Plan Administration Can Be Challenging

Any type of 401 plan is highly regulated because there are various opportunities for tax-deferred income associated with these accounts. The government wants to ensure that these retirement accounts are used fairly and in accordance with IRS standards. Because these accounts are federally regulated, the government also works to ensure that theyre beneficial for all employees who have them. Below are some examples of issues that can arise with basic 401s.

At one large corporation, the lowest-paid employees may make $30,000 per year, while the CEO makes $3 million per year. If a 401 is part of the benefits package for the business, employees across this wide range of pay scales all have the opportunity to make voluntary contributions to their 401 each year. However, an employee who makes $3 million may be able to save far more than an employee who makes $30,000 by making maximum contributions to their account. In 2021, the maximum amount of money a person can contribute to their 401 is $19,500 a number thats not easy for someone earning $30,000 to save.

Heres another example. At a small business, there are five employees, four of whom are business partners with 25% ownership rights in the company. The other employee is a receptionist who has a salary of $40,000. As the business grows more successful, the partners are more likely to contribute the maximum amount to their 401s each year, while the receptionist may have trouble contributing $2,000.

What Are The Rules For Employers Regarding Safe Harbor 401 Plans

Employers wishing to include safe harbor provisions in their offered 401 retirement plans must give ample notice in writing to all of their employees. Not only must employers announce the availability of the plans, they must provide detailed information regarding the type of safe harbor plans available and all tax information and employee rights regarding the plans.

In order to satisfy this requirement in a timely manner, employers must give notice not less than 30 days and no more than 90 days before the year in which the plans activate. By complying with these requirements regarding notification, employers allow their employees to make the necessary inquiries and adjustments to their retirement plans.

Because employers commit to a contribution amount, they must keep their finances in proper order to guarantee a delivery on their commitment. If you own a small business and are considering including safe harbor provisions to your employees 401 retirement plans, contact a trusted accountant or financial advisor.

Employees rely on the stability of their retirement plans to plan for their future and make important financial decisions. Casting any doubt in your companys mind regarding your ability to keep your end of the deal regarding their benefits package causes top talent to seek other employment. Securing their future secures your businesss future in turn.

Safe Harbor Contribution Limits For 2022

Siân Killingsworth / 10 Feb 2022 / Safe Harbor 401k

The IRS is increasing the maximum individual 401 contribution limit by $1,000 from $19,500 to $20,500in 2022. The Safe Harbor 401 contribution limit for 2022 is the same as a Traditional 401, even though Safe Harbor plans are exempt from most nondiscrimination testing. The 2022 catch-up contribution limit for Traditional and Safe Harbor plan participants who are age 50 or older remains the same at $6,500.

Continue reading to learn how Safe Harbor contribution limit changes for 2022 can affect how much you are able to put into tax-deferred savings this year. The amount you contribute is pre-tax, meaning that it can also reduce your taxable income, tax bracket, and the percentage of taxes you owe for 2022.

Contact Ubiquity, a leading provider of Safe Harbor 401 plans for small businesses, for details. Its not too late to start a Safe Harbor 401 plan or add a Safe Harbor provision to an existing plan for 2022.

Cut through the complexity of choosing and customizing the right 401 for your small business. Get an instant quote.

Also Check: Can You Do A Partial 401k Rollover

Havent Heard This Term Before Dont Let It Intimidate You Safe Harbor Is Just A Type Of 401 Plan That Offers Benefits For Meeting A Few Requirements Its A Popular Solution For Business Owners Who Want To Reduce Their Administrative Burden

Safe harbor 401 plans have a simpler plan design that allows you to bypass some of the annual compliance testing required by the IRS*. In return, you must make a minimum safe harbor contribution to the plan. The most common form of contribution is a match, meaning the business owner is only responsible for making a contribution when the employee does so. Employees benefit by getting free money in the form of the matching contribution, which incentivizes them to save more. Theyre also immediately vested in the plan.

If youre not sure about setting up a safe harbor plan on your own, a third party administrator can assist with this type of plan design.

Non-safe harbor 401 plans typically dont require you to make a minimum matching contribution. But theyre subject to more compliance testingwhich means more administrative paperwork and potential hassle if a correction is needed.

So, whats plan compliance testing? The IRS requires a series of annual tests to ensure that qualified retirement plans are in compliancein other words, that they follow the applicable laws and plan provisions, and are fair to all participants. Safe harbor plans are automatically deemed to pass non-discrimination compliance tests, which are tests to ensure the plan doesnt provide a more significant benefit to highly compensated employees .

