A Wide Array Of Unbiased Investment Choices

Making the best possible investment decisions for your plan is critical to its success. Whether your advisor is providing investment advisory services or you are considering hiring a third party for this support, ADP offers two distinct options for selecting investments:

- Our open-fund architecture provides access to over 13,000 nonproprietary investment options from 300+ investment managers. You and your advisor can compare and evaluate funds to find the right candidates for consideration.

- Our screened investment tiers put simplicity at the forefront by offering fund tiers that have been evaluated and are organized based on ADPs underwriting criteria.2

In both options, as an independent record keeper, ADP is able to provide investment options without any bias or agenda.

A separate, indirect subsidiary of ADP, Inc., ADP Strategic Plan Services, LLC provides fiduciary investment management services. including the analysis, selection, monitoring, and if necessary, replacement of investment options on behalf of employer-sponsored retirement plans.

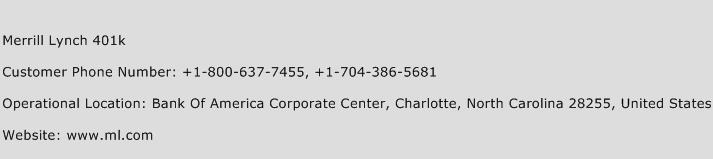

Is Merrill Lynch Going Out Of Business

However, in 2019, a decade after completing the acquisition, Bank of America announced plans to retire the brand to some extent as part of CEO Brian Moynihans one-company strategy. In 2019, Bank of America stopped using the Merrill Lynch brand for its capital markets group, investment banking, and global markets.

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Read Also: How Much Should I Have In My 401k At 60

Advantages And Disadvantages Of Doing A 401 Rollover

Weve already discussed some of the benefits of doing a 401 rollover from an old employer plan to a new one. In this section, lets focus on the advantages and disadvantages of doing a 401 rollover into an IRA.

Advantages:

- Youre an experienced investor, and would prefer to manage your own retirement assets.

- The benefits and costs of using a robo-advisor to manage your money are better than those of the current plan.

- Youre not happy with the investment options in your current plan.

- You have several 401 plans from previous employers, and you want to consolidate them into a single IRA.

- Your new employer either doesnt permit a rollover of an old 401 plan, or doesnt provide the investment options youre looking for.

Disadvantages:

- Youre satisfied with the current plan and the returns its providing.

- By moving retirement funds from a 401 plan to an IRA, youll be giving up certain protections 401 plans provide from creditors and lawsuits.

- You have an immediate need for the funds, due to disability, medical costs, or other distributions that will exempt you from the 10% early distribution penalty.

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Also Check: How To Stop Your 401k

The Process Was Dead Simple

This part really surprised me. As I thought about how to start the process, I decided to call Vanguard to see what information about my Rollover IRA I would need to give Fidelity. I already had the IRA account from a rollover six years ago, but had long forgotten the actually steps needed to get the process moving.

My call was routed to a department that does nothing but handle rollovers. The rep walked me through the process, and then offered to call Fidelity with me. So he dialed up Fidelity and did all the talking. I guess Vanguard really wanted my money!

We did hit one snag. According to the Fidelity representative, my old employer still had my status as an active employee. So I had to call my employer to get my status changed. That took a few days, and then the three of us got back on the phone to complete the rollover. It took all of five minutes.

You can check out an even more detailed description of the 401k rollover process here.

Use 711 For Telecommunications Relay Service

TRS permits persons with a hearing or speech disability to use the telephone system via a text telephone or other device to call persons with or without such disabilities. To use TRS for our contact numbers listed below, please dial 711 from your TTY device and provide the appropriate contact number from below to connect to OneAmerica through the relay center.

You May Like: How Much Can I Borrow Against My 401k

What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

What Happens If I Have A Loan In My Qrp When I Leave My Employer

If you leave your employer with outstanding plan loan amounts, explore your options including the following:

- Repay the loan. The plan may give a short period of time to repay that outstanding balance. However, if not repaid, the outstanding loan balance is generally subject to income tax and possibly a 10% additional tax for early or pre-59 1/2 distributions for younger workers.

- Bank loan. Consider whether obtaining a loan from a bank to repay your plan loan would be a good financial strategy.

- Continue plan loan payments. Check with your plan administrator to see if this is an option.

- Rollover cash to an IRA to repay some or all of a loan offset. The loan offset amount will be taxed as ordinary income and may be subject to the 10% additional tax. However, you can avoid taxes and penalty by rolling over the loan offset amount to an IRA by your individual federal tax filing deadline, including extensions, for the year the offset occurred.

- Roll loan to new plan. If you are currently working for an employer that offers a QRP that provides for both rollovers and plan loans, investigate the possibility of rolling your loan into your new plan.

Don’t Miss: When Can You Use Your 401k

Seamless Payroll Integration With Smartsync

For companies using ADP payroll and HR solutions like RUN Powered by ADP® and ADP Workforce Now®, SMARTSync is an efficient way to connect ADPs payroll and 401 plan record-keeping systems. In a recent survey, ADP customers reported real benefits:

- 86% saw time savings5 by greatly reducing manual data entry requirements

- A majority claimed reduced compliance concerns6 due to preset programming that manages tasks and checks for errors

Get started

Get pricing specific to your business.

Transferring Dividend Stocks From Td Ameritrade To Fidelity

My retirement accounts are now completely transferred from Vanguard to Fidelity. But I still have additional taxable accounts with TD Ameritrade and the no-fee broker, M1 Finance. These two accounts are the focus of my .

