Youve Saved Diligently In Your 401 And You Wouldnt Mind Tapping Into It But Youre Not Age 59 Yet So You Could Have To Pay The Irs A 10% Penalty On Your Withdrawal There Are Exceptions To That Rule Though Here Are 10 Of Them

Retirement is something each of us must plan for. Not surprisingly, you want to make sure youll have enough income to last throughout your lifetime. Theoretically, if you plan well, you could even retire early. Perhaps youve sold your business for a profit, maximized your retirement account contributions, invested in non-qualified accounts, and own multiple rental properties.

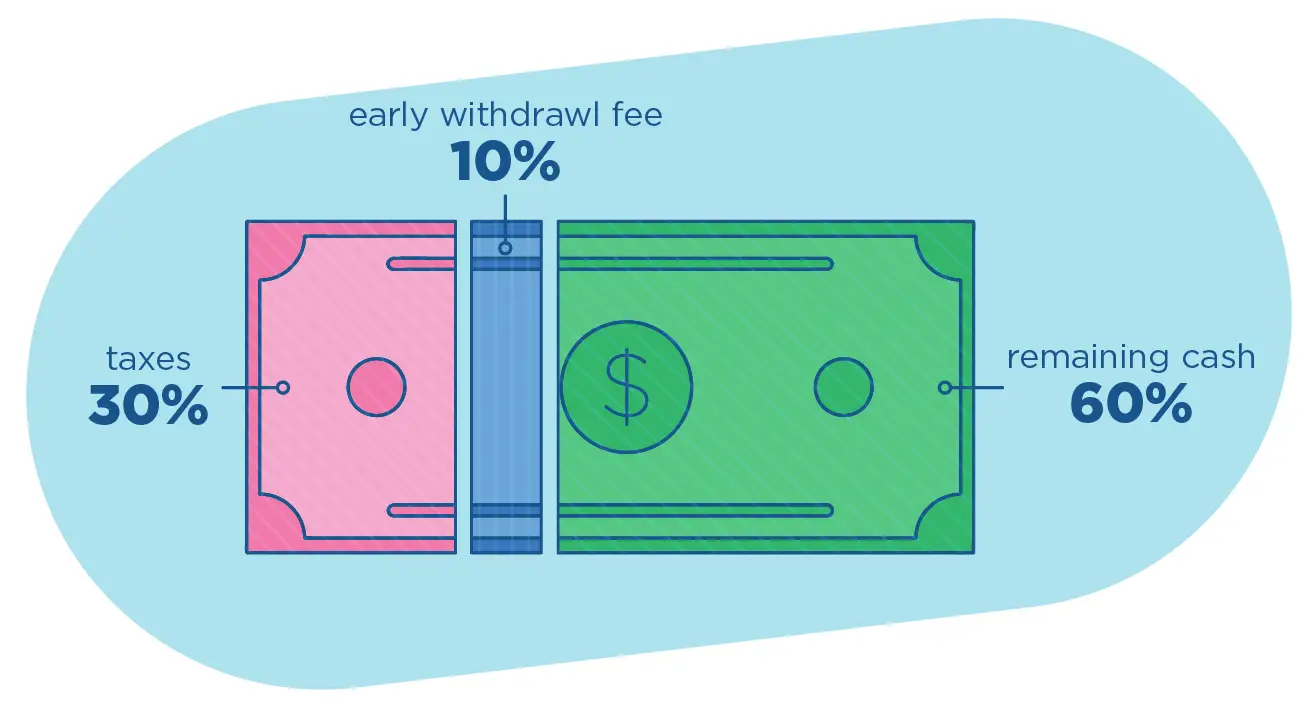

In such a perfect scenario, you could take a blended distribution from various accounts and investments, allowing your money to continue to grow in tax-sensitive ways. On the other hand, taking distributions from your retirement accounts before age 59½ could cause you to owe the IRS a 10% early distribution penalty. However, there are a few conditions in which the government will waive that 10% early retirement penalty.

Before I continue, Id like to make one thing clear. The purpose of this article is to inform you of ways you might be able to avoid the 10% income tax penalty. If you take money from your qualified retirement accounts early, you will still pay ordinary income taxes on that money. You cannot avoid that.

With that out of the way, lets take a look at some of the ways you might be able to avoid the early retirement penalty.

Why People Want To Retire Early

You would think the reason why people want to retire early would be obvious: the desire for freedom. However, life is much more complicated than wanting to do what you want, whenever you want.

