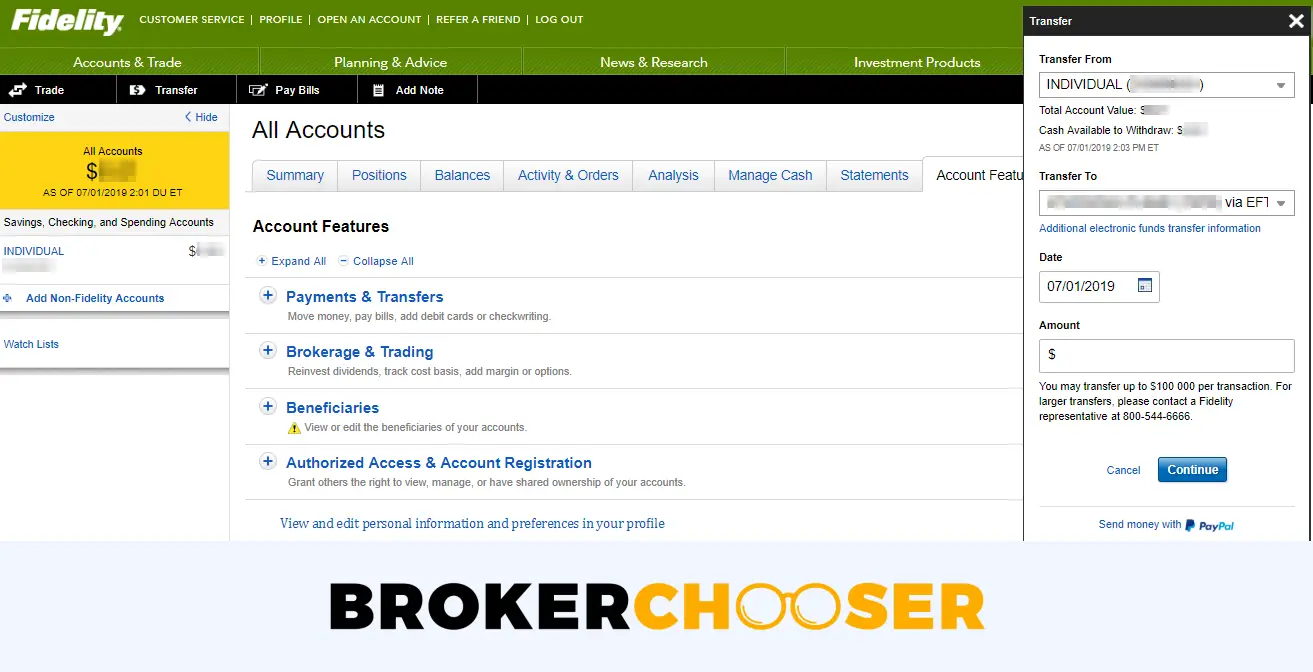

Start Your Transfer Online

Youll get useful tips along the way, but you can call us if you have a question.

Youll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so well ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if youre already a Vanguard client, confirm the information that weve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

How To Close A Deceased Loved Ones Fidelity Account

People have become more aware of their potential digital afterlife. As a result, many are leaving specific instructions for their next of kin. They might leave a comprehensive list of their accounts and access to a password manager. Even if you dont have that luxury, Fidelity makes the account closing process relatively straightforward.

You May Like: Should I Open A 401k

Know Where Youd Like Your Funds To Go

Many reasons may cause you to close a Fidelity account. Maybe you need to liquidate some funds for a purchase. Perhaps youre changing your investment strategy. Or perhaps youve switched jobs and your new 401 is with a different provider. Your reasons for closing your account will determine whether they transfer your funds to another financial services company or release them to you.

What Happens To My 401k If I Quit My Job

If you leave a job, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. If you decide to roll over your money to an IRA, you can use any financial institution you choose you are not required to keep the money with the company that was holding your 401.

Recommended Reading: How Do I Use My 401k To Start A Business

More From Portfolio Perspective

To give your retirement savings an extra boost, Jessica Macdonald, a vice president at Fidelity, recommends opting into an auto-escalation feature, if your employer offers it, which will automatically boost your savings rate by 1% or 2% each year.

And always contribute enough to get the full employer match, she said, “that way you won’t leave money on the table.”

Overall, aim to save 15% of your income in a retirement account, including the employer contribution, Macdonald also advised.