Advantages of a safe harbor 401 plan with Simply Retirement by Principal®

Requirements For A Safe Harbor 401

The main requirement for a traditional Safe Harbor 401 is that the employer must make contributions, and those contributions must vest immediately. Contributions can take three different forms, the first two of which are matching, which means employees must defer funds to their accounts in order to receive contributions. The third option requires your company to make a contribution, even if employees dont defer any of their income into their plan.

Here are examples of the different contribution formulas:

1. Basic matching: The company matches 100% of all employee 401 contributions, up to 3% of their compensation, plus a 50% match of the next 2% of their compensation

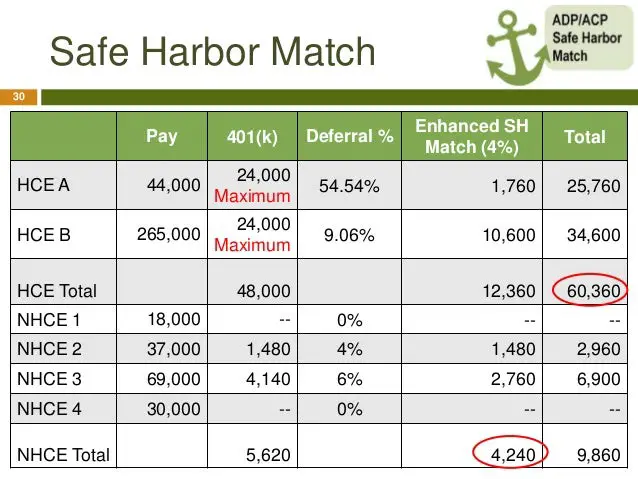

2. Enhanced matching: The company matches at least 100% of all employee 401 contributions, up to 4% of their compensation

3. Non-elective contribution: The company contributes at least 3% of each employees compensation, regardless of whether employees make contributions

This is what the matching and nonelective contributions would look like for an employee under the three different Safe Harbor formulas. The employee in this case earned $150,000 of eligible compensation during the year.

Note that these contributions are only the minimums. For example, a more generous employer can match up to 6% of employees pay, and it could still qualify as Safe Harbor.

You May Like: How To Set Up A 401k Without Employer

Converting To A Safe Harbor 401

What if you already have a traditional 401 plan? Can you change it to a safe harbor plan? The short answer is yes. But there are specific deadlines and other requirements that you need to be aware of based on the type of safe harbor contribution.

- If you want to make a safe harbor matching contribution, the change will be effective on the first day of the following plan yearJanuary 1 for calendar year plans. You must amend your plan document before that date and allot enough time to provide employees with a 30-day notice.

- You can elect the safe harbor nonelective contribution at any time during the year, as long as the change is made 30 days before the end of the plan year and the contribution is retroactive for the entire year. If youre willing to increase the nonelective contribution to 4%, the deadline is extended to the last day of the next plan year . Both options require an amendment to your plan document.

How Do Safe Harbor Plans Benefit Employees

Many employees enjoy the advantages of safe harbor plans. Although some plan types require employees to make voluntary contributions to unlock the benefits of employee matching, this type of 401 offers the ability to double any employee contributions. Even the best of investments dont usually double each time someone makes them.

Immediate vesting is also a big benefit. In other 401 arrangements, employees have to wait three years or more for any 401 contributions to be fully vested meaning theirs to use. With a safe harbor plan, an employee could withdraw all of the employer contributions anytime they want, although tax penalties for early withdrawals in retirement plans still apply.

Recommended Reading: What Happens To 401k When You Switch Jobs

What’s So Safe About A Safe Harbor 401k Plan

A Safe Harbor 401k can seem like an obvious choice, but it may not be the best option for every plan. Safe Harbor plans are a great fit for small businesses and businesses that have failed noncompliance testing in the past. But while you save in administrative hassle, you may pay a bit extra in plan costs and required contributions.

Human resources departments are working to follow either a calendar or fiscal year plan of important notices, paperwork, and changes for employees. Is it possible, then, to make a change mid-year and implement a match safe-harbor 401k plan?

