Do You Have To Calculate Rmds On Your Own

Luckily, no. Most financial institutions will calculate the figure for you. For all my clients that have reached RMD age, my custodian calculates the RMD amount for my clients and then I contact the client to notify them of the amount.

Another thing to consider is that since it is a taxable distribution, your IRA custodian will most likely require you to sign a form to take out the money . If a form needs to be signed, dont procrastinate and wait till the last minute.

Read Also: When Can You Take 401k Out

Types Of 401 Hardship Withdrawals

A hardship withdrawal is defined by the IRS as a withdrawal that is ânecessary to satisfy an immediate and heavy financial need.â Account holders are expected to exercise all other available options to meet their financial need before dipping into their 401, and after a hardship withdrawal is made, they cannot defer income into their account for 6 months.

The IRS allows hardship withdrawals for the following reasons, but plans may vary in what they permit. Some hardship withdrawals do come with income tax and the 10% penalty, some do not.

How Do You Withdraw Money From A 401 After Retirement

To withdraw money from your 401 after retirement, you’ll need to contact your plan administrator. Depending on your company’s rules, you may be able to take your distributions as an annuity, periodic or non-periodic withdrawals, or in a lump sum. Your plan administrator will let you know which options are available to you. You can typically have funds deposited into an account or have your plan send you a check.

Recommended Reading: What Is The Interest Rate On A 401k

How To Retire At 5: Step

Choosing the right age for retirement means understanding all the planning thats required beforehand, as well as what you may need to do afterward if you retire early. The way you shape your financial plan can be very different if you plan to retire at 57, for example, versus waiting until age 65. While retiring at 57 might be your goal, youll need to understand what early retirement means when it comes to things like Medicare planning, retirement account withdrawals and Social Security. If you have questions about your specific situation, consider speaking with a financial advisor.

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

Recommended Reading: How To Roll Over 401k To New Company

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

Taxes On Rolling Over A 401 Account

There are a few instances where you may want to transfer funds from an employers 401 into another account. The most common situation is when you leave an employer and want to transfer funds from your previous employer into your new employers 401, or into your own individual retirement account .

Whenever you withdraw money from a 401, you have 60 days to put the money into another tax-deferred retirement plan. If you transfer the money within 60 days, you will not have to pay any taxes or penalties on your withdrawals. You will need to say on your tax return that you made a transfer, but you wont pay anything. If you dont make the transfer within 60 days, the money you withdrew will add to your gross income and you will have to pay income tax on it. You will also pay any applicable penalties if you withdraw before age 59.5.

If you dont want to worry about missing the 60-day deadline, you can make a direct 401 rollover. This means the money goes directly from one custodian provider) to another without ever being in your hands.

Finally, note that if youre rolling over a 401 into a Roth IRA, youll need to pay the full income tax on the rolled-over amount. However, theres no 10% penalty for doing this before age 59.5.

Read Also: What Will My 401k Be Worth At Retirement

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will trigger a lump-sum distribution, but most people nearing retirement will have more substantial savings accrued.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

Can I Cash Out My 401k At 62

Generally, when you get 59 ½, you can start deducting money from your 401 without paying 10% off your first tax deduction. However, if you plan to retire at 55, you can take the offer without being sentenced.

What age can you cash in 401k without penalty?

Rule 55 iIRS system allows you to withdraw money from your 401 or 403 with no penalty at the age of 55 or older. Read on to find out how it works.

What reasons can you withdraw from 401k without penalty?

Here are some ways to get a free-kick off your IRA or 401

- Unpaid medical bills.

- If you are indebted to the IRS.

- They are buying houses for the first time.

- The cost of higher education.

- For financial purposes.

Also Check: How To Move 401k To Cash

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Recommended Reading: How To Sell 401k Investments

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Here’s How To Avoid Penalties If You Tap Into Your Retirement Savings

If you find yourself unemployed, it’s natural to think about accessing 401 funds to make ends meet. Here’s a recap on how 401 accounts work and the rules governing withdrawals, including new rules helping those impacted by economic downturns and pandemics.

