision expenses tax-free.

You can open an HSA if you have whatâs called a high deductible health plan . An HDHP has a deductible of whatâs called a minimum annual value .

The MAV is what you have to pay out-of-pocket for your health care each year before your insurance kicks in. In other words, itâs what you have to pay before the HDHP coverage comes into play.

You can save money tax-free. You donât have to worry about the IRS taking what youâve saved if something happens whatâs in your account is yours for good.

You May Like: What 401k Funds Should I Invest In

Matching Contributions For A Roth 401

If you choose to save money in a Roth 401, matching contributions must be allocated to a separate traditional 401 account. This is because IRS rules require you to pay regular income tax on employer contributions when they are withdrawnand Roth 401 withdrawals arent taxed in all but a few cases.

Remember, with a traditional 401 account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth 401 account, your contributions are made using after-tax dollars, and qualified withdrawals are generally tax free.

What Is A Recharacterization Of A Contribution To A Traditional Or Roth Ira

A recharacterization allows you to treat a regular contribution made to a Roth IRA or to a traditional IRA as having been made to the other type of IRA. A regular contribution is the annual contribution youre allowed to make to a traditional or Roth IRA: up to $6,000 for 2020-2021, $7,000 if youre 50 or older . It does not include a conversion or any other rollover.

Recommended Reading: Can I Transfer Roth 401k To Roth Ira

Don’t Miss: How To Withdraw My 401k From Fidelity

What Does Vesting Mean

Even if your employer makes a matching contribution to your 401, that money may not be yours. Many employers use their 401s to retain talent, so they include a vesting period for matching contributions. Once the vesting period ends, the money becomes fully yours.

Any money your employer contributes is kept separate from your contributions. Depending on your 401 plan, employer contributions can vest all at once or slowly over time. Once youve finished the vesting period, all previous and future contributions are vested and become yours immediately.

When considering a job change, take into account any money you may be leaving behind because it has not vested yet check your employers vesting schedule for more details.

For more on 401 vesting, check out our article detailing how 401 vesting works.