If you are over age 50, you set aside even more withcatch-up contributions. plans and $6,000 for IRAs in 2021 those who qualify can put an extra $6,500 in their 401 or $1,000 in their IRA.)

Finally, avoiding borrowing from these accounts at all costs. “Try to stash a little bit of money away in a rainy-day fund so you can dip into that instead,” Macdonald said.

Q: What Do I Need To Apply For A Business Loan

This is a list of the general information that may be needed to apply for a business loan at Fidelity Bank: Name of the business, Tax identification number, Legal structure , Validation of business existence , State of formation, Nature of business , Financial documentation , Mailing and physical address , Contact phone number, Purpose of account , Expected level of cash activity . Certain accounts may require additional information.

Recommended Reading: How Soon Can I Get My 401k After I Quit

Why Did Gethuman Write How Do I Find My Fidelity Investments Account And Routing Numbers

After thousands of Fidelity Investments customers came to GetHuman in search of an answer to this problem , we decided it was time to publish instructions. So we put together How Do I Find My Fidelity Investments Account and Routing Numbers? to try to help. It takes time to get through these steps according to other users, including time spent working through each step and contacting Fidelity Investments if necessary. Best of luck and please let us know if you successfully resolve your issue with guidance from this page.

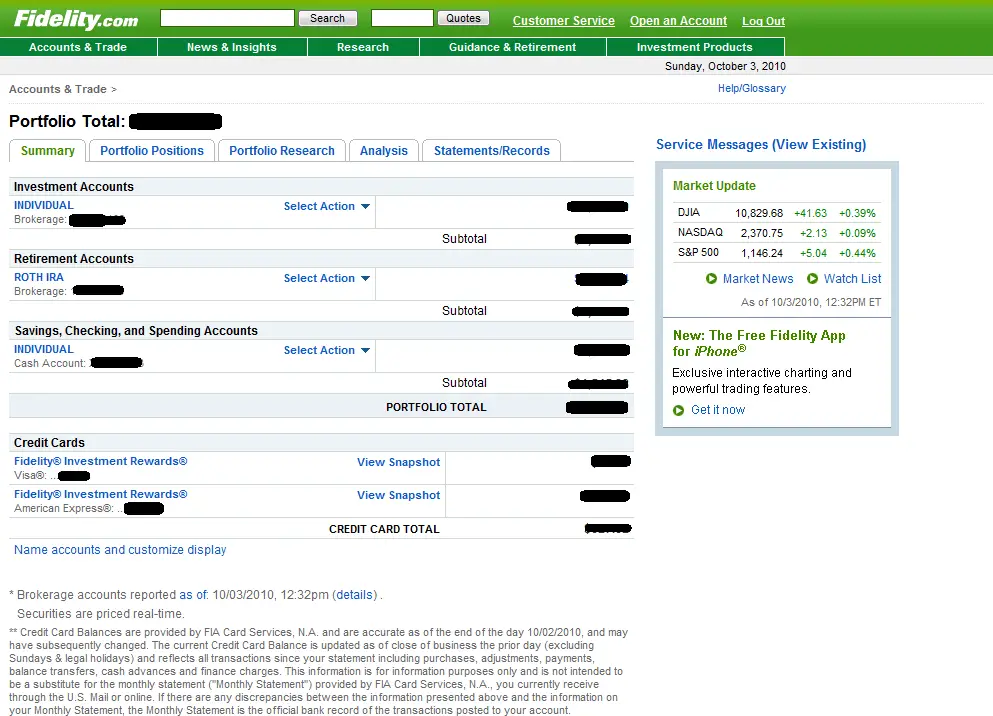

Q: How Do I Print My Statements

To print statements, log in to your Online Banking account. Click on the desired account. Click on the documents button, make sure Online Statements is selected in the Document Type dropdown box, select your date range, and click submit. A list of available documents will appear, click on the link to the statement youd like to print. The statement will open in a new window and you can print your document.

You May Like: How To Avoid Penalty On 401k Withdrawal

How To Check Fidelity Bank Account Number Via Mobile App

If you have internet banking ID, all you need is to download the fidelity mobile app and login with your banking ID. Your account number and balance will be displayed at the app homepage. If you havent gotten your internet banking ID, Read our guide Fidelity Bank Internet banking. Follow the process and get your banking ID.

