Buying Or Distributing Solo 401k Owned Real Estate Question:

Excellent and popular questions. First, no you cannot buy property such as a condo from your own solo 401k plan as that would result in violation of the following prohibited transaction rule.

Sale, exchange, or leasing of property between a plan and a party in interest .

However, it would not be prohibited if you take an in-kind solo 401k distribution of the property since the rules allow for distributions in the form of an asset instead of cash. You can also spread the tax liability by taking partial in-kind distributions of the property. You will need to get the property appraised each time you process a partial distribution, however.

Practical Considerations On Brokerage Windows In 401k Plans

Plan committees need to ask questions, and get answers, before offering a brokerage window. Should the committee offer one at all? If it does, what is the process for selecting and monitoring the window and its provider? This column by Fred Reish looks at these and other questions about brokerage windows in participant-directed plans.

Plan sponsor, with self-directed brokerage accounts in their plans, may unknowingly expose themselves to liability. This article is about the hidden dangers of 401k plans in offering self-directed brokerage accounts to plan participants.

Labor Department Drops Brokerage Window Provisions

The DOL clarified that brokerage windows are not considered designated investment alternatives and that the regulation doesn’t prohibit the use of these brokerage accounts. The agency said that plan fiduciaries, however, still have a duty of prudence and loyalty to participants who use the brokerage window — including taking into account the nature and quality of services provided.

Field Assistance Bulletin No. 2012-02R clarifies that fiduciaries of plans covered by these rules that offer brokerage windows, self-directed brokerage accounts or similar arrangements are not required to treat these arrangements as designated investment alternatives.

Recommended Reading: How Do You Know If You Have An Old 401k

Which Is The Schwab Retirement Plan Self Directed Account

It gives participants more flexibility to select the individual investments in their plan. The Schwab Personal Choice Retirement Account ® is our self-directed account option, and its designed to fit seamlessly into any plan you offer, can be rolled out digitally, and is backed by a dedicated team of self-directed-account specialists.

How Do I Open A Bank Account

Banks are warming to the idea of self-directed defined benefit plans. In fact, we work with banks that can provide the following:

- Free bank account set-up

- Accounts can be set-up usually in 48 hours

- Free mobile check deposits

- complex structures including multiple nested LLCs and trust

- Free checks and debit cards

- Online banking with ACH and wire access

- Online application forms with minimal paperwork

- FDIC insured bank accounts

- Non-recourse loans on real estate

Recommended Reading: How Do I Apply For 401k

Transactions Between Related Parties

Don’t entangle your 401 plan with your family members. For this purpose, “family members” are your parents, grandparents, children, grandchildren, or spouse’s children or grandchildren.

This means you can’t lend your 401 money to any of these relatives, let them live in property owned by your 401 plan, invest that money in your relatives’ businesses, or otherwise cause your family members to benefit from your 401 investments.

Considerations For Offering Sdbas In Retirement Plans

A recent report from Charles Schwab might give retirement plan sponsors reason to think about offering their participants a self-directed brokerage account, particularly one that offers the participants the service of an adviser. For example, Schwab found that while only 20% of participants in a brokerage window worked with an adviser as of the second quarter, their average balance of $448,515 was nearly twice as much as the $234,673 held by non-advised participants.

