Invest In A Traditional Or Roth Ira

Yep, you may be able to put money into a traditional or Roth IRA even if you have a workplace 401. You can invest $6,000 a year . If you go with a traditional IRA, You might be able to deduct the full amount of the contributions if you or your spouse participated in a retirement plan at work. If thats the case, and you want to contribute to an IRA, you can opt for a Roth IRA instead.

A Roth IRA is funded with money thats already been taxed, so youre not limited by the contributions youve made in other funds. However, not everybody can go the Roth IRA route. If your modified adjusted gross income doesnt exceed IRS limits , you can contribute to a Roth IRA. Thats good for you, since that money grows tax-free and it wont be taxed when you take it out in retirement!

Dont Miss: How Do Companies Match 401k

What Is The 5 Year Rule For Roth Ira

The Roth IRA five-year rule says that you cannot withdraw income tax-free until it has been at least five years since you first contributed to a Roth IRA account. This rule applies to anyone contributing to a Roth IRA, whether they are 59 ½ or 105 years old.

Does the 5 year rule apply to Roth rollover? The five-year rules only apply to the original owner of a Roth IRA. They do not apply to a beneficiary who inherits your Roth IRA. These details are for Roth IRAs only. For Roth 401s, the rules are a little different.

Is A Roth Ira Worth It

A Roth IRA may not be right for everyones savings plan. However, if you are willing to set up an account and manage it on your own, you might benefit from tax-free contributions, as well as tax-free and penalty-free withdrawals. A Roth IRA may also be a good idea if youre certain your tax bracket in retirement will be higher than it is now.

If you believe your retirement income will be lower than your current income, a traditional IRA might be a better choice than a Roth IRA. Because of the tax implications, a Roth IRA also might not be the right fit for you if your earnings are currently at a peak.

Additionally, you dont have to necessarily choose just one type of retirement account and stick with only that. You may consider opening a Roth IRA after youve already maxed out your 401 contributions, for example. Pairing a Roth IRA and a 401 can also offer you more tax flexibility in retirement.

Recommended Reading: What Happens When You Roll Over 401k To Ira

The Best Mutual Funds For Roth Iras

Mutual funds offer simplicity, diversification, low expenses , and professional management. They are the darlings of retirement investment accounts in general, and of Roth IRAs in particular. An estimated 18% of Roth IRAs are held at mutual fund companies.

When opting for mutual funds, the key is to go with actively managed funds, as opposed to those that just track an index . The rationale: Because these funds make frequent trades, they are apt to generate short-term capital gains.

These are taxed at a higher rate than long-term capital gains. Keeping them in a Roth IRA effectively shelters them, since earnings grow tax-free.

Can You Buy Crypto In A Retirement Account

![How Much Can I Put In My Roth IRA [2020 Edition] ~ A Rich Idea How Much Can I Put In My Roth IRA [2020 Edition] ~ A Rich Idea](https://www.401kinfoclub.com/wp-content/uploads/how-much-can-i-put-in-my-roth-ira-2020-edition-a-rich-idea.jpeg)

Buying Bitcoins for retired investors can pave the way for self-directed IRAs through managers and trustees. The process of adding Bitcoins to your autonomous IRA is simple and fast.

Can you buy crypto in an IRA account?

A Crypto IRA allows you to invest in cryptocurrencies and can enjoy the same benefits that Roth and other IRAs offer. You can also roll over funds from another IRA to fund your cryptocurrencies for a new bitcoin Roth IRA.

Can I buy ethereum in my IRA?

If you are interested in the long-term value prospects of Ethereum-based cryptocurrencies, consider purchasing Ethereum within a self-directed IRA. Setting up a self-directed IRA allows you to invest in special assets that are not allowed in conventional retirement accounts.

Recommended Reading: How Do I Get A Loan From My 401k

Leveling The Playing Field

Because they aren’t offered through employers, IRAs are not subject to the type of nondiscrimination testing that applies to 401 contributions.

However, IRAs were developed to encourage the average worker to save for retirement, not as another tax shelter for the rich. To prevent unfair benefit to the wealthy, the contributions to a traditional IRA that are tax-deductible may be reduced if the account holder or spouse is covered by an employer-sponsored plan, or if their combined income is above a certain amount.

Also, Roth IRA contributions are phased out for people whose modified adjusted gross income is above a certain level.

Reduced contributions to Roth IRAs are allowed for:

- Single filers with MAGIs between $125,000 and $140,000 for 2021 .

Roth IRA contributions are not allowed for:

- Single filers earning more than $140,000 in 2021 .

