Can I Max Out 401k And Roth Ira In Same Year

You can contribute to both a Roth IRA and an employer-sponsored retirement plan, such as a 401, SEP, or SIMPLE IRA, subject to income limits. Contributing to both a Roth IRA and an employer-sponsored retirement plan can make it possible to save as much in tax-advantaged retirement accounts as the law allows.

Max Out Your Contribution

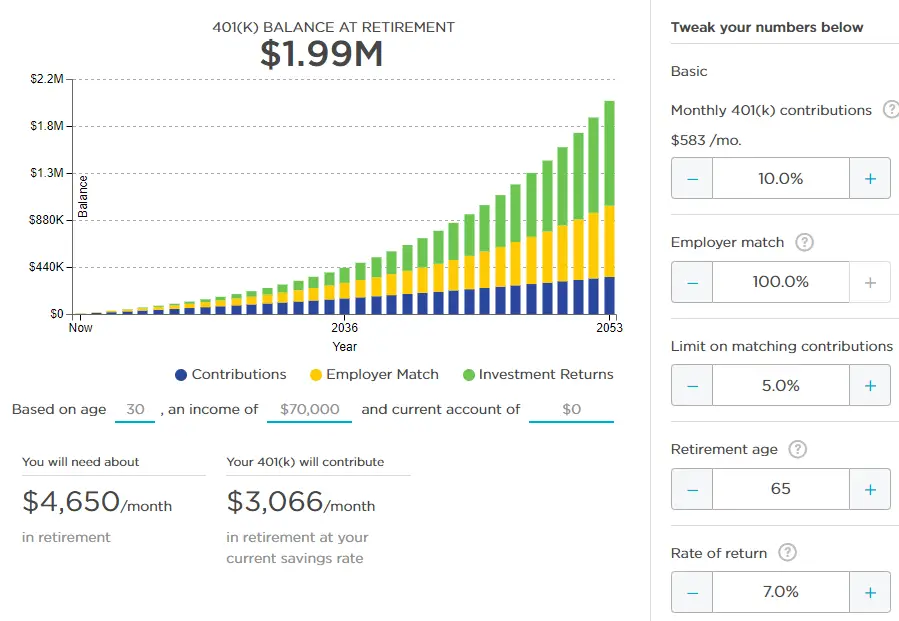

While that sounds like a lot of money from a 4% contribution, it may not be enough to sustain the lifestyle you want in retirement. Based on the often-used “4% rule” for retirement and using our preceding example, a $900,000 nest egg would safely produce $36,000 in annual income in retirement. Withdrawing any more than this greatly increases the chances you’ll eventually run out of money. Even when you factor in Social Security, it might not be enough.

Fortunately, you can save more than your employer is willing to match — a lot more, in most cases. For the 2020 and 2021 tax years, the IRS allows you to funnel up to $19,500 of your compensation into your 401.

One popular strategy is to increase your contributions by 1% per year until you hit the maximum amount you’re comfortable with saving. Any small increase can make a big difference. Returning to our example, consider how small increases in elective contributions affect retirement savings in the long run.

| Your Contribution |

|---|

| $1,351,305 |

Assumes $60,000 starting salary and 2% annual salary increases. Also assumes 7% annual investment returns.

There are even more opportunities to invest beyond a 401, such as an IRA. However, you should be sure to capture your employer match on your 401 first.

Total 401 Employer And Employee Annual Contribution Limits

| 2020 | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$63,500 |

$64,500 |

Vanguard data from 2018 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

Recommended Reading: Can You Get 401k If You Quit

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

Read Also: What Should I Do With My Old Company 401k

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

How Much Can I Contribute To Roth Ira And 401k

In recent years, more and more has been said about the importance of saving for retirement. Watching so many current retirees struggle for cash has left many Americans concerned about saving enough.

According to The Economic Policy Institute, the average family aged 56-61 has only $163,577 in retirement savings. If a 61-year-old with an average balance doesn’t save any more before he retires at age 65, and lives to be 85, he’ll have just $8,178 per year in retirement savings to live off of, not including interest accrual.

The good news is that yes, you can contribute to both a 401 and an IRA. Contributing to both types of retirement accounts goes a long way in helping ensure you’ve got enough for retirement.

Let’s go over some basic questions between 401s and IRAs. That way you’ll have enough information to know how to best manage your retirement savings monies.

In This Article

- What is the Difference Between a 401 and an IRA?

- The 401

Don’t Miss: How To Get Your 401k Out

Situation : Im Maximizing My 401 And Saving Money On The Side

If youre in this category, youll want to maximize every savings vehicle you can. Wed recommend maximizing your ESPP sometimes even before maximizing your 401.

The percentage will vary, but youll want to calculate what youll need to contribute to maximize your ESPP contributions.

Note: If you have the ability to max out an HSA or Roth IRA, those should be priorities as well. When possible, you should consider maxing those out in addition to maximizing your ESPP savings. It depends on the person, but typically Roth IRA should be first, followed by equally-prioritized contributions to your ESPP and HSA.