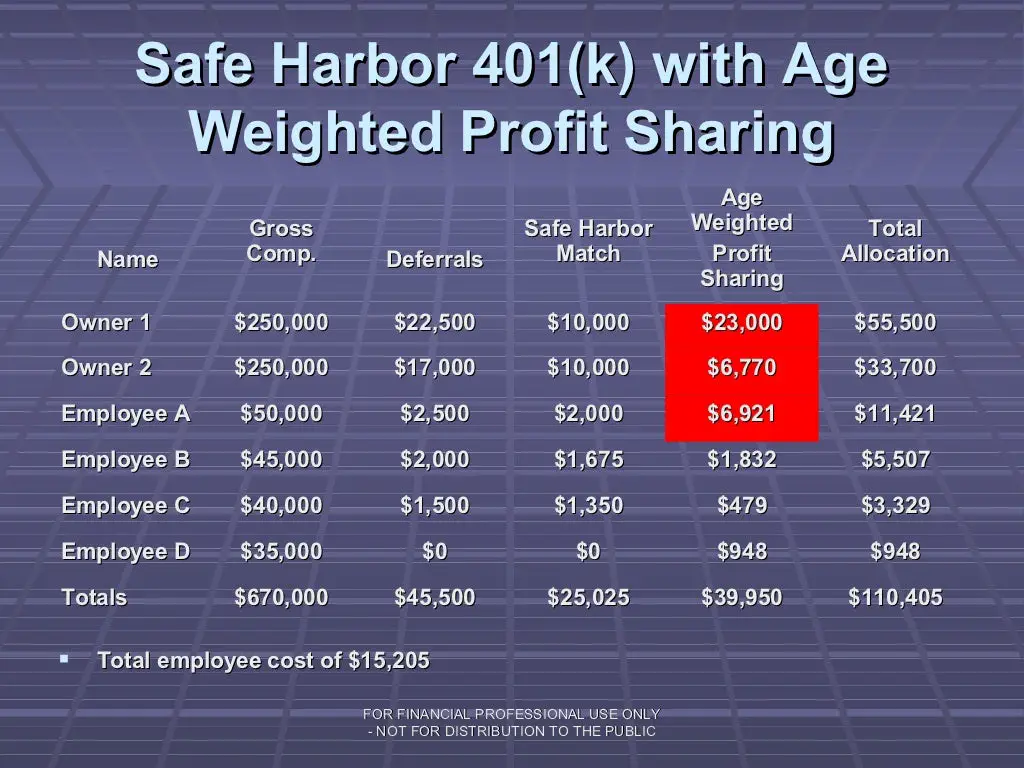

What Is A Double Advantage Safe Harbor 401

The term double advantage safe harbor 401 is a retirement investment plan that combines the benefits of a traditional 401 with a profit-sharing plan. Just like regular 401s, these plans are offered to workers of participating employers. This type of plan maximizes the tax efficiency for both employers and employees. DASH 401 plans are well-suited for small or mid-sized businesses and companies that want to compensate employees at specific levels.

Don’t Miss: How To Make 401k Grow Faster

Automatically Satisfy Irs Testing

All 401 plans except Solo 401s are subject to government tests to help ensure the plan is serving the best interest of employees and not just high earners. A Safe Harbor plan allows you to automatically satisfynon-discrimination testing by providing an immediately vesting match. Companies that choose a Safe Harbor plan must either:

- Make a dollar-for-dollar matching contribution for all participating employees on the first 4% of each employee’s compensation , OR

- Contribute 3% of the employee’s compensation for each eligible employee, regardless of whether the employee chooses to participate in the plan.

Safe Harbor plans work particularly well for companies that have consistent streams of revenue. Businesses finding it difficult to maintain matching funds year-round might find that a 401 plan without Safe Harbor could make more sense.

Safe Harbor 401k Rules

So why would someone select a safe harbor 401k plan over a traditional 401k? It comes down to the testing requirements. As a general rule, the government wants to make sure that 401k plans dont just favor highly compensated employees over non-highly compensated employees .

The government has set forth certain compliance tests to make sure that all employees are fairly represented in the plan. A safe harbor plan allows you to automatically pass these non-discrimination testing rules by making certain contributions to participating employees.

Making contributions to youremployees 401k is the most notable Safe Harbor requirement, but there areadditional rules surrounding when and how you offer your plan.

The implementation of a 401k planprovides the opportunity for retirement savings by the employees themselveswhich is tax deferred. The employer has the option of depositing matching orprofit sharing contributions.

Many 401k plans provide for employermatching contributions to encourage and reward elective deferrals by employeesand to maximize employee appreciation of the plan.

Recommended Reading: How Do You Take Money From Your 401k

Can An Additional Discretionary Match Also Exempt From The Acp Test

It depends. If you make a discretionary match in addition to safe harbor contributions, it must meet two conditions to be exempt from the ACP test:

- The match formula cannot be based on more than 6% of deferred compensation.

- The match cannot exceed 4% of deferred compensation in total.

For example, a discretionary 50% match on the first 6% of deferred compensation would be exempt from the ACP test, while 25% match on the first 10% of deferred compensation would not.

