You Expect To Pay Higher Taxes In The Future

Since Roth IRAs use after-tax dollars, youll have to pay taxes upfront on any funds you roll over. However, you wont have to pay taxes on your distributions, which could be extremely beneficial if youre taxed at a higher rate when you reach retirement. Youll pay taxes either way now or later. But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, you’ll want to reach out to your provider to determine if moving the assets over “in-kind” or “as is” could be an option for you.

If it is an option, then you’ll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isn’t an option, don’t worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

How To Roll Over A Pension Into An Ira

Private sector employers that once offered workers traditional pensions, typically defined benefit plans, have been encouraging people to roll over their pensions into tax-advantaged plans like individual retirement accounts and 401s. If youre considering such a move, its important to understand your options, the pros and cons of each option and the tax-related rules about such a move. Before you do anything, though, consider working with a financial advisor who can help you make the best choices.

During the 1980s, 60% of private-sector companies offered their workers traditional pension plans, which were usually defined benefit plans. As the years have passed and employees stopped staying with the same company for life, the defined benefit plan is going the way of the dinosaur. Today, only 4% of private companies offer defined benefit plans.

As private-sector companies have discontinued their traditional pension plans, they have encouraged workers to launch a pension rollover to an IRA. Some have replaced the defined benefit plan with a 401, a defined contribution plan. They have encouraged their workers to either roll over their pension money to the new 401 or initiate a pension rollover to an IRA.

Don’t Miss: How To Transfer 401k From Vanguard To Fidelity

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employers plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

How To Roll Over A 401 While Still Working

Some 401 plans allow you to roll them over while still employed with your company.

Anyone can roll over a 401 to an IRA or to a new employers 401 plan when leaving a job. Depending on your plans policies, you might be able to make the rollover while youre still with the company. Unlike a post-job rollover, your plan doesnt have to allow in-service rollovers, but many companies do. However, there are usually significant restrictions.

You May Like: How To Use Your 401k

Also Check: What Is An Ira Account Vs 401k

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

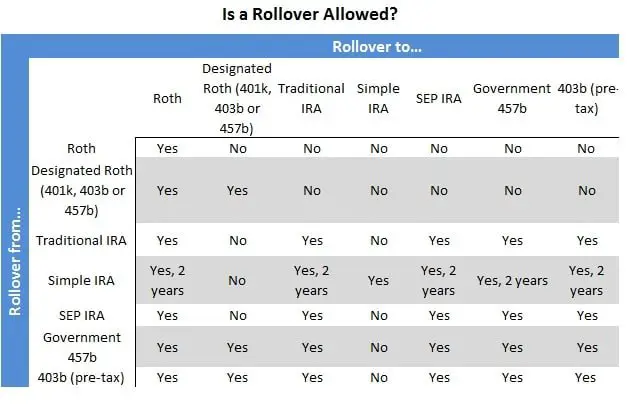

The Rollover Chart PDF summarizes allowable rollover transactions.

Ial Ira Conversion To A Roth

Generally, you dont want to convert all of your pre-tax money into Roth in the same year. If you do so, you will owe a lot of taxes!

The goal is to convert part of the pre-tax money over a number of years, thus partial Roth conversions. This leads lower taxes over your lifetime. Often, it is most efficient to fill-up the tax bracket you are in.

So, for instance, if you are in the 24% tax bracket, find the top of the bracket and convert tp fill up your taxable income to that mark. If you go slightly over, it is not a huge deal. This is because you are only taxed at the higher bracket for just the amount you go over. Remember, ! The goal of partial conversion to a Roth IRA is tax bracket arbitrage over the rest of your life.

Generally, you need to have a 20-30 year tax projection in hand to know your yearly goal conversion amount.

For instance, if RMDs start you in the 28% tax bracket when you turn 72, it may be a good idea to fill-up your 24% bracket now. This is tax bracket arbitrage, where you pay taxes now at a lower rate than you will in the future.

The tax brackets are set up with low brackets , middle brackets , and high brackets. It is generally less efficient to jump between the low to middle or the middle to the high brackets, but it, again, depends on your future tax projection.

Lets look at an example of Partial Roth conversions.

You May Like: What Is The Tax Rate On 401k After 65

How Do You Choose Which Bracket To Fill With Conversions

Which tax bracket should you fill with partial IRA conversion to a Roth?

Figure 2

In figure 2, you can see the tax brackets overlying the taxable income both with and without partial Roth conversions. This is a slightly complicated figure but the most important concept to understand.

In green, note the future expected taxable income starts out in the 10% tax bracket and increases at age 66 when TCJA expires. It then jumps into the 22/25% tax bracket when Required Minimum Distributions start at age 72 and increases over time up into the 24/28% tax bracket.

With partial Roth conversions, in blue, we fill up the 12% tax bracket up until RMDs start at age 72. This depletes the IRA enough that it stays out of the 24/28% tax bracket for the projected future!

This smoothing effect is what allows us to save in taxes with partial Roth conversions!

Note that it doesnt make sense to convert the whole IRA to Roth now. Dont pay taxes at a higher rate now than you will in the future! There are, of course, some exceptions to this rulesuch as those worried about the Tax Torpedo and perhaps those with very large pension or other incomes.

So, how much should you convert every year?

Avoid These Costly Mistakes When Rolling Over A 401 To An Ira

- Before you move your money, be sure you know the rules that differ between 401 plans and IRAs.

- If the rollover process is done incorrectly, it could be considered a distribution, which would make it subject to taxation and, possibly, an early withdrawal penalty.

- There are also some situations that call for caution before embarking on the rollover.