You May Like: Can You Take Out Your 401k To Buy A House

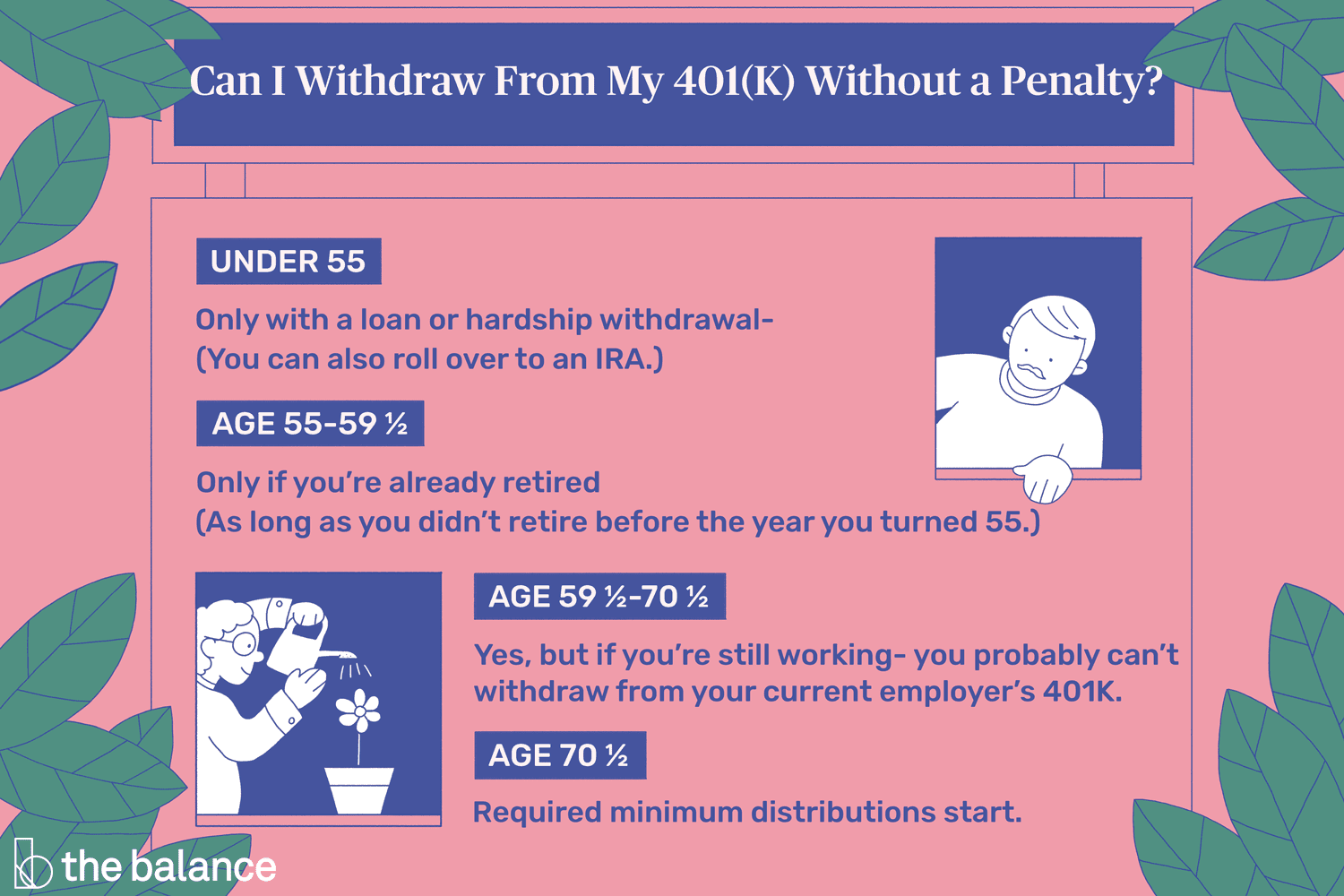

Withdrawals Before Age 59 1/2

Any withdrawal made from your 401 will be treated as taxable income and subject to income taxes in the year in which you made it, before or after retirement. But you’ll also be subject to a 10% early distribution penalty if you’re younger than age 59 1/2 at the time you take the withdrawal.

