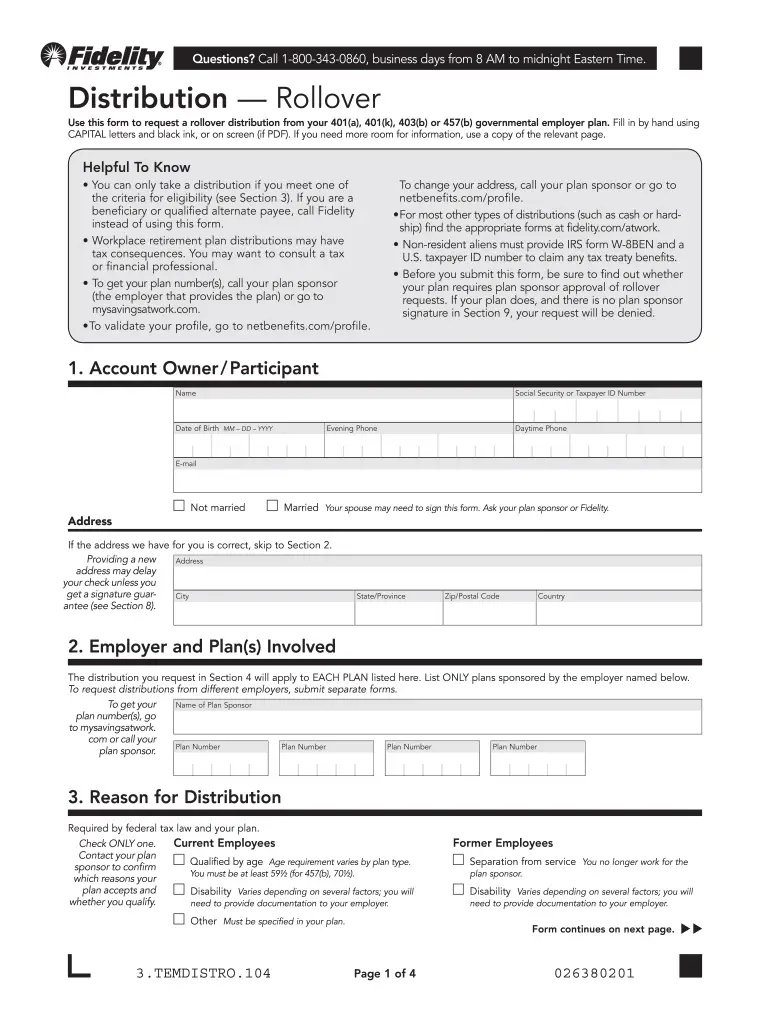

How To Make An Electronic Signature For The Distribution Form 401k Online

Follow the step-by-step instructions below to eSign your fidelity withdrawal form 401k:

After that, your 401k withdrawal form get is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with a number of additional features like Add Fields, Invite to Sign, Merge Documents, and so on. And due to its cross-platform nature, signNow can be used on any device, personal computer or smartphone, irrespective of the operating system.

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

You May Like: Can I Withdraw My 401k If I Quit My Job

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Read Also: Can I Borrow From My 401k To Refinance My House

Supplement Your Savings Outside Of A 401

The IRS is so keen on individuals saving for retirement that its willing to allow workers to save in multiple types of tax-favored accounts at once. Combining the powers of a 401 and an IRA can really supersize an individuals tax savings and future financial freedom.

The ability to contribute to a Roth or traditional IRA is not just beneficial for workers stuck with a subpar 401. IRAs offer a lot more flexibility and control for all investors in terms of investment choices , access to portfolio building and investment management tools, and control over account fees.

Also Check: How To Calculate Employee 401k Match

Compliance And Funding Questions

The final section covers important compliance information for the IRS. Question 9 asks whether participants had any participant loans against the plan. Section 10 and 11 both ask about minimum funding requirements and waivers to those requirements.

