How Much Can I Borrow From My 401

The maximum anyone can borrow is $50,000. Even if you have a $1 million in your account, $50,000 is the most you can borrow under federal guidelines. If you have less than $100,000 in your account, you only can borrow as much as half your balance so if you have $84,000 in your account, you can borrow no more than $42,000. Some plans offer an option that allows you to borrow as much as $10,000 even if your account has less than $20,000 vested. Again, you need to read your plans rules or talk to your employer or plan administrator to learn more.

What To Know Before Borrowing Against Your 401k

Borrowing against your 401k should only be considered as a last resort loan option. Other forms of private loans will be more financially beneficial to you. However, if you are unable to get funding from another source and are in immediate need, some employers will allow you to borrow from your 401k fund. These loans are very different than other loans. You are basically making a withdrawal from your account and then paying the funds back later.

Advantages

The main advantage of borrowing from a 401k is you are essentially borrowing from yourself. This means you do not have to undergo the same screening process you receive when you are borrowing from another lender. Most people who consider borrowing from a 401k have bad credit, leading them to this option. You will be able to borrow up to 50% of the monies you have fully-vested. This can amount to a very large loan without any credit check, a down payment or collateral.

Loan Limits

You can only borrow up to 50% of vested funds. This can be tricky for some people who do not understand the contribution process. When you contribute funds automatically in each paycheck, the funds hit the account very quickly. It is against the law for your employer to wait to deposit the contributions you have individually made. All contributions must be deposited within the 15th business day in the month following your contribution.

Loan Terms

Tax Penalties

What Other Options Are There If You Need Cash

- If you have a Roth IRA for five years, you can withdraw your original contributions at any age, free of federal taxes and penalties.

- For education expenses, explore scholarships or student loans. You can borrow for school but not for retirement.

- You can borrow against the value of your home with a home equity loan or home equity line of credit.

You May Like: How Can I Check My 401k Online

Understanding The Taxable Event

The Internal Revenue Service rules determine which events have federal tax consequences for individuals and businesses.

Generally, taxable events must be reported by both the payer and the payee, whether or not any taxes are eventually due. For example, a bank pays interest on its savings accounts to the account holders. The bank reports the payment to the government. The account holder then reports it on a tax return. Taxes on the interest may or may not be due, depending on the account holder’s total net income.

There are several broad categories of taxable events.

What Is The 5 Year Rule For Roth 401k

A Roth IRA is a type of retirement plan that offers significant tax advantages. Roth IRAs are a terrific alternative for seniors since you can invest after-tax cash and withdraw tax-free as a retiree. Investment gains are tax-free, and distributions arent taken into account when assessing whether or not your Social Security benefits are taxed.

However, in order to profit from a Roth IRA, you must adhere to specific guidelines. While most people are aware that you must wait until you are 59 1/2 to withdraw money to avoid early withdrawal penalties, there are a few more laws that may cause confusion for some retirees. There are two five-year rules in particular that might be confusing, and failing to follow them could result in you losing out on the significant tax savings that a Roth IRA offers.

The initial five-year period

Don’t Miss: Can You Transfer A Rollover Ira To A 401k

Should I Borrow From My 401

Borrowing from a 401 to pay off debt may seem like an attractive option, but it comes with a major tradeoff a . In addition to having less savings in your retirement account to hold you over during your golden years, you could also be slammed with penalty fees for withdrawing from your 401 early.

According to the IRS, if you withdraw from your 401 before the age of 59 ½, you will be required to pay a 10% early withdrawal penalty in addition to income tax on the distribution. While it may be easy to borrow from your retirement fund, it is wise to consider the post-retirement implications borrowing from this source could cause.

Is It Worth Converting 401k To Roth Ira

You may have an old 401or severalfrom prior companies laying around. Transferring money from a 401 to a Roth 401 at your new job could seem like a good idea. But keep in mind that if you go that path, youll be hit with a tax bill.

Another option is to convert your existing 401 into a standard IRA. With the guidance of your financial advisor, youll have more control over your assets and will be able to choose from hundreds of funds. Furthermore, because youre transferring funds from one pretax account to another, there will be no tax implications.

You could use a Roth IRA if you cant move your money into your new employers plan but think a Roth is right for you. You will, however, pay taxes on the amount you put in, just as you would with a 401 conversion. If you have the funds to pay for it, go ahead.

Also Check: How Do You Withdraw From 401k

The Loan Is Tied To Your Job

This is one of the more obvious reasons for staying away from the 401k loan. If you leave your job for any reason, most companies will require you to pay that loan back at a much faster rate, or even immediately. You dont want to be stuck holding this loan if you get canned.

Remember, you borrowed because you didnt have enough money to begin with. So what makes you think youll be able to pay it back quickly? Studies show that a majority of the people who leave their job with an outstanding 401k loan, end up in default.

