A National Database To Find Forgotten 401s And Pensions Could Be On The Way But Savers Should Take Action Now To Locate Any Missing Retirement Accounts

At a time when many Americans are worried that they wont have enough money to retire comfortably, thousands have lost track of billions of dollars in savings.

There are more than 24 million forgotten 401 accounts containing some $1.35 trillion in assets, according to a report from Capitalize, which helps workers roll over their retirement plans when they change jobs. Companies are also holding on to billions in unpaid pension payments earned by former employees.

The problem is so widespread that Congress is considering legislation to address it. SECURE Act 2.0, which includes a wide range of benefits and protections for retirement savers , would create a national online lost-and-found database to help people track down these orphaned plans.

Brian Stivers, owner of Stivers Financial Services, in Knoxville, Tenn., says he typically meets one to two new clients a month who are in this situation. Most of the time, theyve changed jobs and forgotten about an old plan, usually because it had a small balance. Retirement plans are also misplaced when one spouse dies and the survivor is unaware of accounts with his or her former employers.

Rollovers From Your 401 Plan

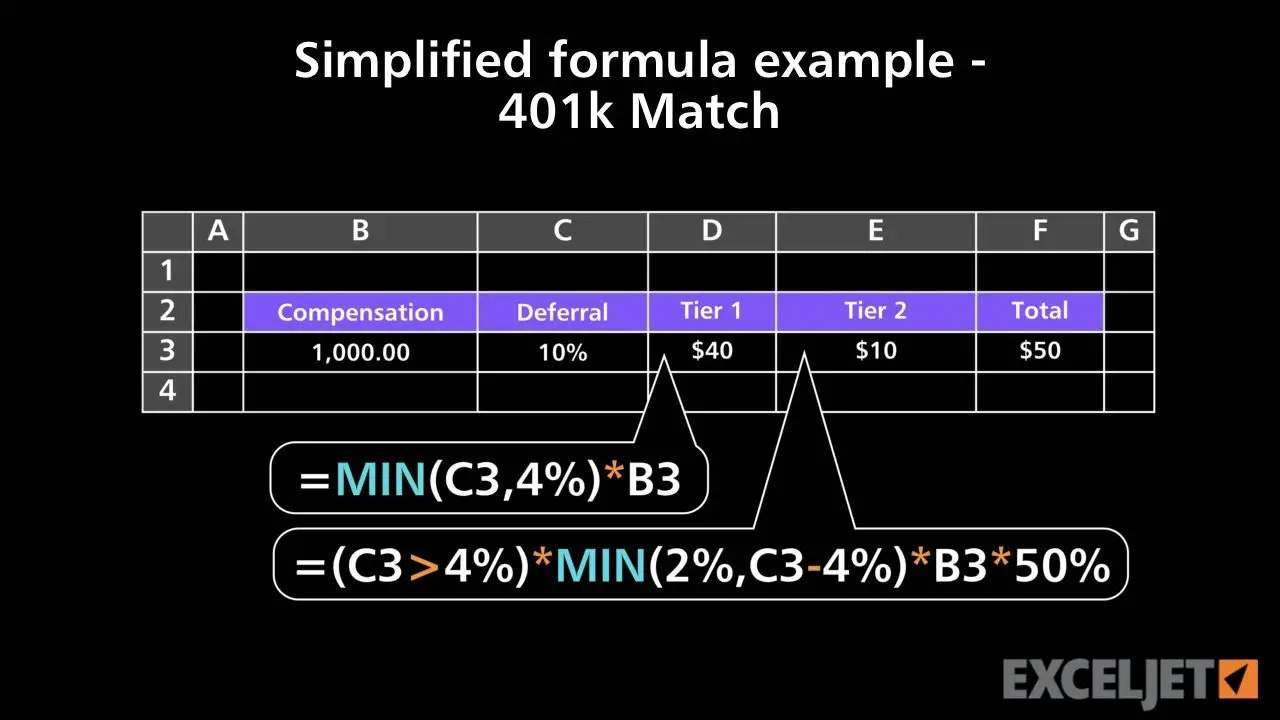

A rollover occurs when you receive a distribution of cash or other assets from one qualified retirement plan and contribute all or part of the distribution within 60 days to another qualified retirement plan or traditional IRA. This transaction is not taxable however, it is reportable on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. PDF and your federal tax return. You can roll over most distributions except:

- A distribution that is one of a series of payments based on life expectancy or paid over a period of ten years or more,

- A required minimum distribution,

- A hardship distribution, or

- Dividends on employer securities.

Any taxable amount that is not rolled over must be included in income in the year you receive it. If the distribution is paid to you, you have 60 days from the date you receive it to roll it over. Any taxable distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll the distribution over later. If the distribution is rolled over, and you want to defer tax on the entire taxable portion, you will have to add funds from other sources equal to the amount withheld. You can choose to have your 401 plan transfer a distribution directly to another eligible plan or to an IRA. Under this option, no taxes are withheld.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

Also Check: Can I Transfer From 401k To Roth Ira

Check With The Department Of Labor

The U.S. Department of Labor operates the Employee Benefits Security Administration. Its a federal organization that can help you find lost 401 or pension benefits.

You can search for your old employers Form 5500 here. Certain retirement plan administrators are required to file that form, which gives details on companies defined benefit plans.

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

You May Like: What Should I Do With My 401k After Retirement

Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above. In 2022, the limit is $20,500 per year for workers under age 50 and $26,500 for those aged 50 and above.If the employee also benefits from matching contributions from their employer, the combined contribution from both the employee and the employer is capped at the lesser of $58,000 in 2021 or 100% of the employees compensation for the year .

