What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

Contribution Limits In 2021 And 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

401 plans are an excellent way to save for retirement, but because 401s are tax-advantaged, the IRS sets a contribution limit on how much you and your employer can put into your 401 per year.

Start Lower And Increase Later

If you find that you cant contribute as much as you think you will need based on whats outlined above, because of your living expenses or debts, figure out what you can contribute. Start by making a budget. Separate out your necessary expenses from your discretionary expenses and see where you can decrease your discretionary spending. Based on your budget, look to contribute as much as you feel comfortable with.

You can also look to increase your contributions later on, consider doing so when you get a raise, a promotion, or on a set periodic basis. For example, you could increase your contributions by 1% each year until you reach 15% of your pay or you could increase one percent for every 4% you get in compensation increases. It’s important to start saving as early as possible.

Also Check: What Is A Roth 401k Vs 401k

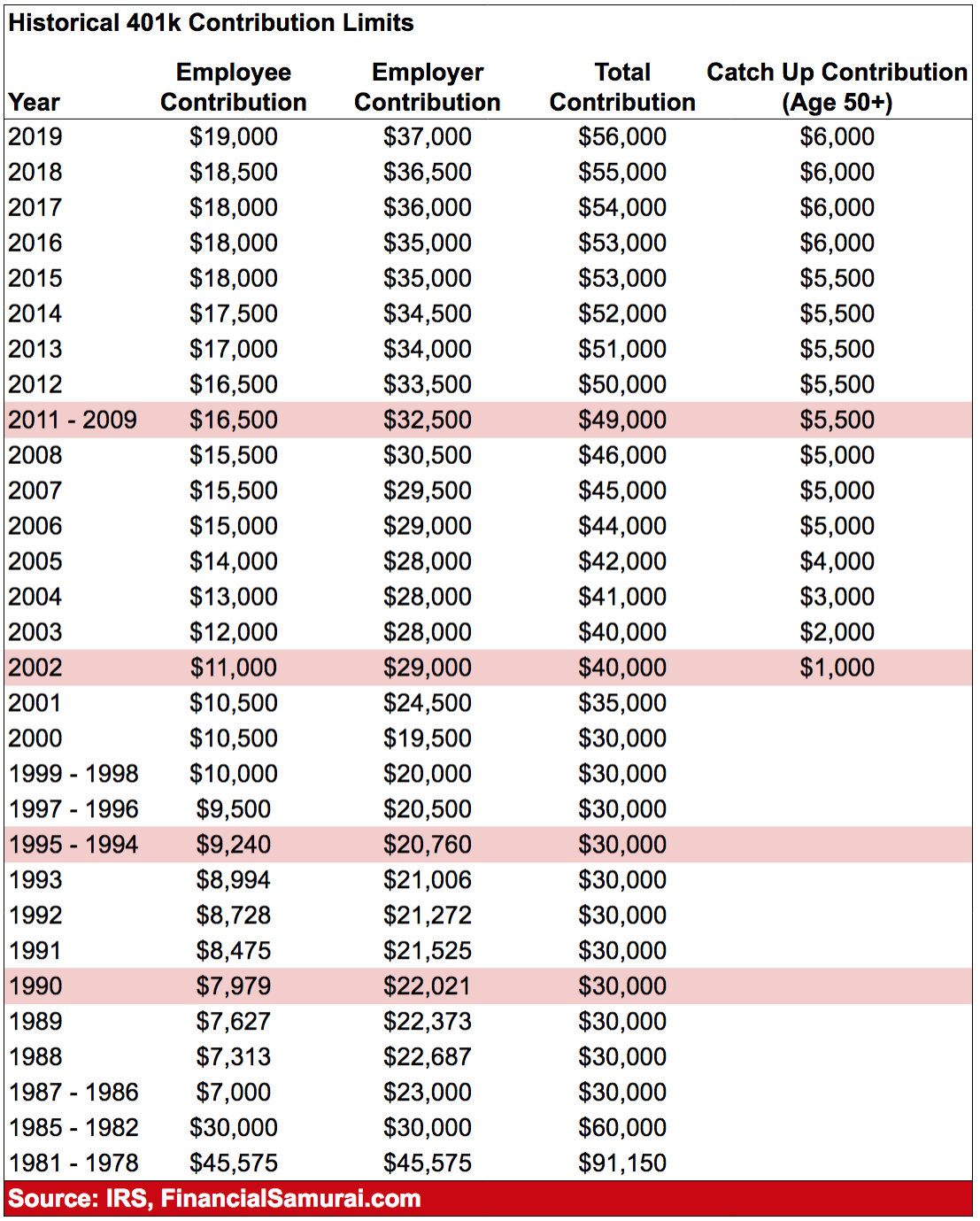

What Is The 401 Max Contribution For 2020

In November 2019, the IRS announced that the contribution limits were higher for 2020. Employees who participate in 401, 403, and most 457 plans can now contribute $19,500. Combined employer and employee contribution limits increased to $57,000. If youre over the age of 50, the limit is $6,500.

The limits increased by $500 for individuals and seniors and $1,000 for combined employer and employee contributions.

What Percent Should I Contribute To A 401

Brewer suggests that your contributions should be based on a percentage of your income, depending on your age. She recommends that you stash away between 10 percent and 15 percent of your gross income if youre in your 20s and 30s, or if you started saving during those years. If youre behind in retirement savings in your 40s and 50s, Brewer encourages you to set aside between 15 percent and 25 percent of your income.

If youre not saving anything for retirement right now and want to get started, start with at least 3 percent to get going, Brewer says. Increase your contribution by at least 2 percent each year and do a larger increase in years where you get a big raise until you hit your target savings percentage.

Don’t Miss: Can You Use 401k To Buy Stocks

Why It’s Worth Meeting The Higher 401 Contribution Limit

If you can already afford to max out your 401 account, you should take advantage of the increased contribution limit in the new year and plan on saving an additional $1,000 to make your total contribution for the year $20,500.