Most Solo 401k plans that we recommend will help self-employed people steer clear of these requirements. This means youll be able to answer No to these questions. If youre subject to minimum funding requirements you will, unfortunately, have to complete Form 5500 to answer the questions.

How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employer’s matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

Don’t Miss: When Can You Use Your 401k

Donotpay Can Get You Back Into Your 401k Account

There’s a lot of paperwork involved with getting your 401K account back. You have to prove that you’re really you, which can be shockingly hard if your identity has been stolen. At the very least, you’re probably going to be on the phone for long periods of time, listening to mind-numbing music after you get put on hold for the third time in twenty minutes.

DoNotPay can help simplify this process, however. Just a few steps will have this matter cleared up, so you can get back to life before you were hacked.

Instructions And Help About Form 401k Distributions Form

okay congratulations you got your 401k establish you’ve established your checking account now it’s time to start moving the assets into the retirement plan how do you do that well we’ve got a form for doing this and let’s just walk through this step by step now first big warning on this form and the whole process many times your current investments will have surrender fees you need to make sure that you know what if any surrender fees are gonna be due by moving these assets over to your brand-new self-directed retirement plan other issue to be aware of chances are your current custodian or your employer already has a form they want you to fill out in order to request those funds if that’s the case by all means use the their form you don’t need to use this form other aspect whoever we set up the checking account with let’s say as well as Fargo they aren’t your custodian they aren’t your third-party administrator their role is strictly to be the checking account provider for you so if yo

Recommended Reading: What Percent To Put In 401k

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Dont Miss: How Do I Open A Roth 401k

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

Recommended Reading: How To Find Where Your 401k Is

What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. It is named after a section of the U.S. Internal Revenue Code.

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

Confirm A Few Key Details About Your Massmutual 401

First, get together any information you have on your MassMutual 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Read Also: What 401k Do I Have

