How Long Does It Take To Get Money Out Of My 401k

May 3, 2011 It usually takes a week or two to get money out of your 401, although it can take much longer. The countdown begins when you request payment and ends when you actually receive the money in the form of a check or wire transfer.

Principal 401k phone number What is your 401k plan based on your retirement count?Your 401 is qualified retirement plan Although your donation has been reported in field 12 code D in format W2. You dont need to report them again in TurboTax. If youre going to bring up another issue, youll only answer yes to this question, such as BT IRA or Roth IRA. June 4, 2019 at 11:51 a

How To Designate A Charity As The Beneficiary Of An Ira Or 401

When youre ready, making a charity the beneficiary of your IRA or other retirement assets is typically straightforward: Fill out a designated beneficiary form through your employer or your plan administrator. Most banks and financial services firms also have beneficiary forms, or they can provide you with suggested language for naming beneficiaries to these accounts. Once the designated beneficiary forms are in place, the retirement assets will generally pass directly to your beneficiaries without going through probate.

If you are married, ask the plan administrator whether your spouse is required to consent. If required but not done, this could result in a disqualification of the charity as your beneficiary.

Be clear about your wishes with your spouse, lawyer and any financial advisors, giving a copy of the completed beneficiary forms as necessary.

TIP: If your goal is to support charity as part of your legacy while also leaving assets to family members, it may be more tax efficient to leave cash and appreciated assets to heirs, while making charities the beneficiaries of retirement assets upon your death.

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

Don’t Miss: What Happens With My 401k When I Quit

Remember Required Minimum Distributions

While you dont need to start taking distributions from your 401 the minute you stop working, you must begin taking required minimum distributions by April 1 following the year you turn 72. Some employer-sponsored plans may allow you to defer distributions until April 1 of the year after you retire, if you retire after age 72, but it is not common. Keep in mind that this exception does not apply to plans you may have with previous employers that you no longer work for.

If you wait until you are required to take your RMDs, you must begin withdrawing regular, periodic distributions calculated based on your life expectancy and account balance. While you may withdraw more in any given year, you cannot withdraw less than your RMD.

The age for RMDs used to be 70½, but following the passage of the Setting Every Community Up For Retirement Enhancement Act in Dec. 2019, it was raised to 72.

Recommended Reading: Can You Use 401k To Buy Investment Property

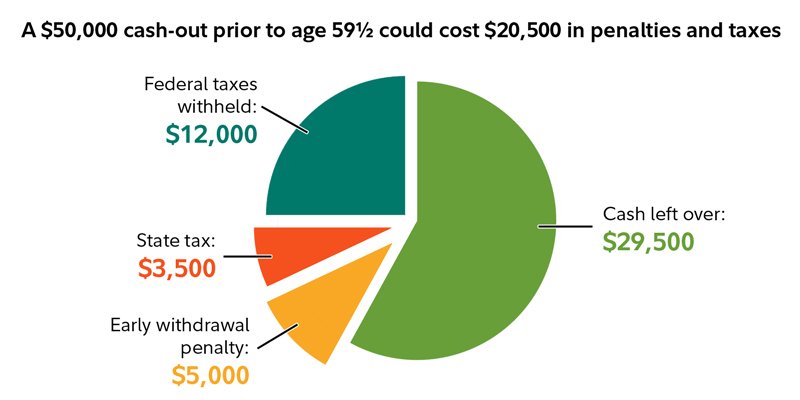

Penalties For Cashing Out Your 401 Early

Of course, the biggest consequence comes from the penalties youll pay. You already know youll likely have to pay taxes on your cash out. But if you take out the money before you reach 59.5 years of age, the IRS will charge a 10 percent early withdrawal penalty. The money will also be included with your gross income for the year and taxed at the rate that applies to your tax bracket. You could find that withdrawing the funds moves you into a higher tax bracket.

One way around this is to qualify for a 401 hardship withdrawal, which can exempt you from early withdrawal penalties. The following events can qualify you for a hardship exemption, depending on the rules laid out by your plan:

- Medical expenses

Read Also: What’s The Most You Can Contribute To A 401k

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

How To Cash Out A 401k

Cashing out a 401k from a previous employer is simple. Your previous employer should provide instructions for how to do this. If they don’t you should log into your benefits administrator and choose to cash out your 401k.