So you’ve left your job and want to move assets from your workplace savings plan to an individual retirement account.

You may want to pause before doing the rollover. If you’re not careful, you could make costly errors or lock yourself into a move that can’t be easily undone.

Both 401 plans and IRAs have the common purpose of letting you put away tax-advantaged savings for retirement. However, there are some rules that differ between the two. Even the rollover process itself can come with snags if you’re not careful.

More from Smart Tax Planning:

Here are some things to be aware of before initiating a rollover. These apply to traditional 401 plans and IRAs, whose contributions are generally made pre-tax.

Recommended Reading: What Happens When You Roll Over 401k To Ira

Considering A 401 Rollover Consider Your Options First

If you decide a 401 rollover is right for you, we’re here to help. Call a Rollover Consultant at .

One great thing about a 401 retirement savings plan is that your assets are often portable when you leave a job. But what should you do with them? Rolling over your 401 to an IRA is one way to go, but you should consider your options before making a decision. There are several factors to consider based on your personal circumstances. The information provided here can help you decide.

What Happens If You Default On A 401 Loan

The biggest cause of 401 loan default is separation from oneâs job. Once you leave your job for whatever reason, your former employer can no longer deduct your paycheck to meet the loan payments. This opens the door to defaults, since you will be responsible for making loan payments on time.

When a default is on the horizon, you have two choices to pay back the outstanding loan balance or let the loan default. Paying the unpaid 401 loan in a lump sum will absolve you from any tax liability. However, if you let the outstanding loan default, the consequences can be steep. The unpaid balance will be considered a distribution, and you will owe income taxes on the lump sum of income at your tax bracket. Also, there could be an additional 10% penalty if you are below 59 ½. When a defaulted loan is considered a distribution for tax purposes, you will have removed a sizable portion of your tax-deferred retirement savings, and you will not be able to restore the tax-deferred status of these funds.

Read Also: What Is The Penalty For Taking Money Out Of 401k

How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

Avoid Taking The Cash

When times get tough, it can be easy to see the cash in your retirement account and consider tapping that to help get you through. In fact, in a recent Bankrate survey, about one in four Americans said that they had hit up their retirement savings or planned to do so as a result of the coronavirus-related economic decline.

Taking an early withdrawal comes with a heavy cost. If you take money out of a 401 before retirement age , the IRS will hit you with a 10 percent bonus penalty on top of the taxes that youll already owe. In addition, you may have to sell investments at low prices, and youll lose any potential appreciation over your working years, hitting your nest egg still more.

If you must tap your retirement account, see if your plan allows you to borrow against the money in the account. Youll have to repay the funds, of course, but you may be able to avoid the taxes, which is a win in itself. You may also see if you can take a hardship withdrawal.

You May Like: How Should I Roll Over My 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

What Is A Rollover Ira

A rollover IRA is identical to a Traditional IRAor Roth IRA in the case of rolling over Roth 401 fundsexcept that the source of the money is not annual contributions. Instead, the money that goes into a rollover IRA is money from a previous retirement plan, such as a 401 plan. If you do not already have an IRA, you may open one for the purpose of rolling over your 401 funds without making any additional annual contributions. On the other hand, if you do have an IRA, you are permitted to roll over your 401 into that existing contributory IRA account.

It is important to note, however, that you may not combine traditional IRA and 401 funds with Roth IRA and Roth 401 funds.

Read Also: How To Lower 401k Contribution Fidelity

You May Like: How To Save For Retirement Without A 401k

How Do 401s And Iras Work

A 401 is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks, often with a partial match from their employers. Money deposited into 401 accounts is not taxed until it is withdrawn. It gets its name from the section of the tax code that covers it.

An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. Often, individuals who leave companies where they had 401 plans will roll the funds from them into IRAs.

Regardless of whether you own a 401k or an IRA, once a distribution is taken, it is taxable as ordinary income. Additionally, if you are withdrawing money prior to the age of 59½, then the IRS levies an additional 10 percent penalty tax. The same rules of taxation apply when you roll a 401 plan or an IRA into an annuity.

Key Options For A 401 Rollover

As youre considering where to roll over your 401, youll want to consider the advantages of each account type, the drawbacks, your own financial situation and the tax implications.

Depending on how much you have invested in your plan, you may have a limited time to make this decision, and in some cases your former company can make the decision for you:

- If you have less than $1,000, your ex-employer can just cash you out. You can still roll over the money into another account, but you typically must do so within 60 days.

- If you have between $1,000 and $5,000, your ex-employer can move the money into an IRA of its choice. If you dont like that IRA, you can always move it.

- If you have more than $5,000 in your 401, your company must await your instructions on how to proceed. You could continue to leave your money in your old 401.

The specific rules vary from employer to employer, and the rules that apply to your old 401 can be found in the plans documents. So check there first, if youre unsure how to proceed.

Also Check: How To Invest In 401k Without Employer

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Itâs also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, itâs a good way to save money, stay organized and make your money work harder.

Reasons Why You Might Want To Do A Partial 401 To Ira Rollover

One common reason for rolling funds out of a 401 is to streamline your accounts into fewer ones. Each time you change jobs you have to enroll in the new employers plan. Once you change jobs a few times, you could have several accounts to juggle.

Another reason is to avoid paying the extra fees assessed by some 401 plans. Additionally, the investment choices afforded by some 401 plans leave something to be desired, prompting people to move money out as soon as possible.

So why would you want to do a partial rollover in the first place? Why leave part of your retirement funds in the 401 account?

There are a few reasons why people choose this approach.

Also Check: How To Roll 401k To Ira