Automatic Enrollment And Aip

As an eligible associate, youâre automatically enrolled in the 401 on the first of the month coincident with or following 60 days of employment at a contribution rate of 3% of eligible pay. As part of automatic enrollment, youâre also enrolled in the automatic annual increase program , which increases your contribution by 1% each year until you reach 6%.

- If you want to change the automatic contribution elections before they begin, visit NetBenefits.com or call Fidelity at 1-800-635-4015 before 60 days of employment and make your own choices.

- If you donât actively enroll and choose investment funds for your account, Syscoâs contributions will be invested in the Vanguard Target Retirement Fund thatâs closest to your projected retirement date .

If you wish to contribute to the Plan before you are automatically enrolled or to opt out of automatic enrollment, log in to NetBenefits.com or call Fidelity at 1-800-635-4015. Note that youâll need to sign up for AIP if you choose to actively enroll. To do so, log in to NetBenefits.com and click Contribution Amount.

What Are The Pros And Cons Of Cashing Out A 401k

- Access to money. The biggest benefit of retiring from your 401 is having money. Everyone would like to have more money in their pocket.

- taxes. Regardless of how you use your 401 withdrawal, you will have to pay withdrawal tax.

- To punish. Even if you qualify to be fired for difficult working conditions before you turn 59 1/2, the IRS will penalize you for doing so.

Fidelity Investments And Paylocity Team Up To Provide Integrated Payroll Capabilities For Fidelity Advantage 401 Clients

Integration Will Drive Efficiency by Enabling Employers to Automate Contributions, Reduce Risk, and Deliver More Competitive Benefits

BOSTON—-Fidelity Investments®, the countrys largest1 401 provider, and Paylocity, a leading provider of cloud-based HR and payroll software solutions, announced today that seamless access to payroll capabilities is now available with the Fidelity Advantage 401SM pooled employer plan . This enhancement will reduce the administrative burden on small- and mid-sized businesses offering retirement plans for their employees and help workers start saving towards their retirement goals.

Retirement benefits have traditionally been cost-prohibitive to smaller businesses, and workers are seeking financial security more than ever. According to a report2 by the Georgetown University Center for Retirement Initiatives, there are roughly 57 million private sector workers who do not have access to a retirement plan through their employers. This access gap more heavily impacts smaller businesses and disproportionately affects lower-income workers, younger workers, underrepresented communities, and women. At the same time, retirement planning is top-of-mind for workers, according to the Fidelity Investments 2021 State of Retirement Planning Study, which found that seven out of 10 workers in the U.S. are making changes to improve their retirement preparedness.

About Fidelity Investments

About Paylocity

Fidelity Distributors Company LLC

Also Check: Can I Borrow From My 401k Without Penalty

Need Help Or Have Questions

Contact MIT Benefits by phone, email or in-person, or see the additional contact options below.

| Vendor |

|---|

To find out who you designated as your Pension Plan beneficiary or to designate a new beneficiary, visit PensionConnect or call 855-464-8736 .

To find out who your Supplemental 401 beneficiary is, call Fidelity Investments at MIT-SAVE , or visit Fidelity NetBenefits to designate your beneficiary online.

Visit Atlas to evaluate your participation in the MIT Optional Life Insurance Plan. Spouse or partner life insurance coverage can be added within 31 days from the date of your marriage or domestic partnership or during Open Enrollment.

Review and update your beneficiaries under the MIT Optional Life Insurance Plan, the MIT Basic Retirement Plan and the MIT Supplemental 401 Plan to ensure they are current. If you are married and your most recent beneficiary designation on file for the MIT Retirement Plan does not designate your spouse as the sole primary beneficiary, and does not have spousal consent for this designation, your spouse will be beneficiary of 100% of your account balance. More on beneficiaries.