The below reasons why people want to retire early might sting, but thy are the truth. It is the dark side to early retirement.

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

You May Like: How To Create A 401k

Does A Federal Pension Run Out

While its virtually impossible for a federal or postal retiree to run out of money, its possible to get dangerously low even with an annuity indexed in whole or in part to inflation. And retired FBI has not run out of money. Even with COLAs, and especially the diet COLA, they can be short on money.

How long does a federal pension last?

After retirement you are entitled to a monthly annuity for life. If you leave federal service before reaching full retirement age and have a minimum of 5 years of FERS service, you may choose to retire on a deferred basis.

Do pensions last for life?

Retirement benefits are made for the rest of your life, regardless of how long you live, and may be continued with your spouse after death. It is not uncommon for people to take a lump sum to survive payment, while pension payments continue until death.

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Also Check: Should I Convert My 401k To A Roth Ira

No : Roth Ira Qualified Education Expense Withdrawals

Last but not least, you can pull money from your Roth IRA to pay for qualified education expenses for yourself or your dependents. As I stated in method No. 9, you can always pull your contributions out. However, in this case, you can also pull your earnings out early and penalty-free if you follow the rules.

If youre blessed enough to be able to retire early, thats fantastic! But make sure you let your pre-planning work for you. You obviously want to have enough income to last throughout your retirement, but you also need protection from events as they happen in your life. Whether you need to cover unexpected medical bills or send your children to college without racking up mountains of student debt, know your options.

While you cant avoid paying ordinary income taxes on early retirement account withdrawals, there may be ways you could avoid paying the 10% penalty. Speak to your financial adviser to determine if any of these methods are right for your unique situation.

How To Withdraw From A 401 At Age 55

Under the right circumstances, you can withdraw from a 401 at age 55 . If you retire, quit or get fired between age 55 and 59, you can withdraw without penalty from your 401. See IRS Publication 575

The tax doesnt apply to distributions that are: From a qualified retirement plan after your separation from service in or after the year you reached age 55

What is separation from service? Heres how the IRS defines it:

To meet the requirements for the first exception in the list above, you must have separated from service in or after the year in which you reach age 55 . You cant separate from service before that year, wait until you are age 55 , and take a distribution.

If you leave your job before age 55 you cant take a distribution without paying the 10% penalty. If you wait until after you turn 55 you can take a distribution without paying the 10% penalty.

See page 34 of the publication.

There are several important points to know about the Rule of 55.

Don’t Miss: Can You Have More Than One 401k

Your Age And 401 Early Retirement Withdrawals

Early retirement cant begin soon enough for some. Of course, setting up a 401 retirement plan should result in financial independence at an advanced age.

What happens, though, if you end up retiring early? Would you be able to enjoy your retirement benefits?

Often, 401 early retirement questions come to mind for would-be retirees. This is if they plan on retiring earlier than the average person.

This article talks about the penalties and taxes and the methods you can implement to use funds from your assets before the mandated retirement age.

Leave Your Assets Where They Are

If the plan allows, you can leave the assets in your former employers 401 plan, where they can continue to benefit from any tax-advantaged growth. Find out if you must maintain a minimum balance, and understand the plans fees, investment options, and other provisions, especially if you may need to access these funds at a later time.

You May Like: What Is 401k In Usa

What Are The 401k Spouse And Non

- When a spouse inherits a 401k plan, they cannot withdraw less than the required minimum distributions. But they can choose to withdraw more than the required minimum distributions.

- A spouse can choose to roll over the funds in the inherited 401k plan to an inherited IRA plan. Distributions are based on your life expectancy and you can choose to withdraw more the required minimum distributions, but you cannot withdraw less.

For a non-spouse beneficiary, rolling over inherited 401k plan funds into their own IRA account is not allowed. The beneficiary needs to create an inherited IRA account, which has to be separate from their other retirement accounts.

- A spouse who has inherited a 401k plan is expected to have withdrawn all the money in the account within 5 years after their spouses death. You have the option of taking out a lump-sum distribution or the required minimum contributions.

Careful Who You Listen To About Early Retirement

The dark side of early retirement is real.

Early retirees will croon about how great their lifestyles are. In some ways they are spot on. But notice how they seldom write about the hardships they face.

They cant, because its important they continue highlighting how awesome everything is, to justify their decision to no longer work.

