How To Enter Your Username And Password

Usernames and passwords containing letters need to be translated to numbers to enter them in a Fidelity phone system. Use your telephone keypad to convert the letters to numbers. There is no case sensitivity. Substitute an asterisk for all special characters. Here’s an example:

This illustration shows a typical telephone keypad layout. To enter a username, for example, Smith123, press 7-6-4-8-4-1-2-3.

Important Information

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

What Is Gethuman’s Relationship To Fidelity Investments

In short, the two companies are not related. GetHuman builds free tools and shares information amongst customers of companies like Fidelity Investments. For large companies that includes tools such as our GetHuman Phone, which allows you to call a company but skip the part where you wait on the line listening to their call technology music. We’ve created these shortcuts and apps to try to help customers like you navigate the messy phone menus, hold times, and confusion with customer service, especially with larger companies. And as long as you keep sharing it with your friends and loved ones, we’ll keep doing it.

Fidelity Investments Contact Info

Fidelity Representatives Are Available To Speak To You From : 00 Am To : 00 Pm Et Monday To Friday

Due to high call volumes, you may experience longer than anticipated wait times.

Send us a message at .

Please note that email is not a secure form of communication and should be used only for general inquiries and information about products and services. Do not send trading instructions, account changes or any personal information by email. To protect your privacy, Fidelity will not accept this type of information sent by email. Please contact a Fidelity representative by phone with any specific account instructions.

You May Like: How Do I Take Out My 401k

Protecting What’s Most Important

Weve grown from a small mutual auto insurance company, owned by policyholders who spent their days farming in Ohio, to one of the largest insurance and financial services companies in the world.

Today we still answer to our members, but we protect more than just cars and Ohio farmers. Were a Fortune 100 company that offers a full range of insurance and financial services across the country. Including car, motorcycle, homeowners, pet, farm, life and commercial insurance. As well as annuities, mutual funds, retirement plans and specialty health services.

Weve served generations. Protecting whats most important. Let us do the same for you.

