A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

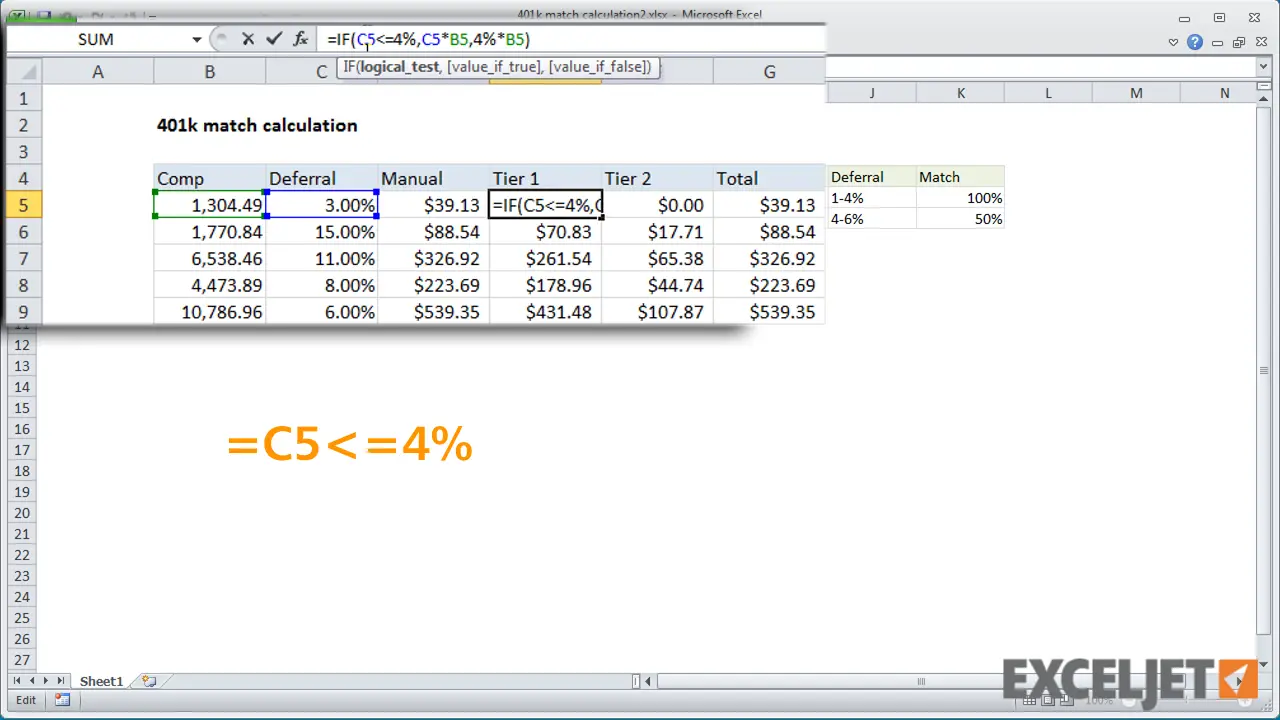

Re: Formula To Calculate A 401k Company Match

“Trish” wrote:> The company I work for will match employees 401K with the> following: The first 3% the company matches 100%, the 4th> and 5th % the company will match 50%. Does anyone know> a formula that will calculate this, I need to figure this> semi-monthly.I presume you mean that anything above 3% and less than orequal to 5% is matched at 50%. If the salary is A2 and thepercentage contribution is in B2:=A2*MIN + 50%*A2*MAX)or equivalently:=A2* + 50%*MAX))You probably want to put all that inside ROUNDDOWNor ROUNDDOWN to round down to dollars or cents.However, if you mean that anything under 4% is matched100% and anything between 4% and 5% inclusive is matchedat 50%, that is harder. Post again if this is your intent.