These taxes and penalties can add up and can nearly cut the value of your original withdrawal in half in some cases.

You can avoid these taxes and the penalty with a trustee-to-trustee transfer. This involves rolling over some or all of your 401 assets into another qualified account. You might consider a 401 loan if you want to access your account’s assets because of financial hardship.

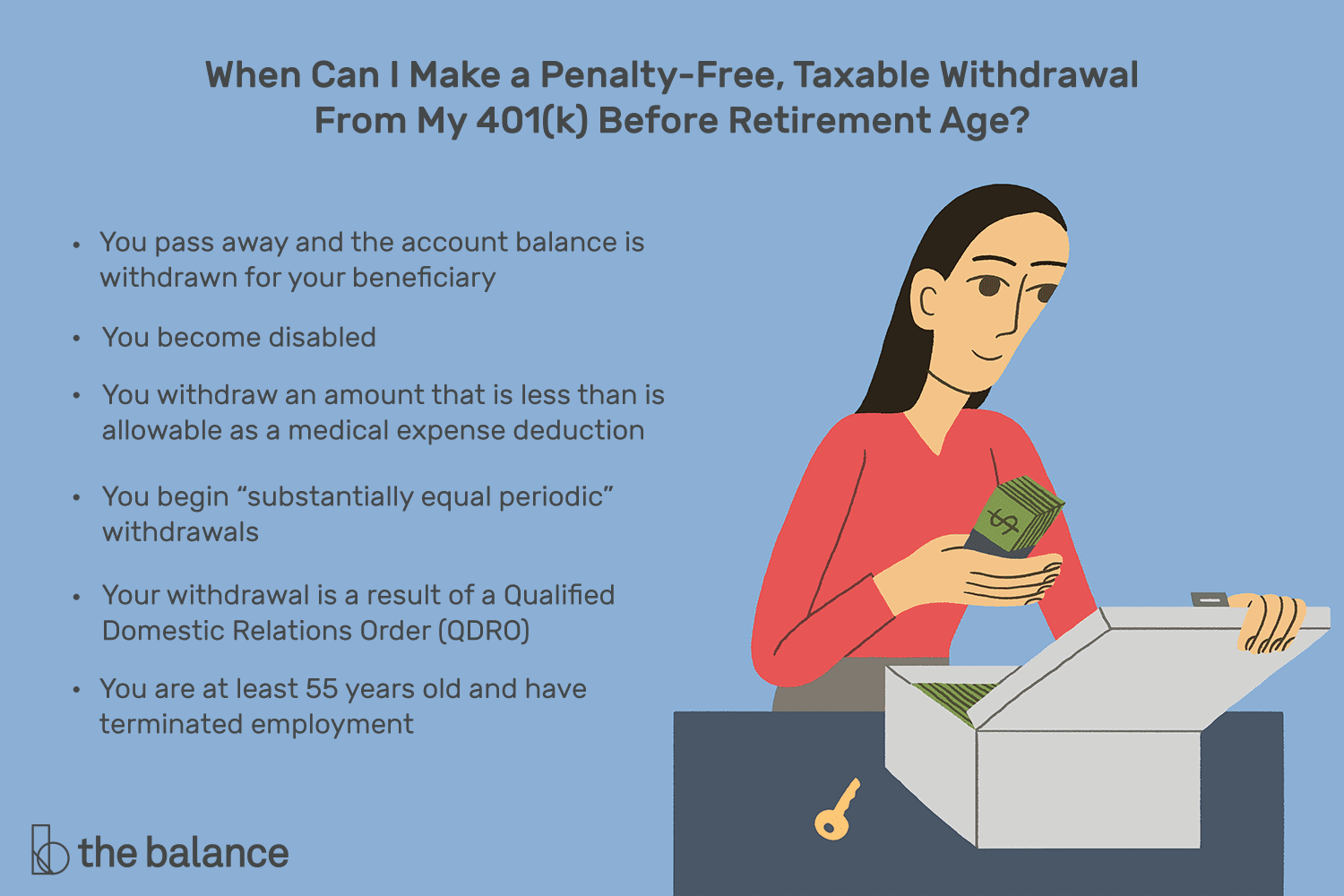

You can take a penalty-free withdrawal from your 401 before reaching age 59 1/2 for a few reasons, however:

- You pass away, and the account’s balance is withdrawn by your beneficiary.