The Best Bonds For Roth Iras

When they think of income-oriented assets, many investors think bonds. Interest-paying debt instruments have long been the go-to for an income-oriented stream. About 7% of Roth IRA balances are allocated to bonds and bond funds.

Corporate bonds and other high-yield debt are ideal for a Roth IRA. It’s the same principle as with the high-dividend equitiesshield the incomeonly more so. You can’t invest interest payments back into a bond in the way you can reinvest a dividend back into shares of stock . The Roth’s tax protection is thus even more valuable here when receiving cash flows from interest or dividends that would normally be subject to taxation in non-Roth accounts.

You May Like: Is 401k The Best Way To Save For Retirement

Should I Invest In The 401k Or Roth Ira

Ideally, you should contribute the maximum to both the 401k and Roth IRA. However, most new investors dont have that much income. To max out both accounts, youd need to save $25,000. Thats a lot of money. If you cant save that much, then do this.

First, contribute to the 401k up to the employer matching. This is the best investment you can make because your investment will double right away. If youre not contributing this much, youre giving up free money. Lets calculate and see where to invest after that. Ill use an excel spreadsheet to do this.

Here are some assumptions.

- The investor is in the 22% tax bracket. He can invest $6,000 in Roth IRA or $7,690 pretax in 401k.

- 8% annual gain.

- The investor starts at 22, retires at 60, and lives until 86.

- The withdrawal rate is 7% at 60. I made the money run out at 86.

- After retirement, the investor will have a lower effective tax rate due to not having a job. I assume the investor will pay 12% tax. This is a big assumption, but it should be valid. Most retirees make less money after they retire and pay less tax.

Here is the graph of the 401 vs Roth IRA.

As we expected, the 401 portfolio grows much more than the Roth IRA. Thats because you dont have to pay tax initially and can invest more. The 401k grows to $1,829,768 by the time were 60 years old. The Roth IRA grows to $1,427,647. Thats a big difference.

How Much Can I Contribute To A Roth Ira Each Year

The IRS limits annual contributions to IRAs. In 2021, the maximum you can contribute to all of your Roth and traditional IRAs combined can’t exceed $6,000 . However, your contribution to a Roth IRA also may be limited by your tax filing status and income. If you’re married filing jointly, for example, and your modified adjusted gross income is less than $198,000, you can contribute up to the maximum, but if your MAGI is $208,000 or more, you can’t contribute at all. See this IRS website for more details.

However, there is a way to contribute to a Roth IRA even if your income is too high: a backdoor Roth. This isn’t a special type of retirement account, but instead a complicated but IRS-sanctioned method for high-income taxpayers to fund a Roth.

You May Like: What Is A Pension Vs 401k

What’s The Difference Between A Roth Ira And A Traditional Ira

Both types of IRAs allow you to save for retirement. A Roth IRA allows you to save after-tax funds, and you must meet income requirements to continue to one. You can withdraw those funds tax-free in retirement. A traditional IRA allows you to save pre-tax funds, and you may be able to deduct your contributions depending on your income and whether you and/or your spouse have retirement plans at work. You pay taxes on withdrawals in retirements.

Where Should I Invest After Maxing Out A Roth Ira And A 401

If you have access to a health savings account , this is a great and lesser-known third option for retirement investing. If you accumulate more money than you need for medical expenses in your HSA, you can withdraw this money for any reason with no penalty after age 65. You’ll just pay ordinary income tax on your withdrawals if you don’t use them for medical expenses. After that, you might want to look into standard, taxable investment accounts.

Read Also: Can You Convert Your 401k To A Roth Ira

Comparing Contribution Limits: Roth 401 Vs Roth Ira

You know, of course, what a 401 is and what an IRA is. But ever since the Roth versions of these tax-advantaged vehicles came on to the scene , allocating retirement-planning dollars has gotten more complicated. Here’s the lowdown on both Roths. The good news is that, unlike the Roth IRA, the Roth 401 functions nearly identically to the traditional 401 as far as contributions go.

Can I Use My 401k To Buy Cryptocurrency

If your employer offers a self-managed 401 , you may be able to purchase cryptocurrencies directly through that account. These types of accounts are not as common as traditional or Roth IRAs, so you will need to do some research to find out which brokers offer them.

Can I roll my 401k into Coinbase? The platform, called Alt 401 , will allow workers in participating companies to transfer up to 5% of their account balances to a Coinbase-traded cryptocurrency window. They will have over 50 cryptocurrencies to choose from as investment cars.

Don’t Miss: How To Transfer 401k Accounts

When Not To Convert

Converting to a Roth IRA might not make sense in the following situations:

- You don’t have cash funds sufficient to fully pay the tax of the Roth conversion.

- You expect to be in a lower tax bracket in retirement than you are in currently.

