Highlights Of Changes For 2022

The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan is increased to $20,500, up from $19,500.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements , to contribute to Roth IRAs, and to claim the Saver’s Credit all increased for 2022.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or the taxpayer’s spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. Here are the phase-out ranges for 2022:

- For single taxpayers covered by a workplace retirement plan, the phase-out range is increased to $68,000 to $78,000, up from $66,000 to $76,000.

- For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is increased to $109,000 to $129,000, up from $105,000 to $125,000.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the phase-out range is increased to $204,000 to $214,000, up from $198,000 to $208,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is not subject to an annual cost-of-living adjustment and remains $0 to $10,000.

Max 401 Contribution Limits

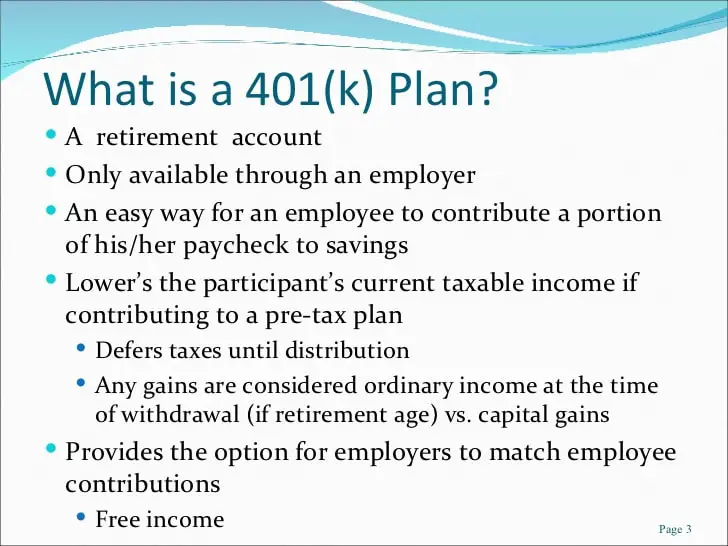

A 401 is a common type of retirement account in which you contribute savings that come out of your paycheck before you pay income tax. Most commonly, employers sponsor an employees 401. However, sole proprietors, independent professionals, and other small business owners with no employees except for a spouse may qualify for a self-employed 401.

Even if youre new to investing, a 401 offered through your employer is a powerful, simple way to put money away for your retirement. And each year, participants in these plans can save up to the max 401 contribution established by the Internal Revenue Service . The IRS increased contribution limits in 2022 for 401 plans and more. Heres what you need to know.

Solo 401 Establishment Deadline:

For 2021, in order to make employee contributions for 2021, the self-employed business owner had to establish the solo 401k plan by December 31, 2021. However, if the plan was established on January 1, 2022 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2021 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

You May Like: How Do You Find An Old 401k

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

Employers Have A Higher Contribution Ceiling

![[] 2020 401k Limits [] 2020 401k Limits](https://www.401kinfoclub.com/wp-content/uploads/2020-401k-limits.jpeg)

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $61,000 in 2022, up from $58,000 in 2021. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $305,000. Even at that level, the employer would have to contribute a hefty amount to reach the $61,000 limit.

Read Also: What Is My Fidelity 401k Account Number

Do You Think Its Possible To Contribute 100 Percent Of My Earnings To A 401 Account

The maximum amount you can contribute is the amount of money you earn if your wages are less than $19,500 annually. Be aware that every 401 plan has their own rules and regulationsthat might limit the amount the money you are able to put into your account each year. If you earn more than $130,000 annually or have more than 5% ownership of the company will be affected as will the highest-paid employees, who will be classified as having a salary of more than $130,000 annually or have more than 5% ownership of the company as of 2021.

To ensure that highly-rewarding employees do not receive a disproportionate benefit when compared with other employees The sponsors of the most important business plans must adhere to strict discriminatory testing criteria. The highest-paid workers, despite likelihood to to save greater, often not able to contribute more than 2 percentage points higher than those who earn less on average. Instead of favouring the one group over the other, the idea is to make everyone participate in the program.

This could be avoided in the event that a company is worried about complying with anti-discrimination testing rules. They can either provide all employees with a three percent match, regardless of the amount employees contribute or they can match everyones contributions with four percent match and vice versa.