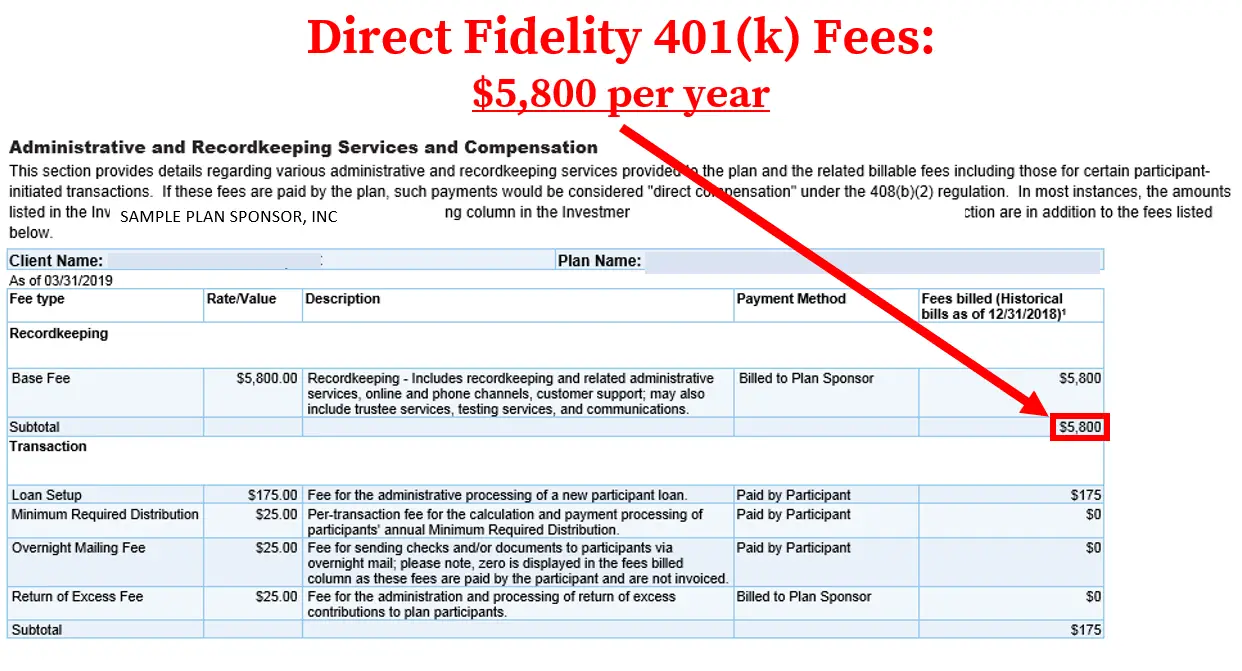

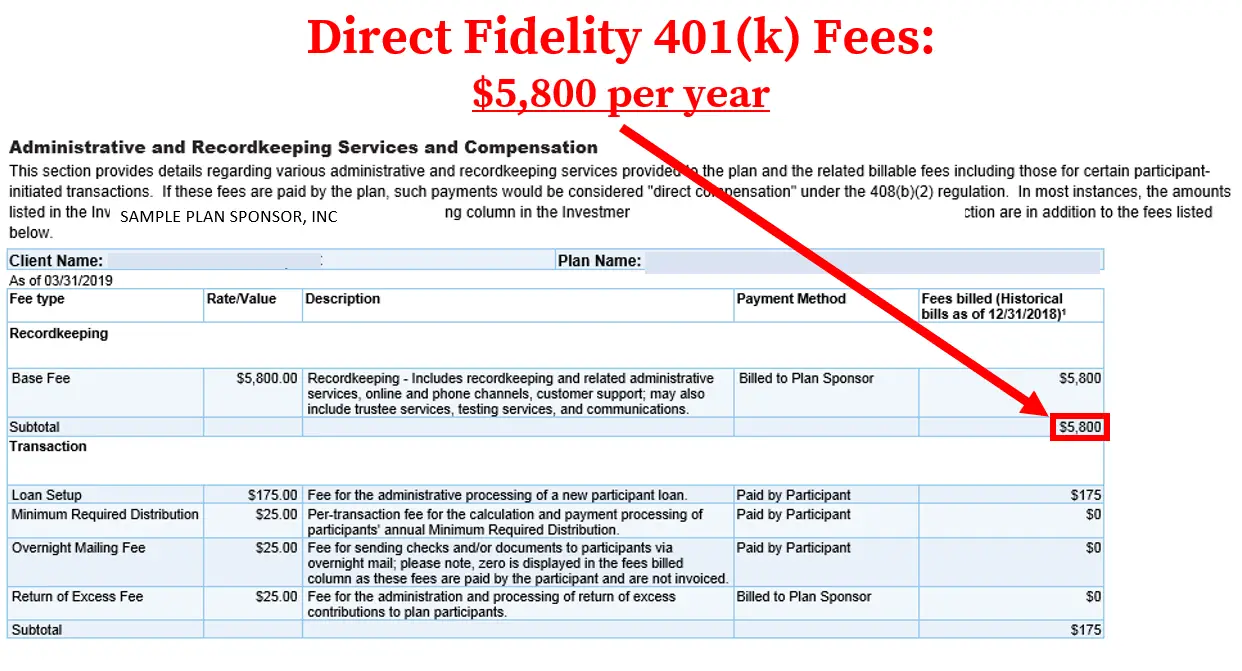

Where Can I Find My Fidelity 401k Fees

Whether due to my own ineptitude, or through deliberate camouflaging on Fidelitys part, I could not for the life of me figure out what these additional fees were. The info that I sought is information that your 401 provider must supply youyet I could not locate and account for these mysterious fees. A few days after giving up on Fidelitys website, I happened to receive an email with Fidelitys annual prospectus disclosure and viola, a CTRL F later and I finally uncovered the fees that were eating up nearly one percent of my account on an annual basis. You can find this required disclosure information under the Plan Information and Documents tab on your account.

Assuming Im not the only one who sucks at navigating an unfamiliar financial services website, I wanted to spell out those fees in somewhat plain English. For those who dont have a 401k plan through Fidelity, this information should still prove somewhat valuable, as it allows you to compare the fees in your own plan to another provider. I had a next-to-impossible time finding my own 401k providers fees, never mind search for those of competing plans.

Now, lets take a look at the Fidelity 401k fees that Im paying.

Also Check: How To Transfer 401k Accounts

Also Check: How Much Should I Put In My 401k Per Paycheck

Why Did Gethuman Write How Do I Find My Fidelity Investments Account And Routing Numbers

After thousands of Fidelity Investments customers came to GetHuman in search of an answer to this problem , we decided it was time to publish instructions. So we put together How Do I Find My Fidelity Investments Account and Routing Numbers? to try to help. It takes time to get through these steps according to other users, including time spent working through each step and contacting Fidelity Investments if necessary. Best of luck and please let us know if you successfully resolve your issue with guidance from this page.

