How To Manually Calculate How Much Life Insurance You Need

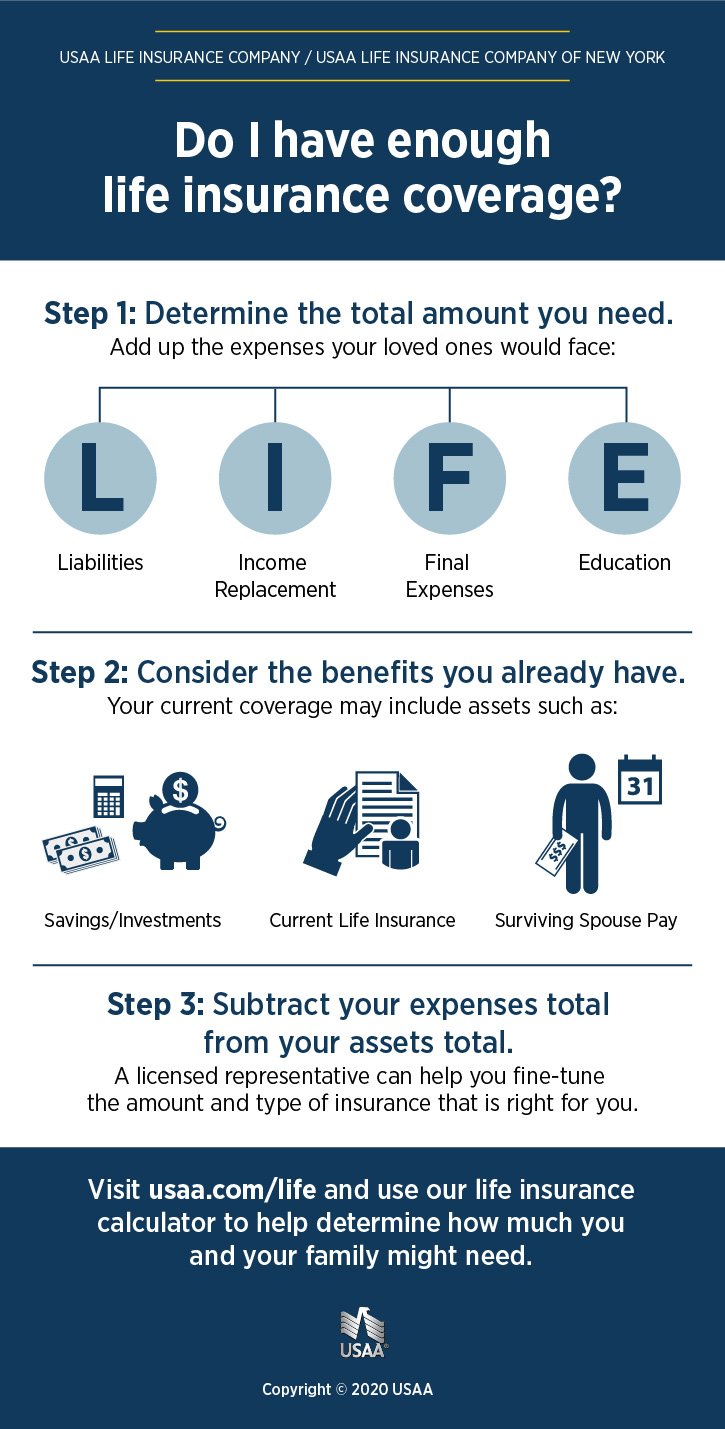

Follow this general philosophy to find your own target coverage amount: financial obligations minus liquid assets.

Step 1: Add up the following items to calculate your financial obligations:

-

Your annual salary multiplied by the number of years you want to replace that income.

-

Your mortgage balance.

-

Any other debts.

-

Any future needs such as college fees and funeral costs.

-

The cost to replace services that a stay-at-home parent provides, such as child care, if applicable.

Step 2: From that total, subtract liquid assets, such as savings, existing college funds and current life insurance policies.

The number youre left with is the amount of life insurance you need.

