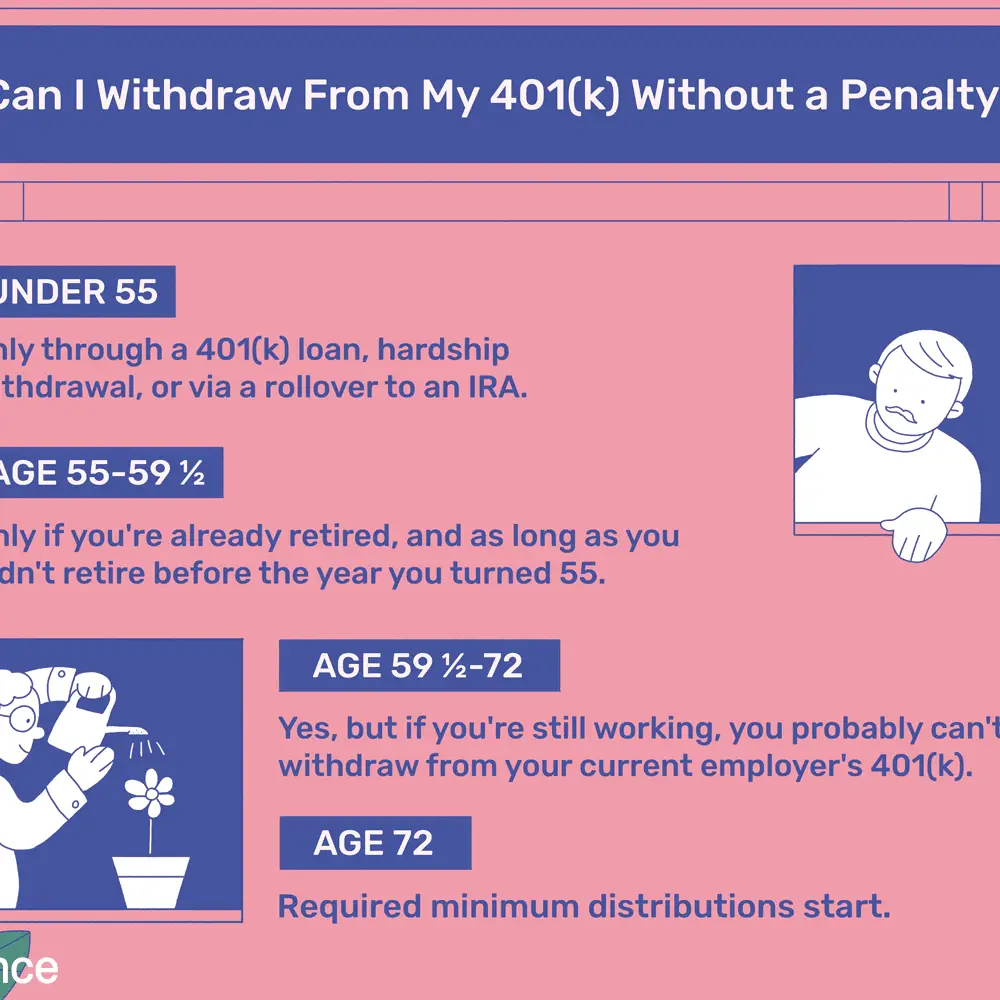

Withdrawing Funds From 401 After 55 But Before 59

If you are 55 or older and still working for the company managing your retirement savings, you cannot take a penalty-free distribution until you are 59 ½. However, you may still qualify to take a hardship withdrawal if you have a qualified expense. You will owe income taxes and a 10% penalty tax on the distribution you take. You may also qualify for a 401 loan if your retirement plan provides this benefit.

Social Security Recipients And New Income Tax Credits

With tax season in full swing, the SSA also wants recipients to be aware that there are some new special tax credits that can go towards expenses. The tax credits are available even if someone receives Supplemental Security Income but doesn’t normally file a tax return.