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

You May Like: How To Rollover 401k To Charles Schwab

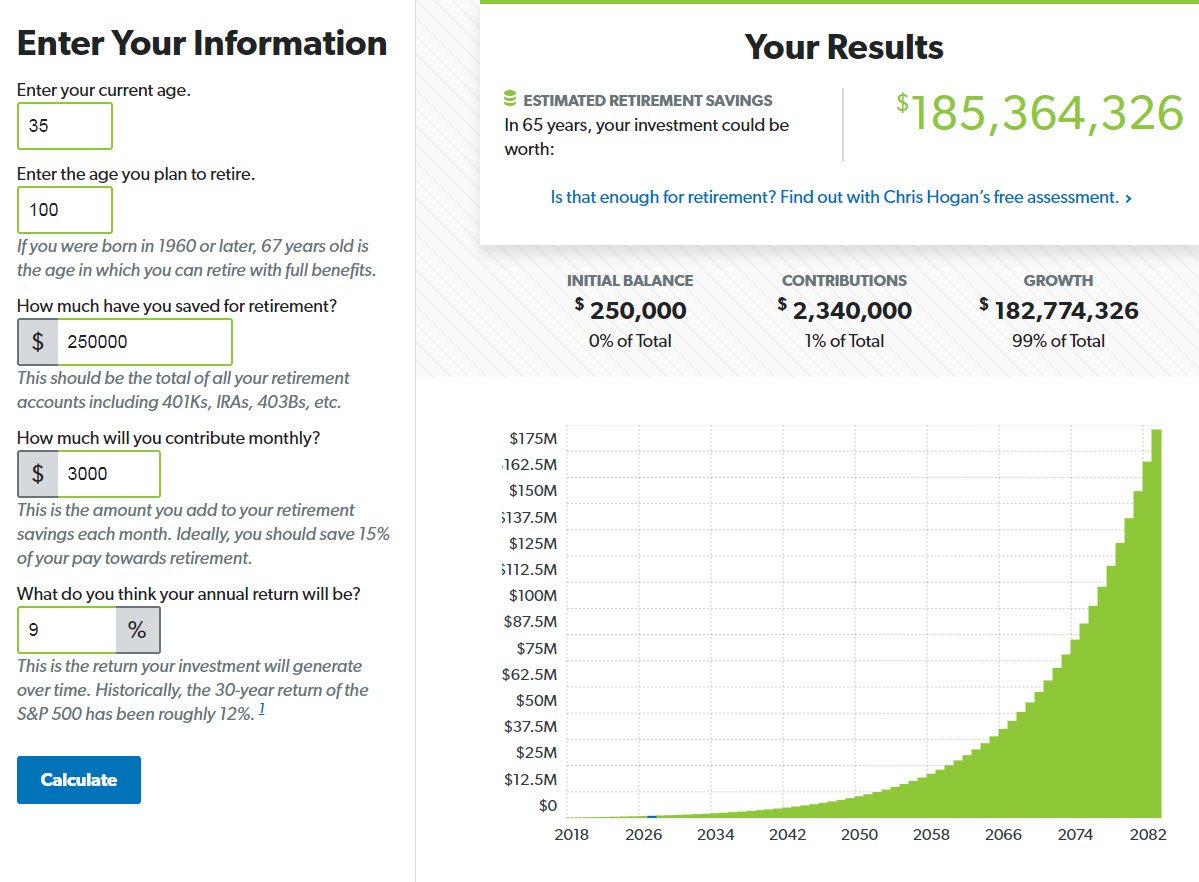

When To Start Saving For A 401k

Not everyone gets the opportunity to invest in their 401k early on. As soon as it becomes available, consider taking advantage of this benefit. As of 2017, individuals under 49 could legally contribute $18,500 per year. Those 50 years or older, can save an additional $6,000 for a total annual $401k contribution of $24,500.

Many 20-something-year-olds have student debt, changed jobs a handful of times, have not started saving, or are not in a job where a 401k plan is offered. In this case, well look at the amount you should have saved starting at age 30.

A good rule of thumb is to add on one year of salary saved for every five years of age for example, at age 30 youd want to have saved one year of salary, at age 35, two years, at age 40, three years, and so on. Use these guidelines along with your post-retirement budget to gauge if you are on track for a comfortable retirement.

Should I Have Both A 401k And Roth Ira

Investing in both a 401 plan and a Roth IRA offers the perfect combination of tax savingssome now and some in the future. Roth IRA contributions are made with after-tax dollars, so theres no conflict between this type of plan and a 401, which is funded with pre-tax dollars.

Don’t Miss: How To Set Up 401k In Quickbooks

How Much Should I Put In My 401k

There are two sets of answers when it comes to the question of how much should I put in my 401k?

The first answer is the technical side as in, how much are you actually allowed to put in your 401k each year? As youll soon see, the IRS caps how much you can put in your 401k each year.

The other answer is more qualitative and much more personal. If youre unable to contribute the maximum amount, then how much should you contribute? Or better yet, should you contribute to your 401k at all?