It’s sort of a no-brainer option, thanks to these tax breaks that come with 401 contributions:

What If You Contribute Too Much

If you discover that you contributed more to your IRA than you’re allowed, you’ll want to withdraw the amount of your overcontributionand fast. Failure to do so in a timely way could leave you liable for a 6% excise tax every year on the amount that exceeds the limit.

The penalty is waived if you withdraw the money before you file your taxes for the year in which the contribution was made. You also need to calculate what your excess contributions earned while they were in the IRA and withdraw that amount from the account, as well.

The investment gain must also be included in your gross income for the year and taxed accordingly. What’s more, if you are under 59½, you’ll owe a 10% early withdrawal penalty on that amount.

Don’t Miss: How To Opt Out Of Fidelity 401k

How Much Can I Contribute To My 401k In 2022

The maximum employee deferral for 2022 is $20,500 per person. The employee deferral is the amount the employee can contribute to their 401k plan from their paycheck.

There is also a maximum Catch-up Contribution of $6,500, which is only available to participants age 50 and over. This is the same amount as it has been since 2020, when it was increased $500 over the previous limit of $6,000, which had been in place since 2015.

2022 saw a $1,000 increase for the maximum employee deferral over the 2021 tax year. .

There was also a $3,000 increase to the Total Contribution Limit for 2022, which now comes to $61,000. The max deferred compensation includes employee contributions, matching contributions, bonuses, and other deferred compensation. .

Lets take a look at all of these numbers in more detail and discuss what they mean for investors.

Benefits Of Contributing To Your 401 Plan

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

Recommended Reading: Is Having A 401k Worth It

Where Should You Invest First Ira Or 401

Another consideration when contributing to your 401 plan is whether or not you should contribute to it at the expense of contributing to a Roth or Traditional IRA. I covered this topic in a previous article where should you invest first IRA or 401?

In general, it is best to contribute enough to maximize any employer contributions you may be eligible for, then try to max out a Roth IRA if you are eligible to contribute to one.

This ensures you are taking advantage of the free money through your employers matching contributions. It also gives you the best of both worlds when it comes to current and future taxes. Tax flexibility is an important retirement planning tool.

