Outlook For The Stock Market Looks A Tad Rocky

After a 10+ year sustained bull market, the market is strong, but inflation has investors worried.

Retired investors could face difficulties if a market correction occurs, even though the losses are likely to be temporary.

As such, there may be an increased demand for investments that offer less risk or downside protection like bonds, lifetime annuities, real asset funds and more

Average Retirement Income And The Risk Of Running Out Of Money

The Boston College Center for Retirement Research publishes the National Retirement Risk Index . It measures the share of American households that are at risk of being unable to maintain their pre-retirement standard of living in retirement. The index is updated each year.

According to their most recent analysis, the percentage of retirees in 2021 who are at risk of not having enough is about 50%.

The most recent analysis uses data from 2019, but because the economy has changed dramatically over the last year, the researchers have attempted to determine the impacts of job losses and also growth in the financial and housing markets.

Their conclusion? The bottom line is that half of todays households will not have enough retirement income to maintain their pre-retirement standard of living, even if they work to age 65 and annuitize all their financial assets, including the receipts from a reverse mortgage on their homes.

Jump down to see average projected retirement income numbers for 2022. Or, use the NewRetirement Planner to calculate your own retirement income, assess if it is enough, and learn about moves to make now so you can feel great about your financial future.

Guaranteed Income For Life May Not Be As Good As It Seems

One fairly popular option is to use the money to purchase an annuity, which basically means you’ll receive a steady stream of income for the rest of your life in exchange for a large payment now.

Obviously, the upside to this is that you’ll have a steady “paycheck” for as long as you live, and there is zero chance that you will outlive your money. There are several options when choosing annuities, including options that guarantee payments to your spouse or heirs if you die before a certain time. Here’s a primer on annuities to help you get started if you want more information.

The major downside to an annuity is inflation. In other words, the payments you receive from the annuity will be worth less and less as time goes on. For example, if you buy an annuity that pays you $2,000 a month and the inflation rate averages 2%, those checks will have just $1,336 in purchasing power 20 years from now. You can find annuities with payments that increase over time, but this will cut down your initial income significantly.

You May Like: Can I Invest My 401k In Gold

Scenario : Monthly Pension

If you receive distributions as a monthly pension, you should check about the status of a tax treaty between the US and your home country. In most cases, you will only have to pay taxes in the country where you are a resident. If you have moved back to India, for instance, you only have to pay taxes in India when you receive your monthly 401 pension. However, you may still be required to file US tax returns. If there is no treaty between the US and your home country, the brokerage has to withhold 30% from the monthly distributions.

Since taxation rules and requirements differ from one country to another, it would be best to consult a tax advisor like MYRA prior to your move to help you create a strategy.

Related Article: When Is It Ok To Withdraw Money Early From Your 401?

Average Retirement Income 2022 By Household Age Incomes Drop Dramatically For The Oldest Surveyed

Both the mean and median retirement income numbers above might seem above average relatively healthy. However, these numbers dont tell the whole story. Nor do they reflect the retirement crisis that is so often reported.

And, there is a reason. Those numbers dont show the reality of all retirees especially those who are older.

You see, for most people, retirement income falls dramatically as you age. The median household income for households older than 75 is just over half that of the income for households ages 6064!

Compare the median income by age range:

| Age of Household | ||

|---|---|---|

| Households Aged 75 and Older: | $36,925 | $57,550 |

SOURCE: Data is summarized from the US Census Bureaus Current Population Survey Annual Social and Economic Supplement. The CPS is a joint effort between the Bureau of Labor Statistics and the Census Bureau.

You May Like: Can I Withdraw From My 401k To Buy A House

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you won’t run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

Option : Cash Out Your 401

When you leave your employer and return to your home country, you can also cash out your 401. But if you do are not 59 ½, the withdrawal will be taxable and you may be subject to a 10% early withdrawal penalty on the distribution.

Between all three options, we recommend that individuals returning to their home countries pursue Options 1 or 2: leave their 401s with their former employer or do a rollover to an IRA.

Related Article: Beware The Exit Tax. Giving Up Your Green Card Can Be Costly

Don’t Miss: How To Locate Lost 401k

Why Doesn’t 401 Income Affect Social Security

Your Social Security benefits are determined by the amount of money you earned during your working yearsyears in which you paid into the system via Social Security taxes. Since contributions to your 401 are made with compensation received from employment by a U.S. company, you have already paid Social Security taxes on those dollars.