What Is A 401 Match

For many employees, one of the main draws of their employment is a defined contribution plan. One of the most popular options is a 401 plan, which you contribute to over the course of your working years. During that time, your employer may have a matching program, which means they contribute some money to that account as well. The actual dollar amount of a 401 match depends on the employer and your annual contribution level, though.

Your employers plan documents should outline the specifics of their 401 plan. But oftentimes youll run into one of these two matching styles: partial matching or full matching.

Partial matching means that your employer will contribute enough funds to match a portion of the money you put into your 401. However, it is only up to a certain amount. A common partial amount provided by employers is 50% of your annual contribution, up to 6% of your overall salary.

In contrast, full matching is a dollar-for-dollar match. Your employer puts in the same amount up to a monetary limit. So, for example, it may have a cap of 5% of your salary.

You May Like: What Do You Do With Your 401k When You Quit

The Average Employer 401 Match Is At An All

Many retirement professionals recommend that individuals put at least 15% of their annual income into retirement accounts. Employer match contributions reached an all-time high average of 4.7% in 2019, and that can be a powerful incentive for employees. Employers who want to encourage employee retention and good financial planning among their employees can use match programs to help their employees save and attract talented prospects to their company.

If you want to learn more about your 401, were here to help. Contact our team at Human Interest today to learn about our flexible management tools and how to help your employees save for their retirement.

If you want your company to start offering a 401 match program, you can also read our Employees Guide to Asking Your Manager or Boss for a 401 for Your Company. If you want to encourage them to offer a retirement savings plan, this article may give you a strong foundation to demand a re-evaluation of a matching contribution policy. After all, the better the workplace retirement plan, the more useful it is as a recruiting tool.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment advising, and integration with leading payroll providers.

When Does The Year End For A 401 Match

In terms of IRS contribution limits, the year resets on January 1. Any contributions and matches made during the year count toward your total contribution limit for the year. It’s referred to as a calendar year. Your employer might choose to deposit its match each time you withhold your contribution from your paycheck, or it may deposit it at less frequent intervals, say, quarterly or yearly.

The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

Read Also: How Much Can I Put In My 401k Per Year

Can I Afford It

Offering a retirement plan with a match may be less expensive than you think: With modern providers, a 401 for an entire company may cost less than a single employees health insurance. Companies that offer some level of matching are likely to stand out among similar businesses that do not offer this benefit, giving a boost to recruitment and retention initiatives.

Do I Qualify For 401 Employer Match

Your eligibility for employer 401 matching depends entirely on your employer. Not all employers offer a match program. According to statistics from the Bureau of Labor Statistics in 2015 around 51% of companies with a 401 offer some sort of match.

Its important not to assume your employer has automatically enrolled you for contribution matches. Be sure to ask when your matches will take effect. If youre unsure whether your employer offers a match program at all, dont be afraid to ask your boss or human resources representative about the company policy. Be sure to ask about the guaranteed match amount and what the match limits are.

Some firms may also have a vesting period for their contributions. This means that while the company may match 5% of your contributions, those contributions arent permanently yours until youve been at the company for a predetermined amount of time. If you leave before that time is up, you lose that money from your account.

Vesting schedules vary. Some companies have no vesting period, meaning all matching contributions are yours right away. Others have a vesting cliff at which point all of your matching contributions become permanently yours. Others have a schedule where a certain amount of your vested matches say 20% become permanently yours each year.

Don’t Miss: When Can I Set Up A Solo 401k

What Is A Partial 401 Match

With a partial 401 match, an employers contribution is a fraction of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

Matching structures vary by plan, said Young. In fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.

Lets say you earn $40,000 per year and contribute $2,400 to your 4016% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

Why Always Investing To Get The Full Match Is So Smart

Okay, you probably have a lot of different money goals , and retirement might feel a long way off. But consider this: The stock market has historically earned an average return of 9.8% a year. The key word here is average. In any given year, it might be more, it might be less. Theres risk involved. At Ellevest, we assess your risk and recommend an investment portfolio aimed to get you to your goal in 70% of market scenarios or better but still. Risk.