Withdrawals From A 401

-

401 hardship withdrawals If you find yourself facing dire financial concerns and need cash urgently, your 401 plan may offer a hardship withdrawal option. Unlike a 401 loan, you wont have to repay the money you take out, but you will owe taxes and potentially a premature distribution penalty on the amount that you withdraw. In addition, IRS 401 hardship withdrawal rules state that you may not take out more money than what is needed to cover your hardship situation. In order to qualify for a 401 hardship withdrawal, your plan administrator must offer this option and you must be facing an immediate and heavy financial need. According to the IRS, approved 401 hardship withdrawal reasons include:

- Postsecondary tuition for you or your family

- Medical or funeral expenses for you or your family

- Certain costs related to buying, or repairing damage to, your primary residence

- Preventing your immediate eviction from or foreclosure of your primary residence

If you experience a financial hardship from a circumstance not on this list, you may still be able to qualify for a hardship withdrawal, so check with your plan administrator.

- In-service, non-hardship withdrawals

This type of withdrawal is only allowed under certain plans and is mainly used by those who would like to explore other investment options. Learn more about in-service distributions. An Ameriprise financial advisor can provide more detailed information on in-service 401 distributions.

Don’t Miss: Does Mcdonald’s Offer 401k

Can I Borrow Against My 401k Plan Not If You Can Help It

July 31, 2016 by Justin

It can be tempting. You spend years and years building up a stockpile of money that just sits in an account and doesnt seem to do anything for you in the present. Sure you know your savings is for retirement. But that seems so far away. What about my problems and needs for today? Can I borrow against my 401k and use the money to tide me over for a little while?

This line of thinking is exactly the rationale that gets many people into trouble with their retirement savings. Sometimes when youve got a decent chunk of money stashed away in your IRA or 401k, it can be very tempting to think that you should be able to help yourself to even a small portion of it if needed.

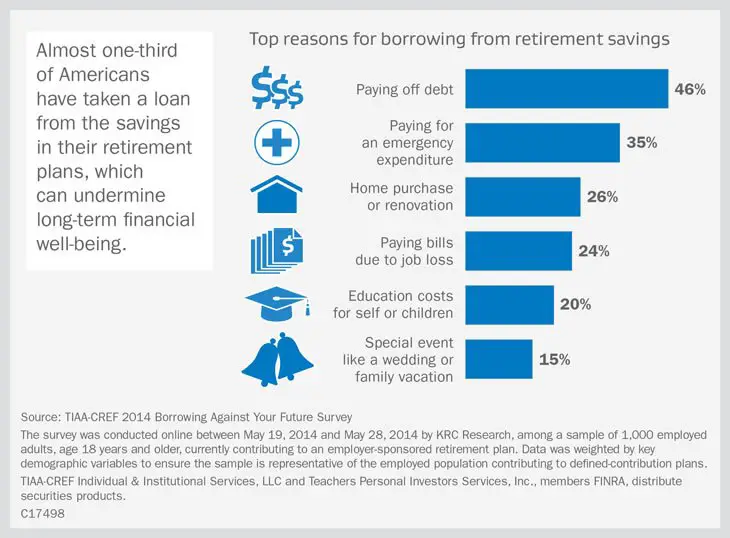

The IRS recognizes this too. Although your employer can restrict the terms of the loan, they do have to be reasonably available to all participants of the retirement plan. Some of the common reasons people decide to borrow against their 401k include:

- Paying for education expenses

Can I Borrow Against My 401k Not If You Want to Succeed:

While borrowing from your 401k can be tempting, there is one major setback that you should strongly consider:

- It will reduce the overall growth potential of your entire balance.

Lets look at a simple example: Say youve got two employees that are exactly the same. They both contribute $6,000 to their 401k balance , and it grows at an average annualized rate of 8% each year.

So how much more money does Employee A have over Employee B after 30 years?

Ways To Tap Your Savings

Different rules apply to withdrawals, loans and hardship distributions.

Loans. If your employer allows you to borrow from your 401, you may be able to take out a loan free of taxes if you meet certain criteria.

Regardless, you’re limited to a maximum of 50% of your vested account balance or $50,000, whichever is less.

You must repay the loan within five years and make substantially level payments at least quarterly.

Withdrawals. A distribution from your 401 plan is subject to 20% withholding for taxes. You’re also subject to a 10% penalty if you’re under 59½.

Hardship distribution. Your plan might allow you to take a hardship distribution. The IRS allows this if it’s made due to an “immediate and heavy financial need.”

Applicable emergencies include medical care, funeral expenses and payments necessary to prevent that employee’s eviction from her home.

These distributions are included in your gross income and could be subject to additional taxes, but they aren’t repaid to the plan.

That means when you take a hardship distribution, you’ve permanently lowered your balance.