Also Check: How Do You Take A Loan Out Of Your 401k

What Makes It Self Directed

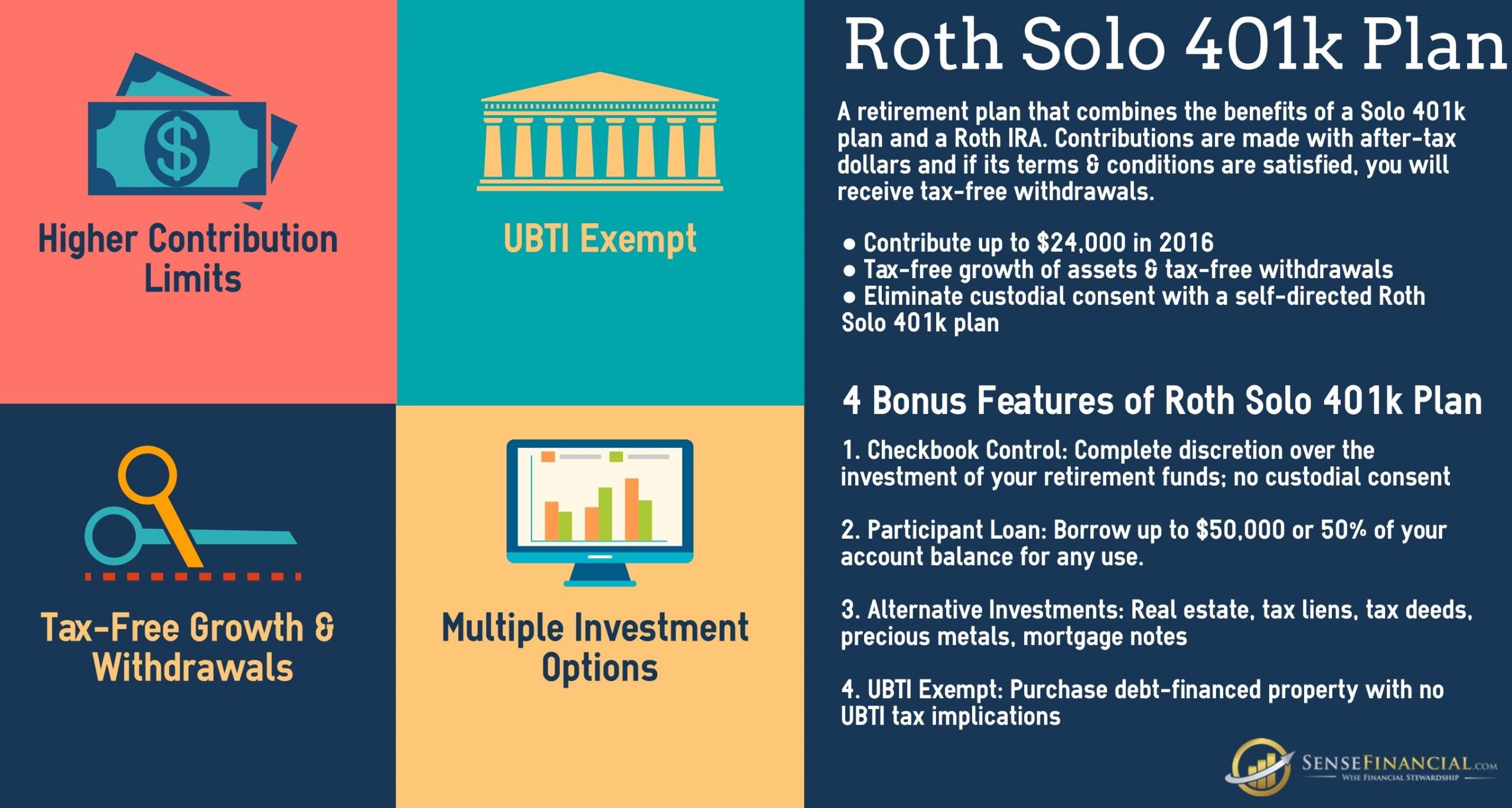

Knowing that your IRA or 401k can be invested in what you choose is an important benefit to most people. However, many people are not aware that they can choose to invest their IRA or 401k into assets other than stocks, bonds, and mutual funds. This is a common misunderstanding due to the marketing efforts of many of the large mutual fund companies and financial firms. These firms are not necessarily misleading investors that there are not other choices, but since these firms do not offer alternative investments such as tax liens, physical real estate, farmland, or private mortgages, there is no point of them educating the public of the additional options with their marketing dollars. The use of the term self-directed was most likely created as a marketing hook or gimmick to convince people that they should take control of their retirement account by self-directing it. Regardless of the origins of the term self-directed, many custodians and consumers currently use the term to describe a retirement account which is capable of investing in alternative investments, in contrast with one that does not. These alternative investments would be investments such as: physical real estate, tax liens, physical gold and silver, horses, livestock, farmland, medical equipment leasing, private mortgages, private businesses or franchises, and more.

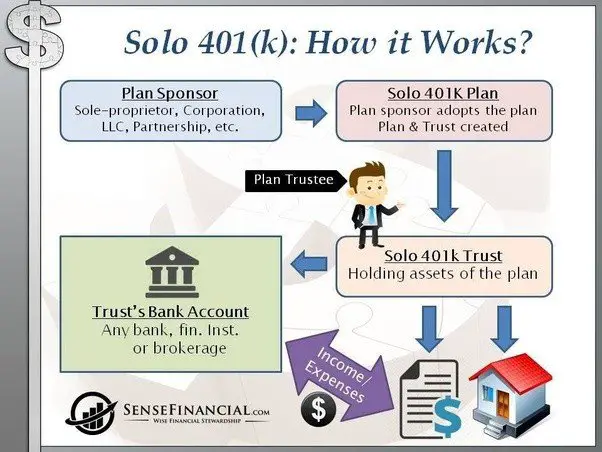

History Of The Solo 401k

After the Economic Growth and Tax Relief Reconciliation Act of 2001 taking effect in 2002, it became possible for a sole proprietary business to defer more money into a retirement plan cost-effectively than a profit-sharing plan. As such, Solo 401 became the most popular retirement plan for the self-employed.

Also Check: How 401k Works After Retirement

Who Qualifies For An Individual 401

- Businesses that are corporations, partnerships, LLCs, or sole proprietorships and who do not have any full-time employees other than partners or their spouse.

