How To Use Your 401 To Start A Business

If you plan on using a 401 to start a business, youll want to first consider the risk involved with utilizing your retirement savings for business financing. If you do decide this is the right option for you, you have three options for 401 business financing. If youre eligible, you can either use a 401 business loan, you can use rollovers as business startups , or you can take a distribution from your retirement account.

We dont have to tell you that financing your business is one of the biggest challenges of entrepreneurship, whether youre just starting out or looking to grow or buy an existing company. Although business loans work for many entrepreneurs, you might not like the idea of taking on debt, especially if you have funds of your own that you can bring to the business. In this case, however, the problem is that most people have personal savings tied up in investments or retirement accounts like 401s and individual retirement accounts .

If you have one of these retirement accounts, you might then be wondering how to use your 401 to start a business. Fortunately, there are ways to take cash out of a retirement account and invest the money in your business, though there is substantial risk involved.

Rollover For Business Startups : Ultimate Guide 2021

Tom has 15 years of experience helping small businesses evaluate financing options. He shares this expertise in Fit Small Businesss financing content.

This article is part of a larger series on Startup Loans.

A rollover for business startups allows you to invest funds from an existing 401 or individual retirement account into your business without paying early withdrawal penalties or taxes. A ROBS is not a business loan nor a loan from your 401, which means there are no interest payments to make or debt to repay. It is a way for you to leverage your retirement funds to provide capital to your business.

Most small business owners utilize a ROBS provider for this. We have compared a number of ROBS providers and ranked Guidant as the best overall in a recent ranking because it offers a free consultation and provides very good customer service.

What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

Recommended Reading: Can I Move Money From 401k To Ira

You May Like: Can Roth 401k Be Converted To Roth Ira

Can I Withdraw From My Ira In 2021 Without Penalty

Contents

The CARES Act allows people to withdraw up to $ 100,000 from a 401k or IRA account without penalty. Advance withdrawals are added to the participants taxable income and taxed at the ordinary rates of income tax.

What are the new rules for IRA withdrawals? Roth IRAs do not require withdrawals until after the death of the account owner. If you were 70 and a half years old before 2020, RMDs came into play at that point. If you have reached that age in 2020 or later, you will have more time these withdrawals must begin at the age of 72.

What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeeping make the implementation and maintenance of offering a retirement plan more affordable than ever.

Recommended Reading: What Is Better Than A 401k

Benefits To You And Your Employees

Investments in the plan grow tax-free after contributions are made, and no tax is paid on investment gains until employees take out the money. Contributions to the plan can reduce taxable income for the year.

Employees can make contributions through payroll deductions, and move the assets in their plan to another employers plan when they change jobs.

Ira Or Solo 401k Question:

They both allow for investing in alternative investments including real estate, but the solo 401k is generally more advantageous. For example, the contributions limits are higher for a solo 4o1k plan, you can borrow from a solo 4o1k plan, and the ongoing fees are also generally much less. See the following link for more on this.

Don’t Miss: What Is Max Amount To Contribute To 401k

My Business Is My Nest Egg

The second most popular way small business owners secure funding to start their business is through a retirement account rollover as a business start-up . But its not enough to rely solely on your business to meet your retirement goals. Consider the following:

-

According to the U.S. Small Business Association , business owners over the age of 50 are less likely to have well-funded retirement funds than their employees: the majority of their wealth remains invested in their business.

-

What if the business doesnt sell? Some studies show that 12 million business owners nearing retirement entered the market looking to sell their business. However, 75% of these could not sell at the asking price, forcing business owners to sell at a discount or close and find employment elsewhere.

Dont leave retirement to a what if? Business owners now have options that allow them to build their retirement savings while they build their business. Theres no need to compromise either.