- You might need to tap into your IRA funds in the next five years and you will be younger than age 59 1/2 when that happens.

It doesn’t make sense to pay tax now at a higher tax rate if you reasonably expect to be in a lower tax bracket in retirement. It also doesn’t make sense to pay tax now if you might have to tap into those funds in the next five years. In this case, you’ll essentially be paying tax twiceonce on the conversion and again on the withdrawal, plus any penalties that might apply.

How Do You Profit From Stocks

Collecting Dividends: Many stocks pay out dividends, a distribution of the companys earnings per share. They are usually issued quarterly and are an additional reward to shareholders, usually paid in cash, but sometimes in additional shares.

How do beginners make money in the stock market?

One of the best ways for beginners to start investing in the stock market is to put money into an online investment account, which can then be used to invest in stocks or mutual funds. Many brokerage accounts allow you to start investing for the price of a single share.

How do you get profit from stocks?

To make money investing in stocks, stay invested. More time means more chance for your investments to go up. The best companies tend to increase their profits over time, and investors reward these higher earnings with a higher share price.

Don’t Miss: Can Anyone Open A 401k

The Rules You Need To Knowplus A Pitfall Youll Want To Avoid

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Even if you participate in a 401 plan at work, you can still contribute to a Roth IRA and/or traditional IRA, as long as you meet the IRAs eligibility requirements. You might not be able to take a tax deduction for your traditional IRA contributions if you also have a 401, but that will not affect the amount you are allowed to contributeup to $6,000, or $7,000 with a catch-up contribution for those 50 and over, for 2021.

It usually makes sense to contribute enough to your 401 account to get the maximum matching contribution from your employer. But after that, adding an IRA to your retirement mix can provide you with more investment options and possibly lower fees than your 401 charges. A Roth IRA will also give you a source of tax-free income in retirement.

Here are the rules youll need to know.

How Much Money Is Too Much For A Roth Ira

Earning Too Much to Contribute Income Limits for Roth IRAs are adjusted periodically by the IRS. See the article : 10 Generous Financial Gifts for Grads. In 2021, people who are married to propose together or widows who qualify must make less than $ 198,000 in order to give the maximum contribution.

Can I invest in a Roth IRA if I make over 200k? Roth IRA contributions are unlimited for the high -income that is anyone who has an annual income of $ 144,000 or more if filing taxes as a sole or head of household in 2022 , or with an annual income of $ 214,000 or more if marriages are filing together .

Don’t Miss: How Much Should I Put In My 401k

Calculating Income To Report On A Roth Conversion

The first step is to figure out your Roth conversion income. If you’re converting deductible IRA funds, you’d report the current value of the funds on the day you make the conversion as your income. Your basis in a deductible IRA is zero because you received a tax deduction for your savings contributions.

If you’re converting nondeductible IRA funds, report as income the current value of the funds on the day you convert, less your basis. If you contributed $5,000 to a traditional IRA in 2016 and received no deduction for that contribution, your basis in those funds would be $5,000: $5,000 of income minus zero for the deduction.

Now let’s say you decide to convert that IRA to a Roth two years later in 2018. The value is now $5,500. You would report $500 of income on your tax return: $5,500 current value minus the $5,000.

Should I Invest In 401k Or Roth Ira

Many new investors wonder if they should invest in the 401k or Roth IRA. Both of these are tax-advantaged retirement accounts, but there are differences. Ideally, you should contribute the maximum to both your 401k and Roth IRA. Thats what we do. However, its a lot of money when youre starting out. Some people cant contribute that much. Which one should you invest in if you cant contribute the maximum to both accounts? First, well quickly go over the 401k and Roth IRA. Then well see which one we should invest in first.

