What Happens If I Cash Out My 401

If you simply cash out your 401 account, you’ll owe income tax on the money. In addition, you’ll generally owe a 10% early withdrawal penalty if you’re under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

One: Roll Over Your 401 To A Traditional Ira

Contributions to your 401 plan were pre-tax. This means your employer deducted them from your taxable salary when reporting your income to the IRS. Same goes for any employer matches. So you have yet to pay taxes on any contributions and on any accrued earnings.

Traditional individual retirement accounts are also tax-advantaged. The difference, of course, is that individuals rather than employers send their contributions to their financial institutions and claim the deduction when filing their taxes. So like 401 balances, the money in an IRA is tax-deferred. You wont owe taxes on it until you retire and start taking distributions.

This is why rolling over your 401 to a traditional IRA is fairly straightforward. Its an apples-to-apples transaction.

Who Can Make A Fully Deductible Contribution To A Traditional Ira

If you and your spouse don’t have retirement plans at work, you can deduct your traditional IRA contributions in full. If you or your spouse has a retirement plan at work, you may be able to deduct your full contribution, take a partial deduction, or have no deduction. For example, if you’re filing as single or head of household and have a modified adjusted gross income of $66,000 or less for 2021 , you can take a full deduction. You can take a partial deduction if it’s more than $66,000 and less than $76,000 for 2021 . If it’s $76,000 or more for 2021 , you can’t deduct your contribution.

Recommended Reading: How To Roll Over 401k To New Employer Vanguard

Youll Pay Higher Tax Rates Later

Theres also a rule of thumb for when a conversion may be beneficial, says Victor. If youre in a lower income tax bracket than youll be in when you anticipate taking withdrawals, that would be more advantageous.

The reason for why you might be in a higher tax bracket could be anything: living in a state with income taxes, earning more later in your career or higher federal taxes later on, for example.

Lets say that you are a Texas resident and you convert your IRA to a Roth IRA and then in retirement, you move to California, says Loreen Gilbert, CEO, WealthWise Financial Services in Irvine. She points to high-tax California and no-tax Texas as examples. While the state of California will tax you on IRA income, they wont be taxing you on Roth IRA income.

In this example you avoid paying state taxes on your conversion in Texas and then avoid paying income taxes in California when you withdraw the funds at retirement.

Does The 5 Year Rule Apply To Roth 401 K

A Roth IRA is a type of retirement plan that offers significant tax advantages. Roth IRAs are a terrific alternative for seniors since you can invest after-tax cash and withdraw tax-free as a retiree. Investment gains are tax-free, and distributions arent taken into account when assessing whether or not your Social Security benefits are taxed.

However, in order to profit from a Roth IRA, you must adhere to specific guidelines. While most people are aware that you must wait until you are 59 1/2 to withdraw money to avoid early withdrawal penalties, there are a few more laws that may cause confusion for some retirees. There are two five-year rules in particular that might be confusing, and failing to follow them could result in you losing out on the significant tax savings that a Roth IRA offers.

The first five-year rule is straightforward: you must wait five years after your first contribution to pull money out of your Roth IRA to avoid paying taxes on distributions. However, its a little more intricate than it appears at first.

First and foremost: The five-year rule takes precedence over the regulation that allows you to take tax-free withdrawals after you reach the age of 59 1/2. You wont have to pay a 10% penalty for early withdrawals once you reach that age, but you must have made your initial contribution at least five years before to avoid being taxed at your ordinary income tax rates.

Recommended Reading: Should I Do 401k Or Roth Ira

Transfer Of A 401 To An Ira To An Rrsp

If your 401 plan isnt eligible for a rollover directly to an RRSP , it can be rolled into an IRA that qualifies for a transfer to an RRSP. Subsequent to this, the new IRA can be transferred to an RRSP on a tax-deferred basis provided the conditions required for a transfer from an IRA to an RRSP, as outlined above, are satisfied.

Read Also: Should You Borrow From 401k To Pay Off Debt

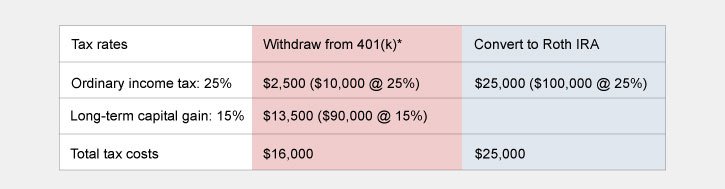

K Conversion Tax Consequences

Retirement accounts like 401k plans are typically funded with pretax money a Roth IRA is an after-tax account. Thus, youll likely face tax consequences on your 401k conversion to a Roth. Youll have to report the transaction on your taxes, and the IRS will consider all of the pretax income you convert to your Roth to be fully taxable at ordinary income tax rates, which can amount to a significant hit if you have a large 401k fund.

For example, if the amount of your rollover pushes you into the highest tax bracket, youll owe 37 percent on the transfer, just in federal taxes. And if you live in a high-tax state, such as California, you might face as much as 13.3 percent in additional state tax, pushing your total tax burden to over 50 percent of the amount of your 401k rollover.

Also See: How to Use Your IRA as a Last-Minute Tax Deduction

Don’t Miss: How Much Can You Invest In 401k

Question 4 Of : Can I Roll My 401 Into A Roth Ira Without Penalty

Pros And Cons Of A Roth Conversion

Your current income tax rate, your expected future tax rate, and the anticipated rate of return on your investments all factor in to whether a conversion is a good, or bad, idea for you. These might not be easy determinations to make. Fortunately, there are many calculators available online to assist you.