- To qualify for employer contributions, as an employee you must have received taxable earned income during the year.

- If the only employees of the business are under the age of 21 or do not work more than 1,000 hours/year , the business owner can still use this plan.

Do you have a side business?

If you have a side-business apart from your regular job, you can use an individual 401 even if you have a 401 through your employer. A solo-k sponsored by your side business can help you max out your overall 401 annual contributions if you and your employer are not contributing the full amount allowed to your employer-sponsored plan.

How Can You Remain Protected

A self-directed brokerage 401 account also allows the plan participant to seek a professional adviser. No longer restricted to generic index funds or one or two mutual fund families, a plan participant can hire a professional to lead them to the investments and returns that they are seeking. A professional adviser will already have the expertise to understand the operation of the tax and investment limitation rules applicable to retirement accounts. Studies by Vanguard show that when investors work with a professional adviser, it can add 3% or more to your portfolio value. And, 3% compounded over time can make a huge difference in the value of an account.

The adviser can tailor a plan to the participants precise needs and goals and guide them on contribution levels and other matters related to the account. Finally, the adviser can look at the plan assets as part of the participants overall financial planning. In the end, that adviser can help make the most of plan assets and contribute to a richer, more secure retirement for the participant.

A self-directed brokerage 401 account can offer plan participants exciting new opportunities to invest for retirement. The important thing to remember is to be prepared and understand your plan to avoid mistakes that could harm your long-term financial future. A professional adviser can help you achieve that goal.

Recommended Reading: How Much Can I Put In A 401k A Year

What Are My Investment Choices Now

Since 1980 when 401s first went into effect, 401s have generally been offered to employees with a limited palette of investment options. Most employers try to offer a variety of investment choices that are diversified, because they have to follow the rules and regulations under the Employee Retirement Income Security Act , but many plans come up short. The employee does not have input into these choices, so they can only make selections within the limited menu offered.

When The Time Comes Plan Your Withdrawals

Self-directed IRAs are subject to the same withdrawal rules as other IRAs: Youll owe taxes on any money that hasnt been taxed before, except for earnings in a Roth account. If you take a withdrawal before you are 59½, youll also owe a 10% IRS penalty. Self-directed traditional IRAs are subject to required minimum distribution rules, meaning youll have to start withdrawing money from your account once you turn 72.

Heres the big difference: Because they hold non-traditional assets, self-directed IRAs may be less liquid, making withdrawals more complicated. Youll generally need to reverse the process you embarked on when you purchased your assets and find a broker to sell them for you. Allocate plenty of extra time to make RMDs in particular. Even if you ask the custodian to deliver precious metals to you, youll still owe taxes on the withdrawal that must be paid in dollars, based on the value of the distribution.

Read Also: How To Check Your 401k Balance

Steady Growth For Self

Heading into the fourth quarter, there are both encouraging signs and cause for caution, as markets have been walking a fine line, according to the latest findings from Charles Schwab. In looking at the retirement plan participant investment activity within self-directed brokerage accounts, the report found that the average SDBA balance across all participant accounts finished the third quarter of 2020 at $302,256, a 9% increase year-over-year and a 6% increase from the second quarter.

How Do I Set Up A Self

If you have a self-directed 401 account, you can open up any kind of investment type available in the market.

You can do almost everything with your money, including buying and selling stocks, purchasing real estate, starting a company, and so on. This wide variety of investments is because the people who created these accounts didnât want them to have any limitations.

Setting up a self-directed 401 is a bit complicated, but if you follow the guidelines given by the IRS, you shouldnât have any problems.

The first thing you should do is visit their website and create an account so that everything goes smoothly from thereon.

You will also have to create an account with the bank where you want your money to be deposited, and this is also very easy to do.

Once everything is set up, you can start using your self-directed 401 and invest in whatever you want.

Also Check: How To Move 401k To Another Company

Who Can Benefit From A Self

Self-employed people, contractors, and owners of a sole proprietorship may find a self-directed 401 beneficial. Spouses can be members of the plan so that you dont need a custodian as you do with an Individual Retirement Account . You must meet specific criteria and follow certain rules to qualify to open a self-directed 401 plan.

-

To open a self-directed 401 plan for yourself as a business owner, you must be a sole proprietor with no employees other than your spouse. The partners in a partnership, along with their spouses, can also qualify if there are no other employees.

-

You must have taxable compensation as an individual during the current financial year.

-

The deadline for setting up a self-directed 401 plan, regardless of the companys corporate structure, is the last day of the tax year.

-

The self-directed 401 should be the only one maintained by the business unless otherwise dictated by law.

What Types Of Assets Can I Have In My Defined Benefit Plan

But first things first. This strategy only really works for owner-only businesses. This includes a spouse, but no qualifying employees. If the business has qualifying employees, the self directed plan is much more challenging to execute.