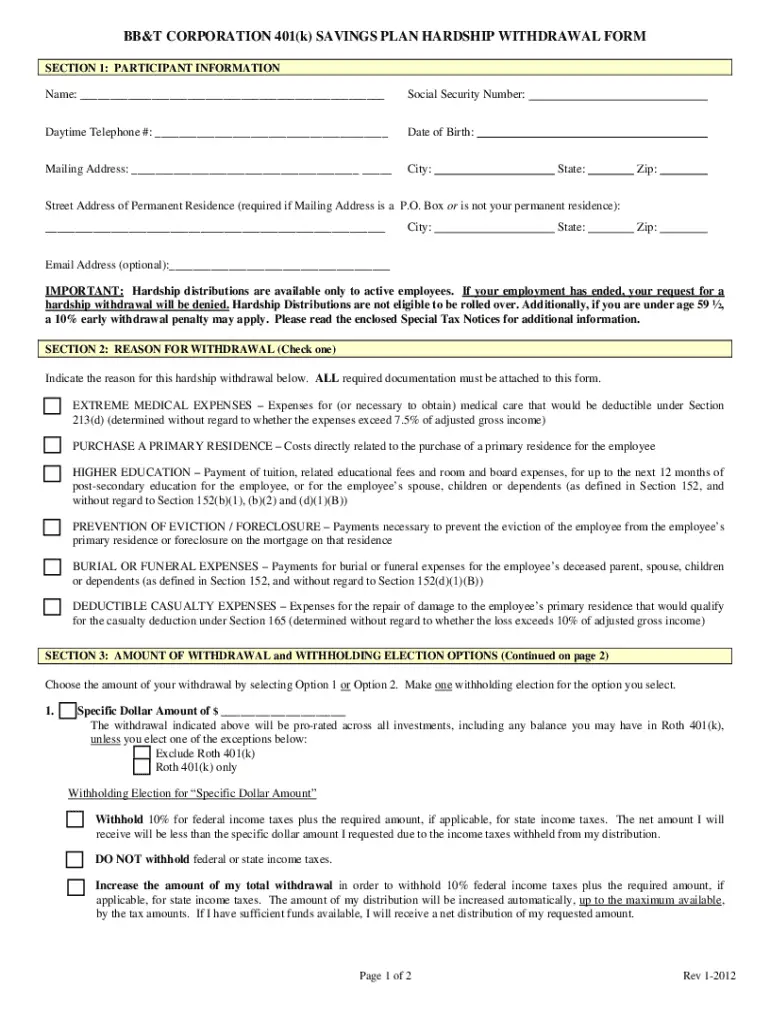

Eligibility For A Hardship Withdrawal

The Internal Revenue Service ‘s immediate and heavy financial need stipulation for a hardship withdrawal applies not only to the employee’s situation. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary.

Immediate and heavy expenses include the following:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

You wont qualify for a hardship withdrawal if you have other assets that you could draw on to meet the need or insurance that will cover the need. However, you needn’t necessarily have taken a loan from your plan before you can file for a hardship withdrawal. That requirement was eliminated in the reforms, which were part of the Bipartisan Budget Act passed in 2018.

The $2-trillion coronavirus emergency stimulus bill signed into law on March 27, 2020, allows those affected by the coronavirus situation a hardship distribution to $100,000 without the 10% penalty those younger than 59½ normally owe account owners have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

How To Get Your Hacked 401k Account Back

It’s nice to know that when you’re retired, you can turn to your 401K account to help cover the bills. But what happens if you discover your 401K has been hacked, and someone has withdrawn money from it?

The process to get your funds back can be long and drawn out. It’s also very stressful. Thankfully, there is a way to skip all the drama, thanks to DoNotPay.

