How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

How Do I Create A 401 Plan

Creating a 401 plan for a companyeven a small oneis a complex process. The following is a basic overview of the steps for getting approval and starting the plan:

- Write a plan with the help of a plan adviser and send it to the IRS for a determination letter .

- Find a trustee to help you decide how to invest contributions and manage individual employee accounts.

- Begin making employer contributions, if offered, and allowing employee contributions through your payroll system.

You Can Take It With You

Even if you change jobs, the money youve contributed to your 401 and its earnings belong to you. Depending on your plan type, there are different ways to keep your retirement plan invested and growing on a tax-deferred basis. If youve left an employer, but still have an old 401 with them, find out what your options are for leaving it in plan or moving it somewhere else.

Read Also: What Can You Roll Your 401k Into

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

Roth And Traditional Iras

Often the first thing advisors recommend to those who dont have an employer-sponsored 401 is opening a Roth individual retirement account, where youd set up your own contributions with after-tax dollars.

I love the Roth IRA for young investors, said Tess Zigo, a certified financial planner at Emerge Wealth Strategies in Lisle, Illinois, adding that this is because young people are usually in a lower tax bracket early in their careers than they will be later.

Saving money in a Roth IRA means the funds will grow tax-free, meaning you dont have to pay anything to withdraw the money in retirement. People using a Roth IRA can also put away a nice chunk of money each year. In 2021, the total you can save in a Roth IRA is $6,000, or $7,000 if youre 50 or older.

More from Invest in You:10 work-from-home jobs that pay six figures

Of course, there are some limits. In 2021, your modified adjusted gross income must be less than $140,000 for single filers and $208,000 for those married filing jointly in order to qualify.

If you have taxable compensation, you could also save for retirement in a traditional IRA, which allows you to defer taxes, similar to a 401. This makes sense if you are in a higher tax bracket now than you will be later. In 2021, the contribution limit for a traditional IRA is $6,000 or $7,000 if youre 50 or older.

You May Like: What To Do With Old 401k Account

Start Saving And Enjoy

Once your 401 plan is designed, we will get it up-and-running as quickly as possible so you and your employees can begin benefitting.

-

I can now sleep at night knowing that Employee Fiduciary has no hidden charges. My bookkeeper who processes the contributions each week has commented how simple it is. Thank you EF

-

We have been very pleased with Employee Fiduciary. Theyre responsive and great at demystifying 401 management. The fee structure is low-cost and transparent and they offer a broad range of investment options. Theyve worked very well for us.

-

With all of the headaches associated with running a business, you have far exceeded my expectations in completing this conversion process.

How To Set Up A 401 Plan For Your Business

401 plans are one of the best benefits you can offer your employeesand theyre a staple if you want to be successful in recruiting and retaining top talent.

With the decreased use of pensions and the limitations of Social Security, many working people have to partially or completely fund their own retirement savings. You can help your employees better prepare for their financial future by starting a 401 plan with features that meets their needs.

But, not all 401 plans or service are the same. Over 81% of workers would agree that, all else being equal, the retirement benefits offered by a company would have a major impact on their decision to take a new position.1 That’s just one of the reasons getting it right is important. In addition, retirement plans can offer business owners tax-shelter benefits they can’t otherwise get. Get all the details here on how to start a 401, the benefits of a 401 and more.

You May Like: How Do I Get My 401k

But Avoid Being Too Aggressive

If you have a long time horizon, it can be smart to get aggressive with your portfolio, but those closer to retirement should be careful, too. For retirees and near-retirees, it may be time to shift into preserving your assets rather than trying to play catch-up.

Yet many are focused on growing their assets including aggressive investment strategies rather than preserving their assets against sudden market downturns, says David Potter, former spokesperson for MassMutual Financial, citing the companys research. Many people may be taking more risk than they realize.

Potter suggests that investors reevaluate their portfolio regularly to consider how they would fare if the market declined significantly.

Typically, financial professionals recommend that retirement savers dial back their exposure to stocks as they get within five years of retirement and within the first five years after retiring, he says. A steep market downturn of 20 percent or more during those periods could irreversibly reduce your income in retirement.

Heres how to tell if your portfolio is too aggressive.

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

Don’t Miss: Where To Open A 401k

How A Health Savings Account Works

HSAs are funded with pretax dollars, and the money within them grows tax-deferred as with an IRA or a 401. While the funds are meant to be withdrawn for out-of-pocket medical costs, they dont have to be, so you can let them accumulate year after year. Once you reach age 65, you can withdraw them for any reason. If its a medical one , its still tax-free. If its a non-medical expense, you are taxed at your current rate.

To open an HSA, you have to be covered by a high-deductible health insurance plan . For 2021 and 2022, the Internal Revenue Service defines a high deductible as $1,400 per individual and $2,800 per family.

Also, the annual out-of-pocket expenses, including deductibles, co-payments, but not premiums, must not exceed $7,000 for self-only coverage or $14,000 for family coverage for 2021, but for 2022, not exceed $7,050 for self-only coverage or $14,100 for family coverage.

The annual contribution limit for 2021 is $3,600 for individuals and $7,200 for families the 2022 contribution limit is $3,650 for individuals and $7,300 for families. People age 55 and older are allowed a $1,000 catch-up contribution.

Your 401 Is Set Up Now What

Your contributions will automatically be deducted from each paycheck, so you wont have to worry about making them manually. Youll want to check your first pay stub to ensure the right amount is being deducted.

Remember: A retirement plan is all about the long haul, so dont panic if things go south for a while or if you arent currently happy with your specific investments. You can always reallocate as your plan allows.

The Find a Financial Advisor links contained in this article will direct you to webpages devoted to MagnifyMoney Advisor . After completing a brief questionnaire, you will be matched with certain financial advisers who participate in MMAs referral program, which may or may not include the investment advisers discussed.