Dont Miss: Where Can I Find My 401k Balance

What To Do With A Lost Retirement Account When You Find It

Once youve found a lost retirement account, what you do with it depends on what type of plan it is and where its located.

Old 401k balances can be rolled into your current employers plan or rolled into an IRA in a trustee-to-trustee transfer. You can also request a payout of the plan balance, but if you are under the age of 59.5, the payout will be subject to income taxes and a 10% penalty for early withdrawal.

If you find an old pension through the PBGC, youll have to go through a process to verify your identity. Once the PBGC has established that you are owed the benefits, you can apply for them at any time once youve reached retirement age.

Its not uncommon for former employees to leave funds in a former employers retirement plan, believing theyll get around to dealing with it later. Years pass by, and maybe youve forgotten about a few old accounts. Even if they didnt amount to much at the time, a few hundred dollars here and there combined with some market growth over the years just might add up to a nice addition to your retirement savings. Its worth a look!

Also Check: How Do I Transfer My 401k To A Roth Ira

Don’t Miss: How Old Do You Have To Be To Get 401k

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the âCalculateâ or âRecalculateâ button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

Also Check: When Leaving A Company What To Do With 401k

What Is A Routing Number

Youll find your bank routing number on the lower left-hand corner of your checks, right next to your account number. The first two digits in the routing numbers represent one of 12 Federal Reserve Bank districts the bank is located in. The next two digits are the Federal Reserve Bank district branch that covers your bank.

Bank Regionally, Get Perks: Fidelity Savings Account Review

You May Like: How To Find Old 401k Contributions

What Is My Fidelity Netbenefits 401k Account Number

Your account number is located on the first page of your statement, directly above Your Account Value.

How do I contact Fidelity NetBenefits? Call 800-343-0860 for questions on user name and password, and service-related transactions. Take control of your account through Fidelity NetBenefits with access to account balances, educational tools and resources.

How do I get my 401k from Fidelity?

Did This Answer Your Question

We’re sorry – tell us how we can improve it.

Please remember that past performance is not necessarily a guide to future performance, the performance of investments is not guaranteed, and the value of your investments can go down as well as up, so you may get back less than you invest. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. This website does not contain any personal recommendations for a particular course of action, service or product. You should regularly review your investment objectives and choices and, if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser. Before opening an account, please read the Doing Business with Fidelity document which incorporates our client terms. Prior to investing into a fund, please read the relevant key information document which contains important information about the fund.

Read Also: How Do I Find 401k From Previous Jobs

Fidelity Investments Review : Pros Cons And How It Compares

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Dont Miss: How Do I Take Money Out Of My Voya 401k

Can You Take Money Out Of A Brokerage Account

Why withdrawing money from a brokerage account can be complicated. Taking money out of a bank account is easy. The only time that taking money out of a brokerage account is as simple as it is with a bank account is if you keep a significant amount of uninvested cash in a regular brokerage account.

Recommended Reading: How To Claim 401k From Previous Employer

Start Your Transfer Online

Youll get useful tips along the way, but you can call us if you have a question.

Youll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so well ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if youre already a Vanguard client, confirm the information that weve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

Be Prepared To Print Scan And Mail Things

Oh, and possibly get them notarized as well.

TIAA-CREF allowed me to sign and scan the necessary documents, and send them back via their messaging service.

Vanguard, and the retirement plan for Ohio public employees, did not. Vanguard required a signature and that I mail the form back to them. The public employees fund, on the other hand, required that I sign and get the document notarized before either mailing or faxing it back to them.

Why is this all required? Because of the Retirement Equity Act of 1984!

That law, signed by Americas Handsome and Senile Grandpa, Ronald Reagan, was passed to keep people from screwing over their spouses. Thus, to roll over your 401, start taking withdrawals, or change beneficiaries, you have to get your spouses signature. And if youre not married, youve got to swear to your singleness in writing.

The particulars of proving that you are acting with the approval of your spouse vary from plan to plan. Some might simply require a signature others require notarization. If youre not married, some nice plan administrators might allow you to just swear to that by checking a box.

If you dont have a scanner at home , then there are several iPhone or smartphone apps that will do. .