The biggest of those is the Child Tax Credit , which was expanded last year to help families that are raising children. The credit can be claimed by anyone who has a qualifying child, even if they dont usually file a federal tax return. It can benefit the taxpayer up to $3,600 per qualifying child under age 6 and up to $3,000 for each qualifying child aged 6 to 17 years old. Full details on the CTC are available here.

The agency reminds Social Security recipients that they may also be eligible for the Earned Income Tax Credit . Beginning in 2021, the amount of investment income an American can receive and still be eligible for the EITC increased to $10,000. The only catch is that a person must qualify and file a federal tax return to claim the EITC. You can visit ChildTaxCredit.gov for options to file a federal tax return for free.

Officials Say Taxpayers Might Be Eligible For Some Added Benefits

That might be a dont-hold-your-breath kind of thing. The last time Congress changed the full retirement age was in 1983, a move that came on the heels of life expectancy increasing and health improvements being made for older Americans.

The action is estimated to affect about 70 million Americans and is the biggest change since 1982, when recipients saw a 7.4% increase in benefits.

Also Check: How To Calculate Rate Of Return On 401k

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS website for more details.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

What Is The Earliest Age You Can Collect Social Security

Starting Your Retirement Benefits Early You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

Also Check: How Do You Take Money Out Of 401k

When Must I Receive My Required Minimum Distribution From My Ira

You must take your first required minimum distribution for the year in which you turn age 72 . However, the first payment can be delayed until April 1 of 2020 if you turn 70½ in 2019. If you reach 70½ in 2020, you have to take your first RMD by April 1 of the year after you reach the age of 72. For all subsequent years, including the year in which you were paid the first RMD by April 1, you must take the RMD by December 31 of the year.

A different deadline may apply to RMDs from pre-1987 contributions to a 403 plan .

How Much Should I Have In My 401 By Age 60

Retirement is a big milestone but getting there doesnât happen overnight. Financially preparing yourself to leave the workforce requires some forward thinking. If youâre asking yourself, âHow much should I have in my 401 by age 60?â youâre not alone.

A general rule is to have six to eight times your salary saved by that point, though more conservative estimates may skew higher. The truth is that your retirement savings plan hinges on your individual goals and financial situation, not some magic number. Here are a few ways to measure whether youâre on the right track.