Q: Why Would I Use Remote Deposit Instead Of Mobile Deposit

Remote Deposit Service is an ideal solution if your business often deposits checks, or deposits multiple checks at a time. Remote Deposit Service allows you to quickly scan and deposit multiple checks. The service conveniently batches all your items together into one deposit account and extends your deposit window to 7 p.m. for same day credit.

Recommended Reading: How To Avoid Taxes On 401k

How Do I Open A Fidelity Account

FESA FAQs: Download Here.

How Long Will My Transfer Take

This depends on the type of transfer you are requesting:

Total brokerage account transfer: Most total account transfers are sent via Automated Customer Account Transfer Service and take approximately five to eight business days upon initiation. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Transfers coming from some smaller firms, which are not members of the National Securities Clearing Corporation , which is responsible for regulating and governing the ACATS system, are processed as non-ACATS transfers. Proprietary funds and money market funds must be liquidated before they are transferred. Please complete the online External Account Transfer Form The transfer will take approximately 5-8 business days upon initiation.

Partial brokerage account transfer: List the specific number of shares for each asset to be transferred when you complete the Transfer Form. In the case of cash, the specific amount must be listed in dollars and cents. This type of transfer is processed as a non-ACATS transfer. Please complete the online External Account Transfer Form.- The transfer will take approximately 3 to 4 weeks from the date your completed paperwork has been received.

Internal TD Ameritrade transfer: Transferring assets between two TD Ameritrade accounts requires an Internal Account Transfer Form. .

Dont Miss: How To Rollover 401k From Empower To Fidelity

Read Also: How To Cash Out 401k After Leaving Job

You Are Viewing This Page As An Investor

Advisors, switch views to see more relevant content.

TFSA basics

Regardless of what youre saving for, a TFSA is a great way to reach any financial goal.

RRSPs 101

You can reduce tax on your current income when you save for the future. Here are six RRSP tips.

For you and your goals

Over 1.5 million

To business leaders around the world

Over 25,000

* Source: More on the Value of Financial Advisors, by Claude Montmarquette and Alexandre PrudHomme, CIRANO, 2020. The average household with a financial advisor for 15 years or more had asset values 2.3x higher than an average comparable household without a financial advisor.

Commissions, fees and expenses may be associated with investment funds. Read a funds prospectus or offering memorandum and speak to an advisor before investing. Funds are not guaranteed, their values change frequently and investors may experience a gain or loss. Past performance may not be repeated.

Read our privacy policy. By using or logging in to this website, you consent to the use of cookies as described in our privacy policy.

This site is for persons in Canada only. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only qualified for sale in the provinces and territories of Canada.

88747-v202076

Recommended Reading: How To Recover 401k From Old Job

What Is The Account Number And Routing Number

While the routing number identifies the name of the financial institution, the account numberusually between eight and 12 digitsidentifies your individual account. If you hold two accounts at the same bank, the routing numbers will, in most cases, be the same, but your account numbers will be different.

You May Like: Is It A Good Idea To Borrow From Your 401k

Fidelity Routing Number United States

Fidelity Routing Number is used for wire transfer transactions in your bank. Fidelity is not the usual brick-and-mortar bank. It focuses on brokerage accounts while functioning as a checking account too. Fidelity even has FDIC insurance for deposits, and it also offers interests with consumer-friendly policies. To boot, it yet has basic savings accounts. If you want a free cash account with little interest, this Fidelity will work for you. You can also get the routing numbers of similar banks in our complete Routing Numbers List.

Meanwhile, you can also wire money with Fidelity. Before you can do this, you need to have Fidelity direct deposit or direct debit routing numbers. Ensure that your Fidelity account is a checking account in the case of Automated Clearing House .

You May Like: Can Business Owners Have A 401k

Q: How Do I Add Or Change Payees In Bill Payment

To make changes, first log in to your Online Banking account and click on Bill Payment. To add a new company or person, click on the Add Company or Person button and follow the on-screen instructions. To make changes or delete existing payees, click on the payee name in the list on your Payment Center. A box will appear that will allow you to make changes or delete. Once your changes are complete click Save Changes.

You May Like: Should I Roll My 401k Into An Ira

Q: How Do I Log In To Mobile Banking

First you need to download our convenient mobile banking app. Visit the App Store or Google Play and search for Fidelity Bank NC/VA or Fidelity Bank NC/VA Business to download the app. Once the app is downloaded, enter your log in information to start using mobile banking.