But first

This blog is about 401ks, but the rules were about to discuss also apply, for the most part, to other types of employer retirement plans like 403bs and TSPs. For simplicitys sake we will use the term 401k as a catch-all since it is the most popular type of employer retirement account.

Perks For Older Investors

If you happen to be 50 or older, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $26,000 in 2021, which is the same as the contribution limits from 2020. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $64,500 in 2021, or $6,500 more than the $58,000 max for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

Recommended Reading: How To Invest My 401k Money

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Dont Cash Out Your 401 Early

Another lesson: Whatever you do, dont cash out your 401 savings. If you leave your job, you are allowed to spend your 401 funds if you pay taxes on the amount, including a 10% penalty tax assessed on most withdrawals made before age 59 ½. You may be tempted to take the cash and spend it on a vacation before you start your next job, but thats not a very good idea.

Roll over that retirement money, sign up for the retirement plan with your new employer and take a nice and affordable staycation instead. Your retired self will be very grateful to your working self for making a small sacrifice that could have a big impact down the line.

You May Like: How Much Can I Take From 401k For Home Purchase

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Can I Contribute To Both A 401k And A Roth 401k

What Are Roth 401 Contribution Limits? For 2018, the 401 contribution limit is $18,500. This contribution limit applies to any 401 contributions, whether they are in a Roth 401 or a traditional 401. That means if youre contributing to both, the combined total of your contributions can t exceed $18,500.

Recommended Reading: How Much Should You Put In Your 401k

What Are The Deduction Limits For The 401k And Ira

As we discussed briefly earlier, both 401 and IRA contributions can be deducted from your taxable earnings in some cases.

Your annual adjusted gross income plays a factor in how much of your contributions you can deduct on your taxes. Remember that Roth IRA contributions are not deductible, but that their earnings grow tax free instead.

Your marital status and how you file your taxes can make a difference as well. The list of deduction limits and rules is too expansive to go over here. For more information, check out the IRS web pages linked to below:

IRS Deduction Limits for 401 Plans

IRS Deduction Limits for IRAs

How Much You Should Have In Your Retirement Fund At Ages 30 40 50 And 60

Age 30: The 1X Recommendation

By age 30, you should have saved an amount equal to your annual salary for retirement, as both Fidelity and Ally Bank recommend. If your salary is $75,000, you should have $75,000 put away. How do you do that?âWhen starting your career, commit to automatic savings of 20% per year into your 401. It will discipline you to live and give on the remaining 80%,â said Jason Parker of Parker Financial in the Seattle area, author of âSound Retirement Planningâ and host of the âSound Retirement Radioâ podcast.

Age 30: Planning Starts in Your 20s

Age 40: The 3X Recommendation

Both Fidelity and Ally Bank recommend having three times your annual salary put away for retirement at age 40. If you donât have a retirement savings strategy as part of your overall financial plan by this point, donât delay, one expert said.âEvery household, regardless of their net worth or stage of life, owes it to themselves to create a comprehensive, individualized financial plan,â said Drew Parker, creator of The Complete Retirement Planner.

Age 40: Resist the Temptation

Age 50: The 5X Recommendation

Age 50: Cut Costs

Age 60: The 7X Recommendation

Age 60: Reduce Risk

Don’t Miss: Where Can I Move My 401k Without Penalty

How Much Should I Save For Retirement

We get that question a lot. So we asked Stanley Poorman, advice and planning manager for Principal®, who said theres no one-size-fits-all answer.

A good rule of thumb is to save 1015% of your income toward retirement, but that also depends on when you get started. That may be fine if youre 25, but if youre starting at 50, you may need to save more to retire comfortably, Poorman says.

One way to get a quick snapshot of how much you may need to save is to use the Retirement Wellness Planner. By entering a few numbers, youll get a sense of whether youre on track or not.

Another factor is whether you have a matching contribution from your employer, and if so, what percentage the company contributes. Poorman suggests deferring enough of your pay to get that match.

The Ira Contribution Deadline Is April 15

Speaking of later, you have until April 15, 2021, to contribute to your individual retirement account for 2020. The maximum you can put into an IRA is $6,000, plus an extra $1,000 if you’re over age 50. Roth IRAs also have income-based contribution maximums.

Remember that you can only save earned income in an IRA, meaning real estate profits, interest, dividends and pension funds don’t qualify.

Also note that these totals are for all your IRA accounts added together. You can’t put $6,000 in a Roth IRA and $6,000 in a traditional IRA it’s $6,000 total. If you go over the IRA limit for 2020, you have to withdraw the excess by the time you file your tax return. If not, you’ll be subject to a 6% tax on the excess.

One policy that’s changed recently is that the age limit for IRA contributions has been eliminated with the passage of the SECURE Act. Previously, you had to have been under 70 1/2 to put money into a traditional IRA. Now, you can be as old as you want.

Overall, End says it’s been a long, hard year, so “don’t beat yourself up if you didn’t meet your goals in 2020.”

If you lost income or encountered financial challenges, take December to review the personal finance basics. Set up an emergency fund, stash away what you can for the future and chat with an expert to make a plan for 2021.

Read Also: Can You Use Your 401k To Buy Real Estate