Don’t Miss: How To Get The Money From Your 401k

How A Roth 401 Works

Like Roth IRAs, Roth 401s are funded with after-tax dollars. You don’t get any tax benefit for the money you put into the Roth 401, but when you begin to take distributions from the account, that money will be tax-free, as long as you meet certain conditions, such as holding the account for at least five years and being 59½ or older.

Traditional 401s, on the other hand, are funded with pretax dollars, providing you with an upfront tax break. But any distributions from the account will be taxed as ordinary income.

This basic difference can make the Roth 401 a good choice if you expect to be in a higher tax bracket when you retire than when you opened the account. That could be the case, for example, if you’re relatively early in your career or if tax rates shoot up substantially in the future.

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above. In 2022, the limit is $20,500 per year for workers under age 50 and $26,500 for those aged 50 and above.If the employee also benefits from matching contributions from their employer, the combined contribution from both the employee and the employer is capped at the lesser of $58,000 in 2021 or 100% of the employees compensation for the year .

Recommended Reading: How To Withdraw From 401k

How To Start A 401 Toolkit

Starting a retirement plan is exciting. Its one of the most powerful savings tools the government gives business owners and employees. Complete the form below to download the small business retirement plan toolkit. Inside has important How-To Information, Tools to help you along the way, and Checklists.

Take The Guesswork Out Of Small Business Retirement Plans With Fisher Investments

Starting a retirement plan doesn’t have to be hard. Just look at some of the ways our solution takes on the heavy lifting:

- Hassle-free plan administration

- With our transparent and fair pricing, we make offering a retirement plan an affordable choice

- In just three steps, we help you build a plan thats right for your businessgetting started is easy and fast

Ready to get your new small business retirement plan off the ground in time for the New Year? Contact us today to speak with an experienced retirement specialist and start saving by next months payroll.

1 Source: 19th Annual Transamerica Center for Retirement Survey

2 Certain restrictions apply. Please visit for more information.

You May Like: What Is Better Than A 401k

Can I Set Up A 401 Without An Employer

Unfortunately, no. You cannot set up a 401 plan for yourself. You can only access a 401 through an employer-sponsored plan. If you are a sole proprietor, working as a freelancer or consultant for example, you may be able to set up a for yourself. If you own your own business and only have you or you and your spouse as the employee, thats when the solo 401 can be a great tool.

What Are The Benefits Of A 401 Plan Compared To Other Retirement Options

When compared to other retirement options , the benefits of a 401 retirement plan include a broad range of advantages for both employers and employees. Along with a vesting schedule to incentivize retention, both business owners and staff can benefit from:

Tax-advantaged retirement saving: With a 401, employees can save upfront with pre-tax dollars while they are working. By the time they need their savings to fund their retirement, they will likely be in a lower tax bracket, which can generate long-term tax savings.

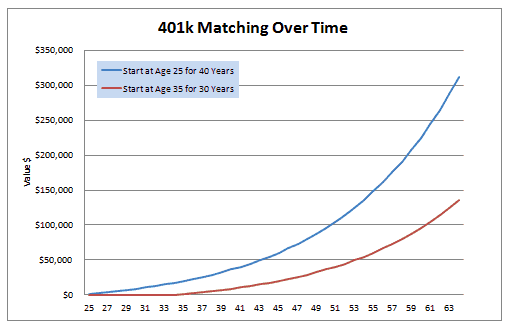

Employer match: Matching contributions are among the top benefits of 401 plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary.

Defrayed 401 plan startup costs: Eligible employers may be able to claim a tax credit of up to $5,000 for the first three years to pay for associated costs of starting a qualified plan such as a 401 for employees. Claiming the credit requires completing Internal Revenue Service Form 8881, Credit for Small Employer Pension Plan Startup Costs.

Also Check: Can Anyone Have A 401k

What Is A 401 Plan

A 401 plan is a type of IRS-approved retirement plan that allows employees to contribute pretax amounts to individual retirement accounts. Employers also can contribute to employee accounts, often by matching employee contributions, up to a certain percentage.

You can choose from several types of small-business 401 plans and other varieties of retirement plans. Get help from a retirement plan advisor to select the best one for your business.

What If I Don’t Have Access To A 401

If you don’t work for a company that offers a 401, you can save for retirement using one or more of these other accounts:

- 403: A 403 is similar to a 401, but it’s available only to public school employees, select ministers, and employees of tax-exempt organizations.

- SIMPLE IRA: A SIMPLE IRA is designed for self-employed individuals and small business owners. It offers fairly high contribution limits and has mandatory contribution requirements for employers.

- : A SEP IRA is available to self-employed individuals with or without employees. Contribution limits depend in part on annual income.

- Solo 401: A solo 401 is simply a 401 that a self-employed person can open for themselves. Contribution limits are higher than for traditional 401s because you can make contributions as both employee and employer.

- IRA: Anyone can open and contribute to an IRA if they’re earning income throughout the year, but these accounts have more restricted contribution limits.

You May Like: Can I Withdraw Money From 401k

Roll Your Money To An Ira

Transfer your money into an Individual Retirement Account .

- Your savings stay invested, with similar tax advantages

- You have access to a wide range of investment options

- You can roll in retirement savings from other jobs

- You can keep contributing money to the account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

How To Set Up 401 For A Small Business

Do companies have to offer 401?

Companies do not have to offer a 401 but it can be a cost-effective way to compete for talented people in the workforce. Around 51% of employers who offer a 401 also offer matching contributions. Companies generally choose a 50% match on 401 contributions on up to 6% of the employees pay. If you are doing a safe harbor 401, youll need to choose a specific employer matching scheme.

You May Like: How To Add Money To 401k