Customizing Your Life Insurance Plan

A good life insurance agent will construct your whole life insurance policy in a way that rapidly grows cash value and will teach you in detail about what you can do to never run into a situation that threatens your policy.

To learn more about enriching your retirement plan, with a Wealth Strategist.

Which Is A Better Way To Save For Retirement

When prioritizing retirement savings, a 401 is always a better choice than a life insurance policy. Even if you would benefit from a LIRP, you should maximize contributions to your 401 and other retirement accounts before investing in alternatives.

LIRPs require you to own a permanent life insurance policy, which is significantly more expensive than term life insurance coverage. In exchange for the higher premiums, you get lifetime insurance coverage and a cash value account that earns interest over time. But, most people donât need either of those features and will save more by buying an affordable term life policy while investing in traditional retirement funds.

You May Like: Should I Roll My 401k Into An Ira

Life Insurance: Is It Worth It And When Do You Need It

Modified date: Nov. 16, 2021

Were all going to live forever, right? Okay, maybe not. But chances are, youll live out many more decades and even get a chance to enjoy those retirement savings youve worked so hard to build.

Retirement isnt the only thing you need to plan, though. If, for some reason, you dont live to the ripe old age of 105, what happens to those you leave behind? In some cases, a good life insurance policy can make a big difference to your survivors. But life insurance isnt for everyone. In fact, in some cases, it may not be a wise idea.

If you want to even begin to ballpark the cost of life insurance, you can answer super quick questions to get a few quotes to determine how much life insurance will cost you and how much coverage.

Whats Ahead:

Tips For Calculating How Much Life Insurance You Need

Keep these tips in mind as you calculate your coverage needs:

-

Think of life insurance as part of your overall financial plan. That plan should take into account future expenses, such as college costs, and the future growth of your income or assets.

-

Dont skimp. Your income likely will rise over the years, and so will your expenses. While you cant anticipate exactly how much either of these will increase, a cushion helps make sure your spouse and kids can maintain their lifestyle.

-

Talk the numbers through with your family. How much money does your spouse think the family would need to carry on without you? Do your estimates make sense to them? For example, would your family need to replace your full income or just a portion?

-

Consider buying multiple, smaller life insurance policies, instead of one larger policy, to vary your coverage as your needs ebb and flow. For instance, you could buy a 30-year term life insurance policy to cover your spouse until your retirement and a 20-year term policy to cover your children until they graduate from college. Compare life insurance quotes to estimate your costs.

Also Check: Where To Find My 401k

Dont Leave Life Insurance Until Its Too Late

Whatever path youre on, always remember that its cheaper to buy life insurance the younger you are.

If youre ready to buy life insurance, we recommend RamseyTrusted provider Zander Insurance. Theyll be able to serve all your life insurance needs. And theyll help you get the best term life policy at the best price!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Update Your Details Below To Find A Personalized Policy That Meets Your Needs

My Details

| You currently are covering only final expenses and legal fees, update your information on the left by adding a spouse or dependents if you would like to leave additional money behind for your family. | How much money do you want your family to receive annually?% of incomeReset | How many years of income will your family need?Dismiss |

Recommended Reading: How To Find Out 401k Balance

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How Many Kids Do You Have

Kids are great, but they can be expensive. Keep in mind, the idea of life insurance is to provide for future income needs for your spouse and your children.

Here are some things to consider:

- Do you want to pay for them to go to college? Maybe factor in about $40,000 per kid.

- Do you want to pay for their weddings? Perhaps, consider $20,000 per child.

- Do you need to pay for daycare costs if something were to happen to you? This could be a big one, depending on the age of your kid and the area you live in.

Obviously there are many more things to consider when factoring in kids, but this should give you an idea of what future costs to consider when purchasing life insurance. So lets say you have two young kids and you want to pay for all three of these.

So you would want an additional $120,000 plus whatever daycare costs might be. Lets say another $96,000 .

This would bring the grand total to $956,000 .