You May Like: Can I Take My 401k If I Leave My Job

Whats The Best Way To Compare This Loan To Borrowing From Somewhere Else

The first thing that most people do is to compare the interest charged on the loan. The rate is set by the plan administrator. The law says that it needs to be a reasonable rate. For our illustration lets say that the rate is 2% less than the rate that Lucys dealer would charge. Good deal, right?

Not so fast, my spendthrift friend. Lets think about this. When youre a borrower you want lower rates. But when youre the lender you want higher rates. This time youre both. So were back to our original question. Is this a good deal or not?

Start living better for less.

to get money-saving content by email that can help you stretch your dollars further.

Twice each week you’ll receive articles and tips that can help you free up and keep more of your hard-earned money, even on the tightest of budgets.

Subscribers receive a free copy of our eBook Little Luxuries: 130 Ways to Live Better for Less.

We respect your privacy. Unsubscribe at any time.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Recommended Reading: Is Rolling Over A 401k Taxable

Do I Have To Pay Taxes When I Rollover A 401k To A Roth Ira

A taxable event is rolling over your 401 plan to a Roth IRA. Your contributions, employer-match contributions, and all earnings will be subject to income tax. This could put you in a considerably higher tax bracket, depending on the size of your account, so dont do it unless youve done the arithmetic. You should also speak with a financial expert to ensure that this is the correct decision for you.

What Is The Downside Of A Roth Ira

- Roth IRAs provide a number of advantages, such as tax-free growth, tax-free withdrawals in retirement, and no required minimum distributions, but they also have disadvantages.

- One significant disadvantage is that Roth IRA contributions are made after-tax dollars, so there is no tax deduction in the year of the contribution.

- Another disadvantage is that account earnings cannot be withdrawn until at least five years have passed since the initial contribution.

- If youre in your late forties or fifties, this five-year rule may make Roths less appealing.

- Tax-free distributions from Roth IRAs may not be beneficial if you are in a lower income tax bracket when you retire.

Also Check: How Do I Roll Over My 401k

How To Minimize Taxable Events

Successful investors work on limiting their taxable events or, at least, minimizing the most expensive taxable events while maximizing the least expensive taxable events.

Holding on to profitable stocks for more than a year is one of the easiest ways to minimize the effects of taxable events, as it means paying taxes at the lower long-term capital gains tax rate.

In addition, tax-loss harvesting, meaning selling assets at a loss to offset capital gains for the same year, can help minimize taxable events.

To avoid being taxed and penalized for withdrawing from a retirement plan, employees changing jobs must directly roll over the balances in their old 401 plans to the new employers plan or to an individual retirement account . A taxable event can be triggered if that money is paid directly to the accountholder even for a short time.

Making A 401 Withdrawal For A Home

Compared to a loan, a withdrawal seems like a much more straightforward way to get the money you need to buy a home. The money doesn’t have to be repaid and you’re not limited in the amount you can withdraw, which is the case with a 401 loan. Withdrawing from a 401 isn’t as easy as it seems, though.

The first thing to understand is that your employer may not even allow withdrawals from your 401 plan due to age. If they do allow employees to tap 401 funds early, you may have to prove that you’re experiencing a financial hardship before they’ll allow a withdrawal. Under the IRS rules, consumer purchases generally don’t fit the hardship guidelines.

You may be able to withdraw funds from a 401 plan that you’ve left behind at a previous employer and haven’t rolled over to your new 401. This, however, is where things can get tricky.

If you’re under age 59 1/2 and decide to cash out an old 401, you’ll owe both a 10% early withdrawal penalty on the amount withdrawn and ordinary income tax. Your plan custodian will withhold 20% of the amount withdrawn for taxes. If you withdraw $40,000, $8,000 would be set aside for taxes upfront, and you’d still owe another $4,000 as an early-withdrawal penalty.

Don’t Miss: How To Start Withdrawing From 401k

Can You Use Your 401 To Buy A House

Retirement accounts are just that: money thats being set aside for you to use in your golden years. And if youve been carefully saving, you might be wondering if its OK to tap those funds to use for something right now, like a home purchase, given that its an investment in its own right.

One of the most common types of retirement plans is the 401, which is often offered by companies to their workers. It provides an easy way to earmark some of your salary for retirement savings, along with the tax benefits that a 401 brings. Youll be setting aside money without paying taxes right now and then will pay the taxes when you withdraw it, which ideally will be when youre in a lower tax bracket than youre in now. In many cases, companies also match up to part of your personal savings, which is another reason that 401 accounts are so popular, since thats essentially free money.

But those funds have been set aside specifically for your retirement savings, which means that if your plan allows you to withdraw it earlier, youll pay a penalty, along with the taxes you owe given your current tax bracket. Theres usually the potential to borrow from it, though, which may be a better option.

So, while you can use your 401 for a first-time home purchase in most cases, the question is whether you should.