Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

Accessing Money Before Traditional Retirement Age

But what happens if you retire before age 59 ½? Can you access your money early without penalties?

You could use the 401 option discussed above.

Unfortunately:

You must retire from the company with the 401 in the calendar year you turn 55 for this to work.

If the 401 option doesnt work for you, there is another option called Rule 72. This rule requires you to follow strict guidelines. That said, it allows you to take penalty-free withdrawals from traditional retirement accounts.

To do so, you must take substantially equal periodic payments.

Read Also: How Much Should I Put In 401k

Don’t Miss: Can I Transfer 401k To Roth Ira

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

Advantages Of Borrowing From A 401

Borrowing from your 401 isnt ideal, but it does have some advantages especially when compared to an early withdrawal.

A loan allows you to avoid paying the taxes and penalties that come with taking an early withdrawal. Additionally, the interest you pay on the loan will go back into your retirement account, although on a post-tax basis.

401 loans also wont require a credit check or be listed as debt on your credit report. If youre forced to default on the loan, you wont have to worry about it damaging your credit score because the default wont be reported to credit bureaus.

Also Check: Can You Roll A 401k Into A Self Directed Ira

Recommended Reading: Can I Borrow From My Solo 401k

How Do You Calculate My Minimum Required Distribution For The Year

Your current year MRD calculation is determined by dividing your prior year year-end-balance by your life expectancy factor as indicated on either the Uniform Lifetime Table or Spousal Exception Joint Life Expectancy Table. The table used to calculate your MRD is indicated next to an asterisk at the bottom of the Minimum Required Distribution Estimate.

Your MRD is calculated once per year, on January 1st. The year end balance of your account on which the MRD calculation estimate is based includes only assets in your Fidelity account on the last business day of the prior year. It does not include any “in transit’ transfers or rollovers that were deposited in your account during the current year that should be considered part of the prior year-end balance and therefore included in the MRD calculation. It is your responsibility to include those balances in MRD calculations to accurately determine the full amount of MRDs required by the IRS.

Continued Growth Vs Inflation

Remember that your retirement savings accounts dont grind to a halt when you begin retirement. That money still has a chance to grow, even as you withdraw it from your 401 or other accounts after retirement to help pay for your living expenses. But the rate at which it will grow naturally declines as you make withdrawals because youll have less invested. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

You also need to take inflation into account. This increase in the cost of things we purchase typically comes out to about 2% to 3% a year, and it can significantly affect your retirement moneys purchasing power.

Recommended Reading: How To Know If You Have A 401k

Read Also: Am I Able To Withdraw Money From My 401k

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred. But the IRS requires that you begin to take withdrawals known as “required minimum distributions” by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while they’re still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

You May Like: What Is The Phone Number For Fidelity 401k

When To Cash Out Your 401k To Pay Off Debt

The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans. Withdrawing the 401k plan early can cost money. The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans.

When Can I Withdraw From My 401 Before Retirement But Without Tax Penalties

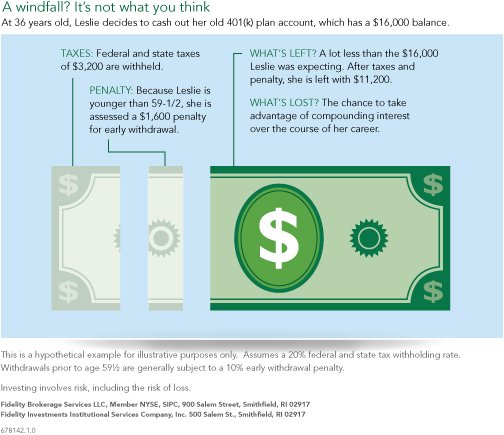

You don’t have to be in retirement to start withdrawing money from your 401. However, there are penalties involved depending on your age. If you wait until after you are 59 1/2, you can withdraw without any penalties. If you can’t wait until you are 59 1/2, then you will experience a 10% penalty on the amount withdrawn.

Don’t Miss: Can You Transfer Your 401k

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2, even if you haven’t retired. The best idea for old 401 accounts is to roll them over when you leave a job. If you are 59 1/2 or older, you will not be hit with penalties if you withdraw from your old accounts. However, you need to check with your human resource department about the rules around withdrawing from your current 401 if you are still in the workplace.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Confirm A Few Key Details About Your 401 Plan

First, get together any information you have on your old 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following three items:

Read Also: How Much Should I Put In My 401k

Recommended Reading: How To Pull Money From A 401k

When You Dont Take An Rmd

If you are subject to RMDs, it is extremely important to withdraw this money by the deadlines.

If you dont take an RMD:

Youll be subject to a penalty of 50 percent of the value of the RMD, which is basically giving money away.

You dont have to spend the money, but you do have to remove it from the retirement plan it is in according to the rules.

You can learn more about RMDs, how theyre calculated in regards to life expectancy and everything else you need to know at the IRSs RMD resource page.