Recommended Reading: Can You Use 401k To Refinance A House

The Problem: Life Insurance Or 401

Todays question comes from Phillip. Phillip just had his first kid, Alexander. Being a good parent, Phillip is making progress toward three vital things for new parents:

- Life insurance

- A will

Like any budget-conscious person, Phillip is aghast at the cost of the insurance policies he now needs. He shared his concern with me, saying:

Life insurance is expensive. Arent I better off putting this money into my 401 to save for retirement?

Thats an absolutely fantastic question. And heres the answer:

Intrigued? Me too! Lets discuss why.

Yes This Life Insurance Calculator Is For You

But I have life insurance through work

Nice one! But you still need coverage that will follow you wherever you work. When you leave your current job, you wont be insured and your family wont be protected. If you wait until you leave your job to search for life insurance coverage, youll probably end up paying more because youll be older. Plus, employer-paid policies usually dont replace as much lost income as people really need.

But Im a stay-at-home parent

Just because youre not generating income doesnt mean youre not generating value for the familyvalue that would have to be replaced if you werent around. If something happened to you, imagine the cost of hiring caregivers to attend to the needs of your children. Your partner would have to hire someone to do everything you do now, from childcare to cooking and shopping. That doesnt come cheap, so make sure you dont undervalue your contribution to the family by skipping life insurance.

But I work out and eat lots of kale

Read Also: How To Close Out Your 401k

Talk To Bankers Financial Advisors Or Insurers

Although privacy regulations may govern how much a banking official can tell you about the deceaseds finances , you may be able to glean some information from them. It may pay to talk to the deceaseds financial advisor or accountant, or even their regular insurance agent.

If you are executor or next of kin, you may have access to safety deposit boxes or other private storage areas that could yield important information. If youre not in a position to access them, see if you can get permission from those in the deceaseds inner circle who may be able to get to them.

How Long Do I Have To Roll Over My 401

You can roll over a 401 at any point after you switch jobs or retire. Bear in mind, though, that the IRS gives you just 60 days after you receive a retirement plan distribution to roll it over to an IRA or another plan. And youre only allowed one rollover per 12-month period from the same IRA.

If you miss the 60-day deadline, the taxable portion of your 401 distribution will be taxed. And if you are under the age of 59½, there will be an additional 10 percent tax penalty.

Recommended Reading: How Can I Invest My 401k

Pros: Convert To Permanent Insurance

If you decide you want to extend your term life policy indefinitely, you could convert it to permanent life insurance coverage. Doing so may increase your premiums but it may be a worthwhile investment if you want to have coverage for life. Converting could also give you the opportunity to accumulate cash value.

What About Life Insurance Through Work

You may be lucky enough to receive life insurance through your employer, known as group life insurance. If your employer offers this coverage for free as a benefit, theres little reason not to accept it, even if the coverage isnt as robust as you would like.

You can also buy supplemental life insurance to go along with your group life policy to increase the death benefit that would pay out upon your death. You may want to do some shopping around to see if the supplemental life insurance policies you can buy through your employer are a better deal than what you could purchase on your own.

Your group life plan may not be enough to cover all of your financial dependents. Review what your employer offers, what you can buy in addition to that policy, and decide whether you want to combine that insurance with your own plan. Keep in mind that youll also need to shop for new coverage if you leave your job.

About the author:Eric is a former insurance writer at NerdWallet.Read more

Also Check: When Leaving A Company What To Do With 401k

Should You Invest In Whole Life Insurance Or Term Life Insurance

Permanent cash value life insurance policies, such as whole life insurance, have an investment component as well as life insurance coverage. However, the primary purpose of these policies is still to pay out a death benefit to your beneficiaries when you pass away, and this benefit makes up a significant portion of the cost of buying a policy. Thats why whole life insurance policies and other cash value life insurance policies dont make sense as an investment unless one of your objectives is to have lifelong coverage.