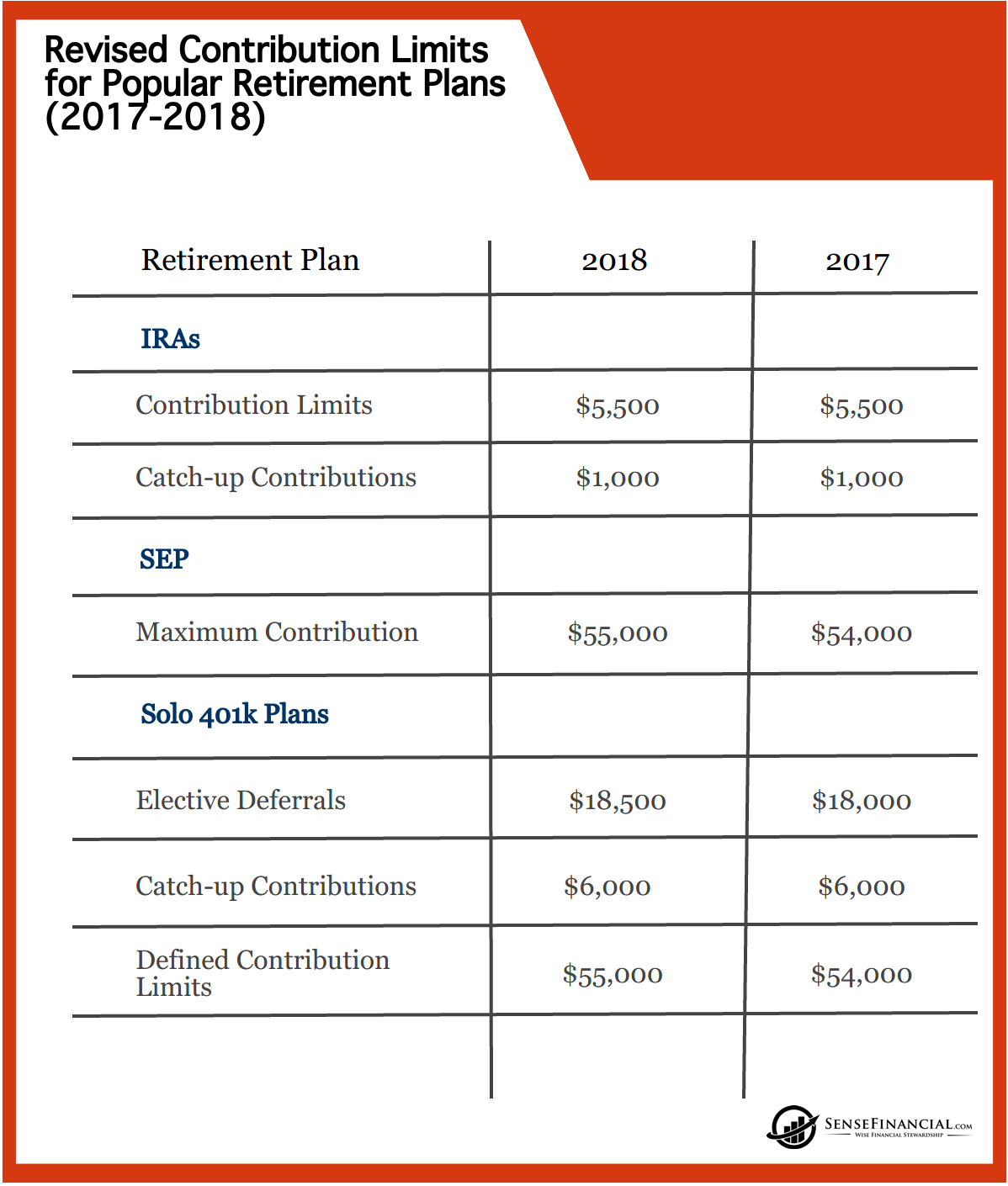

Report Outside Retirement Contributions To The Benefits Office By April 1

To help faculty and staff members avoid tax penalties, Human Resources collects information each spring regarding contributions made to outside retirement plans to help ensure they do not exceed IRS limits.