Recommended Reading: How To Open A Solo 401k

What Are The Consequences Of Taking A Hardship Distribution

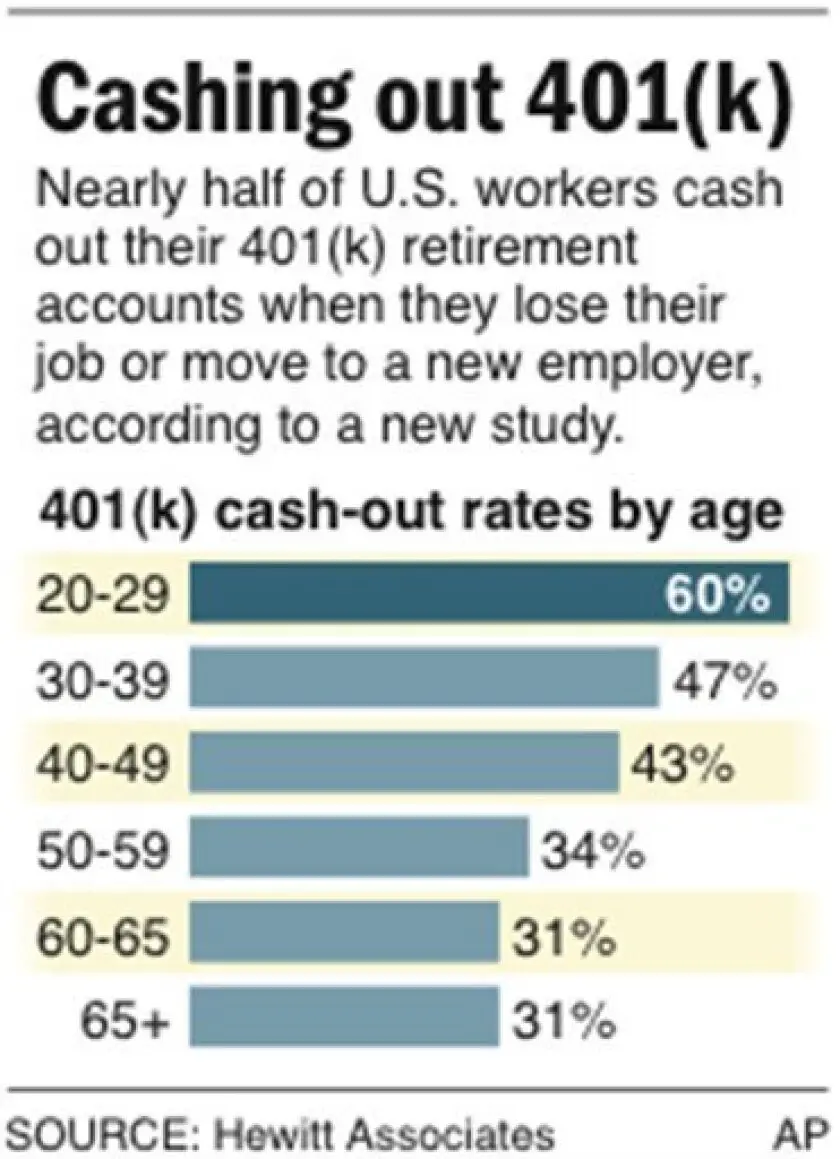

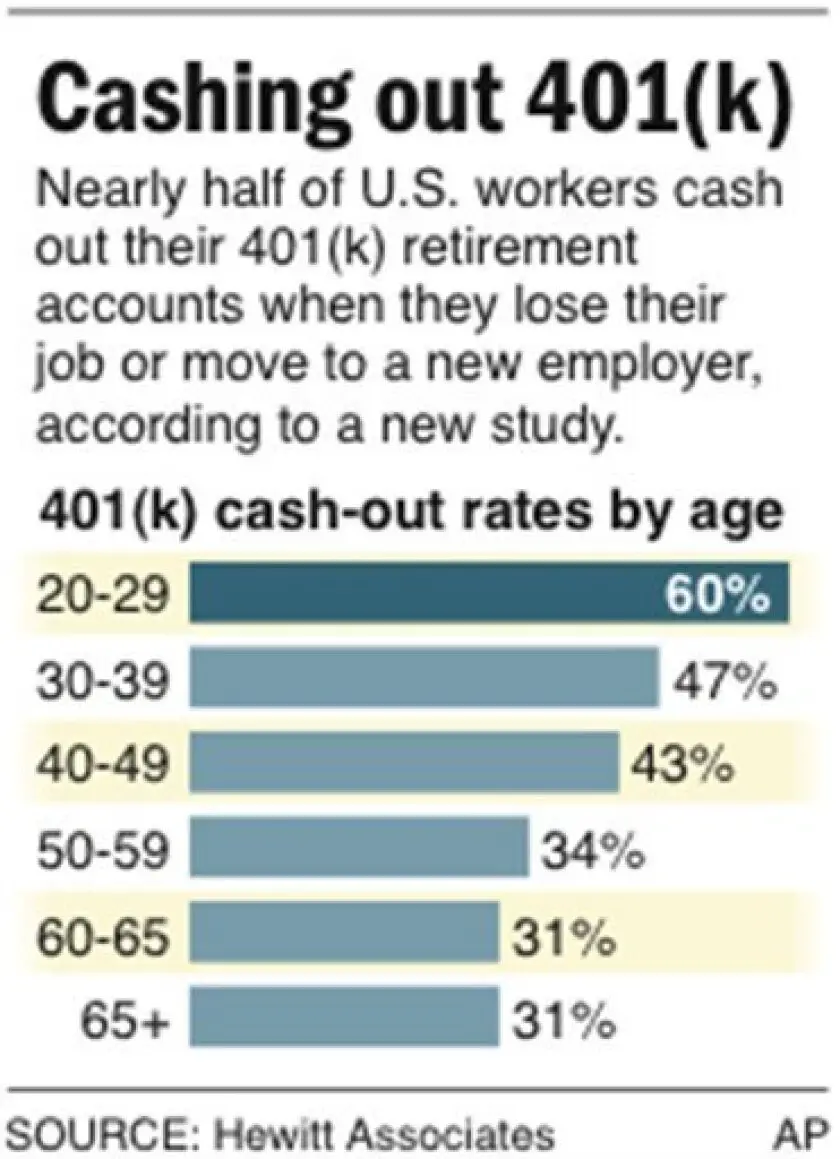

Whether youre a Millennial or Baby Boomer, a hardship withdrawal could have a significant impact on your retirement outcome. As a Baby Boomer, your years of catching up will be shorter. In some cases, you may never entirely catch up to where you once were prior to the withdrawal. It could also mean you may need to postpone your retirement until you are financially more stable, dramatically setting you back on your retirement goals.

As a Millennial, things arent quite as bleak. While a hardship disbursement will certainly set you back, you will have many more years in the workplace to make up the difference. However, they are still costly in the short term when you pay taxes, and participants that are not 59 ½ or older may be subject to a 10 percent penalty tax.

Heres the bottom line: the decision to take a hardship distribution is truly a personal one and is often surrounded by extenuating circumstances. Because of the impact on funds for retirement, hardship distributions should be your absolute last resort for withdrawing funds from your 401 retirement fund.

Can I Take All My Money Out Of My 401 When I Retire

You are free to empty your 401 as soon as you reach age 59½or 55, in some cases. Its also possible to cash out before, although doing so would normally trigger a 10% early withdrawal penalty.

If you want to cash out everything, you can opt for a lump-sum payment. Think carefully before taking this approach, though. Withdrawing your savings all at once could result in a hefty tax bill and, if not managed wisely, leave you living in severe poverty later on in retirement.

Also Check: How Can I Look At My 401k

The Best Age For A Variable Or Indexed Annuity

Variable annuities offer both the benefits and the risks of market exposure. In this case, annuity payments fluctuate as a function of market performance which means that they may be higher than fixed annuities, but it also means that they could be lower. Also, these annuities expose your principal to the market, which means that you could suffer dramatic losses.