Dont Miss: Can I Transfer Money From 401k To Ira

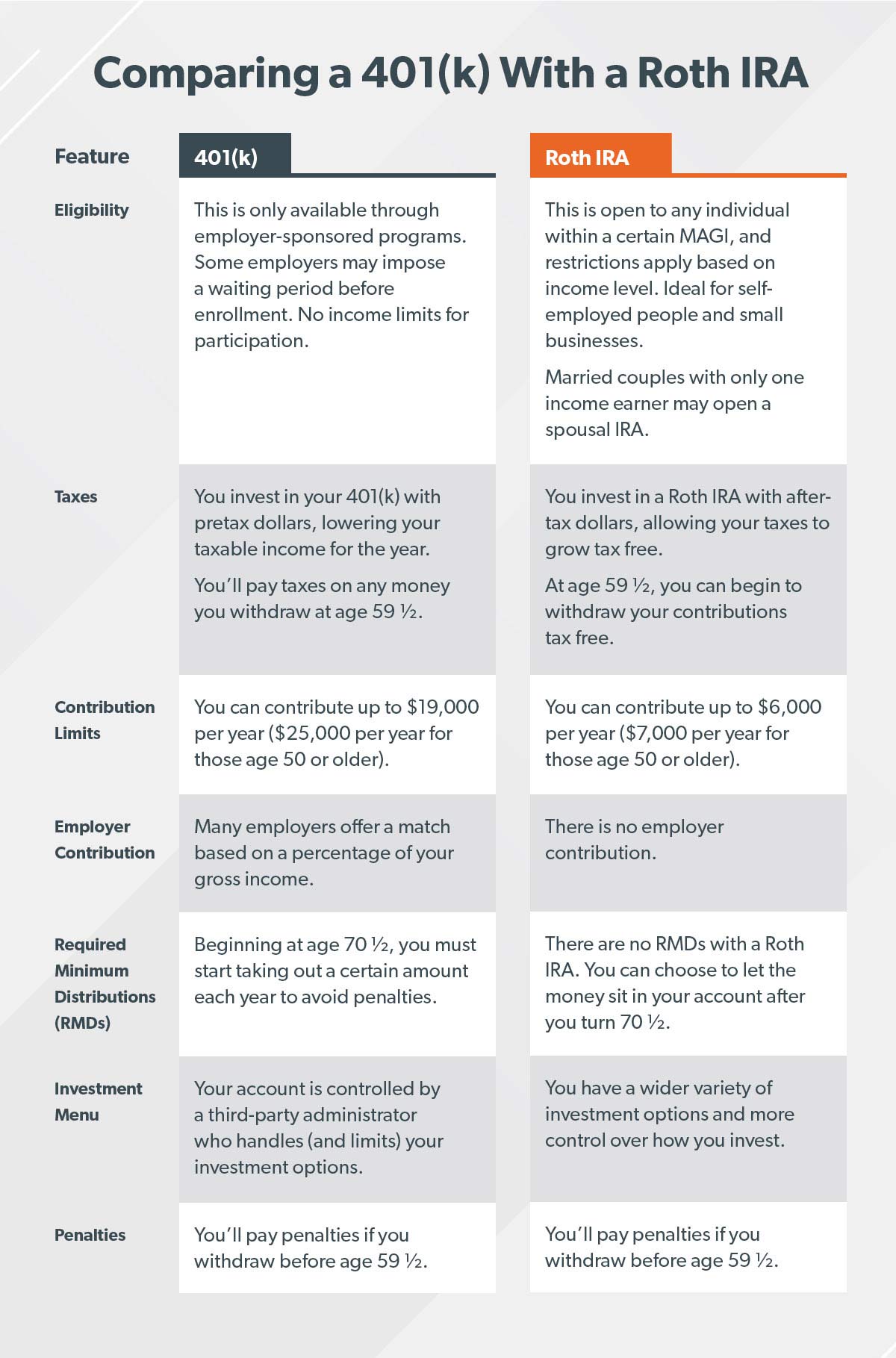

What About A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Read Also: When Can I Roll A 401k Into An Ira

Starting Late Turn Up The Dial On Your Contributions

Making the most of the early years of your career is one way to hit your retirement savings goaland probably the easiestbut its not the only way. If you have less time to save for retirement, youll simply need to save more each year.