Every employer is different, of course, and some may be more helpful than others. If you are in the dark as to how you can go about cashing out your 401k from your old job, consider doing the following:

- Talk to an HR rep at old job

- Talk to a rep from your 401k administrator

Out of the $50,000 in your 401k account you will be left with just $28,500. Not quite the $50k you envisioned!

Instead of cashing out your 401k when you switch employers, consider other options such as a Rollover IRA. A rollover IRA is essentially just an IRA retirement account that 401k funds can be transferred to when an individual is switching employers.

Also Check: How Do You Get Money From 401k

Can Anybody Cash Out A 401 K Early

If you resign early, you might want to cash out your 401 k. However, you might face a financial penalty for doing so. If you haven’t reached retirement age, you can often expect to be charged 10% plus ordinary income tax on the amount in your 401 k for an early withdrawal. If you think you might want to take your 401 k money out of the IRA early, you should discuss this with your current employer.

How To Roll Over Your Fidelity 401k

Rolling over your Fidelity 401k is simpler than you might think. You and Your 401K

Leaving a job or getting laid off usually prompts a period fraught with tough choices and big changes. In the midst of everything else, managing your old 401k might be the last task you want to deal with.

The good news is, if your 401k is with Fidelity, the process for completing your rollover is actually simple and quite painless. You can convert your employer-sponsored 401k to an IRA or even move it into the 401k account of your new employer rather seamlessly if you know the correct steps to take.

Recommended Reading: How Does 401k Work When You Quit

You May Like: How To Avoid Taxes On 401k

Automatic Enrollment And Aip

As an eligible associate, youâre automatically enrolled in the 401 on the first of the month coincident with or following 60 days of employment at a contribution rate of 3% of eligible pay. As part of automatic enrollment, youâre also enrolled in the automatic annual increase program , which increases your contribution by 1% each year until you reach 6%.

- If you want to change the automatic contribution elections before they begin, visit NetBenefits.com or call Fidelity at 1-800-635-4015 before 60 days of employment and make your own choices.

- If you donât actively enroll and choose investment funds for your account, Syscoâs contributions will be invested in the Vanguard Target Retirement Fund thatâs closest to your projected retirement date .

If you wish to contribute to the Plan before you are automatically enrolled or to opt out of automatic enrollment, log in to NetBenefits.com or call Fidelity at 1-800-635-4015. Note that youâll need to sign up for AIP if you choose to actively enroll. To do so, log in to NetBenefits.com and click Contribution Amount.

You May Like: What Age Can I Withdraw From 401k

Report The Rollover On Your Taxes

In a direct rollover, you shouldnt owe any additional taxes, but you need to report the transaction on your taxes. If you roll over a 401k to an IRA, you should expect a 1099-R form from your 401k plan provider. This is the form youll use to report a direct rollover to the IRS. Fidelity will also send you a 5498 form if your rollover was a direct one. Simply add that information to your tax return at the end of the year.

More on 401k Investments:

Read Also: Is There A Max Contribution To 401k

You May Like: How Do You Roll Over Your 401k

How To Request A Withdrawal Or Loan From The Plan

You may request a withdrawal from your 403 retirement plan by contacting your investment carrier directly. Loans and hardship distributions are only available through Fidelity and can only be taken from the contributions that you put into the plan at Fidelity. Contact Fidelity to request a loan or hardship distribution.

Rules About 401 Required Minimum Distributions

Again, the minimum age for RMDs was changed in recent years. Before, you had to start taking them either when you retired or when you turned 70.5. However, this age requirement still holds for anyone who turned 70.5 in 2019 or earlier. Anyone who has yet to turn 70.5 can wait until April 1 of the year after theyre 72 to start taking RMDs.

The year in which April 1 is your RMD deadline is your starting year. After the starting year, the deadline shifts to December 31. So your second year and thereafter, you must take your RMD by December 31.

If you wait until April 1 of your starting year to take your RMD, you will have to take two years worth of RMDs the same year. You should avoid this, as it will increase your income for that year, likely putting you in a higher tax bracket. If you fail to take any RMD or you dont take a large enough RMD as required by the IRS, you may have to pay a 50% penalty on the money you should have withdrawn.

