Contribution Limits For Highly Compensated Employees

Some 401 plans have extra contribution limits on employees who are highly compensated. plan and you are a high earner, these limits may not apply to you.)

Highly compensated employees can contribute no more than 2% more of their salary to their 401 than the average non-highly compensated employee contribution. That means if the average non-HCE employee is contributing 5% of their salary, an HCE can contribute a maximum of 7% of their salary. In addition to the federal limit, your company may have specific caps established to remain compliant.

The IRS determines you are a HCE if:

Either you owned 5% or more of a company last year and are participating in its 401 plan this year.

Or you earned $130,000 or more in 2020 from a company with a 401 plan youre participating in this year.

Unlike most other 401 limit guidelines, HCE classifications are based on your status from the previous year. For the 2022 plan year, the employee compensation threshold is $135,000.

If HCE contribution rates exceed non-HCE contribution rates by more than 2%, companies workplace retirement plans may lose their tax-advantaged status. As a HCE, you may be prevented from contributing to your 401 to the employee contribution max due to low 401 participation rates. You should still be able to make catch-up contributions on top of your HCE cap if you are eligible, though.

Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you earn less than $122,000, you qualify for a Roth IRA in 2019. Youll qualify for a Roth IRA in 2020 if you earn less than $124,000. This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

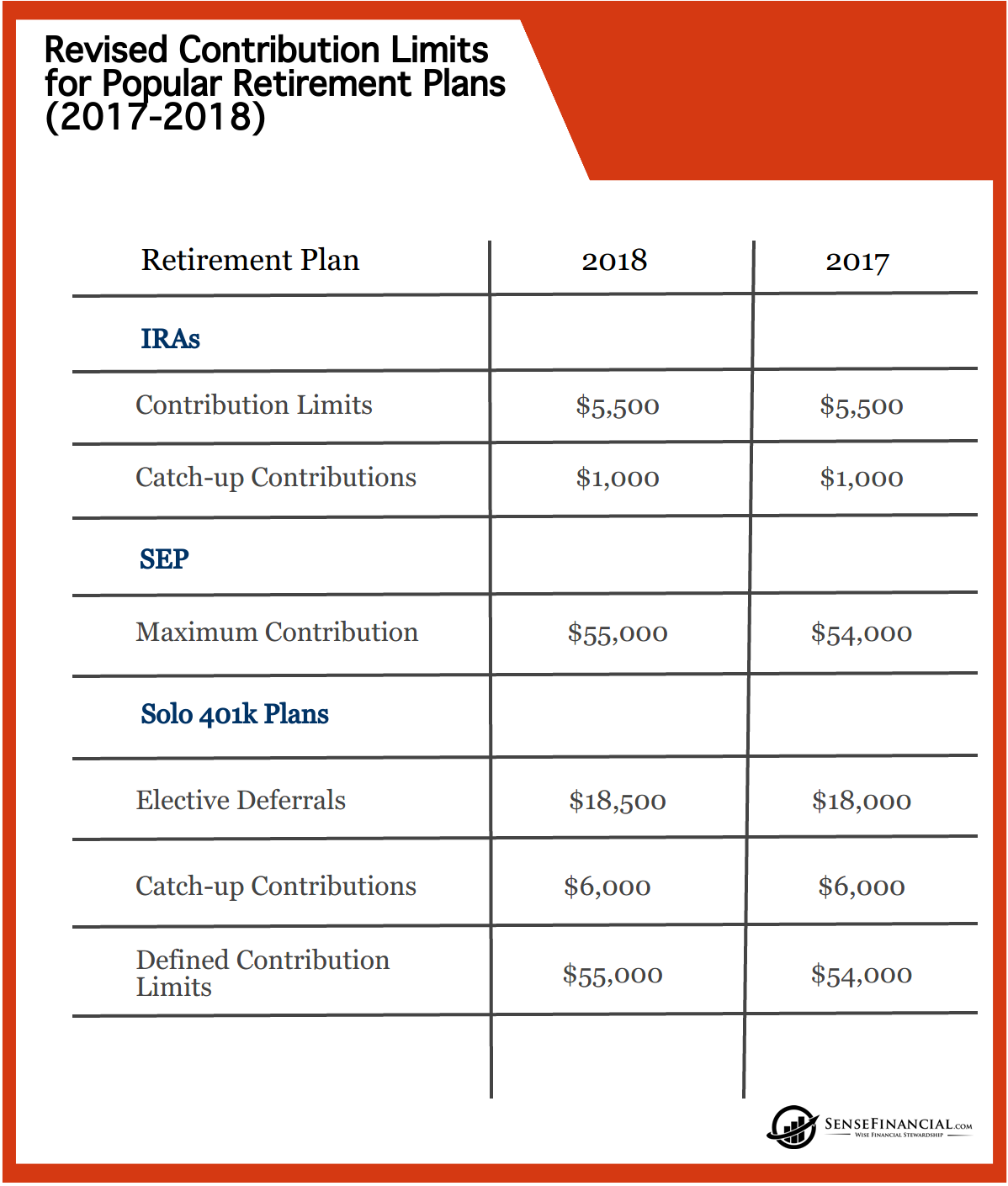

In 2019, you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here too. You can also contribute up to $6,000 in 2020.

