Disadvantages Of Roth Conversion

You expect your tax rate in retirement to be lower. If youre in a high federal tax bracket today and expect your retirement income to be low enough that your tax rate will be lower, too, Roth conversions dont make any sense. That said, you still face the wildcard issue of what Congress might do with tax rates in coming years.

Paying taxes upfront. Do you have the free cash flow to handle the extra tax hit from a Roth conversion? If you have high-rate credit card debt, or your emergency fund is a bit thin, you might want to tackle those issues before giving yourself a bigger tax bill.

Social Security issues. If youre already collecting Social Security, whether the payout is taxableand the extent to which it will be taxedis based in part on your income. The year you do a Roth conversion, your taxable income will rise, which could cause a portion of your Social Security benefit to be taxed or push you into a situation where more of your benefit is taxed.

Less bankruptcy protection. Creditors cant touch money inside a 401 account, but there is a limit on protection of IRA assets. The current combined IRA amount protected from creditors is $1,362,800. This cap is reset every three years to adjust for inflationthe next adjustment will be in April 2022.

Dont Miss: Should I Transfer 401k To New Employer

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

An Extra $56000 In Your 401 How

If you contribute to a 401 through your company, you may be eligible to make additional optional after-tax contributions beyond the $19,000 limit each year . These contributions are not to be confused with Roth 401 contributions, which are made after taxes. However, not all 401 plans allow these contributions in fact, only around 48% of all 401 plans allow it, and only about 6% of participants use it.

You May Like: How Do I Know Where My 401k Is

Before Converting There Are A Few Things To Consider:

- You cannot recharacterize. Understand your tax situation and ability to pay for the conversion because a Roth conversion cannot be recharacterized.

- The availability of funds to pay income taxes. The benefits of a conversion are increased if the income taxes due can be paid out of non-retirement assets.

- To help manage your tax liability, you may choose to convert just a portion of your assets. There is no limit to the number of conversions you can do, so you may convert smaller amounts over several years.

What Is The Waiting Period Before I Can Withdraw Rollover Funds Penalty

You will be subject to a 10% early withdrawal penalty if you do not wait 5 years from the rollover.

Please note, for the purposes of calculating the five-year period, the rollover is considered to have been made at the beginning of the calendar year in which the rollover is complete. For example, if you roll $5,000 from your traditional IRA to your Roth IRA on Feb. 15, 2022, you will be eligible for tax and penalty-free withdrawal of the funds as early as Jan. 1, 2027.

Also Check: What Age Can You Start A 401k

Beware The Roth Conversion Five

You probably already know about the five-year rule for Roth conversions: The IRS charges a 10% penalty on any money you withdraw from a converted Roth IRA within the first five years. But if you decide to pursue multiple Roth conversions over several years, you need to understand that each Roth conversion has its own five-year clock.

If you were to convert a 401 balance to a Roth IRA in 2021, 2022 and 2023, for example, you would have three different five-year rules to abide by.

The clock for the five-year rule starts on Jan. 1 of the year you make the conversion. So if you converted money in December of 2021, the IRS considers your five-year clock to have started on Jan. 1, 2021. For that December conversion, youd essentially have just four years left when you shouldnt touch the money.

Where Are Roth Conversions Reported On 1040

If you convert money to a Roth IRA, you must use either Form 1040 or Form 1040A to file your taxes. To figure out how much of your conversion is taxable, fill out Form 8606. You record the total amount converted on line 11a and the taxable portion on line 11b if you utilize Form 1040A and converted from a regular IRA. Report the total amount on line 12a and the taxable portion on line 12b if you converted from a 401 or 403.

Conversions from a traditional IRA are reported on line 15 of your tax return, with the total amount on line 15a and the taxable portion on line 15b. Report the total amount of the conversion on line 16a and the taxable part on line 16b if youre converting from an employer-sponsored plan.

Don’t Miss: How To Find Out If Someone Has A 401k

How A 401 To Roth Ira Conversion Works

Converting a 401 to a Roth IRA is essentially the same process as rolling your 401 funds over to a traditional IRA, but there’s the extra step of paying taxes on your converted funds, as most 401s are taxed differently from Roth IRAs.

First, make sure you’re allowed to do a 401 to Roth IRA conversion. Many companies will allow only former employees to do rollovers or conversions, but a few may permit current employees to roll some of their savings over to an IRA as well. You should also check to see whether you’re allowed to roll over your 401 funds directly to a Roth IRA. Some plans permit you to roll your 401 savings only into a traditional IRA. Then you can open a Roth IRA and do your conversion.

Second, you must decide how much you’d like to convert. You can convert the full value of your plan, or you may be able to convert just a portion if your plan allows it. If you can’t do a partial conversion but don’t want to convert everything to Roth savings, you can always roll part of your savings into a Roth IRA and the other part into a traditional IRA.

