Understand All The Fees A Provider Is Charging

When considering 401k costs, dont be shy about asking questions about a companys income. Any provider that you actually want to work with should be transparent and honest about the plan costs youll face.

Still, its a bit of a buyer beware situation out there. Hidden fees are an issue with many 401 plans and providers. So wed like to equip you with a tool against unfair fees – The ForUsAll Fee Evaluation Checklist. Use this checklist to quickly and easily get to the bottom of any provider price.

You can also send the DoL’s fee disclosure worksheet to each of the providers you’re evaluating. Theyll fill it out and return it – giving you a thorough report of all fees and plan costs.

Small Business 401 Plan Fees

Small businesses are overlooked in the 401 industry and charged higher fees because they have fewer employee participants and smaller account balances. At Ubiquity Retirement + Savings, helping small businesses with affordable retirement plans is all we do. Ubiquity was the first in the industry to offer small businesses a flat fee retirement plan. We also offer a diverse group of investments for you to choose from. Our goal is to help small business start and maintain 401 plans in a way that saves time and money, so employers and employees can grow their retirement savings.

How Do I Know If My Employees And I Are Getting A Fair Deal

I recommend looking at your 401 expenses every three years as a best practice. If youre ready to examine your plans expenses, my blog post on monitoring and understanding 401 fees is a great place to start. In order to accurately compare your 401 plan to other companies plans, youll want to do a full 401 plan review, documenting the fees you pay and the services you receive from your provider. Recently, we published a webinar series introducing the framework you need to adopt in order to assess your 401 plan. Access the recorded webinars anytime if youre interested in taking a look at your responsibilities as an employer who offers a 401 plan.

Remember: Its critical that you monitor your expenses to ensure you and your employees are getting the best price for the level of service youre receiving. When you do find those opportunities to lower your plans costs, that means either more money for your employees to save, or more resources to get your employees the service they need to make the most of the plan. In either case, I believe thats a reward very much worth the effort.

Recommended Reading: Should I Rollover My 401k When I Retire

Ways To Save On Employer 401 Expenses

While all TPAs will charge you for set up and administration of your plan, its worth shopping around because the fees can vary by provider. Another way you can save on your costs is through plan design. For example, youll be charged less in administration fees if you have a safe harbor 401, a plan that provides for employer contributions that are fully vested when made, since the TPA doesnt have to worry about compliance testing because your plan will be exempt from the requirement.

What Is A 401

A 401 plan is a retirement savings plan that allows workers to make pre-tax contributions from their paychecks and invest them, without having to pay taxes on the money they set aside until its withdrawn.

Unlike pension plans, you dont have to manage the funds. Instead, employees control how their money is invested. But there are still costs to you for running a 401.

Read Also: Should I Rollover My 401k Into A Roth Ira

What Should You Do If Your Fees Are Really High

In most cases, the fees will be under 1%, which is also listed as 100 basis points, Ventre says. If you see a mutual fund expense ratio of 2% or 200 basis points, that to me is a bit of an outlier. In that case, go to your HR department and ask how they manage the plan or when the last time they reviewed it was.

You can’t shop around in the case of your 401, since you’re captive to what your employer offers. But you can choose to invest in different mutual funds within your retirement account if that would help you save on fees and increase your returns.

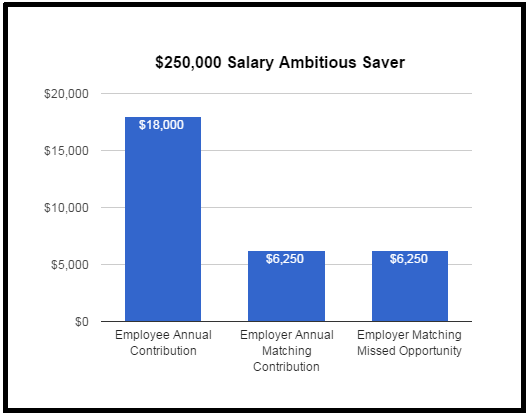

Another option if your fees are high is to contribute just enough to your 401 to meet your company match and invest the rest of your money on your own into an IRA or a health savings account . Fees are also a consideration after you leave your employer, when you’re deciding whether to leave your 401 where it is or roll it over into a new account.

But know that saving something is still better than saving nothing, and saving through any employer sponsored plan is still one of the best ways to automate this hefty task. When you save through an employer-sponsored plan, you’re doing what every investor really should be doing, which is paying yourself first, Moulton says.

Improved Employee Retainment And Morale

Did you know that nearly four in five U.S. employees say theyd prefer new or additional benefits to a salary bump increase? Adding a 401 to your benefits package is a cost-effective way to compete for great talent and reduce turnover of current employees. Because a majority of employers provide a match , providing a match can help you remain competitive.