As a result, variable annuities are best suited for investors who are less averse to risk but that want to take a shot at getting more bang for their buck. Early retirees aged 59 and a half can benefit from this type of annuity while avoiding early withdrawal penalty fees.

Why You Should Consider A 401 Loan Instead Of Hardship Withdrawal

If youre in need of extra funds and have no other options outside of your 401 plan, consider taking a plan loan. First, check out your 401 plan document to see if it allows for plan loans. If allowed, you can borrow up to 50 percent of the vested portion of your 401 balance. Youll pay interest as youre paying the loan off, but it is credited back into your account. And as long as you pay the loan back, its not taxable. In addition, you can still contribute to the 401 plan and pay back the loan at the same time, although it may be wiser to put that additional money toward the principal to get it paid off in a shorter time saving on interest charges.

A loan is better than a hardship distribution because with a loan, you can restore your 401 balance by paying the loan back. But there are no payback provisions for hardships once the hardship distribution is made, its out your 401. You will need to make other arrangements to cover any shortage in your retirement savings objective due to the hardship distribution.

Also Check: How To Find Out How Much Is In My 401k

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

K Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

You May Like: How To Invest 401k In Stocks

Can I Take A Withdrawal Before I Terminate Employment

In general, you cant take a withdrawal from your 401 account until one of the following events occurs:

- You die, become disabled, or otherwise terminate employment

However, a 401 plan can also permit withdrawals while you are still employed. These in-service withdrawals are subject to the following conditions:

- 401 deferrals , safe harbor contributions, QNECs and QMACs cant be distributed until age 59.5

- Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

- Employee rollover and voluntary contributions can be distributed at any time.