Don’t Miss: When Can I Use My 401k

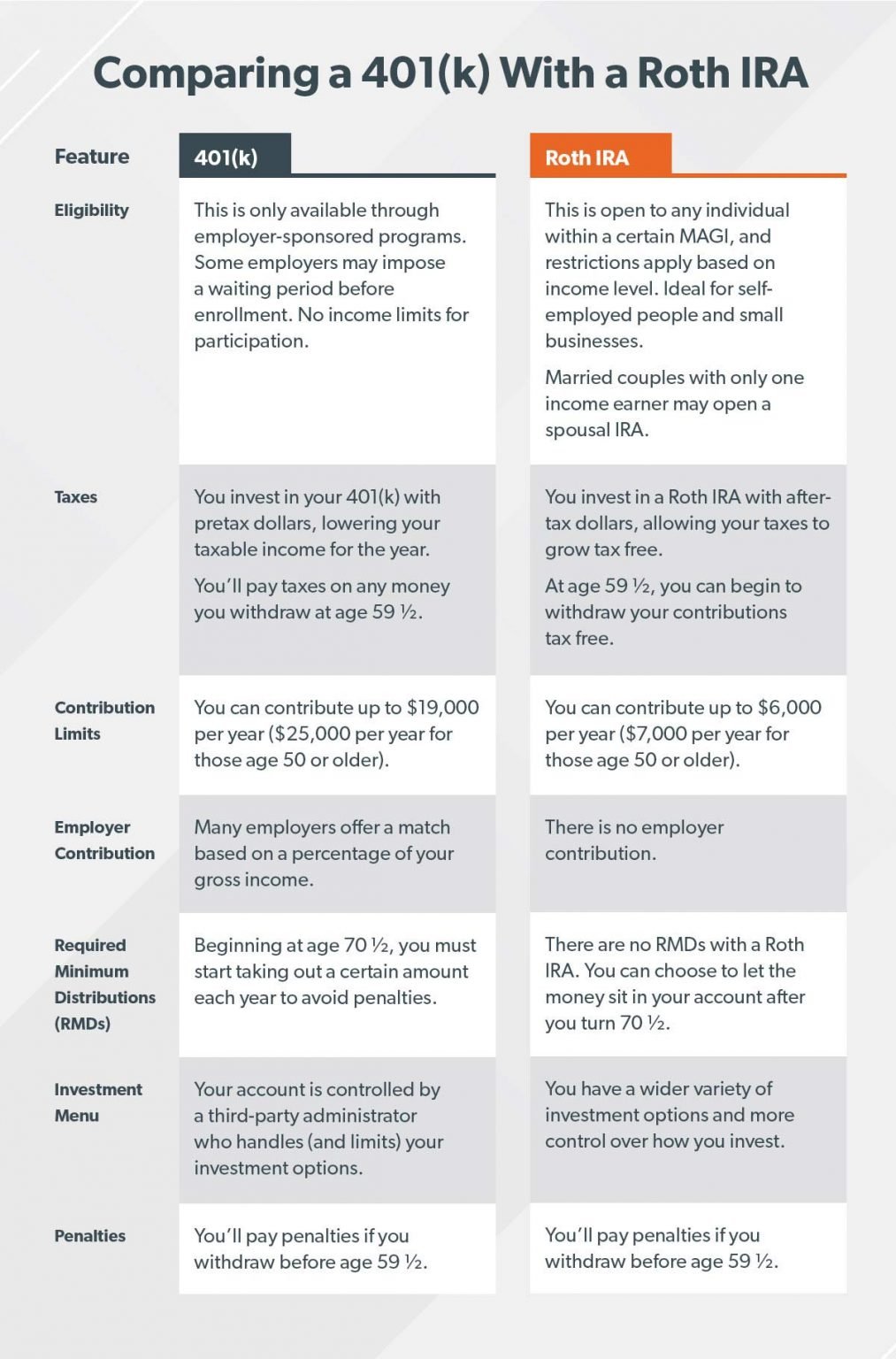

Difference Between Roth Ira And 401k

Here are the differences between a Roth IRA and a 401K

Reminder: We are not investing professionals and we recommend you to do your research and seek advice from financial experts.

The Benefits Of Having Both A 401 And Roth Ira

“A traditional 401 has pretax contributions and Roth IRAs have ‘post-tax,'” Ryan Marshall, a New Jersey-based certified financial planner, tells CNBC Make It. “If you make a $75,000 salary and contribute $5,000 to a traditional 401, your taxable income for that year is reduced to $70,000. On the other hand, if you contribute $5,000 to a Roth IRA and nothing to a traditional 401, then you have a taxable income of $75,000.”

The investment growth for both 401s and Roth IRAs is tax-deferred until retirement. This is a good thing for most participants since people tend to enter into a lower tax bracket once they retire, which can lead to substantial tax savings.

You’re going to want flexibility in retirement, especially since no one can predict what tax rates will be in the future, how your health will fare or how the stock market will behave, Marshall says. “By having multiple buckets of money in diversified retirement funds, such as a Roth IRA and 401, you’ll have more flexibility when facing unknowns,” he adds.

Incorporating more flexibility into your savings strategy “can lead to more tax-efficient withdrawals in retirement,” Marshall says. For example, a 401 balance of $1 million will only be worth about $760,000 to $880,000, depending on your federal tax bracket, Marshall explains. “That’s because lump sum 401 withdrawals are typically taxed at 22% or 24%, and once you add in state tax, you could be looking at 30% going to taxes,” Marshall says.

Read Also: How Much Is 401k Taxed