For example, as we saw above, if your goal is to have $1 million at age 65 and you save just under $4,500 each year starting at age 20, theres a good chance youd meet your goal.

If you start at age 30 instead, youll have to save about $9,000 each year for the same chance at reaching your goal.

Beginning at age 40? Youll need to save about $18,000 a year. And if you wait until age 50, youll need to put away over $40,000 a year to give yourself a good shot at reaching your goal.*

In other words, no matter what your current age, youll always be better off starting now rather than waiting until later.

Read Also: How To Find Out If You Have A 401k Account

How Much Should Employees Contribute

Like the employer, employees are free to contribute as much as they like to the plan, within IRS limitations. For 2022, salary deferrals are $20,500, plus a catch-up contribution limit of $6,500 for employees 50 and older. Consider ways to help employees improve their financial wellness and increase their 401 participation. Doing so could benefit your business in the form of happier, less-stressed employees who are more engaged and productive.

Don’t Miss: Why Cant I Take Money Out Of My 401k

What Did The Ira Call The Troubles

In 1977 the IRA created a new plan that they called the Long War, in which they would keep their plans for most of the Crisis. Sinn Féin maintains the media war and is the public and political voice of the movement .

What do the Irish call the troubles?

The Troubles is an ethno-nationalist conflict in Northern Ireland that spanned some 30 years from the late 1960s to 1998. It is also known internationally as the Northern Ireland conflict, sometimes described as an unusual value or low value.

Was the IRA punished?

In the 1970s, when the IRA took control of the organization of no -go places, humiliation was often used as a form of punishment. The victim was forced to hold a paper or tar and feather. In government areas, women accused of colluding with British soldiers shaved their heads.

Terminating A 401 Plan

401 plans must be established with the intention of being continued indefinitely. However, business needs may require that employers terminate their 401 plans. For example, you may want to establish another type of retirement plan instead of the 401 plan.

Typically, the process of terminating a 401 plan includes amending the plan document, distributing all assets, and filing a final Form 5500. You must also notify your employees that the plan will be discontinued. Check with your plans financial institution or a retirement plan professional to see what further action is necessary to terminate your 401 plan.

Also Check: How To Find Out If You Have An Old 401k

If Youre Short Decide How Youll Make Up The Difference

If thereâs a gap between what youre saving now and what you may need, you have options. Consider the following.

- Defer more money into your 401 retirement plan, especially if youre not setting aside enough to get the full company match. Figure out how much it costs per week to put another 1% in your retirement plan. Make it bite-sized and its more doable. Then continue to bump your deferral another 1% as you can. A good time to do that is when you get a promotion or raise.

- Make annual contributions to a traditional Individual Retirement Account .Like a 401, it allows you to invest for the long-term and pay taxes on earnings later.

- Makecatch-up contributions to your 401 or IRA if youre age 50 or older.

- Manage debt so you have more money in your budget for long-term savings.

- Plan to work longer, if youre able. Delaying retirement by a year or two could help boost your savings.

- Work for a significant bump in income and then save it. How? Change jobs, try for a promotion, or turn a side hustle into extra cash flow.

- Win the lottery.

Benefits Of A Business Funding Ira

The Business Funding plan may well be your best optioneven if you have other options. Think about the possibilitiesyou can operate the business, draw a salary, and contribute to your retirement plan with profits from the business. Advantages for this type of funding strategy include the following:

- An all-cash purchase of a business eliminates the need for debt financing

- Funds can be used as a down payment to secure additional financing

- Profits enjoy tax-advantaged status by being directed back to your 401

- As an owner of the business, you may draw a salary and receive benefits

- Family members may be employed by the company and draw salaries

Don’t Miss: How Much Is 401k Taxed

What Are The Roth Ira Requirements

To be eligible to fully contribute to a Roth IRA, you must:

-

Have an earned income.