At this stage, I am planning to transfer the TD Ameritrade account to Fidelity when Im ready.

My TD Ameritrade dividend growth portfolio has also grown to a six-figure account. But Im not an active trader. I buy stocks and collect dividends. Then I reinvest the dividends into more dividend-paying stocks. Ive almost always been happy with them.

I dont need a fancy trading platform. My priority now is to simplify my life a bit. Fidelity is an equally capable online brokerage for my needs, so it makes sense to move my money there.

Fidelity charges $4.95 per stock trade while TD Ameritrade charges $6.95 is now commission-free as of October 2019!

The only hesitation I have is the cost basis data on record at TD Ameritrade. When I transferred my decades-old DRIPs , I had to update the cost basis from my records. Since these were DRIPs, there were dozens of transactions for each.

Im afraid that when I transfer my holdings, the cost basis will not be transferred correctly or at all. Ive seen this screwed up many times. I will back up my cost basis very carefully in case I have to resubmit the data.

Read Also: Can You Take Out Your 401k To Buy A House

Also Check: Should I Borrow From My 401k

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

The Opm Has Many Digital And Analogue Ways Of Being Contacted Making Sure That They Are As Easy To Contact As You Need

The Office of Personnel Management is a wing of the US government that controls the civilian service. The agency coordinates healthcare, life insurance and retirement benefits for federal government employees, retirees and their dependents.

The OPM has a multitude of ways it can be contacted if you are having problems.

Don’t Miss: Does Vanguard Have 401k Plans

Contact Your Old 401 Provider

First, identify the provider of your old 401. If you arenât sure who your old 401 provider is, the name should be on your account statements. If you have trouble finding this information, call your former employer.

Is your old 401 with Fidelity? If so, you can do the entire rollover through your NetBenefits®. account. You donât need any additional paperwork, and the money can be directly transferred.

Is your old 401 with a different provider? If so, they will need to start the rollover process, so youâll need to either call them or initiate the process online. They may need some paperwork, such as a Letter of Acceptance from Fidelity, or their own paperwork completed and signed by you or a Fidelity representative. If you have multiple accounts or employers, you may need more than one LOA.

Here are some questions to ask when you contact them. If youâd like to have a Fidelity rollover specialist on the line with you when you call, call us first at 800-343-3548.

Covington, KY 41015-0037

Do you own company stock?

If you have shares of company stock, itâs easiest to give us a call at 800-343-3548 and one of our rollover specialists can help you understand your options and take action.

October 22, 2019Keywords: 401k, Fidelity, IRA, rollover, Schwab

You need to find out from the receiving IRA custodian how they want the check made out to. I was rolling over to an IRA at Fidelity. Fidelity says on their website:

Say No To Management Fees

Initiate Your Rollover With Empower

Youre making great progress. Youve confirmed key details about your 401 plan and you have an IRA to transfer your money into. The next step is to initiate your rollover with Empower. Empower has two methods for requesting a rollover to another institution:

You May Like: What Age Can I Withdraw From 401k

Ways You Can Contact The Opm

A help request

On the OPM website there is a section where you can choose a topic and write about your issue. The OPM says it will usually take 3 to 5 business days to send a response.

The link can be found here.

You can call the OPM if you can’t find an answer to your question on OPM.gov or if you can’t sign in to OPM Retirement Services Online.

The phone number is: 1-888-767-6728.

There are only certain hours the OPM can be reached.

- Monday – Friday: 7.40 a.m. to 5.00 p.m. ET

- Not open on weekends or federal holidays

Writing a letter

Included in the letter must be:

- First and last name,

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Top 5 distribution option questions about qualified employer sponsored retirement plans , such as 401, 403, or governmental 457.

Recommended Reading: Is It Better To Have A 401k Or Ira

Contact Your 401 Provider

Youre making great progress. You know where your 401 is and you have an IRA at Fidelity to transfer your money into. The next step is to initiate your rollover by contacting your 401 provider.

Often, the easiest way to do this is by phone. Your 401 providers phone number should be visible on an old account statement.

In order for your call to go smoothly, follow these tips:

Employer Frequently Asked Questions About The Nc 401 Plan Nc 457 Plan And Nc 403 Program

The North Carolina Supplemental Retirement Plans consist of the NC 401 Plan , the NC 457 Plan , and the NC 403 Program .

The NC 401 Plan is a tax-qualified, defined contribution plan under Section 401 of the Internal Revenue Code. The NC 457 Plan is an eligible defined contribution plan under Section 457 of the Internal Revenue Code. The NC 401 Plan and the NC 457 Plan are single plans that are sponsored by the State of North Carolina and that have multiple participating employers. The NC 403 Program allows school districts and community colleges, as 403 plan sponsors, to utilize the investments and recordkeeping services offered by the program. The NC 401 and NC 457 Plans and the NC 403 Program are administered by the Department of State Treasurer and the Supplemental Retirement Board of Trustees.

To compare the plans, please refer to the Plan Comparison Chart and the summaries of the NC 401 Plan,NC 457 Plan, and NC 403 Program.

If you have questions about the plans, you can:

- Contact your Retirement Education Counselor or

- Email Prudential Retirement at or

As a participating employer in the NC 401 Plan, NC 457 Plan, and/or NC 403 Program, your responsibilities include:

Read Also: When You Quit Your Job What Happens To Your 401k