A discretionary match can be subject to a vesting schedule up to a 3-year cliff or 6-year graded schedule.

Safe Harbor 401k Testing

401k plans generally have three maintypes of compliance tests. These tests are typically required to be performedon plan to ensure that employees are treated fairly:

- Actual Deferral Percentage test. This test compares the deferral percentage of HCEs and NHCEs. As a general rule, the HCE deferral amount should not be more than two percentage points higher than the non-HCEs average.

- Actual Contribution Percentage test. This test compares the employer matching contributions between both the HCEs and NHCEs.

- Top-Heavy test. This test examines whether the account balances of key employees is greater than 60% of total plan assets.

So what is a highly compensatedemployee ? Highly compensated employees are typically defined asindividual with more than 5% ownership, the family members of a more than 5%owner , or employeeswho make more than $125,000 in the prior calendar year.

So if you do not have a safe harborplan, the owner and any other HCEs will be able to defer only about 2% morethan the average of the eligible Non-Highly Compensated Employees . Shouldthe plan have no eligible NHCEs participants, then none of the HCEs would beable to participate.

You May Like: How Can I Borrow Money From My Walmart 401k

What Is A Safe Harbor Plan Design

Employer-sponsored retirement plans can avoid annual nondiscrimination testing by instituting a safe harbor plan design. The employer safe harbor contribution provides an opportunity for all employees benefit from employer-sponsored retirement plans not just the highest paid staff members. This can happen in one of two ways:

- A plan sponsor can provide a 100% match to pretax contributions made by non-highly compensated employees on 3% of their pay, plus a 50% match on the next 2% of pay on their contributions.

- A plan sponsor can automatically contribute 3% of pay to the retirement accounts of all non-highly compensated employees, regardless of whether those employees contribute to their accounts.

The Purpose Of A Safe Harbor Plan

Government agencies conduct annual non-discrimination testing on company-run 401 programs to ensure that the benefits of the programs dont become skewed towards helping certain employees more than others. The testing compares the voluntary contributions highly compensated employees make with the contributions of other employees.

Theres a variety of standards to determine who qualifies as a highly compensated employee. It could be an employee who has more than 5% ownership in the business, or it could be someone with annual earnings of $130,000 or more. Some companies also opt to set their own standards for highly compensated employees when no employees meet the traditional standards.

When an excessively high percentage of annual contributions comes from highly compensated employees, the business is at risk of failing a non-discrimination test. The business must take remedial action if it fails a test, which could involve making contributions on behalf of lower-earning employees. The most serious consequences of repeated failed tests can be the dissolution of the 401 plan, meaning the IRS no longer recognizes the savings as being tax-deferred.

An alternative solution is to convert the program to a safe harbor plan. A safe harbor plan protects the business from expensive pitfalls that can arise when high-earning employees make the majority of voluntary contributions.

Don’t Miss: How Much Can You Put In Your 401k A Year

How Double Advantage Safe Harbor 401s Work

Investors have a number of options when it comes to how they want to save for their retirement. Many people can take advantage of the different employer-offered options, including 401s. These are tax-advantaged savings plans that allow workers to contribute to their retirement plans through automatic payroll deductions. Some employers match some or all of these amounts.

The double advantage safe harbor 401 is one of these options. This employer-sponsored plan is a hybrid plan that combines both the safe harbor 401 with profit-sharing. Safe Harbor 401s work just like traditional 401s with one key exception. Employer contributions are made without having to go through a vesting period. Profit-sharing allows companies to include employees in their profits.

The DASH 401 plan is commonly used by employers who want to maximize contributions to certain employees, such as owners and company executives. In exchange for mandatory vested employer contributions, administration fees are generally lower than a standard 401 plan and contribution limits are often much higher. Employers and employees can contribute the maximum allowable deferral on an annual basis. Companies can make tax-deductible contributions through profit-sharing.

There are three steps to creating a DASH 401:

Is A Safe Harbor 401 Right For Your Business

Low participation by non-highly compensated employees , failed nondiscrimination tests, and easier administration are just a few of the reasons you might consider a safe harbor 401 plan instead of a traditional 401. Your financial professional and other plan advisors can help you decide if its the right solution for your organization.

The content of this document is for general information only and is believed to be accurate and reliable as of the posting date, but may be subject to change. It is not intended to provide investment, tax, plan design, or legal advice . Please consult your own independent advisor as to any investment, tax, or legal statements made herein

MGT-I 45339-GE 07/21 MGR0818211760014

Recommended Reading: Can I Rollover My 401k