If a faculty/staff member contributes to a non-Grand Valley State University retirement plan through an outside business in which they are at least a 50 percent owner, they must report the prior years contributions to Human Resources by April 1.

This applies if the answers to the following questions is yes:

If you answered no to any of the above questions, no action is needed.

If you answered yes, please complete and submit the Internal Revenue Code Section 415 Aggregation Form by April 1.

While faculty/staff are responsible for independently reporting retirement contributions to the IRS, HR may be able to help you avoid tax penalties by collecting this information.

See the IRS website for more information about Section 415.

Don’t Miss: How To Transfer Your 401k To Another Company

How To Roll Over Your Fidelity 401k

Rolling over your Fidelity 401k is simpler than you might think. You and Your 401K

Leaving a job or getting laid off usually prompts a period fraught with tough choices and big changes. In the midst of everything else, managing your old 401k might be the last task you want to deal with.

The good news is, if your 401k is with Fidelity, the process for completing your rollover is actually simple and quite painless. You can convert your employer-sponsored 401k to an IRA or even move it into the 401k account of your new employer rather seamlessly if you know the correct steps to take.

Recommended Reading: How Does 401k Work When You Quit

And 457 Savings Plans

COVID-19 Communications:

Effective March 16, 2020, all in-person retirement planning sessions with TIAA, Fidelity, ICMA and VRS that were scheduled for UVA offices have been canceled or rescheduled to a virtual meeting. You will be contacted by the appropriate vendor retirement consultant with more information. Future appointments are still available through the signup links below and will be held virtually until further notice.

Please visit the HR COVID-19 webpages for additional HR information related to the coronavirus, health, and retirement.

Read Also: What Is The Minimum Withdrawal From 401k At Age 70.5

What Is An Opt

An opt-out plan is an employer-sponsored retirement savings program that automatically enrolls all employees into its 401 or SIMPLE IRA. Companies that use the opt-out provision enroll all eligible employees into a default allocation at a set contribution rate, usually around 3% of gross wages.

Employees can change their contribution percentages or opt-out of the plan altogether. They also may change the investments their money goes into if the company offers choices.

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.

Also Check: How To Find Your Old 401k

Cut Off Date For Making Contributions To 401

The less painful it is to save for retirement, the better. When you contribute part of your paycheck to your 401, youre making an important investment in your future. You also receive tax benefits, so it benefits you in the present. As your circumstances change, you may want to make changes to how much you contribute to your 401. If you get a raise, for example, you may want to increase your contribution. If youre experiencing a financial crunch, you may want to temporarily lower your contribution. In most cases, in order to change your 401 contribution, you will need to contact the companys 401 plan provider.

Avoid These 5 Common 401 Mistakes To Maximize Your Returns

- Half of Americans now have access to 401 retirement savings plans.

- The average 401 retirement plan employer match has reached an all-time high of 4.7%.

- But many investors are making mistakes that will leave them short of retirement goals.

If you’re in the lucky half of Americans who have access to a 401 retirement savings plan, you probably understand its appeal. Your money grows tax-free until withdrawal, contributions are automatically deducted from your paycheck and you might even get free money in the form of an employer match.

But many Americans are making mistakes with their 401 accounts that could be costing them some serious dollars. Missteps range from failing to contribute enough to receive an employer match, to overpaying in plan fees and costs. As the economy booms and the average 401 balance rises, these mistakes could be having an even more pronounced effect on Americans’ retirement accounts.

Also Check: Can I Roll Part Of My 401k To An Ira

How To Make Changes To Your 401 Contributions

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Whether you just set up your 401 plan or you established one long ago, you may want to change the amount of your contributions or even how theyre invested. Fortunately, changing your 401 contributions is usually straightforward, and you may be able to change your 401 contributions at any time .

After all, the point of a 401 plan is to help you save a substantial amount for your retirement. So its important to keep an eye on your account and your investments within the account, to insure that youre saving and investing according to your goals.

To understand how to maximize this investment opportunity and grow your nest egg, its important to start with the basics.