You May Like: What Age Can You Start A 401k

Keep Employee Costs Below 075%

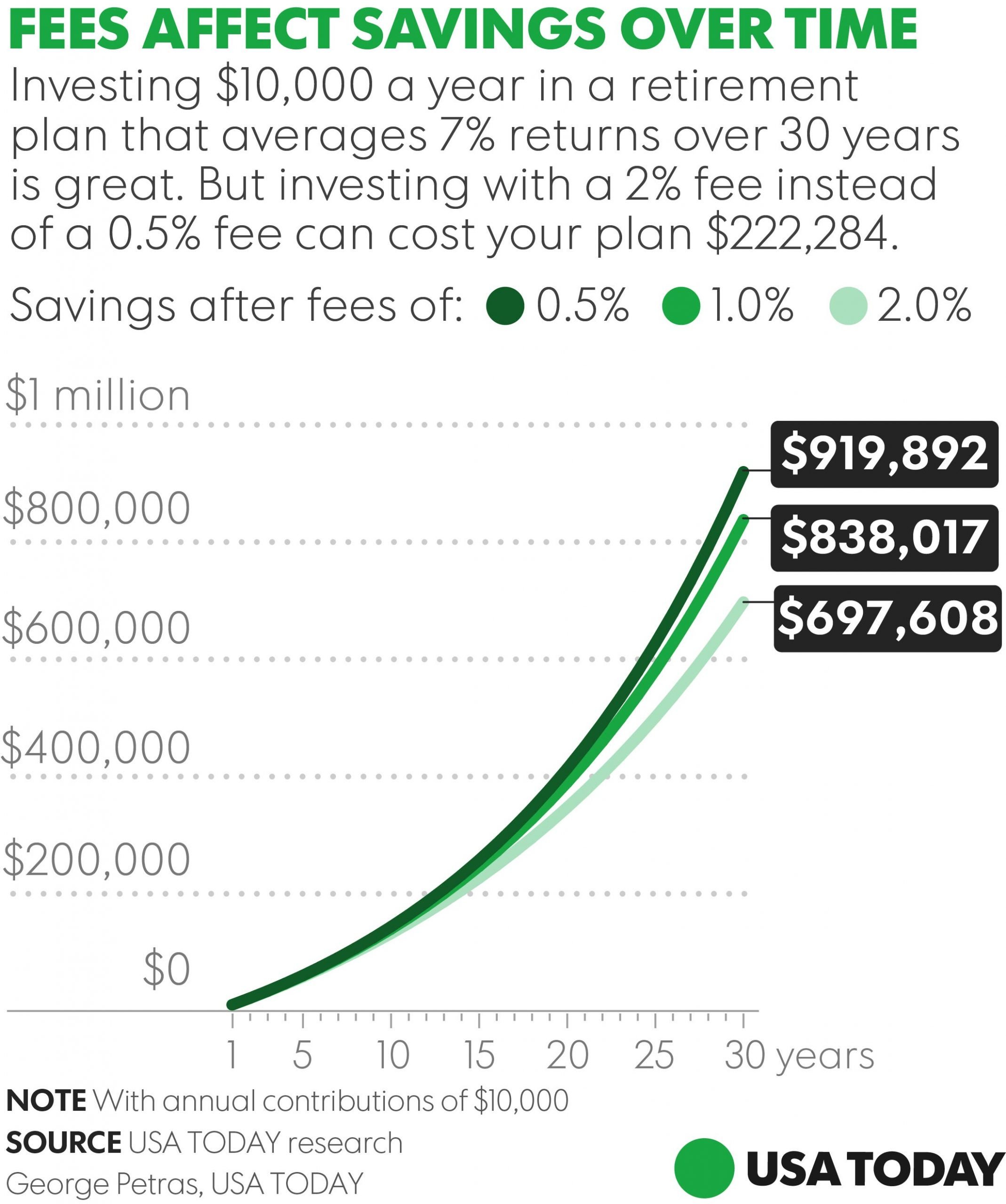

You’ve already seen how average 401 costs can cut into annual the bottom line. Here’s how those fees can impact employee retirement over the years:

For a 30 year old employee contributing $4,000 a year, with a 6% yearly return, with all-in fees of $0.6%, theyll have $390,028 in their account when they retire at age 65. Drop those fees to 1.9%, and theyll have $291,519 in their accounts a difference of almost $100,000!

About $100,000 less in your retirement savings is a significant and unsettling sum – something that neither employees nor plan sponsors want to see. Prevent this kind of unpleasant situation by picking a low-cost 401 from the get-go.