- 401 deferrals , non-safe harbor contributions, rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time.

To find the in-service withdrawal rules applicable to our 401 plan, check your plans Summary Plan Description .

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2021. So if you contribute the annual limit of $19,500 plus your catch-up contribution of $6,500, thats a total of $26,000 tax-deferred dollars you could be saving towards your retirement.

Read Also: Can You Contribute To 401k After Leaving Job

How To Make The Best Use Of The Rule Of 55

The restrictions of the rule of 55 make it vital to use smart retirement planning techniques. First and foremost, you need to time your early retirement so you don’t leave your job before the year in which you’ll turn 55.

Second, if you want to maximize the amount of money you can withdraw without penalties, you should take advantage of rollover options to move as much money as you can into your current employer’s 401 before leaving your job. For example:

- Many companies allow you to roll over 401s from previous employers into your new employer’s account.

- Many also enable you to move money from an IRA into your workplace 401if the money got into the IRA when you rolled over a former workplace 401.

Any money in your current employer’s 401 account when you leave your job will qualify for the rule of 55, so using rollovers to put as much money into that account as possible provides you with the most flexibility. If you don’t roll the money from old 401s or rollover IRAs into your current 401 before leaving, you won’t have the option to withdraw without penalty until age 59 1/2.

Finally, remember not to roll over your eligible 401 account into an IRA after quitting at age 55 or older. Doing so will cause you to lose the exemption and subject you to penalties for withdrawals until you hit 59 1/2.

Overall State Of Health And Lifestyle

One of the simplest forms of annuities is a fixed income annuity that is guaranteed for life. In these cases, the amount you receive every month depends on how long the insurance company expects you to live, and this is directly related to your overall health and lifestyle.

The longer youre expected to live, the lower your monthly payments will be and vice versa. Therefore, since good health and a healthy lifestyle can affect your life expectancy, then itll impact the optimum age at which to get an annuity. Consequently, healthier people will likely benefit from waiting if they want to optimize their monthly payments.

Recommended Reading: How To Get A Loan From My 401k

What Happens If A Person Does Not Take A Rmd By The Required Deadline

If an account owner fails to withdraw a RMD, fails to withdraw the full amount of the RMD, or fails to withdraw the RMD by the applicable deadline, the amount not withdrawn is taxed at 50%. The account owner should file Form 5329, Additional Taxes on Qualified Plans and Other Tax-Favored Accounts PDF, with his or her federal tax return for the year in which the full amount of the RMD was not taken.

What Is The Full Retirement Age

Your FRA, which is sometimes called your normal retirement age, is the age you are eligible for full Social Security retirement benefits.

The year and month you reach your FRA depends on the year you were born.

Prior to 1983, no calculation was needed as the normal retirement age was age 65 across the board.

In 1983, Congress created a law to redefine FRA.

FRA now works on a sliding scale to adjust for the fact that people are living longer and generally healthier lives.

The current FRA increases a few months for each birth year, until hitting 67 for people born in 1960 and later. This change applies to everyone born in and after 1938.

You May Like: When Can You Take Out 401k Without Penalty

Can The Penalty For Not Taking The Full Rmd Be Waived

Yes, the penalty may be waived if the account owner establishes that the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall. In order to qualify for this relief, you must file Form 5329 PDF and attach a letter of explanation. See the instructions to Form 5329 PDF.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2, even if you haven’t retired. The best idea for old 401 accounts is to roll them over when you leave a job. If you are 59 1/2 or older, you will not be hit with penalties if you withdraw from your old accounts. However, you need to check with your human resource department about the rules around withdrawing from your current 401 if you are still in the workplace.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Recommended Reading: Can You Move Money From 401k To Roth Ira

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Read Also: Can You Rollover A 401k Into A Traditional Ira

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.