But waitweren’t your contributions to your 401 account made with pre-tax dollars? Yes, but this tax shelter feature only applies to federal and state income tax, not Social Security. You still pay Social Security taxes on the full amount of your compensation, up to a pre-determined annual limit established by the IRS, in the year you earned it. This limit is typically increased yearly and is currently capped at $142,800 for 2021 and will increase to $147,000 in 2022.

“Contributions to a 401 are subject to Social Security and Medicare taxes, but are not subject to income taxes unless you are making a Roth contribution,” notes , founder and president of Index Fund Advisors Inc. in Irvine, CA, and author of Index Funds: The 12-Step Recovery Program for Active Investors.

In a nutshell, this is why you owe income tax on 401 distributions when you take them, but not any Social Security tax. And the amount of your Social Security benefit is not affected by your 401 taxable income.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Is Max Amount You Can Put In 401k

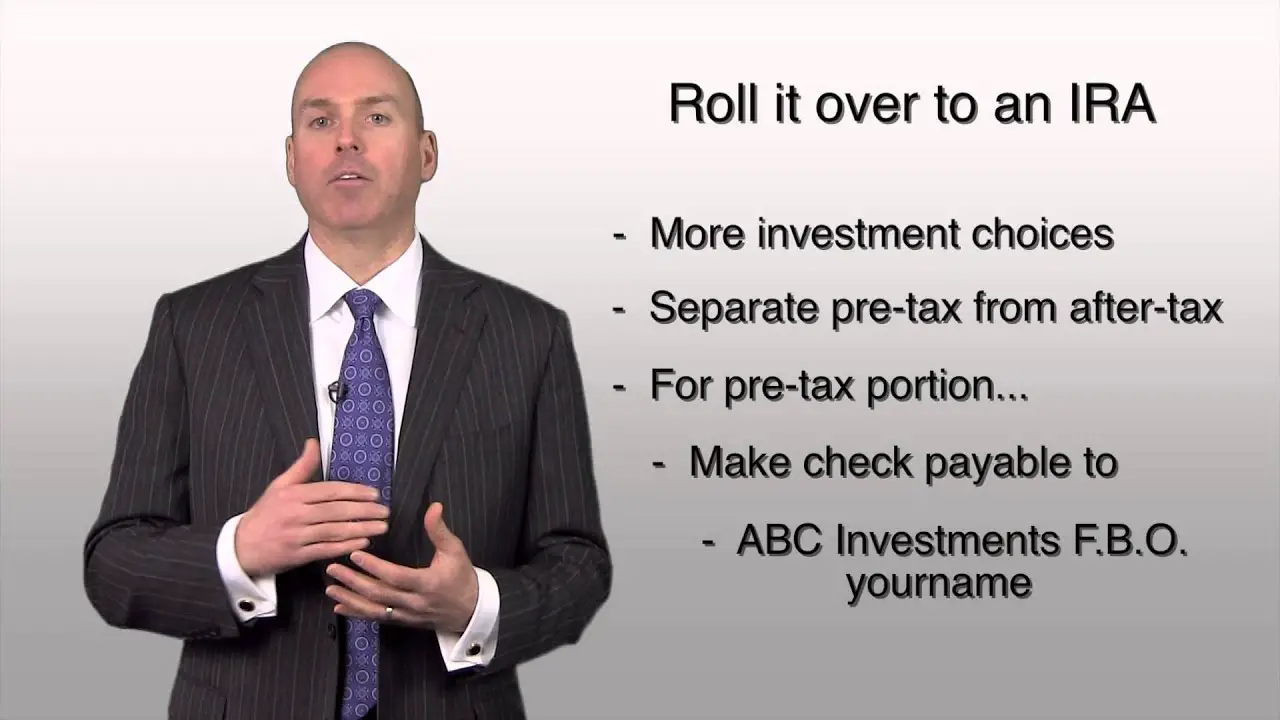

Rolling Over Your 401

Rolling over your 401 into an IRA is a great option because it can give you access to a wider world of investments. Keep in mind that if you have a traditional 401, it can only be rolled into a traditional IRA, and you can only roll a Roth 401 into a Roth IRA.