- Real estate. This is typically the most popular asset class. Valuation and securing non-recourse financing can often be difficult.

- Hard money loans and commercial notes. Acquiring non-performing mortgages or issuing hard money loans is another plan favorite. This can be risky because of note impairment. However, the interest income is generally not considered UBIT.

- Gold and precious metals. Precious metals in retirement accounts became very popular with self-directed IRAs. Many folks like these investments because they often run counter to the stock market and mutual funds. They can help diversify a retirement portfolio.

- Bitcoin and cryptocurrency. I dont recommend bitcoin in a defined benefit plan because of volatility. The goal is to get a consistent return that is in line with the interest crediting rate.

- Partnerships and private placements. These investments come with a Form K1 that is generated from the partnership tax return. The returns can be good, but can have UBIT issues. Discuss these with your plan administrator before you invest.

The investment options are almost endless. But there are a few pitfalls and complications to consider. These usually surround annual valuations, bonding requirements, and 5500 filings.

You May Like: How Do I Get My 401k Money From Walmart

Avoiding Taxes And Penalties On Self

The best way to avoid taxes and early 401k withdrawal penalties is to complete the rollover within sixty days. If you do this, you will not face any penalties or taxes. If you miss the deadline, you will owe a ten percent penalty as well as owe taxes on the amount that you withdrew. If you pay the taxes on a traditional to a Roth conversion from your 401k, you will need to pay the penalty on that money. Be sure to talk to a tax professional about this if you end up owing a penalty or taxes.

If you are ready to roll your self directed 401k into a self directed IRA, you can call 1-800-776-7253 to find a professional in your area to answer any questions about the process and to help you find the right options for you.

Transfer Retirement Funds To Solo 401

When you choose your solo 401 provider and you set up your IRS compliant Solo 401k plan, transfer your retirement funds from your current custodian to a financial institution or credit union that can serve as your custodian. There is no fee, and the transfer is also tax-free.

Make a tax-free direct rollover to your new Solo 401k plan bank account. You can contact the specialists at IRA Financial Group can assist you in completing this step in setting up your Solo 401. We will expedite the process in a tax-free manner.

Read Also: Is Fidelity A 401k Plan Administrator

Exchange Promissory Note Investment Question:

Such investment would result in a prohibited transaction. You cannot assign an investment that you personally own to your own solo 401k plan.

Sale, exchange, or leasing of property between a plan and a disqualified person.

- Your Spouse

- Your natural children and/or your adopted children

- The spouses of your natural children

- Any fiduciary of your Solo 401k

- Any people providing services to your Solo 401ksuch as your stockbrokeras well as his employees and both his and his employees blood relatives

- Your Solo 401k trust document provider or administrator

Your Fund Lineup Has Above

Workplace retirement plans require fee disclosures to be sent to participants, and understanding your associated costs is important. The general trend in the retirement plan industry is leaning toward lower costs. But lower-cost options might be available in a self-directed brokerage account if the fees in your retirement plan at work are too expensive.

Also Check: How To Split A 401k In Divorce

Benefits Drawbacks And Options Of A Self

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Self-directed 401 accounts arent as common as managed or target-date 401 plans, but they can be of real value for DIY-minded investors.

These 401 planswhich may be employer-sponsored or available as a solo 401 for self-employed individualsexpand account holders investment choices, giving them more control over their own retirement plans. Instead of being limited to a packaged fund, an investor can choose specific stocks, bonds, mutual funds and sometimes even alternative investments, in which to invest their retirement money.

What Are The Disadvantages Of A Self

Self-directed 401 plans have a few disadvantages.

-

These plans are expensive for employers to set up and monitor. The administrative costs of managing loans, early withdrawals, and other transactions require a great deal of costly oversight.

-

Since the employer chooses your investment options, you may not get a wide variety of choices, and you may be dissatisfied with the quality. If you dont have a range of index funds available, long-term management can be challenging.

-

The employer also sets the eligibility rules, so those who are part-time, new, or union members may be excluded, for example.

-

If you make a withdrawal from the plan before you are age 59 1/2, you may incur a 10% penalty, unless you retire in the calendar year you turn 55.

You May Like: Where To Find My 401k

How Do I Open A Sdba

Enjoy trading and researching investments online? A SDBA might be a good option for you.

First, you have to be eligible. You need at least $4000 in the core funds or target date retirement funds and have to deposit at least $3,000 into the new SDBA account.

Top open the account, you have to complete a TD Ameritrade SDBA application. The application may be downloaded from the Savings Plan Web Tool or you can call the Savings Plan Information Line to get an SDBA application mailed to you.

To get to the Savings Plan Web Tool, visit LM People at https://www.lmpeople.com. Youll need to determine on the application what type of account you want to open, then fax the application back to the number on the form. Your account should be open in a few business days.