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

You May Like: How Much Will Be In My 401k When I Retire

Don’t Neglect Old 401 Accounts

If you’ve changed jobs, you’ll need to decide what to do about 401 accounts with old employers. You’ve got several options: rolling the account over to an individual retirement account , leaving it in the old plan, or rolling it to a new employer’s plan.

How you transfer money from existing accounts to a new account has tax implications. Because the money contributed into a 401 is tax-deferred, withdrawing the money and not depositing it into a new tax-deferred retirement savings account within 60 days could trigger taxes due, plus a 10% early-withdrawal penalty if you are younger than 59½. Instead, use a direct rollover to avoid paying taxes or penalties on the withdrawal.

The most important thing is to keep tracking this money. As you move on in your career and have more employers, it can be difficult to remember where all your assets are. Whichever choice you make now, you may want to consolidate them with other retirement accounts, later on, to make your funds easier to manage.

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Also Check: Can You Use Your 401k To Pay Off Debt

Don’t Miss: How To Borrow From 401k To Buy A House

How Often Should I Rebalance

A good rule of thumb is to rebalance when an asset allocation changes more than 5%. For a lot of people, it makes sense to use the end of the year as a time to examine their financial investments and look at any potential changes coming in the new year.

Beware Of Phishing And Spam Attacks Related To Retirement Benefits

Many employees are receiving emails from companies with names like relaxedretirements.com,yourretiring.com and appreciationnetwork.com. These emails indicate that it is time to set up an appointment to discuss your retirement benefits, or that they are available to help public employees understand their retirement plans or benefits. These entities are not authorized by GVSU and you should treat their message as spam.

Beware of attempts to gain financial information via unsolicited emails, texts and phone calls from outside companies who offer to meet with you to advise on your retirement plans, accounts or benefits.

Your HR Benefits team is here to help you with your employee benefits, including your retirement plan. Legitimate email regarding your benefits will come from , , or individually from one of the members of the Benefits & Wellness Team. You will also receive information from our retirement plan investment providers, Fidelity Investments and TIAA.

Read Also: How Much Can We Contribute To 401k

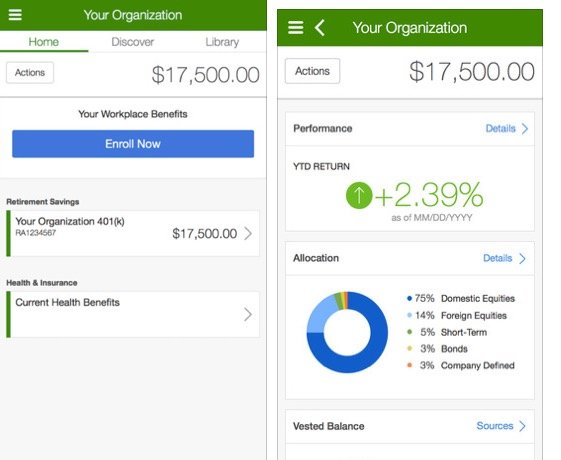

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on Register Now at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose Contribution Amount. If you are already logged in, click on the Contributions tab.

Step 2:There are three choices:

- Contribution Amount to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

You May Like: Should I Rollover 401k To New Employer

Are You Investing Enough For Retirement

Periodically, you may decide to invest more for retirement. This can be easily done using the following steps:

Recommended Reading: Is There A Limit For 401k Contributions

How Much To Save For Retirement

The Department of Labor outlined a few best practices for investing in order to save for retirement.

Its estimated that most Americans will need 70% to 90% of their preretirement income saved by retirement, in order to maintain their current standard of living. Doing that math can give plan participants an idea of how much they should be contributing to their 401.

Participants might also consider a few basic investment principles, such as diversifying retirement investments to reduce risk and improve return. These investment choices may evolve overtime depending on someones age, goals, and financial situation.

The DOL recommends that employees contribute all they can to their employer-sponsored 401 plan to take advantage of benefits like lower taxes, company contributions, and tax deferrals.