All of this is crazy annoying, and counter to our expectation that transactions be smooth and seamless. But theres often a lot of money on the line in these transactions, and those plans dont want to be responsible for money being moved when it shouldnt be.

You May Like: How To Convert Your 401k To A Roth Ira

How Do I Download My 401k Statement

To view or print your statement, just log into www.principal.com/retirement/statements to view account information. If you have not yet set up an online account at www.principal.com, you will need to complete the following steps first: Under Account Login, select Personal as the login type and click Go.

Get Help From Customer Service

This is another simple and straightforward method anyone with the Fidelity account can use to determine their account number. Customer service can be accessed by visiting any Fidelity bank outlets near you or contacting customer care through phone call. Using the live chat feature on the website can also put you through with customer service. The banks social platform is also a good channel for those that want to get in touch with customer care through the internet without having to use the website.

When talking to customer service, you will be required to provide your full names, the phone number that was used to create the account, home address, date of birth, next of kin, and any other information that can help them identify you as the owner of the account.

You May Like: Whats The Most You Can Contribute To A 401k

Also Check: What Is 401k In Usa

I Cant Imagine A Better Financial Service

I have been a very happy Fidelity customer for 35 years. I tried the big brokerage companies that offer personal service. What did I find out? They grew rich and I barely broke even, even in booming markets. Fidelity gives me the tools and the information I need to make the best financial decisions. My money has grown exponentially so that I can withdraw funds to pay big bills and still see huge gains to my portfolio. It isnt rocket science. Research the highest yielding funds over the long and short term at the risk level you are comfortable with. Fidelitys research is sooo darn easy that I can find and print off the research in minutes. I rebalance my funds, drop the dogs, invest in some new winners. It really is that easy. Need money transferred to your bank account? Click, click, you are done. Fees are extremely low too. Need help? Call the 800 number and their very knowledgeable Representatives will assist you quickly and cheerfully. Now I am the one making the money, not my broker. I have taught all of my children to invest with Fidelity and they are light years ahead of their peers financially.

To Add Eft Using An Offline Form

If you prefer to add EFT offline, then heres what you can do.

- Download the PDF form here: Electronic Funds Transfer Authorization

- Be sure to fill out sections 1, 2, and 5, plus those sections that apply to you.

- Attach a copy of a void check, bank statement, or deposit slip

- Submit the form by following the instructions that you will find at the bottom of the form

If you want to set up EFT for a third party account , then here are the steps:

- Download the PDF form here: Electronic Funds Transfer Authorization

- Be sure you fill out sections 1, 3, and 5, plus those that apply to you.

- Attach a Medallion Signature Guarantee in part 5, or you may proceed to a Fidelity Investor Center with all involved parties present to sign documents.

- Submit the form by following the instructions at the bottom of the form

Also Check: Can Anyone Have A 401k

Could You Invest Just 2 Percent More

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even 2 percent more from your pay could make a big difference. Enter information about your current situation, your current and proposed new contribution rate, anticipated pay increases and how long the money might be invested, as well as your own assumptions about the growth rate of your investments, and see the difference for yourself*. For additional information, see How to use the Contribution Calculator.

*This calculator is intended to serve as an educational tool, not investment advice. It enables you to enter hypothetical data. The variables you choose are not meant to reflect the performance of any security or current economic conditions. The examples are intended for illustrative purposes only and are not a prediction of investment results.

Calculations are based on the values entered into the calculator and do not take into account any limits imposed by IRS or plan rules. Also, the calculations assume a steady rate of contribution for the number of years invested that is entered.

Organize And Rebalance Your Accounts

After years of neglect, your forgotten retirement accounts may not be properly balanced. This means there may be too much emphasis on one type of investment, or not enough on another.

If you plan to keep the IRA or company plan open, you may want to consider diversification, so theres the right amount in stocks, bonds, U.S. investments or international exposure thats appropriate for your investment goals and risk tolerance.

Youll need to check each account individually at first. However, if you can list them all in one place, youll see how your combined investment diversification stands up. An online tracking service can continue to monitor your accounts, possibly flagging you if you need to consider rebalancing again.

Online tracking services cant do the rebalancing for you, however youll have to go to each individual account to manage the rebalancing. And if the diversification seems off but its not time for you to rebalance, youll have to look at each individual account to determine which one may be out of balance the most.

Read Also: What Is The Best 401k Match