Get The Maximum Match

If your company matches, you should always contribute at least enough to get the full match amount every year. Heres an example of what that might look like:

If your company has a 100% up to 5% match, this means they will match you dollar for dollar, up to 5% of your pay that you deposit into your 401 account. If you make $100,000, you will need to contribute at least $5,000 to get the maximum match of $5,000 annually. If you dont contribute at least $5,000, you will be leaving money on the table that otherwise would have been yours. Dont cheat yourself out of this money! Your future self will thank you.

If you are only contributing the minimum to get the maximum match, keep aware of any increases your company may make to their matching contributions. If you can, you should increase your contributions accordingly to continue to receive the maximum match.

Are Roth Iras Still A Good Idea

If you have earned an income and meet income limits, a Roth IRA can be an excellent tool to save for retirement. But remember, its only part of an overall retirement strategy. If possible, its a good idea to contribute to other retirement accounts as well.

Is a Roth IRA a good idea right now?

Roth IRAs are ideal retirement savings accounts if youre in a lower tax bracket now than you expect to be in retirement. Millennials are well positioned to make the most of the tax benefits of a Roth IRA and decades of tax-free growth.

Are ROTH IRAs high risk?

But they should follow Thiels example in one respect: Roths accounts are a great place for high-risk, high-return investments. Unlike a traditional individual retirement account or 401, Roths are funded with after-tax dollars.

Read Also: Do I Have To Pay Taxes On 401k Rollover

Solo 401 Establishment Deadline:

For 2021, in order to make employee contributions for 2021, the self-employed business owner had to establish the solo 401k plan by December 31, 2021. However, if the plan was established on January 1, 2022 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2021 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

Read Also: Who Can Open An Individual 401k

What Is The Maximum An Employer Can Contribute To Your 401 In 2021

One of the best things about a 401 is that most employers offer some kind of match on your contributions, usually up to a certain percentage of your salary. In fact, about 86% of companies with a 401 plan provide a match on employee contributions.2 And the average employer 401 match is around 4.5% of your salary.3 Thats great news for you. After all, an employer match is basically free money!

But there is a limit on how much you and your employer can put in together. Between you and your employer, the maximum that can be put into your 401 in 2021 is $58,000 .4

Also Check: How To Move 401k To Another Company

Where Is The Safest Place To Put My 401k Money

Federal bonds are regarded as the safest investments in the market, while municipal bonds and corporate debt offer varying degrees of risk. Low-yield bonds expose you to inflation risk, which is the danger that inflation will cause prices to rise at a rate that out-paces the returns on your investments.

Recommended Reading: Is There A Limit On Employer 401k Match

Extension Apply To Both Contribution Types Question:

Self-directed 401k contributions deadlines are based on the type of entity sponsoring the solo 401k so you are correct. Please see the following.

- If the entity type is a Sole Proprietorship, the annual solo 401k contribution deadline is April 15, or October 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an C-Corporation , the annual solo 401k contribution deadline is April 15, or September 15 if tax return extension is timely filed.

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Read Also: How Can I Look At My 401k

Max 401 Contribution Limits

A 401 is a common type of retirement account in which you contribute savings that come out of your paycheck before you pay income tax. Most commonly, employers sponsor an employees 401. However, sole proprietors, independent professionals, and other small business owners with no employees except for a spouse may qualify for a self-employed 401.

Even if youre new to investing, a 401 offered through your employer is a powerful, simple way to put money away for your retirement. And each year, participants in these plans can save up to the max 401 contribution established by the Internal Revenue Service . The IRS increased contribution limits in 2022 for 401 plans and more. Heres what you need to know.

How To Invest 401 Money

Youll also need to decide how to invest your 401 money. One option, which most 401 plans offer, is target-date funds. You pick a fund with a calendar year closest to your desired retirement year the fund automatically shifts its asset allocation, from growth to income, as your target date gets nearer.

These funds also have model portfolios you can choose from and online tools to help you assess how much risk you want to take. You can also decide which fund choices would match up best with your desired level of risk.

Don’t Miss: What Employees Can Be Excluded From A 401k Plan

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Next Steps: Strategic Investments

Let’s say you have also maxed out your IRA optionsor have decided you’d rather invest your extra savings in a different way.

Although there is no magic formula that is guaranteed to achieve both goals, careful planning can come close. “Look at the options in terms of investment products and investment strategies,” says Keith Klein, CFP and principal at Turning Pointe Wealth Management in Tempe, Arizona. Here are some non-IRA options to consider as well.

Don’t Miss: How Do You Know If You Have An Old 401k

Increased 2022 Hsa Contribution Limits

If youre already maxing out your 401 or other retirement contributions, consider putting pre-tax dollars toward an HSA , if you have one. An HSA helps those with high-deductible health plans save taxes on money earmarked for medical expenses not covered by the plan.

Unlike a flexible spending account , which has a use it or lose it provision, the assets you contribute to an HSA are yours for the long term and can be rolled over each year. Plus, an HSA offers a triple tax advantage: Money put in isnt taxed, it grows tax-free, and youre not taxed when you take money out to pay for qualified medical expenses.

| $7,300 |

Save For Health Care Costs

Contributing to a health savings account can reduce out-of-pocket cost for expected and unexpected health care expenses. For 2020, eligible individuals can contribute up to $3,550 pre-tax dollars for an individual plan or up to $7,100 for a family plan.

The money in this account can be used for qualified out-of-pocket medical expenses such as copays for doctor visits and prescriptions. Another option is to leave the money in the account and let it grow for retirement. Once you reach age 65, the funds are tax-free when you use them for qualified medical expenses. If you spend the funds in other ways, they are taxed as income with no penalties.