If your company doesnt offer 401k matching contributions, then you may consider contributing to a Roth IRA first, then contributing to your 401k if you are able to do so.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Recommended Reading: How To Calculate Employer 401k Match

Who Is Required To Contribute To A 401k Plan

SIMPLE 401 plans. As with a safe harbor 401 plan, the employer is required to make employer contributions that are fully vested. This type of 401 plan is available to employers with 100 or fewer employees who received at least $5,000 in compensation from the employer for the preceding calendar year.

Increased 2022 Hsa Contribution Limits

If youre already maxing out your 401 or other retirement contributions, consider putting pre-tax dollars toward an HSA , if you have one. An HSA helps those with high-deductible health plans save taxes on money earmarked for medical expenses not covered by the plan.

Unlike a flexible spending account , which has a use it or lose it provision, the assets you contribute to an HSA are yours for the long term and can be rolled over each year. Plus, an HSA offers a triple tax advantage: Money put in isnt taxed, it grows tax-free, and youre not taxed when you take money out to pay for qualified medical expenses.

| $7,300 |

Recommended Reading: Can I Use My 401k To Purchase A Home

If You Have Multiple Roth Accounts

The question for those who also want to have a Roth IRA: Do you meet the income limits for being permitted to contribute to one? In 2021, the income phaseout for Roth IRA contributions started at $125,000 for single filers and eligibility ended at $140,000. For those who were married filing jointly in 2021, that income threshold started at $198,000 and ended at $208,000.

In 2022, these figures went up. Income phaseout for Roth IRA contributions starts at $129,000 and ends at $144,000 for single filers. For those married filing jointly, plus qualifying widows, the income phaseout starts at $204,000 and ends at $214,000.

The 401 contribution deadline is at the end of the calendar year, whereas the deadline on IRAs is April 15 or thereabouts. In other words, for the 2021 tax year, you can contribute to your Roth IRA until April 15, 2022.

If you have both a Roth 401 plan and a Roth IRA, your total annual contribution for all accounts in 2022 has a combined limit of $26,500 contribution + $6,000 Roth IRA contribution) or $34,000 if you are 50 or older contribution + $6,500 catch-up contribution + $6,000 Roth IRA contribution + $1,000 catch-up contribution).

Roth IRA accounts have a separate annual contribution limit of $6,000, with an additional $1,000 limit for catch-up contributions if you are age 50 or over . This limit has been in place since 2019.

Contributions And Market Volatility

During a market downturn, its important to take a step back, and recognize that when saving in your 401, you are investing for the long-term. Even though you might be afraid of investing in a volatile market, its actually a very good idea to continue to contribute to your 401.

Putting money into your 401 each pay period is a natural way to dollar cost average, which is a strategy where you invest a fixed dollar amount of money at regular intervals, over a long period of time.

This means you wont invest all your money into the market when it is either at a low or a high. With dollar-cost averaging, there is no wrong decision about when to invest in the market. In fact, while the market is at a low you could actually receive a better deal on buying investments.

Of course, when the market stumbles, it can mean the economy isnt doing well, so its important to reassess the personal impact on your budget and expenses too. You should take a look at your whole financial picture to strategize how you can continue to save, and continue your regular 401 contributions to smooth out your returns over time.

Also Check: How Do I Find Out What My 401k Balance Is

Highlights Of Changes For 2020

The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan is increased from $19,000 to $19,500.

The catch-up contribution limit for employees aged 50 and over who participate in these plans is increased from $6,000 to $6,500.

The limitation regarding SIMPLE retirement accounts for 2020 is increased to $13,500, up from $13,000 for 2019.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements , to contribute to Roth IRAs and to claim the Saver’s Credit all increased for 2020.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or his or her spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. Here are the phase-out ranges for 2020:

What Are The 401 Contribution Limits For 2021 And 2022

8 Minute Read | December 17, 2021

What if you had access to the same type of investing account millionaires use to build their wealth? Youd jump on the chance, right? Well, you do! Believe it or not, millionaires dont roll the dice on flashy investment trends. Nope! More than anything else, they invest money in their humble, unflashy 401 plan at work.