Recommended Reading: What Should You Invest Your 401k In

What Are 401 Income Limits

The IRS doesnât limit 401 plan participation by how much an individual makes. Whether employees earn $25,000 or $250,000, everyone can contribute to a 401 plan if their employer provides one.

However, the total contributions are limited by how much an individual makes. In 2021 the total 401 contribution limit is $58,000. Those that make less than $58,000 in 2021 wonât be able to contribute that full amount. Thatâs because the IRS limits total contributions to the lesser of 100% of gross compensation or $58,000 for 2021.

So, in essence, there is an income limit to 401 contributions in that total contributions canât exceed a participantâs total annual income. This falls back on the rule across all retirement accounts that in order to be eligible to contribute towards a retirement account, an individual must have earned income during that year.

Don’t Miss: How To Move 401k To Cash

Save For Health Care Costs

Contributing to a health savings account can reduce out-of-pocket cost for expected and unexpected health care expenses. For 2020, eligible individuals can contribute up to $3,550 pre-tax dollars for an individual plan or up to $7,100 for a family plan.

The money in this account can be used for qualified out-of-pocket medical expenses such as copays for doctor visits and prescriptions. Another option is to leave the money in the account and let it grow for retirement. Once you reach age 65, the funds are tax-free when you use them for qualified medical expenses. If you spend the funds in other ways, they are taxed as income with no penalties.

Increased 2022 Hsa Contribution Limits

If youre already maxing out your 401 or other retirement contributions, consider putting pre-tax dollars toward an HSA , if you have one. An HSA helps those with high-deductible health plans save taxes on money earmarked for medical expenses not covered by the plan.

Unlike a flexible spending account , which has a use it or lose it provision, the assets you contribute to an HSA are yours for the long term and can be rolled over each year. Plus, an HSA offers a triple tax advantage: Money put in isnt taxed, it grows tax-free, and youre not taxed when you take money out to pay for qualified medical expenses.

| $7,300 |

Recommended Reading: How Long Will My 401k Last

The Maximum You Can Put Into A 401 In 2021 And 2022

-

If youre under age 50, your maximum 401 contribution iso $19,500 in 2021 and $20,500 in 2022.

-

If youre 50 or older, your maximum 401 contribution is $26,000 in 2021 , because you’re allowed $6,500 in catch-up contributions.

For 2021, your total 401 contributions from yourself and your employer cannot exceed $58,000 or 100% of your compensation, whichever is less. For 2022, that number rises to $61,000.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000 and contribute 5% of your salary and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

What Is The 401k Employer Match Limit For 2020

Employee 401 contributions for 2020 can increase by $500 to $19,500, while the combined employer and employee contribution limit rises by $1,000 to $57,000, the IRS announced on Nov. 6, 2019. For participants ages 50 and over, the additional catch-up contribution limit will rise to $6,500, up by $500.

Read Also: How Can I Use My 401k To Buy A House

Alternatives To An Employer 401 Match

Deferred annuities can offer premium bonuses on contributions that mimic an employers 401 match with no annual limits.

For example, an annuity may offer a bonus of up to 11% on all contributions for the first seven years of the annuity. The 11 percent premium bonus mimics the employers match, and there are no annual contribution limits for the employee.

Unlike a 401, employees can open a deferred annuity without an employer.

What Is The Max Annual Contribution To A Roth Ira

Contribution restrictions for various retirement plans can be found under Retirement Topics Contribution Limits.

For the years 2022, 2021, 2020, and 2019, the total annual contributions you make to all of your regular and Roth IRAs cannot exceed:

For any of the years 2018, 2017, 2016, and 2015, the total contributions you make to all of your regular and Roth IRAs cannot exceed:

Also Check: How To Collect My 401k Money

How Much Should You Save For Retirement In A 401

Experts recommend that workers save at least 15% of their income for retirement, including any employer match. For instance, if your employer contributes 3% then you would need to save an additional 12%.

If you arent saving that much right now, increase your contribution each year until you reach that goal. For example, if you are saving 3% now, increase that to 5% in 2022 then bump that up to 7% in 2023 and so on util you reach 15%.