You May Like: Can You Take Money Out Of 401k

Benefits Of Maxing Out Your 401 And Roth Ira:

Invest In A Brokerage Account

If youâre over whatâs called the age of 59.5, then what goes in your brokerage is yours to keep for good. If you are under the age of 59.5, what you invest in your brokerage is whatâs called a âconstructive receiptâ. This means whatâs in your account is what the IRS considers income.

A brokerage account allows people to invest after-tax money in the stock market, just like a typical 401k, except that it happens after tax. Any capitalgains levied at withdrawal.

Each trade made by the investor incurs a brokerage fee.

Recommended Reading: What Happens With 401k When You Quit

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

Max Out 401k Employer Contributions

Your employer may offer matching contributions, and if so, there are typically rules you will need to follow to take advantage of their match. An employer may require a minimum contribution from you before theyll match it, or they might match only up to a certain amount. They might even stipulate a combination of those two requirements. Each company will have its own rules for matching contributions, so review your companys policy for specifics.

For example, suppose your employer will match your contribution up to 3%. So, if you contribute 3% to your 401, your employer will contribute 3% as well. Therefore, instead of only saving 3% of your salary, youre now saving 6%. With the employer match, your contribution just doubled.

Since saving for retirement is one of the best investments you can make, its wise to take advantage of your employers match. Every penny helps when saving for retirement, and you dont want to miss out on this free money from your employer.

If youre not already maxing out the matching contribution, you can speak with your employer to increase your contribution amount.

Don’t Miss: How Much Are You Allowed To Contribute To 401k

How Do The Immediate Tax Savings Work With My 401 Account

Jenae earns $75,000 per year and doesnt contribute to a retirement plan. Jenae is single with no dependents. She is eligible for one personal exemption of $4,050 and the standard deduction of $6,300 for a total deduction of $10,350. Jenae will owe $11,933.75 in Federal income tax. Heres how her tax return will look:

-

Adjusted gross income: $75,000

-

Taxable income: $64,650

-

Tax due : $11,933.75

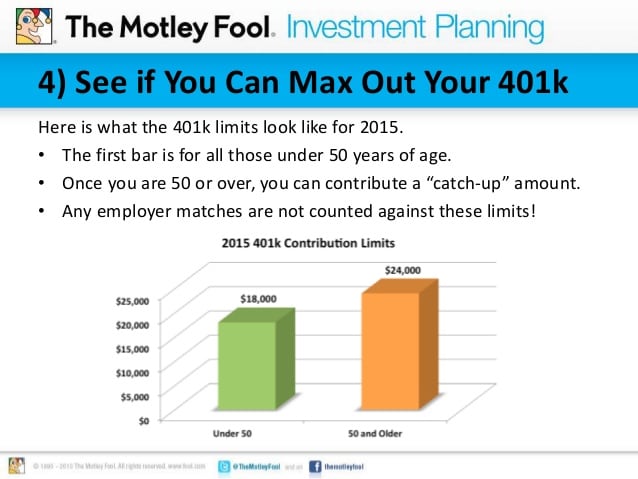

Now, imagine that Jenae to her 401 account. Her adjusted gross income is reduced from $75,000 to $57,000 and her Federal tax liability decreases to $7,433.75 from $11,933.75 for a 37.71% savings. Heres Jenaes tax picture after contributing $18,000 to her 401:

-

Adjusted gross income: $57,000

-

Taxable income: $46,650

-

Tax due : $7,433.75

So, the immediate tax benefit of contributing the maximum amount allowed by law to a 401 is a juicy 37.71% tax savings, or $4,500 for Jenae.

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

Read Also: Why Cant I Take Money Out Of My 401k

Recommended Reading: Can I Cancel My 401k And Cash Out

Next Steps To Figuring Out How Much To Put In Your 401

If youre unsure about how much you can afford to contribute to your 401, check out our paycheck impact tool that can help you calculate an exact number based off your salary and employer match options. If your employer doesnt offer a 401 matching plan, dont fret. There are still many ways you can save for retirement.

Contribution Limits : How They Differ From 2020 And 2019

The 401 contribution limit for 2021 stays flat with 2020. The IRS lifted basic 401 contribution limits for 2020 to $19,500. And it raised the catch-up contribution cap for the first time in five years.

If youre aged 50 or older, 2020 was even more of a boon for your 401. The so-called catch-up contribution limits, for older workers, also rose to $6,500 for 2020. Before this year, catch-up contributions stayed the same, $6,000, from 2015 through 2019.

Also Check: Can I Borrow From My 401k

Recommended Reading: When Can I Borrow From My 401k

Maximum 401k Contributions For Married Couples

Maximum 401k Contributions For Married Couples401k Contribution Limits 2022 It is possible to save a significant amount of money every year for retirement via a workplace 401 policy, but both you and your company are limited on the amount of money that you can put into it each year. It is possible to make the same quantity of donations to a standard 401 for tax deduction at the beginning or a Roth 401 for tax-free income in retirement . This year, lets take a a look at the maximum amount you and your employer could be able to contribute to your 401 account.

If your workplace offers an 401 plan that could be one of the most basic and cost-effective methods to invest in to secure your retirement savings. 401 plans, on the other hand they have restrictions on the amount you can contribute. number of limitations on how much you can contribute despite the fact that they permit you to transfer a percentage of your income immediately to your bank account.

401 plans as well as individuals retirement accounts , and other retirement savings plans have their maximum contributions reviewed and sometimes adjusted to the Internal Revenue Service each year, usually in November or October. This year, the Internal Revenue Service published modifications for fiscal year 2021 on October 26, 2020.

The image above was obtained from: 401klimits2021.com