Heres how…

Small Business 401k Plan Average Costs

For a traditional 401K plan, most businesses should plan to spend $5,000 to $10,000 per year. The majority of these expenses will come from administrative fees. For example, a company with less than $1 million in assets might pay $800 to $1,000 in annual administrative fees, plus a quarterly charge of $15 to $40 for each plan participant. Initial set up fees run $500 to $3,000, depending on the size of your company and the benefits you select.

Simple 401Ks are less expensive. Expect to pay about $500 to $1,000 per year, plus $20 to $50 for each plan participant. Administrative services are billed at an hourly rate, generally $100 to $300.

Other fees you might incur include:

- $800 to $1,500 to rollover assets from another plan

- $100 to $300 per hour for investment advice and initial consulting

- $800 to $2,500 per year for discrimination testing to make sure your plan is properly balanced between managers and rank-and-file employees

Some companies choose to pass some of these fees on to employees. But, most pick up the tab, themselves. It’s an investment in attracting and retaining a strong workforce. The largest accounts may be able to negotiate waving some of these fees.

Also Check: What Is The Difference Between An Annuity And A 401k

The 4 Methods Of 401 Pricing

There are four ways by which 401 fees and costs are charged – each with its own applications and cost range.

1. Asset-Based Fees

These are expressed as a percentage of the plans total assets and are taken to compensate for investment advice, trustee or custodial, and investment fees.

Range: Asset-based fees can range anywhere from 0.08% to 4% of plan assets.

2. Per-Participant Fees

As the name implies, this is a hard-dollar fee charged per active or eligible employee in your plan. Participant fees are usually intended to cover recordkeeping and plan administration.

Range: Anywhere from $2 to $750 per participant.

3. Transaction Fees

These are expenses charged for the execution of a particular plan service or transaction – like changing up the plan funds or applying for a loan.

Range: Anywhere from $0 to $70+/per transaction.

4. Flat Fees

These are fixed fees charged as a flat dollar amount – usually each year.

Range: These can vary widely depending on the provider and what the fixed fee covers.

Depending on the plan and provider, you could pay in several of these ways, and which you select will almost certainly have an enormous impact on the success of your 401.

So lets look at what those fees and costs actually cover.

‘forgotten’ 401s Cost Employers As Well As Their Former Employees

In aggregate, savers could be missing out on a combined $116 billion in additional retirement savings each year by leaving behind 401 accounts.

Alan Goforth

Changing jobs can carry a steep price. Employees have left behind an estimated 24.3 million 401 accounts valued at $1.35 trillion, according to a new white paper from Capitalize. Leaving behind a forgotten 401 account has the potential to cost an individual almost $700,000 in foregone retirement savings over a lifetime.

In aggregate, this means that savers could be missing out on $116 billion of additional retirement savings growth each year.

Recommended Reading: Can I Invest My 401k In Gold

Fees: What Is Reasonable

The goal of protecting your employees retirement savings is worthwhile in and of itself, its also a fundamental part of your legal responsibility as a fiduciary to your company 401 plan. The Employee Retirement Income Security Act of 1974 requires that employers who sponsor a 401 plan take a personal, legal responsibility to make good decisions on behalf of their employees. Managing fees and ensuring employees dont pay more than they should for their retirement plan is a key element of this responsibility.

But how do you tell what is reasonable when it comes to those 401 fees? Though weve already shared that fees in the range of 1-2% are average2, evaluating your plans fees isnt a simple matter of comparing your expense ratio to the average. No two retirement plans are the same, and the level of service your plan receives might be different from another companys. For that reason, its important to periodically benchmark your plans fees against those paid by other companies with similar 401 plans. This should come as part of a broader review whose aim is to give you total clarity on all of the service providers being paid out of your plan, what service they are providing, and how much theyre being paid.

How Do 401k Fees Work

Every so often, you may have noticed some fees on your 401 account statement. Find out how 401 fees work and the types of fees to expect from your plan.

If you participate in a 401 plan, you may be incurring certain fees in the management of your retirement money. However, the fees you pay on your 401 are not obvious, and you need to figure out what fees you are paying. A survey by TD Ameritrade of 1000 investors shows that only 27% of investors know how much fees they are paying in their 401 plan. This means a whopping 73% of investors either donât how much 401 fees they are paying or they donât know how to determine the fees they are paying.

401 fees comprise investment fees, administrative fees, and individual service fees. Some of these fees may be borne by the employer at the plan level, whereas employees incur costs related to their investment options. 401 fees cover record-keeping, investment advice, customer service representatives, online transactions, retirement planning software, etc. On average, 401 fees may range from 1% to 2%, depending on the 401 plan.