Dont have the mobile banking app? Download it for free here:

App Store

Where Can I Find My Fidelity 401k Fees

Whether due to my own ineptitude, or through deliberate camouflaging on Fidelitys part, I could not for the life of me figure out what these additional fees were. The info that I sought is information that your 401 provider must supply youyet I could not locate and account for these mysterious fees. A few days after giving up on Fidelitys website, I happened to receive an email with Fidelitys annual prospectus disclosure and viola, a CTRL F later and I finally uncovered the fees that were eating up nearly one percent of my account on an annual basis. You can find this required disclosure information under the Plan Information and Documents tab on your account.

Assuming Im not the only one who sucks at navigating an unfamiliar financial services website, I wanted to spell out those fees in somewhat plain English. For those who dont have a 401k plan through Fidelity, this information should still prove somewhat valuable, as it allows you to compare the fees in your own plan to another provider. I had a next-to-impossible time finding my own 401k providers fees, never mind search for those of competing plans.

Now, lets take a look at the Fidelity 401k fees that Im paying.

Also Check: How To Transfer 401k Accounts

You May Like: When Can I Draw From My 401k Without Penalty

Q: Are There Daily Cutoff Times For Making Deposits

Deposits made Monday through Thursday before 5:00 p.m. and Friday before 6:00 p.m. Eastern Time will be available the same business day. Mobile deposits made before 5:00 p.m. Eastern will be available the same day. Deposits are subject to verification and any applicable holds. Weekends and holidays do not apply.