Also Check: How To Open Up Your Own 401k

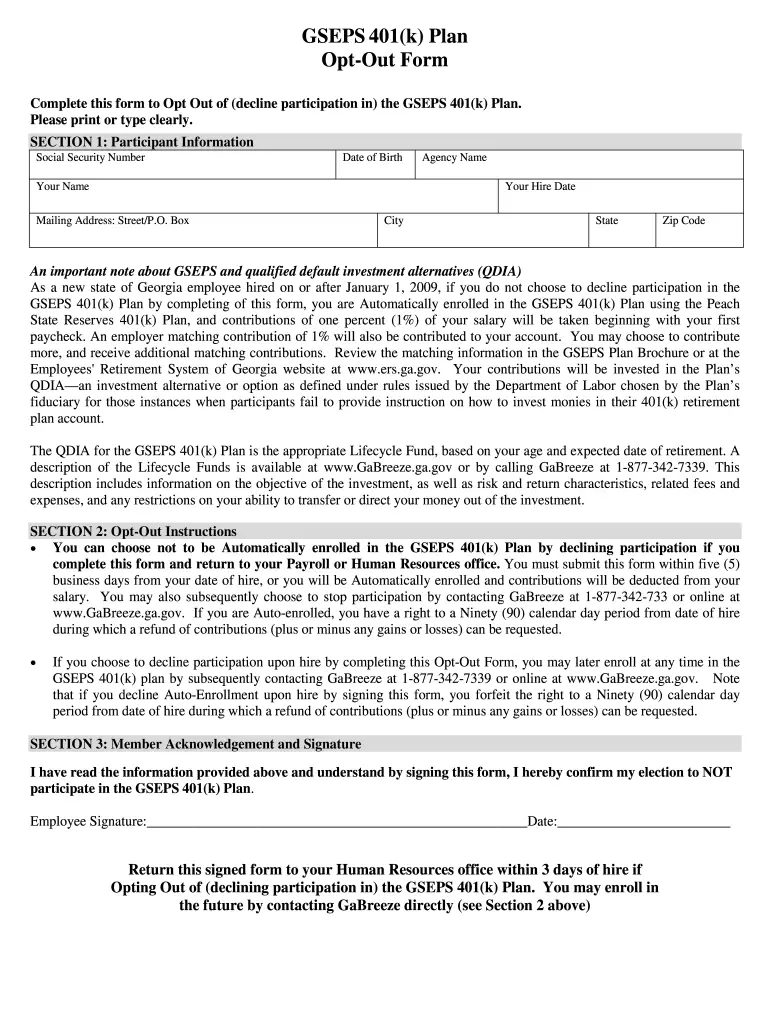

When You Start A Job Theres A Ton Of Paperwork To Fill Out But Dont Let That Keep You From Carefully Considering What To Do About Signing Up For Your 401 Here Are Some Basics To Know To Make The Right Moves

Enrolling in an employers 401 plan can be one of the easiest ways for a worker to save for retirement.

If youre new to 401s, it may seem prudent to do whatever the guy sitting next to you says he did especially if the enrollment forms are included in a pile of orientation paperwork you want to get through quickly. But if you follow a co-workers recommendations, or use the plans default options and then never go back to review and update your choices, you could miss out on important opportunities to maximize your retirement savings.

Whether you choose a traditional 401 or a Roth 401, youll receive some sort of tax break. Any matching contribution you might receive from your company is like getting free money. And by making contributions through automatic payroll deductions, you can build your account without being tempted to spend the money elsewhere.

Although theres no way to know how much income you might ultimately receive from your investments given the unpredictability of the market there arent many financial professionals who would advise against using a 401 as part of an overall retirement plan.

That doesnt mean, however, that you should forgo reading up on your plans rules, the investment options available, or any hidden fees that might eat away at your nest egg over time. Even if youve had a 401 before, the specifics can vary from one plan to the next.

Here are some things to look for when you sign up for a 401:

How These Nest

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Since its inception in 1978, the 401 plan has grown to become the most popular type of employer-sponsored retirement plan in America. Millions of workers depend on the money they invest in these plans to provide for them in their retirement years, and many employers see a 401 plan as a key benefit of the job. Few other plans can match the relative flexibility of the 401.

Read Also: How To Invest In A 401k Plan

What Is A 401k

A 401k is an employer-sponsored retirement account. It allows an employee to dedicate a percentage of their pre-tax salary to a retirement account. These funds are invested in a range of vehicles like stocks, bonds, mutual funds, and cash. Oh, and if you’re curious where the name 401k comes from? It comes directly from the section of the tax code that established this type of plan specifically subsection 401k.

Quick Guide On How To Complete 401k Form

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

SignNowâs web-based service is specifically made to simplify the organization of workflow and enhance the process of competent document management. Use this step-by-step instruction to complete the Generic 401 k enrollment form purpose quickly and with ideal accuracy.

Recommended Reading: What To Do With Your 401k

How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

How To Calculate Using A 401 Contribution Calculator

One needs to follow the below steps in order to calculate the maturity amount for the 401 Contribution account.

Step #1 Determine the initial balance of the account, if any, and also, there will be a fixed periodical amount that will be invested in the 401 Contribution, which would be maximum to $19,000 per year.

Step #2 Figure out the rate of interest that would be earned on the 401 Contribution.

Step #3 Now, determine the duration which is left from current age till the age of retirement.

Step #4 Divide the rate of interest by the number of periods the interest or the 401 Contribution income is paid. For example, if the rate paid is 9% and it compounds annually, then the rate of interest would be 9%/1, which is 9.00%.

Step #5 Determine whether the contributions are made at the start of the period or at the end of the period.

Step #6 Figure out whether an employer is also contributing to match with the individuals contribution, and that figure plus value arrived in step 1 will be the total contribution in the 401 Contribution account.

Step #7 Now use the formula accordingly that was discussed above for calculating the maturity amount of the 401 Contribution, which is made at regular intervals.

Step #8 The resultant figure will be the maturity amount that would include the 401 Contribution income plus the amount contributed.

Also Check: Is An Annuity A 401k