You can also invest in a traditional IRA, which takes pre-tax dollars and lessens your taxable income just like a 401. Some people also have an IRA because when they left a previous employer, they moved their 401 funds into an IRA via an IRA rollover.

Limitation On Elective Deferrals

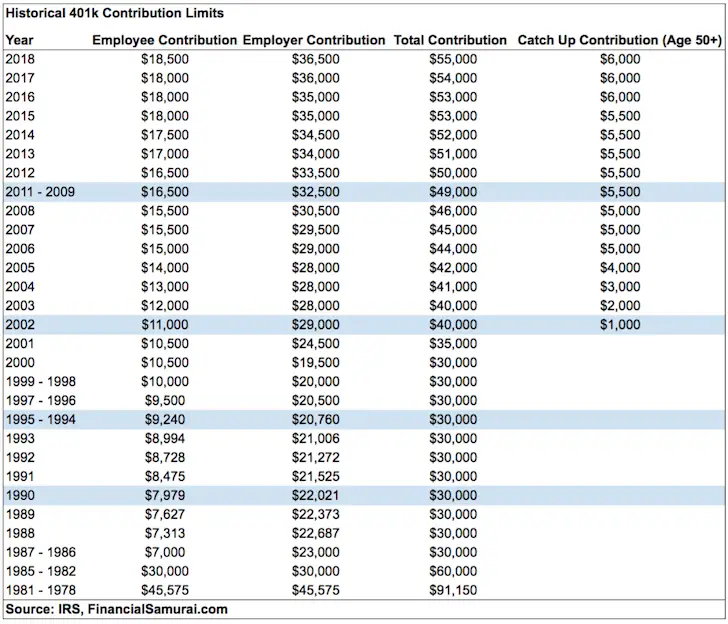

The maximum amount you can defer into your 401 plan adjusts each year for inflation. As of 2012, the standard limit is $17,000. However, for people age 50 and older, the contribution limit increases by $5,500 because of what is known as a catch-up contribution. This extra $5,500 increases the total limit for someone older than 50 to $22,500. The catch-up contribution does not count toward the general 401 plan contribution limits.

Dont Miss: When Can I Set Up A Solo 401k

Don’t Miss: Can You Roll Over 401k From One Company To Another

How To Fix The Mistake:

IRC Section 72 imposes a 10% additional tax for distributions that don’t meet an exception, such as death, disability or attainment of age 59 ½, among others. To avoid this additional tax, correct excess deferrals no later than April 15 of the following year. If you don’t correct by April 15, you may still correct this mistake under EPCRS however, it won’t relieve any Section 72 tax resulting from the mistake.

Under Revenue Procedure 2021-30 PDF, Appendix A, section .04, the permitted correction method is to distribute the excess deferral to the employee and to report the amount as taxable both in the year of deferral and in the year distributed. These amounts are reported on Forms 1099-R. In the case of amounts designated as Roth contributions, the excess deferral will already have been reported in income in the year of deferral. However, the amount will be reported as taxable in the year distributed.

How Much Are You Allowed To Contribute A Pension Plan

If you work in the public sector, you can receive a government employee pension plan thatâs often footed by taxpayers. Itâs often a complement to Social Security and personal investment. In fact, you have the option to contribute a portion of each paycheck to your preferred retirement system.

Moreover, some pension plans come with a voluntary investment component. If you have such a pension plan, you could contribute part of your current income from wages into a retirement investment plan.

Your employer can also match a portion of your annual contributions. This is usually up to a specific percentage or dollar amount.

You May Like: What To Ask 401k Advisor

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

Dont Miss: Can I Start A 401k For My Child

Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

You May Like: How Many Percent Should I Put In 401k

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

Timely Withdrawal Of Excess Contributions By April 15

- Excess deferrals withdrawn by April 15 of the year following the year of deferral are taxable in the calendar year deferred.

- Earnings are taxable in the year they’re distributed.

- There is no 10% early distribution tax, no 20% withholding and no spousal consent requirement on amounts timely distributed.