On the other hand, with an employer match of 50%, youre earning a 50% return on everything you put in . Fifty percent. Thats kind of amazing. And then, because that itself gets invested in the market, your 50% gets the chance to earn even more returns compounded. In case youre counting, thats returns on returns on returns.

And heres the situation: Grabbing that match is even more important for women, because the data shows that were behind as it is women retire with two-thirds as much money as men . So this is one opportunity you usually want to jump on.

Ready to jump in? Heres our lead CFP® Professionals advice on how to get started planning for retirement.

Read Also: What’s The Maximum Contribution To A 401k

Safe Harbor Matching Formulas In 2021

Another type of 401 plan, popular particularly among small businesses with a handful of highly compensated employees, is the Safe Harbor plan which exempts them from annual ADP and ACP nondiscrimination testing, in exchange for agreeing to make generous and fully vested 401 contributions to all eligible employees.

The most common formulas for 401 matching contributions are:

- Basic Match: 100% match on the first 3% put in, plus 50% on the next 3-5% contributed by employees.

- Enhanced Match: 100% match on the first 4-6% put in.

- Nonelective Contribution: 3% of employee compensation, regardless of employee deferrals.

Understand The Value Of An Employer Match

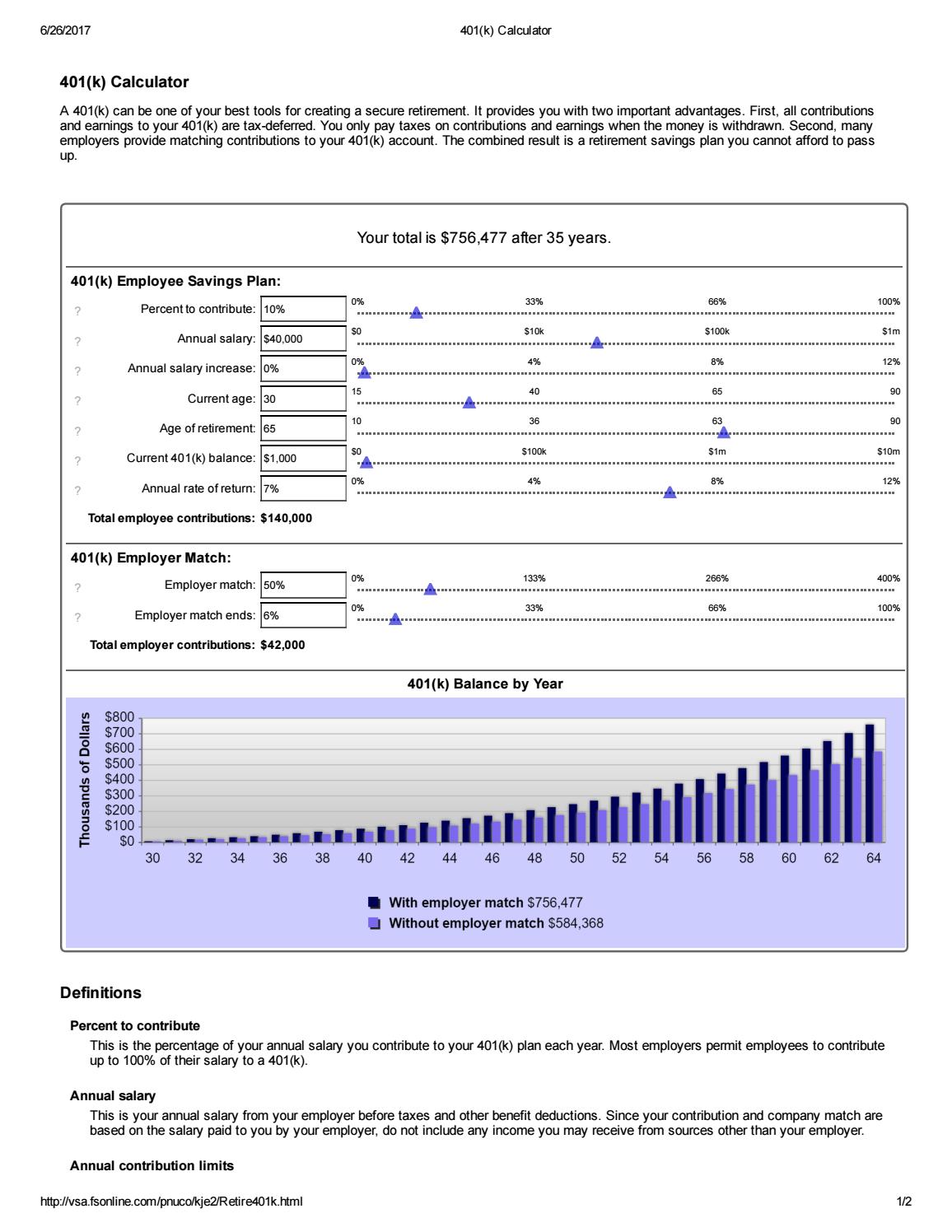

A 401 or similar employer-sponsored retirement plan can be a powerful resource for building a secure retirementand an employer match can add a substantial amount to your nest egg. Lets assume you are 30 years old, make $40,000 and contribute 3 percent of your salary$1,200to your 401. And, for the sake of this example, lets assume you continue to make the same salary and the same contribution each year until you are 65. After 35 years, you will have contributed $42,000 to your 401.

Now lets assume you get a match from your employer. One of the most common matches is a dollar-for-dollar match up to 3 percent of the employees salary. Taking full advantage of the match literally doubles your savings, even assuming no increase in the value of your investments: Instead of having set aside $42,000 by the time you retire, you will have set aside $84,000, with $42,000 in free contributions. Look at it this way: its a no-cost way for you to increase your contributions by 100 percent.