Employer-sponsored retirement plans like the 401 often only give participants access to a handful of mutual funds and may have high fees. But rolling your 401 into an IRA means having access to individual stocks, bonds, and thousands of mutual funds and exchange-traded funds with potentially lower fees.

If the mutual funds available in your 401 plan work for you, there’s no need to roll over. But if your investment options don’t meet your needs, it may be worth the switch.

Rolling your old 401 into an IRA gives you more control over the investments and fees.

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Don’t Miss: How Does A Solo 401k Plan Work

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will trigger a lump-sum distribution, but most people nearing retirement will have more substantial savings accrued.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

You May Like: How Do I Take Out My 401k

How To Increase Your Social Security Income

What is the best way to get more Social Security income? Here are 2 tips:

Postpone the Start: Postpone collecting your benefits until at least full retirement age or longer to get the maximum monthly payment. Delaying the start of Social Security can mean a BIG boost to your overall retirement wealth.

And, more and more retirees are getting the message. It used to be that the most popular age to start benefits was 62. However, now the most popular age for men to start benefits is 66 with 36% starting benefits at that age, followed closely by age 62 with 27% starting at this early age. The most popular age for women to start is a tie. Thirty-one percent of women start at 62 and another 31% start at 66.

Plan for Your Spouses Income, Not Just Your Own: If you are married, it is probably a good idea for the higher earning spouse to defer the start of benefits for as long as possible. As you saw above, retirement income for people living on their own is extremely low.

You can help mitigate that problem with the right claiming strategy. Learn more about smart strategies for Social Security if you are married.

If Youre Thinking Of Quitting Your Job

Timing is important here. If your company offers matching contributions, dont walk away and leave that money on the table. Check your plans vesting schedule to see whether working longer will let you vest more in your employer contributions. Also, find out when matching contributions are deposited into your account. Some companies make the deposit every pay period some only once a year. If you leave before that years contribution is made, youll lose it. *

You May Like: What Happens To 401k When You Leave Your Job

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but there can be serious tax consequences.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Reasons To Leave Your 401 With Your Company

Here are five reasons to consider leaving your 401 with your company as 22 percent of 401 owners did when exiting, according to an Ameritrade survey rather than moving it to a Rollover IRA when you retire:

1. You can pay lower fees Large companies with hundreds or thousands of employees use their sheer size to negotiate lower fees for their 401 plans. Employees then get to take advantage of fees that are lower than what theyd probably never get investing on their own in an IRA.

One of the benefits of staying inside the 401 plan is they have a better fee structure, more competitive pricing and oversight, says Houston. You have an employer working with an adviser picking investment options and providing monitoring.

2. You can avoid an early-withdrawal penalty If you are 55 years or older, left your previous company after reaching age 55 and need to take a withdrawal from your 401, then it is best to keep the money in the 401, says Zaneilia Harris, president of Harris & Harris Wealth Management Group in Upper Marlboro, Md. You can take an early-access distribution without the 10 percent penalty that you would be subjected to if you roll the funds into an IRA. That penalty ends at age 59½ for IRA.

4. You can stay with the investments you know and prefer Your company 401 may have proprietary investments or mutual funds that you like, are familiar with and might not be available elsewhere.

Read Also: Should You Roll Your 401k Into An Ira

Retirement Income For 2022 Is Only Part Of The Equation

Knowing about average retirement income for 2022 is interesting and one way to benchmark your financial health.

However, knowing your own projected retirement income from now throughout retirement and also calculating your future spending is the key to a secure retirement.

The NewRetirement Retirement Planner isnt a magic 8-ball , but it can give you very personalized and detailed answers and forecasts for your retirement income and spending.

Review Different Retirement Income Strategies

You need to consider where your monthly retirement income will come from and how much of it will come from your savings. This income should exceed your expenses, so youll need to account for those too. Consider your housing, transportation, health care, food, travel, entertainment, and personal expenses.

You can also factor in Social Security. The Social Security Administration offers a free retirement benefits calculator you can use to estimate your benefits based on your past earnings.

Keep in mind that you can delay your Social Security benefits. You can start receiving them at age 62 until age 72, and the monthly benefit rises for each month you delay. This means those who wait until age 70 can collect the highest monthly Social Security payout possible.

Also Check: How Do You Know If You Have An Old 401k