Recommended Reading: Should I Roll 401k To Ira

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

Is There An Income Limit For Contributing To A 401

Not exactly. If you have access to a 401 plan at work, you can put money into it no matter how high or how low your salary is. But listen up, high-income earners: The IRS does limit how much of your salary and compensation is eligible for a 401 match.

For 2021, the compensation limit contributions and matches) is limited to $290,000. So keep that in mind! In 2022, the compensation limit increases to $305,000.7

Heres how it works. Lets say you make $500,000 in 2022 and your company offers a 4% match on your 401 contributions. You contribute $20,500the maximum amount youre allowed to put into your 401 in 2022. But instead of matching that $20,500 , your employer only contributes $12,200. Why? Because your employer is only allowed to apply your match on up to $305,000 of your compensation, and 4% of $305,000 is $12,200.

Noit doesnt really make sense. But dont let that stop you from using all the tools you have to build wealth for the future!

You May Like: When Should I Start My 401k

Review The Irs Limits For 2021

The IRS has announced the 2021 contribution limits for retirement savings accounts, including contribution limits for 401, 403, and most 457 plans, as well as income limits for IRA contribution deductibility. Contribution limits for Health Savings Accounts have also been announced. Please review an overview of the limits below.

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2021 and 2022 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. fee analyzer.) If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

Don’t Miss: How Do Companies Match 401k

Does My Employers 401 Match Count Toward My Maximum Contribution

To put it simply, the answer is no. An employer matching contribution does not count towards your maximum contribution of $20,500. However, the IRS does limit total contribution to a 401 from both the employer and the employeewhich means total contributions can’t exceed either:

-

100% of an employee’s salary, or

-

The limit for defined contributions .

The limit for defined contribution plans in 2022 under section 415 is $61,000 . Workers older than 50 years are still eligible for a $6,500 catch up contribution and can have a maximum of $64,500 in employer and employee contributions. This applies to both traditional and Roth 401s.

What Are Roth 401 Contribution Limits

Contribution limits for Roth 401 plans are the same as traditional 401 plans

-

Maximum salary deferral: $20,500 in 2022

-

Catch up contributions : $6,500 in 2022, 2021, and 2020

While contribution limits are the same for Roth and traditional 401 plans, a Roth 401 is treated as a separate account within a traditional plan and allows for the contribution of after-tax dollars. Employers can contribute to an employees Roth 401 with matching contributions up to a certain dollar amount or percentage but it will always be through pre-tax contributions. Employers can decide to make elective contributions that arent dependent on employee contributions.

Don’t Miss: How To Set Up A Solo 401k Account

How To Contribute To A 401k

If you have a 401 plan, you should contribute as much as you can to max out your contributions. Find out how you can contribute to a 401 plan.

If your employer offers a 401, you should take advantage of this benefit to accumulate retirement savings for your golden years. 401 plans allow employees to set aside part of their salary each year for their retirement. Once you enroll in a 401 plan, you should find out how you can contribute to the plan.

Contributions to a 401 plan are typically made through payroll deductions. Usually, the employer withholds the contributions from your paycheck every pay period and then makes direct deposits to your 401. Some employers may also allow employees to make check deposits to the 401. In this case, an employee will be required to write a check to the plan with the amount they want to contribute.

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Also Check: Should I Roll My 401k Into An Annuity

Maximizing Your 401 And Ira Retirement Contributions

When you contribute to a 401, 403, or IRA, youre already on a path to help secure your financial future. But could you save more? Making the most of your organizations retirement plan now could help ensure your golden years are even more golden.

Read 5 steps to creating your retirement plan to help you get started.

Extension Apply To Both Contribution Types Question:

Self-directed 401k contributions deadlines are based on the type of entity sponsoring the solo 401k so you are correct. Please see the following.

- If the entity type is a Sole Proprietorship, the annual solo 401k contribution deadline is April 15, or October 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an C-Corporation , the annual solo 401k contribution deadline is April 15, or September 15 if tax return extension is timely filed.

Don’t Miss: What Age Can You Collect 401k

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

How Much Can You Contribute To A 401 Per Year

In 2022, you can contribute up to $20,500 to a 401. If you have multiple 401 accounts, the cumulative annual contributions cannot exceed the $20,500 annual limit.

If you are 50 or older, you can make an extra $6,500 contribution, which increases the total contribution for the year to $27,000.

If your employer offers a 401 match, you will receive matching contributions to your 401 account up to a certain limit. The total employer and employee contributions should not exceed $61,000 in 2022, or $67,500 if you are 50 or older.

Don’t Miss: How To Calculate Employer Contribution To 401k