Look For Contact Information

If you don’t know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

A National Database To Find Forgotten 401s And Pensions Could Be On The Way But Savers Should Take Action Now To Locate Any Missing Retirement Accounts

At a time when many Americans are worried that they wont have enough money to retire comfortably, thousands have lost track of billions of dollars in savings.

There are more than 24 million forgotten 401 accounts containing some $1.35 trillion in assets, according to a report from Capitalize, which helps workers roll over their retirement plans when they change jobs. Companies are also holding on to billions in unpaid pension payments earned by former employees.

The problem is so widespread that Congress is considering legislation to address it. SECURE Act 2.0, which includes a wide range of benefits and protections for retirement savers , would create a national online lost-and-found database to help people track down these orphaned plans.

Brian Stivers, owner of Stivers Financial Services, in Knoxville, Tenn., says he typically meets one to two new clients a month who are in this situation. Most of the time, theyve changed jobs and forgotten about an old plan, usually because it had a small balance. Retirement plans are also misplaced when one spouse dies and the survivor is unaware of accounts with his or her former employers.

You Found Your 401 Plan Now What

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money with the purpose of building a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

Rolling over your 401 into an IRA is a relatively simple process. First, you need to open an IRA, which you can do though most banks, brokerage firms and robo-advisors. The funds from your old 401 then can be sent directly to your new IRA. If you prefer to keep all your investments in one place and your current employer offers a decent 401, then you may want to consider rolling over the funds into that account .

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Read Also: Can You Use 401k To Buy Investment Property

How Does A Plan Sponsor Handle A Residual Balance After An Initial Distribution Is Processed

From time to time, a former participant may receive a full distribution only to have a residual amount hit his or her account. This may be due to the participant being eligible for an employer contribution that is not deposited until after the close of the year. Sometimes, the residual amount is due to investment earnings that are not posted to the account until after the distribution is taken. Regardless of the source, any trailing amounts must be handled.

As long as the paperwork for the original distribution was signed or the small balance forced out within 180 days, the residual can be processed using the same instructions. For example, if the participants original paperwork requested a rollover to his/her IRA at a certain financial institution and that paperwork was signed within 180 days, the residual distribution can be rolled to that same IRA at the same financial institution without the need for additional paperwork.

If more than 180 days have passed, the residual account balance is handled as if no previous distribution has occurred. In other words, residuals below the cash-out threshold are processed the same as any other small balance, requiring notification before forcing out the amount in question. If the residual exceeds the cash-out limit, the participant has the option to keep the money in the plan.

National Registry Of Unclaimed Retirement Benefits

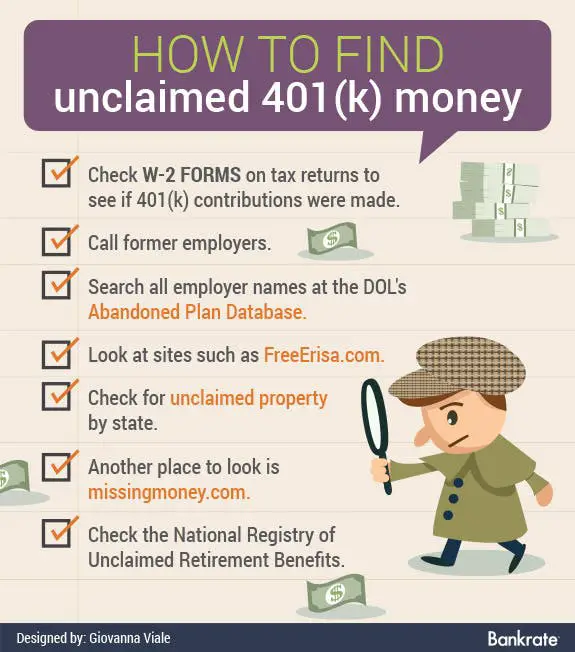

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

You May Like: How To Roll 401k Into New Job

Where Has My 401 Gone

There are a few scenarios in which someone might lose track of their 401.

If you did a bit of job-hopping early in your career, you may have moved on and forgotten about your 401 plan. Or perhaps your company merged with another, but your 401 plan didnt transfer over. In other cases, you may have automatically enrolled in your companys 401 plan without realizing it.

You know all the paperwork from human resources you ignored? The information youre looking for probably was in there.

Regardless of why you lost track of a 401 plan, the good news is that whatever contributions you made no matter how long ago that may have been are yours to keep and always will be. Heres what you need to know to track down your old 401 and make it work in your favor again.

How Can I Find My Old 401k Account

The good news is that its relatively painless to locate lost funds in unclaimed 401k accounts. Online resources such as missingmoney.com and unclaimed.org allow you to search for assets in any states in which youve lived or worked. And if you do find money from an old 401k thats owed to you, its often as easy as filling out a simple online form to get it back.

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new 401s, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

Recommended Reading: How Much Income Will Your 401k Provide

What To Do Next

If your searches uncover an old 401 account in your name, your best bet is to roll the money in that account over to your current retirement savings account, be it another 401 or an IRA. Keeping all your retirement savings in one place helps you to keep track of how your investments are doing and whether or not you’re saving enough to meet your retirement goals.