The most critical issue might be whether you have the money available to pay the taxes that will come due. If you have to use any of the money you took out of your tax-deferred account to pay the taxes, this might be a strong indication that a Roth conversion might not be appropriate right now. Youre just giving the IRS a portion of your retirement savings before you have to.

-

You can take the tax hit for withdrawing from a tax-deferred plan now if you anticipate that your tax rate will be higherand result in more taxes dueif you withdraw the money when you retire.

-

Your investment will grow tax-deferred in the Roth IRA, which can result in some significant savings if you still have some time to go before retirement.

-

Youll take a significant tax hit in the short term if youre in a higher tax bracket now than you expect to be when you retire.

-

Youll defeat the purpose of retirement savings if you use any of the conversion money to pay the tax bill, rather than reinvesting it in a Roth account.

You May Like: How To Withdraw Funds From 401k

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022: Employees with 401 plans that allow after-tax contributions of up to $58,000 would no longer be able to convert those to tax-free Roth accounts. Backdoor Roth contributions from traditional IRAs, as described below, would also be banned. Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, it’s probably best to consult with a financial advisor to weigh your options.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: What Is The Tax Penalty For Early 401k Withdrawal

Points To Consider When Converting From A Traditional To A Roth Ira

Converting funds from a Traditional to a Roth IRA is a taxable event. While there is no Traditional IRA to Roth conversion limit, you will have to pay taxes on the converted amount. For this reason, it is important to discuss conversion with your tax advisor. Here are some general guidelines for converting from a Traditional to a Roth IRA:

- Know your tax bracket. Many people choose to convert only what would keep them within the same tax bracket to avoid having an undue tax burden in the year they make the conversion.

- Watch your income. Converting from an IRA to a Roth IRA is best done in a year or years when you have low income. If you have been out of work, for example, and have a lower income than most years, you can convert from a Traditional to a Roth IRA with less of a tax impact.

- Plan long-term. Converting from a Traditional to a Roth IRA is best done over the course of years, with careful planning, in cooperation with your tax advisor. That way you can minimize the impact on your income taxes, and still enjoy the benefits of a Roth IRA after you retire.

How A 401 To Roth Ira Conversion Works

Converting a 401 to a Roth IRA is essentially the same process as rolling your 401 funds over to a traditional IRA, but there’s the extra step of paying taxes on your converted funds, as most 401s are taxed differently from Roth IRAs.

First, make sure you’re allowed to do a 401 to Roth IRA conversion. Many companies will allow only former employees to do rollovers or conversions, but a few may permit current employees to roll some of their savings over to an IRA as well. You should also check to see whether you’re allowed to roll over your 401 funds directly to a Roth IRA. Some plans permit you to roll your 401 savings only into a traditional IRA. Then you can open a Roth IRA and do your conversion.

Second, you must decide how much you’d like to convert. You can convert the full value of your plan, or you may be able to convert just a portion if your plan allows it. If you can’t do a partial conversion but don’t want to convert everything to Roth savings, you can always roll part of your savings into a Roth IRA and the other part into a traditional IRA.

There aren’t any limits on how much you can convert to a Roth IRA in a single year, but most people try to keep themselves from jumping up to the next tax bracket, which we will discuss below.

Don’t Miss: Can I Withdraw Money From My 401k

Roth 401 To Roth Ira Conversion

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

Income Does Not Necessarily Mean Taxable Income

Income reported on a conversion to a Roth IRA doesn’t always mean that the income will be taxed. The tax impact of reported income can be reduced through various tax deductions or tax credits.

Let’s say someone converts an entirely deductible traditional IRA worth $5,500 to a Roth IRA in 2016. Because these funds were entirely deductible, they would report $5,500 in additional income on his 2016 tax return. They are still entitled to take various deductions or tax credits, just as any other taxpayer could.

They could, therefore, offset the $5,500 in additional income with any available deductions. For example, they might offset the Roth conversion income with $5,500 of qualifying charitable deductions or with a $5,500 business loss. In this case, their amount of taxable income would remain unchangedthe $5,500 in deductions cancels out the $5,500 in conversion income.

Recommended Reading: Should I Rollover My 401k From A Previous Employer

Cons Of Rolling Your Roth 401 Funds Into A Roth Ira

When it comes to Roth IRAs, the most important thing to keep in mind is the five-year rule. The clock starts ticking when you make your first contribution into your Roth IRA, not when you open the account. So even if youve had a Roth IRA for more than five years, you may still have to hold off withdrawals if it took you a few years to start contributing. Any Roth 401 contributions youve made dont make any difference in relation to this timeline.

If you need the money and dont plan to change jobs any time soon, remember that you may be able to get a Roth 401 loan from your plan administrator. To clarify, you could borrow up to $50,000 or 50% of your vested account balance, whichever is less, though the loan must be repaid within five years or immediately upon leaving your employers service to avoid it being treated as a taxable distribution. Roth IRAs dont offer this kind of flexibility, so a rollover would eliminate this option.

You should consider the investment options and fees of a Roth IRA before definitively deciding on a rollover. It may be that your Roth 401 program offers a better selection of possible investments or charges fewer fees than a Roth IRA would.

You May Be Charged Lower Fees

Even if your company covers fees charged by your plan now, it may not once youve parted ways. And you have no guarantee your future companys 401 will be fee-free. Make sure you have a handle on potential costs your employer-sponsored retirement plan has just for managing your money.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

Don’t Miss: How Do I Start My Own 401k