- You become disabled.

- Your unreimbursed medical expenses are more than 7.5% of your adjusted gross income for the year.

- You begin “substantially equal periodic” withdrawals.

- Your withdrawal is the result of a Qualified Domestic Relations Order after a divorce.

- You’re at least 55 years old and have been laid off, fired, or quit your job, otherwise known as the “Rule of 55.”

Your distributions will still be taxed if you take the money for any of these reasons, but at least you’ll dodge the extra 10% penalty.

What Age Can You Take Money Out Of Your 401k Without Penalty

The IRS allows for the removal of the penalty-exempt from retirement accounts after the age of 59 ½ and requires removal after 72 years . There are some options for these 401ks rules and other relevant programs.

Can I subtract from my 401k at 55? What is Rule 55? Under the terms of this rule, you can deduct money from 401 or 403 of your current job plan without 10% tax if you resign that job within or after the year you reach the age of 55 years.

Read Also: Can I Convert My 401k To A Roth Ira

What Is The 4% Withdrawal Rule

The 4% rule is when you withdraw 4% of your retirement savings in your first year of retirement. In subsequent years, tack on an additional 2% to adjust for inflation.

For example, if you have $1 million saved under this strategy, you would withdraw $40,000 during your first year in retirement. The second year, you would take out $40,800 . The third year, you would withdraw $41,616 , and so on.

Potential advantages: This has been a longstanding retirement withdrawal strategy. Many retirees value this strategy because its simple to follow and gives you a predictable amount of income each year.

Potential disadvantages: Lately, this approach has been criticized for not considering the effects of rising interest rates and market volatility. Indeed, if you retire at the onset of a steep stock market decline, you risk depleting your savings early.

I Failed To Take Out Rmds In Prior Tax Years Is There A Penalty

Yes. There is no statute of limitations on how far back the IRS can look for RMD mistakes. If you have discovered mistakes in prior years withdrawal amounts, correct those figures immediately.

If you can provide evidence that you made a reasonable mistake when calculating distributions for prior years, the IRS does have the ability to waive penalty fees. The most common reasons considered for waiving fees include serious illness or dementia.

Don’t Miss: Can I Withdraw From My 401k To Buy A House

There Are Some Situations In Which It Can Be Advisable To Take An Early 401k Withdrawal

- It may be beneficial to cash out a portion of your 401K if you have a loan that has very high interest. For example, taking an early distribution on your 401K be wise to pay down credit card or personal loan with a very high interest rate. In this case, you may be financially better off cashing out the 401K and paying the penalty than continuing to pay that interest. However, it is important to do the math to determine whether its better to cash out a portion of the 401K or not

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Don’t Miss: What Is The Difference Between Roth 401k And Roth Ira

Ways To Make Withdrawals From Your 401

Life is full of unexpected eventsâsome for the better, and some for the worse. If faced with a potentially costly hardship such as foreclosure or medical bills, investors may feel pressed to make an early withdrawal from their 401. For those considering an early withdrawal but concerned about triggering penalties, hereâs what to keep in mind.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

Don’t Miss: How To Convert 401k To Silver

Impact On Student Debt

The SECURE Act also allows people to withdraw up to $10,000 during their lifetime from their 529 plans, tax-free, in order to pay off their student loan debt. Originally, 529 plans were strictly for post-secondary education expenses, but that has been expanded to include K-12 expenses.

Under the SECURE Act, 529 funds can be used to pay off college debt. That said, not all states may allow the student loan benefit to come out tax-free at the state level.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

You May Like: How Do I Get A Loan From My 401k