Assuming you do need life insurance, there are four broad groups of insurance to choose from based upon your financial situation:

| Type of Policy | |||

|---|---|---|---|

| Whole and universal life insurance | Lifetime | Youre considering guaranteed universal life insurance for the permanent coverage, but have a broad portfolio of investments already and want to diversify. | Through a cash value life insurance policy you can get guaranteed returns or take greater risk, such as investing the cash value in an index or actively managed portfolio. |

Since guaranteed universal life insurance policies offer permanent coverage, theyre still much more expensive than term life insurance , but you save money as theres little to no investment component. Whole life insurance policies are regularly ten times the cost of term life insurance since youre paying for permanent coverage, additional administrative costs plus funding the investment account.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most price, customer service, policy features and savings opportunities so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure were putting accuracy first.

Read Also: How Can I Get Access To My 401k

Why Do You Need Life Insurance

Life insurance pays a death benefit to your beneficiaries if you should die while the policy is in effect. If your family would face financial hardship in the event of your death, life insurance offers peace of mind.

If you dont have direct beneficiaries, you may not need life insurance . However, carrying a small life insurance policy can at least help cover the funeral costs.

If youre thinking about getting life insurance, dont delay. Acquiring life insurance while youre young can save you premium costs in the future.

How Whole Life Insurance Works As An Investment

When you pay whole life insurance premiums, a portion goes towards the cost of insurance, some is put towards sales and administrative fees, and the rest goes towards the policys cash value. In the early years, fees and the cost of insurance use up the majority of your premium but, over time, an increasing amount is contributed towards the cash value.

The cash value is basically an investment account inside your whole life insurance policy that grows at a guaranteed rate over time. The guaranteed rate of return is typically enough that your cash value should equal the policys death benefit when you turn 100, assuming you dont make withdrawals. A simple way to think of your policys cash value is that its the amount of money you would get in return for giving up the policy to the insurer.

During the first 10 to 20 years of coverage, a whole life insurance policys cash value is quite small, due to fees and the cost of coverage. Therefore, we wouldnt recommend whole life insurance as an investment if youre older, as you may not live long enough to see good returns and would save money with a guaranteed universal policy.

If you purchase whole life insurance from a mutual insurance company, you may receive dividends as your cash value grows. Mutual insurers are owned by their policyholders, so profits are redistributed as dividends annually.

Recommended Reading: How To Find Out If You Have Unclaimed 401k Money

Accessing Your Whole Life Insurance Policys Investment Gains

A whole life insurance policys cash value is not added to the death benefit if you pass away it is kept by the insurer so you need to either “use it or lose it”. You can access and utilize the cash value by:

When you withdraw or borrow money from the policys cash value, the insurer will reduce the death benefit accordingly. Because of this, you might think of whole life insurance as assisted self insurance. You pay the insurer for the benefits of tax-deferred growth, guaranteed returns and the ability to use the money through a policy loan as it continues to grow.

The insurer, in turn, keeps premiums level as the difference between the cash value and death benefit decreases over time, reducing their liability. But, while your beneficiaries receive the death benefit, they dont get the policys cash value as well.

Also note that while whole life insurance policies have surrender fees during the first several years of coverage, theres no restriction for making a withdrawal or taking out a loan based upon your age. This is actually a key benefit over a traditional 401 or IRA, which carry penalties for withdrawals before age 59.5, as you can access the funds at any time so long as you have a large enough cash value.

How Much Money Do You Need

You may have noticed the rising costs of housing, food, and education. If you have children, it is getting harder and harder for a single parent to provide for their kids, put them through college, and live a comfortable life in the process. The point is that you probably need a lot more money than you think. The cost of a college education has gone up about 10% to 15% a year for the last decade.

When figuring out how much of a shortfall your family would have if one spouse lost their jobs, you can use our life insurance needs calculator for a simple estimation. If you want to calculate your need yourself, the number you are trying to reach is the amount that would pay off the mortgage, provide for all living expenses, and provide for a comfortable retirement, minus the amount of money the other spouse is likely to earn for the remainder of their life and the amount you already have saved. Keep in mind that daycare is usually a new expense for a single parent, or a single parent may need to cut back at hours at work, choose a less demanding job, or even ideally stay at home full time to raise the family.

Also Check: When Changing Jobs What To Do With 401k