There aren’t any limits on how much you can convert to a Roth IRA in a single year, but most people try to keep themselves from jumping up to the next tax bracket, which we will discuss below.

Can I Convert Ira To Roth Ira

- A regular IRA can be converted into a Roth IRA in whole or in part.

- You can conduct a Roth conversion, sometimes known as a backdoor Roth IRA, even if your income exceeds the contribution restrictions for a Roth IRA.

- Youll have to pay taxes on the money you convert, but youll be able to withdraw money from the Roth IRA tax-free in the future.

Read Also: How To Lower 401k Contribution Fidelity

Direct And Indirect 401 Rollovers

Before you roll over your 401, youll need to open an IRA account. You can do this at virtually any major brokerage firm, mutual fund company or robo-advisor. Do some research, then head to your financial institutions website to open your account. At some point, youll want to talk to a customer representative to find out whether the rollover and conversion can be done at once or if they are done sequentially. If its the former case, youll just have to pick your investments once. If its the latter, youll want to keep the money liquid in the IRA before converting to a Roth.

Once youve opened the IRA, you can contact the company managing your 401 account to begin the rollover process. You can do this online or over the phone. Your 401 plan administrator will then transfer your funds into your new IRA account. This is called a trustee-to-trustee or direct rollover, and its the easiest way to do it.

Another path is an indirect rollover. In this case, the balance of the account is distributed directly to you, typically as a check. Youll have 60 days from the date you receive the funds to transfer the money to your custodian or IRA company. If you dont deposit the funds within the 60 days, the IRS will treat it as a taxable withdrawal, and youll face a 10% penalty if youre younger than 59.5. This risk is why most people choose the direct option.

Why Are Roth Conversions Helpful To Clients

In 2010, the IRS began allowing investors to convert traditional IRAs into Roth IRAs regardless of income. With Roth IRA conversions, clients pay taxes on whatever amount of money is converted. However, if they plan to retire in a higher tax bracket, theyll still pay less in taxes in the long run. There are numerous advantages to Roth conversions, so lets take a look at a few of the specific benefits:

- Reduce the amount of taxes that clients must pay in the future.

- Any monetary gains, contributions, and earnings grow tax-free in Roth IRAs.

- Once your clients have paid taxes on their Roth IRA contributions, they wont be required to pay them again if they take qualified distributions.

- Clients will likely owe less in taxes over the long-term if they keep their money in a Roth IRA versus a traditional IRA.

- Clients can make withdrawals at any time without tax penalties, even though advisors should advise them against utilizing their Roth IRA account like a traditional checking or savings account.

You May Like: What To Do With Old 401k Account

Benefits Of Converting A 401 To A Roth Ira

- Youll lock in a zero future tax liability. By voluntarily converting your 401 to a Roth IRA now, youll pay taxes now, but youll also give your money an opportunity to grow completely unrestrained by taxes for the rest of your life.

- IRAs tend to be more flexible. Since an IRA is an independent retirement account, you dont necessarily have to be in any sort of formal employment relationship to open one Money in an IRA is free of the common restraints that typically come with the standard 401 plan youll find at your employer.

- Youll be free to invest in what you want. Most 401 plans have set investment menus that youll need to choose from with IRAs, youll have significantly more choice in terms of how you can invest your money.

There are also some major costs involved with converting your 401 to a Roth IRA.

How To Roll Over Your 401 To A Roth Ira

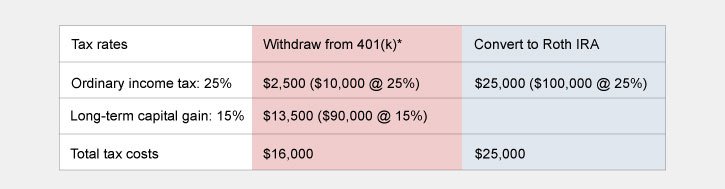

Rolling over your 401 plan to a Roth IRA is a taxable event. Youll have to pay income tax on your contributions, your employer-match contributions and all earnings. Depending on the size of your account, this could push you into a much higher tax bracket, so you shouldnt proceed before youve done the math. You may also want to consult a financial advisor to make sure this move is the right one for you.