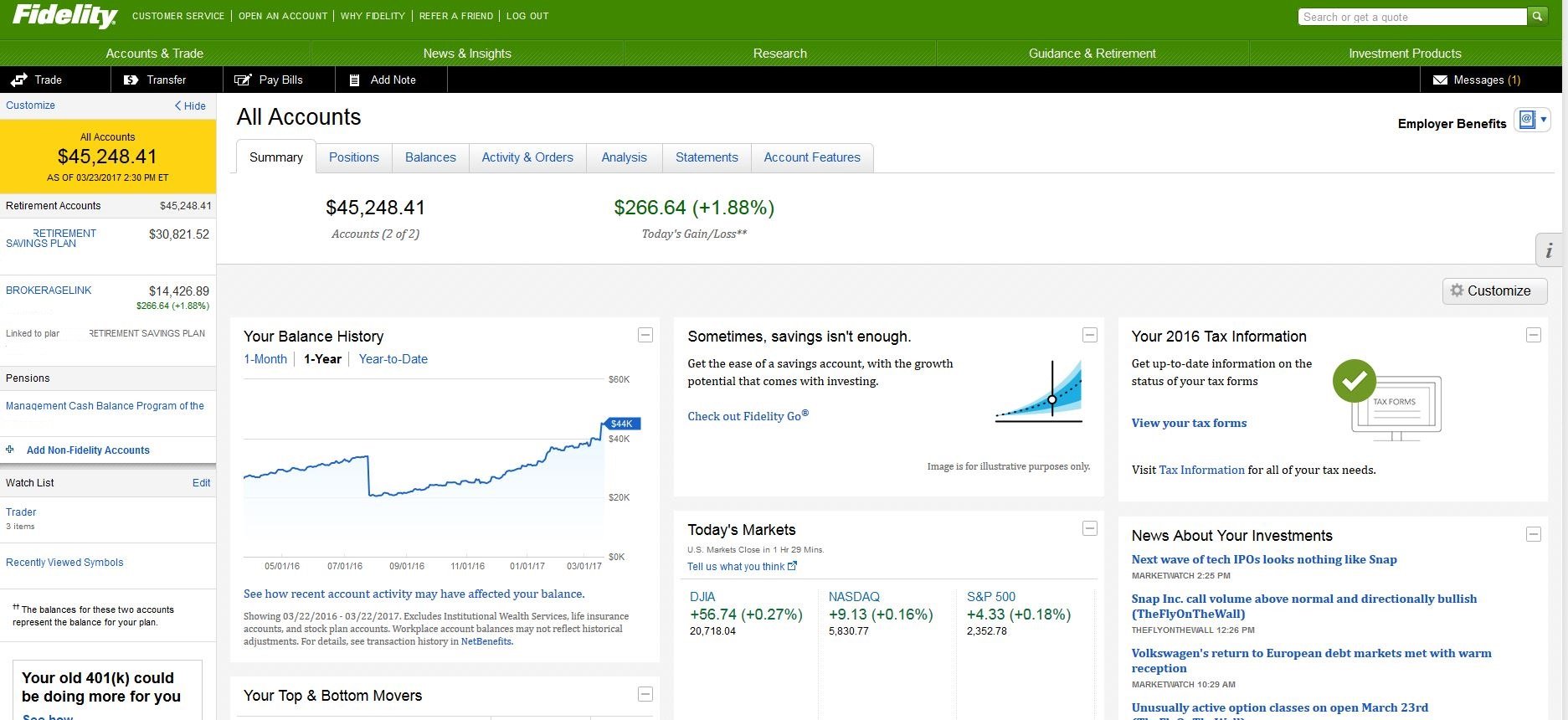

Balances Hit A New All

- Retirement account balances are at new highs, according to Fidelity Investments.

- Thanks to the markets recent run-up and increased savings, the number of 401 and IRA millionaires also hit all-time records in the second quarter of 2021.

Although many Americans continue to face financial uncertainty due to the pandemic, the outlook for retirement savers is only improving.

Retirement account balances, which took a sharp nosedive in 2020 when the coronavirus outbreak caused economic shock waves, are now at new highs, according to the latest data from Fidelity Investments, the nationâs largest provider of 401 savings plans.

The overall average 401 balance hit $129,300 as of June 30, up 24% from the same time last year, according to Fidelity.

Individual retirement account balances were also higher reaching $134,900, on average, in the second quarter, up 21% from a year ago.

Despite Covid case numbers rising in the U.S. and around the world, the yearâs market highs have been a boon for savers. In the second quarter, the S& P 500 ended up 8.2%, before retreating more recently.

Nearly 12% of workers increased their contributions during this time, while a record 37% of employers also automatically enrolled new workers in their 401 plans.

As a result, the number of 401 and IRA millionaires hit fresh highs, as well.

Together, the total number of retirement millionaires has nearly doubled from one year ago.

Read Also: How Do I Invest In My 401k

Recommended Reading: Which 401k Investment Option Is Best

Fidelity Solo 401k Brokerage Account From My Solo 401k Financial

A Fidelity Investments Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, notes, tax liens, and private shares in addition to processing a solo 401k participant loan.

Dont Let Your Fidelity 401 Fees Get Out Of Hand

Even if yours are below average now, Fidelitys revenue sharing can cause them to very quickly become excessive as assets grow. For this reason, its crucial that you compare your plans fees on a regular basis.

Too much trouble? Weve got a solution.

Simply switch to a 401 provider that charges fees based on headcount not assets – to the extent possible. Such a fee structure will make it easier for you to keep your 401 fees in check as your plan grows. You just might save some money while youre at it.

About Eric Droblyen

Eric Droblyen began his career as an ERISA compliance specialist with Charles Schwab in the mid-1990s. His keen grasp on 401k plan administration and compliance matters has made Eric a sought after speaker. He has delivered presentations at a number of events, including the American Society of Pension Professionals and Actuaries Annual Conference. As President and CEO of Employee Fiduciary, Eric is responsible for all aspects of the companys operations and service delivery.

- Connect with Eric Droblyen

Also Check: How To See How Much Is In My 401k

How To Check Fidelity Bank Account Number Using Ussd Code

You can use the USSD code to check your account number, all you have to do is simply dial *770*0#. Although this is the code for knowing what your Fidelity balance is. However, when you dial this code, you will receive a message displaying both your balance and your account number.

Ensure that you dial this code from the line you have linked to your Fidelity Bank account.

Likewise, you must activate/registered for the Fidelity transfer code popularly called Instant Banking. To do that, you can check this article on How to register for the Fidelity instant banking.

How Do I Complete The Account Transfer Form

Open your new account online and follow the step-by-step tutorial.- To transfer to an existing TD Ameritrade account, print the Account Transfer Form and follow the instructions below:

Guidelines and What to Expect When TransferringBe sure to read through all this information before you begin completing the form. Contact us if you have any questions.

Information about your TD Ameritrade Account Write the name/title of the account as it appears on your TD Ameritrade account. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank.- You must complete the Social Security Number or Tax ID Number section because your transfer cannot be processed without this information.

Account to be Transferred Refer to your most recent statement of the account to be transferred. Be sure to provide us with all the requested information.

Transfer Instructions

You May Like: How Does Taking Money Out Of 401k Work

Don’t Miss: How To See How Much 401k You Have