-

Have whats called a modified adjusted gross income . But it has to be less than $198,000 for married couples filing jointly or $125,000 for single people.3

Now listen up, married people, because this is important. Even if you or your spouse doesnt have an earned income, you can still have two Roth IRAs between both of you with something called a spousal IRA, if your spouse has an earned income. For most folks, fully funding two Roth IRAs will be enough to reach the goal of investing 15% of their income for retirement.

Also Check: How Much Do You Need In 401k To Retire

How Do I Set Up A Small Business 401

If youre ready to set up your small business 401, these are the four steps youll need to take.

For small businesses that are ready to help their employees save for retirement, the IRS website covers the actions you need to set up a 401 plan. In case you dont speak in tax code, heres a more approachable step-by-step guide.

Recommended Reading: Should I Transfer 401k From Previous Employer

Check Your Employers Contributions

If youve been enrolled into a workplace pension, your employer should be making a contribution.

Under automatic enrolment rules, your company should be contributing at least 3% of your salary to your pension pot.

A further 5% comes directly out of your salary, bringing your total contribution to 8%.

Some firms will pay more than the minimum amount, so its worth asking whether you can get a bigger contribution.

Sarah says some employers will even match any extra money you pay in pound for pound up to a certain level, often even up to around 10% of your salary.

That could seriously boost the size of your pension pot.

Check your companys pension policy you should have been sent these documents when you enrolled.

If youre not sure where to find the policy, its worth checking with your firms human resources department, which should be able to point you in the right direction.

Pension contributions from your company are basically free money so its worth making the most of it.

You May Like: How Does 401k Work When You Quit

Tailored Funding Options For You

If you use a self-directed IRA to invest in a business, you cant be involved in running the business because this is considered interacting with the plan assets, which is a prohibited transaction. Self-directed IRAs also dont let you draw a salary from the business. Youll never be able to possess more than 50 percent individual or personal ownership in the business.

Recommended Reading: How Much Can Be Put Into A 401k Per Year

Better Alternatives To Borrowing From 401

As you can see, the price for borrowing from your 401 could be very steep. But what are some of the options you have if you need the money? Here are a few ideas:

- Reduce your expenses This is probably the easiest way to free up some money. Are there any recurring expenses that you could reduce? Are there any planned expenses, such as a vacation, that you could defer? Are you practicing frugality?

- Increase your income Looks for things that you could do to generate income. There are many ways to do this ranging from building alternative income streams, working a second job, and selling your possessions.

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Recommended Reading: Who Is Eligible For Solo 401k

How A 401 Works

If your employer offers a 401 and you meet the eligibility requirements, you can enroll in the plan and begin making contributions via payroll. Before you start making contributions, though, youâll need to decide:

- What type of 401 you want: Traditional or Roth

- How much you want to save

- What you want to do with the money you save

401s come in two distinct flavors: Traditional and Roth. Although at their heart they aim to achieve the same purpose â to encourage Americans to save more for retirement by offering tax incentives â they do this in drastically different ways. Here are the main ways they differ.

Have more questions? .

Traditional 401: Your contributions are made before taxes and over the years your money grows tax-deferred. This means the contributions you make help lower your taxable income now, and you donât pay any taxes on either your contributions or investment growth until you begin making withdrawals in retirement. At that point, the money will be taxed as ordinary income.

Roth 401: Your contributions are made after you’ve paid tax on the income, but your money grows tax-free. Because you already paid tax up front, when you withdraw money during retirement, you wonât have to pay taxes.

What Is 401 Business Financing

401 business financing, also known as Rollovers for Business Startups , is a small business and franchise funding method. ROBS allows you to draw money from your retirement account in order to start or buy a business without incurring an early withdrawal fee or tax penalty. This is not a loan ROBS gives you access to your own money so you can build the life you want without going into debt.

You May Like: Is A 401k Worth It Anymore