After you take your RMD, you have a few other places you can withdraw money from, as well.

Try To Have Cash On Hand

Some financial professionals recommend retirees have enough cash or cash equivalents to cover three to five years worth of living expenses. Having cash reserves can help pay for unexpected expenditures that a fixed income may not otherwise be able to cover.

Cash on hand can also mitigate whats called sequence of returns risk. Thats the potential danger of withdrawing money early in retirement during market downturns and, thus, permanently diminishing the longevity of a retirement portfolio. By selling low, the longevity of the investors portfolio is jeopardized. However, with cash reserves retirees can withdraw less money from their 401 during a market decline and use the cash to cover living expenses.

You May Like: How To Fill Out 401k Rollover Form

How Are Mrds Taxed

MRDs are taxed as ordinary income for the tax year in which they are taken and will be taxed at your applicable individual federal income tax rate. MRDs may also be subject to state and local taxes. If you made non-deductible contributions to your IRA, you must calculate your MRD based on the total balance, but your taxable income may be reduced proportionately for the after-tax contributions. Please consult a tax advisor to learn more.

Diversify To Protect Your 401k From A Market Crash

There is no foolproof strategy that will keep your portfolio safe. However, you can mitigate your risks with basic moves like diversification.

The first strategy for protecting your nest egg is diversification. To explain, put your money in several places, so you do not lose everything.

For instance, invest in different stocks and U.S. Treasury Bonds. An example of basic diversification is 20% tech stocks, 20% finance stocks, and 20% energy stocks.

In addition, invest in several good dividend stocks so you will have money coming in. A great rule to follow is to have at least 50% of your 401K funds in dividend stocks.

Finally, having part of your funds outside of stocks will keep part of your money from a crash. Simply, having 20% of your funds in C.D.s or Bonds can ensure you will have cash.

Good diversification can be provided by using the Portfolio Correlation Functionality in Stock Rover.

|

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy. Stock Rover is our #1 rated stock investing tool for: Get Stock Rover Premium Plus Now & Get My LST Beat the Market System Included or Read the In-Depth Stock Rover Review & Test. |

You May Like: Can I Buy A Business With My 401k

What Are The Minimums And Maximums For Online Cash Transfers

The minimum amount for a brokerage account transfer is $10. The maximum transfer into your Fidelity brokerage account is $100,000. The minimum amount for a Portfolio Advisory ServicesSM account transfer is $250. You cannot request to withdraw more than 25% of your Portfolio Advisory Services account’s net worth.

Can I Take All My Money Out Of My 401 When I Retire

You are free to empty your 401 as soon as you reach age 59½or 55, in some cases. Its also possible to cash out before, although doing so would normally trigger a 10% early withdrawal penalty.

If you want to cash out everything, you can opt for a lump-sum payment. Think carefully before taking this approach, though. Withdrawing your savings all at once could result in a hefty tax bill and, if not managed wisely, leave you living in severe poverty later on in retirement.

Read Also: What Happens To My 401k If I Leave My Job

Loans & Hardship Distributions

As a participant in the Stanford Contributory Retirement Plan , you may be eligible to take a loan from your account balance held in Fidelity and Vanguard funds. Loans give you the opportunity to borrow from your account balance, and then repay yourself.

You may take out a loan against your account balance in your Tax-Deferred Account and/or Contributory Retirement Account, as long as your funds are with Vanguard or Fidelity. To request a loan you must have a total account balance in these funds of at least $2,000. Fidelity and Vanguard funds are subject to certain rules and restrictions, including those set by the U.S. Internal Revenue Service.

TIAA does not allow loans from their investment options.

NOTE: The following information pertains to ordinary loans and hardship distribution rules you may have alternative options in 2020 as provided in the Coronavirus Aid, Relief, and Economic Security Act. Read more about the CARES Act distribution and loans in this FAQ.

Recommended Reading: How To Withdraw My 401k From Fidelity

How Should I Take My Mrds If I Have Multiple Accounts

If you have more than one IRA, you must calculate the MRD for each IRA separately each year. However, you may aggregate your MRD amounts for all of your IRAs and withdraw the total from one IRA or any combination of your IRAs. If you have qualified plan accounts in addition to your IRAs, you must calculate and satisfy your MRDs for IRAs separately from your qualified plan accounts. If you have more than one qualified retirement plan account, you must calculate and satisfy your MRD requirements separately for each qualified plan account. For example, if you have both a profit-sharing Plan and a 401, you must separately calculate and withdraw an MRD from each plan. Also, MRDs for inherited IRAs must be satisfied separately from your other IRAs.

Recommended Reading: How To Rollover 401k From Empower To Fidelity

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

More People Than Ever Are Investing 401 Savings In Bitcoin

Here are seven reasons why.

Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must take.

Dont Miss: Can You Use 401k To Buy Investment Property

Recommended Reading: How Can I Transfer My 401k To An Ira