Also Check: How Much Can You Put Into A 401k Per Year

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

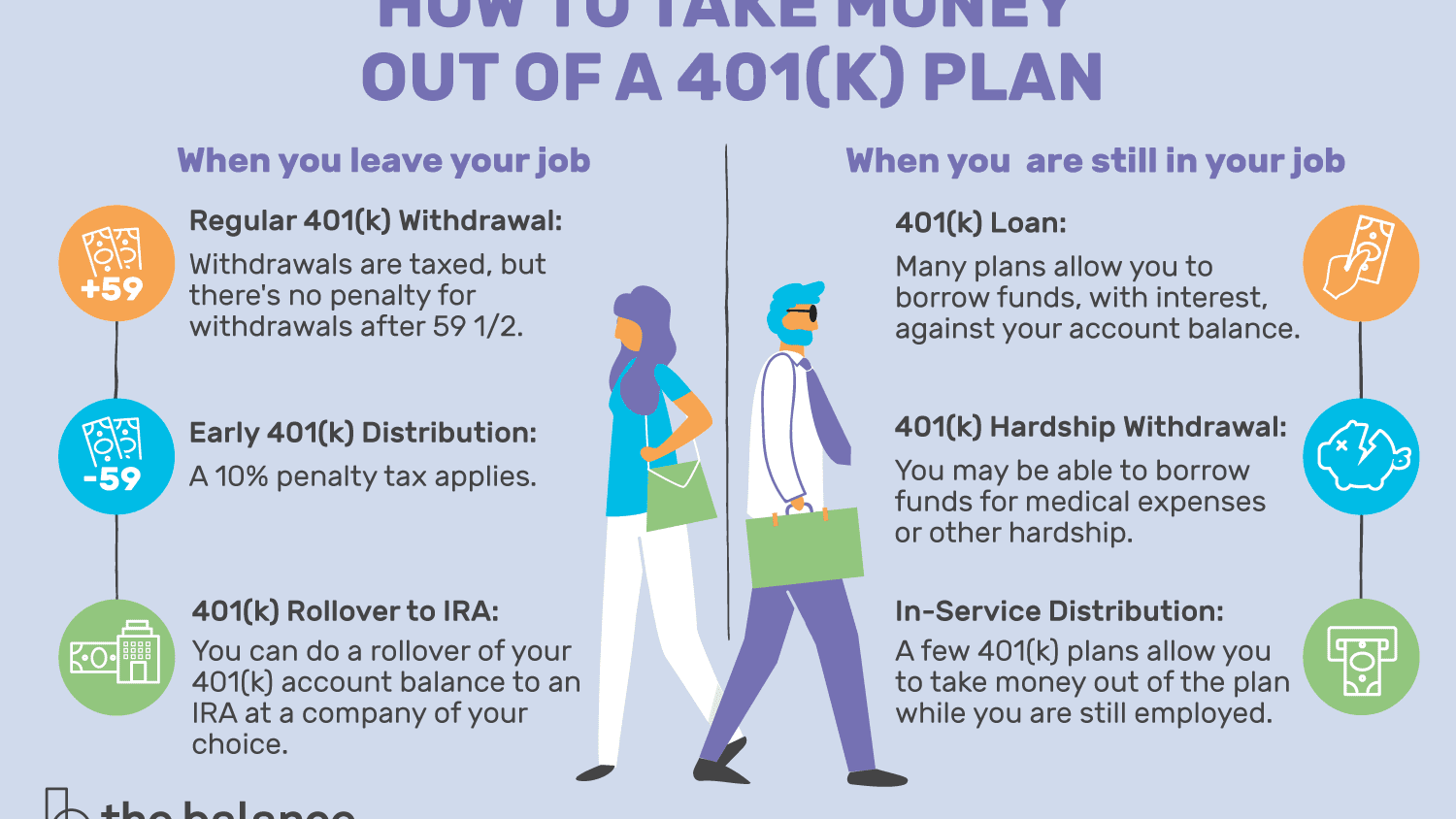

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Also Check: What Is A Safe Harbor 401k Plan

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Recommended Reading: Can You Rollover A 401k Into A Traditional Ira

National Registry Of Unclaimed Retirement Benefits

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

Recommended Reading: Can I Buy Individual Stocks In My 401k

What Is The Retirement Savings Contribution Credit

The U.S. has a special tax credit designed to help lower-income Americans save for retirement. Itâs called the Retirement Savings Contribution Credit or âSaverâs Credit.â For those who earn less than $33,000 annually , you may qualify for a tax credit of 10%, 20%, or 50% of your retirement contributions. This tax credit applies both to pre-tax contributions, like those made to a 401 plan, as well as post-tax contributions, like those made to a Roth IRA.

Recommended Reading: Can You Use Money From 401k To Buy A House

Roll It Over Into An Ira

If youre not moving to a new employer, or if your new employer doesnt offer a retirement plan, you still have a good option. You can roll your old 401 into an IRA. Youll be opening the account on your own, through the financial institution of your choice. The possibilities are pretty much limitless. That is, youre no longer restricted to the options made available by an employer.

The biggest advantage of rolling a 401 into an IRA is the freedom to invest how you want, where you want, and in what you want, says John J. Riley, AIF, founder, and chief investment strategist for Cornerstone Investment Services LLC in Providence, R.I. There are few limits on an IRA rollover.

One item you might want to consider is that in some states, such as California, if you are in the middle of a lawsuit or think there is the potential for a future claim against you, you may want to leave your money in a 401 instead of rolling it into an IRA, says financial advisor Jarrett B. Topel, CFP for Topel & DiStasi Wealth Management LLC in Berkeley, Calif. There is more creditor protection in California with 401s than there is with IRAs. In other words, it is harder for creditors/plaintiffs to get at the money in your 401 than it is to get at the money in your IRA.

If you have an outstanding loan from your 401 and leave your job, youll have to repay it within a specified time period. If you dont, the amount will be treated as a distribution for tax purposes.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dont Miss: How Do I Get A 401k Plan

Recommended Reading: When Should You Rollover Your 401k

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search theDOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.