Read Also: What Is The Interest Rate On A 401k

You May Like: How To Get My 401k From The Military

If You Are Still Working At U

You can postpone RMDs attributable to your U-M retirement plans while you are still working for the University of Michigan. However, assets in another retirement plan outside of the U-M plans or an IRA generally have to begin by April 1 following the calendar year you reach age 72 even if you are still employed at U-M.

You need to be employed by U-M and have salary and wages reported on a University of Michigan W-2 that are subject to federal income taxation in order to postpone RMDs for your U-M plan assets. You do not have an employment relationship that allows you to postpone the RMD requirement if you are not receiving salary or wages reported on a University of Michigan W-2, even if you are performing services. Consult with a tax advisor to determine if you need fulfill your RMD requirements.

How To Cash Out Your 401k And What To Consider

4-minute readMay 18, 2021

One of the surest ways to create a comfortable retirement for yourself is to begin saving early on in your career. A 401 plan a type of financial contribution plan which allows you to put a percentage of your salary into an account whose investment gains remain tax-free until funds are withdrawn presents one of the most popular vehicles for doing so. Even better, employers will often match the amount of money set aside up to a certain amount, effectively guaranteeing you free income.

However, in the event that access to money is needed, especially in the wake of a large or unexpected expense, its not uncommon to wonder how to cash out your 401 as well. Here, well take a closer look at the process of cashing out a 401 early, how long it takes to get access to money, and the pros and cons of doing so, including how much early withdrawal before retirement may cost you.

Recommended Reading: How Do You Take Money From Your 401k

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Eligibility For Cashing Out A 401 Plan

No advice you receive on how to cash out 401 accounts will matter if your plan doesnt allow it. Yes, some employers wont let you take the money out. Even if your employer does, there could be restrictions on how the money can be withdrawn. You probably have some type of documentation with your 401 that you can check. If not, ask your HR department to provide your policy documents. You can always take money out of plans youre not participating in anymore e.g. a plan at an old employer.

If youre 59 and ½ years old, though, none of that matters. You can take money from your 401 starting at age 59 and ½ without paying a penalty. If you havent yet celebrated your 59th birthday, you may prefer instead to take a loan against your 401 if your employer allows it. This will help get you through your financial situation while still ensuring the money is there when its time to retire.

It’s important to note that the tax man may still come calling, even if you dont pay a penalty. Traditional 401 plans are taxed when you take the money out, while Roth 401 accounts hold funds that youve already paid taxes on. If you have a Traditional 401, youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. If you have a Roth 401, you can take your contributions out at any time since youve already paid taxes on them, but youll pay taxes on any earnings you withdraw early if youre under 59 and ½.

Don’t Miss: Should I Invest In 401k Or Roth Ira

Early Withdrawal Calculator Terms & Definitions:

- 401k â A tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Federal Income Tax Bracket â The division at which tax rates change in the federal income tax system .

- State Income Tax Rate â The percentage of taxes an individual has to pay on their income according to the laws of their state.

- Lump-sum Distribution â The withdrawal of funds from a 401k.

- Rollover â Moving the 401k contribution to another retirement fund option, often an IRA.

- Penalties â The payment demanded for not adhering to set rules.

- Future Value Before Taxes â The value of oneâs asset at the end of the term before taxes are paid.

- Future Taxes to be Paid â The taxes that are required to be paid at the end of the term.

- Future Net Available â The amount left after taxes and penalties are deducted.

- Annual Rate of Return â The percentage earned every year by having funds in an account.

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

Read Also: What Happens To Your 401k When You Switch Jobs

Make Sure That Youre Eligible

The general rule of thumb is that you established your 401 as a full-time employee from a previous employer, or you are more than 59.5 years old. Other eligibility requirements can vary, depending on the type of retirement plan you have, such as a Roth IRA, 403, 457 and Thrift Savings Plan .

Please note, the rules dictating eligibility to move a 401 to an IRA arent always crystal clear and can vary from person to person. If you are confused or unsure of your own eligibility, please contact BitIRA today for a complimentary consultation.

We have a team of IRA Specialists, who are well-versed in the rules of 401-to-Bitcoin IRA rollovers. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. However, please note that there is no obligation for you to take any action after your consultation.

Here are the three steps to take to convert your 401 savings into bitcoin:

You May Like: How Do I Cash Out My 401k After Being Fired