Also Check: How To Know If You Have A 401k

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, you’ll want to consider two factors before making a decision:

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How Much Can One Contribute To 401k

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

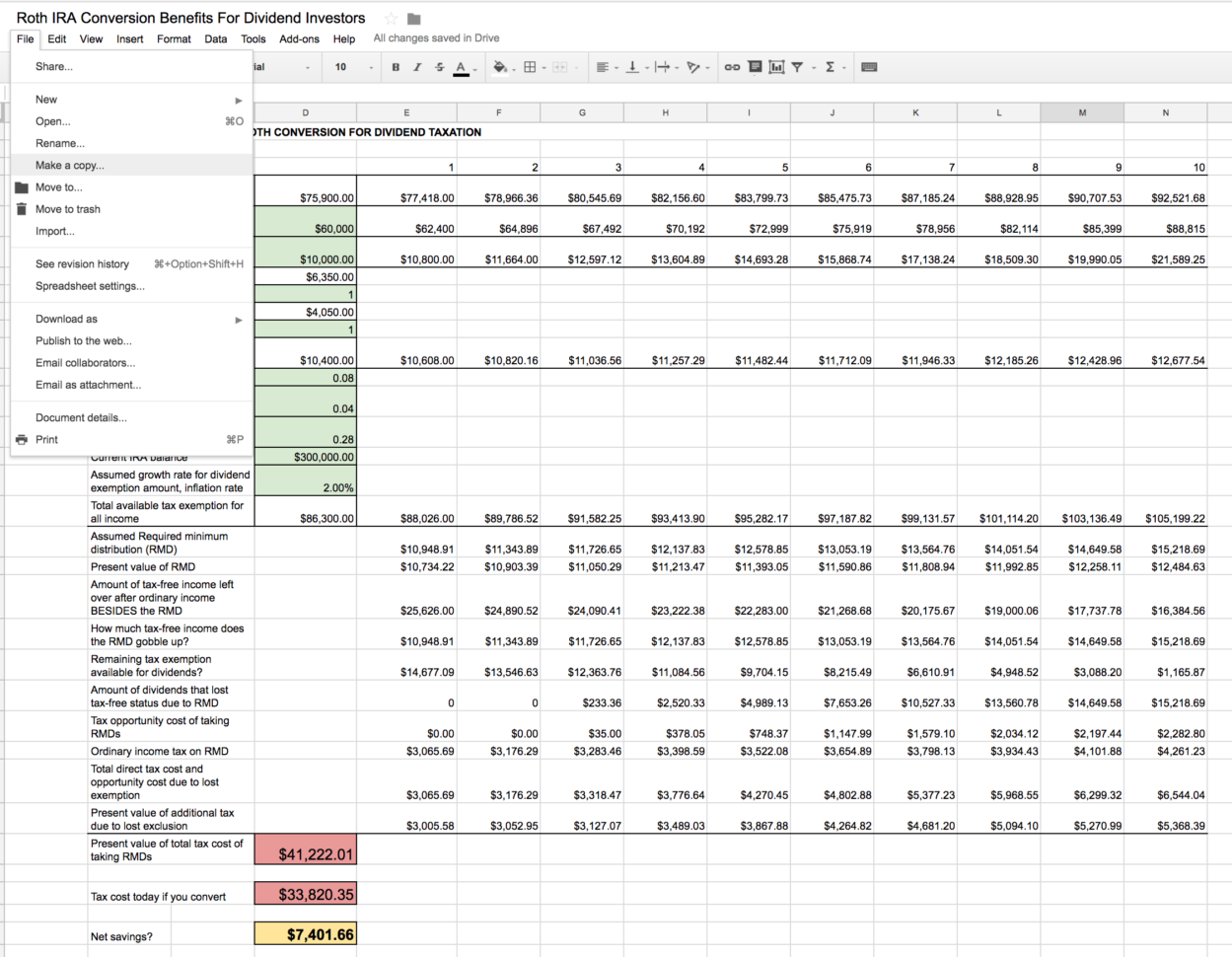

What Else Do I Need To Know About Roth Conversions For My Clients

Converting all or part of a clients traditional IRA into a Roth IRA can lead to long-term tax benefits. Smaller Roth conversions carried out early in retirement can reduce future required minimum distributions by spreading tax liability out over time during retirement. Show clients how valuable your advice is, so they know that working with you is worth it!

Don’t Miss: What’s My 401k Balance

Proposed Rules For Wealthy Investors With Defined Contribution Accounts

High-income individuals and couples with balances of $10 million or more in any defined contribution retirement plans, such as IRAs and 401s, would be required to make withdrawals under BBB.

Individuals earning more than $400,000 a year and married couples earning more than $450,000 a year would be unable to contribute to their accounts and would be obliged to withdraw half of any sum above the $10 million barrier. Lets imagine at the end of 2029, you had $16 million in your IRA and 401. Youd have to take out $3 million under the new regulations.

A separate clause applies to Roth accounts, such as Roth IRAs and Roth 401s. It applies to any couple or individual earning more than the aforementioned thresholds, with more than $20 million in 401 accounts and any portion of that amount in a Roth account. They must either withdraw the full Roth part or a portion of their total account balance to bring their total balance down to $20 million, whichever is less.

So, if you had $15 million in a traditional IRA and $10 million in a Roth IRA, youd have to first withdraw $5 million from the Roth IRA to bring the total down to $20 million, and then withdraw half of the remainder over $10 million, or $5 million.