Related links:

What Causes A 401k To Be Lost Or Unclaimed

Lost 401 Plans at Companies No Longer in Business A common scenario for failure to claim 401k assets arises when former employees of closed or bankrupt companies are unable to locate their accounts, because their employers failed to provide for the administration of 401k plan assets when they ceased operations.

Also Check: Can I Borrow Money From My Fidelity 401k

What Happens When A 401 Plan Is Terminated

According to the U.S. Labor Department, 1,650 401 plans are abandoned each year. Was your old 401 plan one of them?

Companies terminate 401 plans for a variety of reasons. When they do they are required to transfer all accounts to the plans participants. When they cant locate a participant, the firm can then send the money to an IRA, a bank, or even a states unclaimed property fund. While they must attempt to contact you, I wouldnt rely on this to mean you will actually receive information about the retirement plan closing.

If you think your old account may have been turned over to the state, search the unclaimed database in the state you lived in when you worked for the specific employer. You should also search in the state where the plans administrator was located if you worked for a larger or national corporation.

Starting this year, the PBGC will start accepting transfers of missing participant accounts from terminating 401 plans. When a participant is hopefully found they will be paid that money plus interest. Dont expect the interest paid to even come close to keeping up with the average stock market returns.

The search for old retirement assets can be about as much fun as getting a root canal. The only bright side is that you could end up with more money. Almost everyone would most likely welcome a little help reaching their retirement savings goals and finding old, forgotten about retirement accounts might help get them to get closer to their goals faster.

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Read Also: How Do I Find 401k From Previous Jobs

What Happens To My 401 If I Quit My Job

You have several choices. You can leave your 401 with your former employer or roll it into a new employers plan. You can also roll over your 401 into an individual retirement account . Another option is to cash out your 401, but that may result in an early withdrawal penalty, plus youll have to pay taxes on the full amount.

How To Track Down That Lost 401 Or Pension

Tweet This

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

Don’t Miss: Why Cant I Take Money Out Of My 401k

How To Find An Old Retirement Account

The good news is, its never too late to find old 401 plans. They still belong to you, no matter the circumstances surrounding the end of your employment. But the first step is to track it down. You can first try looking through your paperwork or searching your email account, but if that doesnt work out, there are resources you can use.Search the National Registry

The easiest way to search for any outstanding retirement plans is through the National Registry of Unclaimed Retirement Benefits. This is a free searchable database of retirement funds that have been reported as unclaimed. Retirees and estate managers can search the databases, as can third parties who have the required information.

The National Registry of Unclaimed Retirement Benefits 401 and pension search can be conducted using only your Social Security number. Its important to note that the site is set up for individuals wanting to find a 401 with a Social Security number, but anyone with that number can search for funds.

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

Don’t Miss: What’s A Good Percentage For 401k

How To Find Lost 401 Account Funds

If you suspect youve lost track of some old 401 funds, or if your old company has gone out of business, you may still be able to find that money.

If Congress passes the legislation, the proposed SECURE Act 2.0 intends to create a national, online lost and found for orphaned retirement plans. In the meantime, your best option is to work through the options below.

Why Plan Sponsors Should Be Concerned About Missing Participants

- For plan sponsors, missing participants can cause administrative burdens, increased plan costs and fiduciary risk.

- Missing participants are viewed as a more-critical problem when they are at or near a distributable event . When a distribution occurs or is due, the Internal Revenue Service is keen to collect on deferred taxes, and the Department of Labor has a natural interest in ensuring that participants receive the benefits owed to them.

- For plan sponsors, missing participants can lead to plan audits, where the plans policies and procedures for locating missing participants can be scrutinized.

- In the present environment, plan sponsors particularly sponsors of active plans complain that they operate with insufficient guidance in locating missing participants, and are sometimes subject to inconsistent enforcement actions.

- For participants, not have a correct mailing address may result in a range of sub-optimal outcomes, including not being aware of major plan changes , missed transactions or even forgetting about the account completely.

Recommended Reading: How Many Days To Rollover 401k

The Takeaway On Finding Lost 401 Money

If you suspect that you’ve left a 401 behind somewhere and don’t attempt to locate it, you’re risking losing the plan — and the money — for good.

But if you don’t respond, a company holding an old 401 account has no obligation to pursue the issue further, and eventually will relinquish your old account to the state, and all of the funds held, as well.

Don’t let that happen to you. Use the tips listed above to make every effort to find your lost 401 account and get the money back for yourself, and don’t let “free” retirement slip out of your control.

What Are The Implications And Risks Of A Lost Participant

When an employee is terminated from your company but remains a participant of your retirement plan, youre still required by law to send plan notifications to these participants. However, if youre unable to locate them, doing this can be very difficult which is problematic, as you can be subject to Department of Labor penalties for failing to comply with reporting and disclosure requirements.

There is also a cost to maintaining the accounts of lost participants. If your plan allows you to cash out participants below a certain balance, doing so would be prudent to lower your costs. Of course, doing this is incredibly difficult if you cant locate the participant.

You May Like: How Can I Find My 401k

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.