In reality though, the impact will be even bigger than that. Thats because when you invest money its value compounds. Check out The Time Is Now: The True Value of Time for Young Investors to learn how taking full advantage of a match early in your career can add up.

Also Check: Should I Invest My 401k

How Does The Employer Match Work

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution: a percentage of the employees own contribution and a percentage of the employees salary. Employers might match 25%, 50%, or even 100% of an employees contribution up to a set percentage of the employees salary.

Some companies may match contributions dollar for dollar, while others match at a smaller percentage. Other employers may set a hard dollar-based cap instead of limiting match contributions to a percentage of the employees total salary. Total employer contributions cannot exceed 25% of eligible employees annual salary or compensation.

No matter what your companys match program is, its important to strategize. Retirement experts regularly encourage employees to contribute enough to reach the maximum possible employer contribution, or at least as much as they can comfortably contribute. This ensures employees arent leaving money on the table, especially since its part of their total compensation.

How To Calculate Using A 401 Contribution Calculator

One needs to follow the below steps in order to calculate the maturity amount for the 401 Contribution account.

Step #1 Determine the initial balance of the account, if any, and also, there will be a fixed periodical amount that will be invested in the 401 Contribution, which would be maximum to $19,000 per year.

Step #2 Figure out the rate of interest that would be earned on the 401 Contribution.

Step #3 Now, determine the duration which is left from current age till the age of retirement.

Step #4 Divide the rate of interest by the number of periods the interest or the 401 Contribution income is paid. For example, if the rate paid is 9% and it compounds annually, then the rate of interest would be 9%/1, which is 9.00%.

Step #5 Determine whether the contributions are made at the start of the period or at the end of the period.

Step #6 Figure out whether an employer is also contributing to match with the individuals contribution, and that figure plus value arrived in step 1 will be the total contribution in the 401 Contribution account.

Step #7 Now use the formula accordingly that was discussed above for calculating the maturity amount of the 401 Contribution, which is made at regular intervals.

Step #8 The resultant figure will be the maturity amount that would include the 401 Contribution income plus the amount contributed.