The louder you have to brag about how great your early retirement lifestyle is, the less great it probably is. Just like how confident people dont brag about their achievements, people who are busy living great lives arent telling the world about how great their lives really are.

Can you imagine spending 16 years going to school only to work for 10 years? Some would surely say thats a waste, would they not?

Perhaps the worst that could happen is some aspiring scientist, musician, lawyer, or teacher decides to give up their careers because they believe traveling around the world on a shoe-string budget is so glamorous.

Years later, they realize their fingers dont remember the notes anymore and the chemical formulas are one big haze. Maybe they would have made it as a concert pianist, or helped discover the cure for seasonal allergies, ACHOO!

What a shame they never reached their full potential. Perhaps this is the real dark side of early retirement.

Related: If I Could Retire Again Here Are The Things Id Do Differently

Also Check: How Can I Check My 401k Online

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Also Check: Is 401k Required By Law In California

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Start Making Qualified Distributions

If you meet the age requirement, you can begin making qualified distributions from your former employers 401k plan. While you wont be assessed a 10% penalty on these distributions, you will have to pay income taxes at your current ordinary income tax rate if the distributions are made from a traditional 401k.

You May Like: How To Find Out If I Have Any 401k

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choices: Leave your money in the plan until you reach the age of required minimum distributions convert the account into an individual retirement account or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

Life Throws You A Curveball And You End Up Leaving The Workforce Earlier Than Planned Heres What To Do Next

Drew Parker retired at 55 after his employer restructured and offered him a buyout

Early in his career, Drew Parkers goal was to retire at age 57or at least be financially prepared to quit working by then. But three years ago, at age 55, his retirement came sooner than expected when his employer, Nordstrom, restructured and offered him a buyout.

Parker, of Mercer Island, Wash., says he took the buyout because he believed it might be the last time the retailer offered severance packages with job cuts. He left Nordstrom, where he had worked for 16 years, with about six months salary and hunted for another job.

I gave it a good effort, but I got almost no responses, says Parker, who had been a merchandise financial manager, working with Nordstroms buyers. In this area, the competition is tough, and at my age, it was much tougher.

Like Parker, many older workers find themselves suddenly retiredsometimes years ahead of their target date. According to a 2018 survey by the Employee Benefit Research Institute, nearly one-third of workers predict they will remain in the workforce until age 70 or older, and only 10% expect to retire before 60. But in reality, only 7% of retirees surveyed stayed on the job until at least 70, and more than one-third had quit working before age 60. Many end up retiring early because of a job loss, a health problem or caregiving responsibilities.

Don’t Miss: Can You Roll A 401k Into An Existing Roth Ira

Learn Whether You Can Qualify To Supplement Your Income

For many Americans, the balance of their 401 account is one of the biggest financial assets they own but the money in these accounts isn’t always available since there are restrictions on when it can be accessed.

401 plans are meant to help you save for retirement, so if you take 401 withdrawals before age 59 1/2, you’ll generally owe a 10% early withdrawal penalty on top of ordinary income taxes.

However, there are limited exceptions. For instance, if you incur unreimbursed medical expenses that exceed 10% of your adjusted gross income, you can withdraw money from a 401 penalty-free to pay them. Similarly, you can take a penalty-free distribution if you’re a military reservist called to active duty.

Because the exceptions are narrow, most people must leave their money invested until 59 1/2 to avoid incurring substantial taxes. However, there is one big exception that could apply if you’re an older American who needs earlier access to your 401 funds. It’s called the “rule of 55,” and here’s how it could work for you.

Rollover The Money Into Your New Employers 401k Plan

If your new employer offers a 401k plan with low costs and a wide variety of investment options, this might be a viable option to consider. However, we generally recommend that people rollover their 401k plans into an IRA as they are usually lower cost and have more investment options, but more on that later.

If you are interested in rolling the money over into your new employers 401k, meet with the HR department or retirement plan custodian to find out more about your new companys plan, including whether you will be allowed to participate as soon as youre hired or will have to work for a certain number of days before youre eligible.

To accomplish this rollover, you will instruct the administrator of your former employers 401k to transfer your assets directly into your new employers plan once your account has been established. Alternatively, you can instruct the former employers 401k administrator to send you a check but you must deposit the funds into your new account within 60 days to avoid paying income taxes and a potential penalty on distribution.

Also Check: Can I Roll A 401k Into A Roth Ira