How Solo 401 Contribution Limits Work

If youre a self-employed individual, you must calculate the maximum amount of elective deferrals and nonelective contributions you can make. When figuring out your contribution, your compensation is your earned income, or, your net earnings from self-employment after deducting both:

-

Contributions for yourself

-

One-half of your self-employment tax

Keep in mind that self-employed individuals must often pay the employer costs associated with 401 plans, typically including a one-time start-up fee, as well as a monthly account maintenance fee. You must also pay fees on the specific stocks and bonds you purchase with your 401 investments .

For more information, refer to the IRS table and worksheets found in Publication 560, Retirement Plans for Small Business.

Recommended Reading: Can Anyone Have A 401k

Benefits Of Contributing To Your 401 Plan

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

How Much Should You Save For Retirement

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

Recommended Reading: How To Withdraw Money From 401k Before Retirement

Updates To Tax Deduction Limits And Income Limits For Ira Contributions

If youre already contributing to a retirement savings plan at work, such as a 401, you can also contribute to a traditional IRA. These arent subject to income limits, but there are restrictions on what you can deduct from your taxes, based on your income. For 2022, those income ranges increased get all the details on the IRS website.

If you save outside of your workplace plan in a Roth IRA, income limits are a factor. But good news: Theyve increased for 2022.

| Account | |||

|---|---|---|---|

| Helps you invest for retirement with pre-tax deposits. | None. | You may take full, partial, or no deduction based on your income level and retirement plan. | |

| Roth IRA | Funded with after-tax dollars, but eventual qualified withdrawals may be tax-free. | Single/head of household: $129,000 for full contribution $144,000 for a reduced contribution. $204,000 for a full contribution $214,000 for a reduced contribution. | Not deductible. |

Whats the difference between a traditional and Roth IRA? Watch It’s simpler than it sounds.

Can I Contribute 100 Percent Of My Salary To A 401

If your earnings are below $20,500, then the most you can contribute is the amount you earn. It should also be noted that a 401 plan document governs each particular plan and may limit the amount that you can contribute. This applies especially to highly compensated employees, which in 2022 is defined as those earning $135,000 or more or who own more than 5 percent of the business.

Sponsors of large company plans must abide by certain discrimination testing rules to make sure highly compensated employees dont get a lopsided benefit compared to the rank and file. Generally, highly compensated employees cannot contribute higher than 2 percentage points of their pay more than employees who earn less, on average, even though they likely can afford to stash away more. The goal is to encourage everyone to participate in the plan rather than favor one group over another.

There is a way around this for companies that want to avoid discrimination testing rules. They can give everyone 3 percent of pay regardless of how much their employees contribute, or they can give everyone a 4 percent matching contribution.

Read Also: Can I Borrow Against My 401k To Buy A House

Exceeding The 401 Contribution Limit

Some workers may be able to maximize their 401 contribution limits, but they will need to determine how much is too much. One way that an employee can know how much to contribute from their paycheck to the 401 plan is to divide the limit by their gross incomeAnnual IncomeAnnual income is the total value of income earned during a fiscal year. Gross annual income refers to all earnings before any deductions are. It will give the percentage of gross income that workers will contribute to the retirement plan without exceeding the allowed limit. If a workers annual contribution exceeds the allowed limit, he/she should inform the retirement plan to refund the excess contribution.

On some occasions, the employee may contribute the right amount but the employers matching contribution may exceed the 401 contribution limit. In such cases, the employee is responsible for informing the retirement plan of the excess contribution before of every year to receive a refund.

If the employee fails to inform the plan about the error, he/she will be penalized, and the revenues will be taxed twice. The retirement plan may also categorize the employees contribution as non-qualified, resulting in the loss of all their contributions.

Why Can You Only Have 6000 Ira

![[???] 2020 401k Limits [???] 2020 401k Limits](https://www.401kinfoclub.com/wp-content/uploads/2020-401k-limits-fuutou-sozai.jpeg)

The Internal Revenue Service limits contributions to regular IRAs, Roth IRAs, 401s, and other retirement savings plans to prevent highly compensated workers from benefiting more than the ordinary worker from the tax advantages they give.

Contribution restrictions differ depending on the type of plan, the age of the plan participant, and, in some cases, the amount of money earned.

Don’t Miss: How To Take A Loan Out On Your 401k