Recommended Reading: What Is Max 401k Contribution For 2021

How Is An Employer Match Calculated

Ever wondered how matching works? It varies. A lot.

There are literally hundreds of matching formulas out there however, a recent study from Vanguard reveals the types of formulas that are commonly used. The most common involves matching $0.50 of every dollar the employee contributes, up to a set percentage of employee contributions, sometimes called a partial match. For example, this type of match with a 6% limit equates to a 3% matching contribution from the employer, so long as the employee is contributing at least 6%. In contrast, some employers do a dollar-for-dollar match on your contributions. Its up to them.

Match Type

Percentage of Plans Using This Type

Single-tier formula

$0.50 per dollar on the first 6% of pay

Multi-tier formula

$1.00 per dollar on the first 3% of pay $0.50 per dollar on the next 2% of pay

Single- or multi-tier formula with a $2,000 maximum

Variable formula, based on age, tenure or similar vehicles

Can I Contribute To My Simple Ira Outside Of Payroll

Out-of-pocket donations to a SIMPLE IRA account are not permitted. Only your company can contribute to your SIMPLE IRA account, either as employer matching or non-elective contributions, or as a deposit of your elective deferrals from your paycheck. Youll need to contact the SIMPLE IRA custodian to request a refund of the out-of-pocket amount , and then make a fresh contribution to a different IRA account.

Youll enter the regular contribution to the new account into TurboTax just like any other traditional IRA contribution. Traditional and Roth IRA Contributions can be found under Deductions and Credits -> Retirement and Investments -> Traditional and Roth IRA Contributions.

Also Check: What Age Do You Have To Draw From 401k

How Much Can You Contribute

For 2022, you can contribute up to $20,500, and an additional $6,500 if you are age 50 or older, or a total of $27,000. Note that employer matching contributions dont count toward this limit, but there is a limit for employee and employer contributions combined: Either 100% of your salary or $57,000 , whichever comes first.

When it comes to matching, specific terms of a 401k plan can vary widely. Your employer may use a very generous matching formula, or choose not to match employee contributions at all. Additionally, not all employer contributions to an employees 401k plan are the result of matching. Employers may make regular deferrals to employee plans regardless of employee contributions, though this is not particularly common.

Make sure you check your employers plan documents for the details on exactly how your 401k works.

Following are two common types of company contributions.

Do Employers Really Match Contributions To 401s

Yes. And it has been the norm for several years now. In the 18th edition of its How America Saves report, Vanguard analyzed 1,900 defined contribution retirement plans plans) representing a total of 5 million participants and found that 95% of plans provide employer contributions, up from 91% in 2013.

Employers recognize the power of a 401 as a strong tool for attracting and retaining talent. 31% of employees value an employer-sponsored 401 over a salary raise, according to a Glassdoor poll. In addition, a 401 match contribution is tax-deductible for employers. Every dollar a company contributes to employees 401 plans is tax-deductible, providing ongoing tax benefits to companies.

Read Also: How To Get My 401k Early

Read Also: What Happens To 401k When You Die

Matching Average And Contribution Limits

On average, companies that offer matching will match up to around 3% of an individual employees pay.

Regardless of your employers match, however, you should still do your best to contribute some of your pay to your 401. Not only will that lower your tax liability, it will give you a source of income once you hit retirement. Experts recommend saving between 10% and 20% of your gross salary toward retirement. The total amount can be split between your 401 and other retirement accounts you may have, or you might keep all of that in your 401. Be sure to keep yourself on track throughout the work years, checking whether youre meeting your age groups average 401 contribution numbers or not.

Also always keep in mind that the IRS does put limits on how much you can contribute to your 401 each year. For 2022, youre allowed to contribute a maximum of $20,500, up from the 2021 limit of $19,500. If youre 50 or older, you can contribute an additional $6,000 a year. However, your employers match does not count toward that 401 limit. The combination of contributions from all sources can reach up to $64,500 for 2021 and $67,500 for 2022.