Read Also: How To Find 401k From An Old Employer

What Fees Are Included In Your 401

Many American workers believe that 401 funds charge fewer fees than individual investments, but that isnt always the case. 401 fees fall into three basic categories. The U.S. Department of Labor defines them as investment fees, plan administration fees and individual service fees. The table below compares them:

Breaking Down 401 Plan Fees

Notably, 401 plan fees typically fall into four categories:

- Investment

- Individual service

- Custodial

To illustrate the point, heres a sample account quarterly summary, not from a 401provider but rather from a third-party firm that administers plans and keeps records. The figures, which represent dollar amounts, are on a total contribution of $3,207.70 for the quarter.

| Expenses | |

| TOTAL | $44.91 |

This means the contributor is paying $44.91 in fees on a principal of $3,207.70. Curiously, thats 1.4% to the penny, which makes it seem as though the expenses are retrofitted to the ratio.

Is it reasonable that only 98.6% of your contributions find their way into the designated investments? Thats not a rhetorical question.

Also Check: How To Calculate Employer 401k Match

Keep Employee Costs Low

Average expense ratios have been in decline for two decades. In fact, over one decade , the average annual fund fee dropped from 0.87% to 0.45%. To stay competitive, its important to ensure you keep costs low. Every bit counts even a 1% increase can result in significant losses for an employees retirement nest egg over the course of their employment.

Managing 401 Plans For A Small Business

Setting up a 401 can be complicated, but you don’t have to do it alone. Look for a provider with an excellent track record that can help you get started, manage your plan, and even share ideas and guidance to maximize the value to you and your employees. Doing so can go a long way in ensuring an ongoing, positive benefit for years to come.

Read Also: What Happens To My 401k After I Quit

Low Expenses Can Save A Lot

We strongly believe that for long-term investing, keeping total participant fees less than 1% makes the most sense. Paying even 1% more in expenses can cost you hundreds of thousands of dollars in retirement savings over a 40-year career. Every dollar you and your employees spend in expenses is one less dollar invested in the markets for tomorrow.

Fund expenses , investment management, recordkeeping and custodial services often comprise the investment expenses. Sum these up if you are comparing providers. For example, ShareBuilder 401k investment expenses are less than 1% on average and lower as your plan grows in asset value past defined milestones that include amount of assets and number of employees. If assets dip below a milestone expenses could increase.

This example shows the effect that expenses can have on your 401 retirement account over a career of 40 years by comparing the costs of paying 1% versus 2% on investments and how savings may accumulate. It assumes the investments have a fixed annual 7% return before expenses with no distribution or tax considerations and does not imply future returns. The example assumes each employee has a salary of $75,000 in year one and receives a 3% merit raise each year on-going. In addition, the employee contributes 5% of her salary each year and receives a 3% of salary company matching contribution.

What Fees Are There In A 401 Plan

Typically, 401 plans have three types of fees: Investment fees, administrative fees, and fiduciary and consulting fees. Some of these 401 fees are charged at a plan level for the management and administration of a plan, while others are related to the investments made by employees within the plan. Sometimes, the fees paid in a 401 are taken directly from plan assets by your service provider and then paid out to the various vendors working on the plan. In other cases, the investments themselves will carry fees, which are taken out of the money invested in that specific investment. All together, fees in a 401 plan can go to many places, including:

Investment Managers, who oversee the investments in a fund Administrators, who handle things like the transfer of assets in and out of a fund Recordkeepers, who keep detailed records of a 401 plans transactions Lawyers, who draft legal documents and oversee regulatory compliance Accountants, who may perform audits of a 401 plans activities The Government, which collects any applicable taxes related to a funds activities.

Read Also: How To Invest With Your 401k

How Much To Save For Retirement

Naturally, the next question becomes: how much should a person save for retirement? Simply put, it’s an extremely loaded question with very few definite answers. Similar to the answer to the question of whether to retire or not, it will depend on each person, and factors such as how much income will be needed, entitlement for Social Security retirement benefits, health and life expectancy, personal preferences regarding inheritances, and many other things.

Below are some general guidelines.

Gather The Right Documentation

When youre working to understand exactly what fees you and your employees are paying, your best tool is the fee disclosure document, which is required by section 408 of ERISA. You can request one of these from your 401 provider at any time to get a clear look at:

- All services provided by your 401 provider and their affiliates or subcontractors

- Each service providers fiduciary status

- And all compensation expected to be paid to any of these providers.

Your 408 disclosure will also tell you both about direct and indirect compensation, so you will be able to see if any of your providers are being paid through revenue sharing. This will help you understand if the expense ratios being paid by your employees contain any revenue sharing and give you a better understanding not only of the true cost of your 401 plan, but also whether or not your plan may be subject to any potential conflicts of interest.

Additionally, you may also gather your plans asset statement and invoices you have from service providers as available.

Don’t Miss: How To Transfer 401k Balance To New Employer