Thats right! According to The National Study of Millionaires, eight out of 10 millionaires invested in their companys 401 plan. They put money into their accounts month after month, year after year, until one day they looked up and their net worth was in the seven figures. And if they can do it, you can too!

Your 401 is an easy and effective way to put thousands of dollars away each year for retirement. So if youre one of the millions of Americans with access to a 401, dont take it for granted!

But just how much can you put into your 401 in 2021 and 2022? Lets take a look.

401 Contribution Limits For 2021

|

The 401 contribution limit is $19,500. |

|

The 401 catch-up contribution limit for those age 50 and older is $6,500. |

|

The limit for employer and employee contributions combined is $58,000. |

|

The 401 compensation limit is $290,000.1 |

401 Contribution Limits For 2022

|

The 401 contribution limit is $20,500. |

|

The 401 catch-up contribution limit for those age 50 and older is $6,500. |

|

The limit for employer and employee contributions combined is $61,000. |

|

The 401 compensation limit is $305,000.2 |

Also Check: Can You Transfer A Rollover Ira To A 401k

Whats The 401k Contribution Deadline

What is the 401k contribution deadline? The 401k contribution deadline does land at the very end of the calendar year on December 31, 2021.

However, the IRS will allow you to contribute to your IRA account right up to the tax filing deadline of the coming year that is to say, April 15, 2022 of this next year.

Max 401 Contribution Limits

A 401 is a common type of retirement account in which you contribute savings that come out of your paycheck before you pay income tax. Most commonly, employers sponsor an employees 401. However, sole proprietors, independent professionals, and other small business owners with no employees except for a spouse may qualify for a self-employed 401.

Even if youre new to investing, a 401 offered through your employer is a powerful, simple way to put money away for your retirement. And each year, participants in these plans can save up to the max 401 contribution established by the Internal Revenue Service . The IRS increased contribution limits in 2022 for 401 plans and more. Heres what you need to know.

Also Check: Does 401k Roll Over From Job To Job

Maximize Your 401k Through Fixed Contributions

If your company allows contributions of a flat dollar amount per month or per check, then simply contribute that amount from your paycheck. If you are under age 50, then you would be able to contribute up to $1,708.33 per month, or $854.16 each check if you are paid twice each month.

If you are age 50 or over, you can contribute up to $2,250 per month, or $1,125 per check if you are paid twice per month.

Remember, those are the numbers to max out your contributions. You can contribute less than that amount if that is what works with your budget.

How To Get Money Out Of Your 401

Your 401 money is meant for retirement. It’s not easy to take money out while you’re still working, without incurring a steep financial loss. The account is structured that way on purpose you let the money grow for your future use.

There are certain circumstances under which you can take funds out of your 401 without paying any penalty. You’ll still need to pay income taxes on the money, since it most likely went into your account on a pre-tax basis.

You can start taking withdrawals once you reach 59 1/2 years of age. You can also take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday. This is known as the IRS Rule of 55.

Read Also: Do Employers Match Roth 401k

Tips For Saving For Retirement

- Industry experts say that people who work with a financial advisor are twice as likely to be on track to meet their retirement goals. A financial advisor can help you understand retirement and all of its moving parts. SmartAssets free tool connects you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors, get started now.

- Maximize your employers 401 match, if one is offered. As illustrated by SmartAssets 401 calculator, employer contributions can seriously boost the value of your 401 over time. For instance, if your employer will match 50% of employee contributions up to 5% of your salary, you could snag $1,250 in employer contributions if you contribute $2,500 and earn $50,000 a year.

- Consider your options. As indicated by the many contribution limits, you have numerous choices when it comes to saving for retirement. Do your research to make sure youre making the best choice for your needs. Heres a breakdown of IRAs vs. 401s.

- If youre over the age of 50, take advantage of catch-up contributions. Catch-up contributions are a great way to boost your savings, whether you got a late start or havent saved as much as youd hoped. Use SmartAssets retirement calculator to ensure youre saving enough to retire comfortably.