What About The Roth 401k

If your employer offers a Roth 401k and you were savvy enough to take part, the path to a rollover will be much easier. When youre converting one Roth product to another, there is simply no need for conversion. You would simply roll the Roth 401 directly into the Roth IRA with the help of your plan provider.

Roll Your 401 by Following These Steps

What Are The Alternatives To An Ira

Many people save for retirement using 401 plans through an employer or an IRA they have set up themselves that matches their employment situation. That said, there are alternatives to IRAs. Some people use health savings accounts to remove one known cost in retirement and make their other accounts go further in old age. If taxation is not a major concern or you’ve exceeded your contribution space, then you can look at normal taxable brokerage accounts, trusts and custodial accounts, real estate, and other stores of value to hold your wealth.

What Are The Rules For Putting Money In A Roth Individual Retirement Account

Most people who earn income will qualify for the maximum contribution of $6,000 in 2022, or $7,000 for those ages 50 and older. If your income falls within the Roth individual retirement account phaseout range, you can make a partial contribution. You cant contribute at all if your modified adjusted gross income exceeds the limits.

You May Like: How Do You Move Your 401k When You Change Jobs

Do I Have To Convert The Entire Amount In My Traditional Ira Or Qrp

No. You may convert just a portion of your assets, and there is no limit to the number of conversions. To help manage the taxes due on each conversion, you may convert smaller amounts over several years. Keep in mind, if you want to take a distribution, each conversion has its own five-year waiting period to avoid the 10% additional tax if you are under age 59 1/2.

Taxes On Roth Ira Conversions

One of the biggest reasons investors gravitate toward Roth IRAs is the tax benefit. The money is put into the account after tax, so when its time to retire, youll be able to take the money out tax-free. That makes the Roth IRA a natural contender for rolling over 401s since it allows you to enjoy tax-free distributions during your golden years.

However, its important to understand the rollover 401 to Roth IRA tax consequences. You didnt pay taxes when you put money into your 401, with the understanding that youd pay when you took it out. A Roth IRA is funded with money youve already paid taxes on, which is why you dont pay taxes when you take it out. This means that the IRS has to get its money now, when youre putting the money into the Roth IRA account.

Read Also: Can I Roll Over 401k Into Ira

Timing Your Roth Ira Contributions

Although you can own separate traditional and Roth IRAs, the dollar limit on annual contributions applies collectively to all of them. If an individual under age 50 deposits $2,500 in one IRA for tax year 2022, then that individual can only contribute $3,500 to another IRA in that tax year.

Contributions to a Roth IRA can be made up until tax filing day of the following year. Thus, contributions to a Roth IRA for 2022 can be made through the deadline for filing income tax returns, which is April 15, 2023. Obtaining an extension of time to file a tax return does not give you more time to make an annual contribution.

If youre an early-bird filer and you received a tax refund, you can apply some or all of it to your contribution. You must instruct your Roth IRA trustee or custodian that you want the refund used in this way.

Conversion to a Roth IRA from a taxable retirement account, such as a 401 plan or a traditional IRA, has no impact on the contribution limit. However, making a conversion adds to MAGI and may trigger or increase a phaseout of your Roth IRA contribution amount. Also, rollovers from one Roth IRA to another are not taken into account for purposes of making annual contributions.

Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

Read Also: What’s The Difference Between An Ira And A 401k

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Its also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, its a good way to save money, stay organized and make your money work harder.

Read Also: How To Find Where Your 401k Is

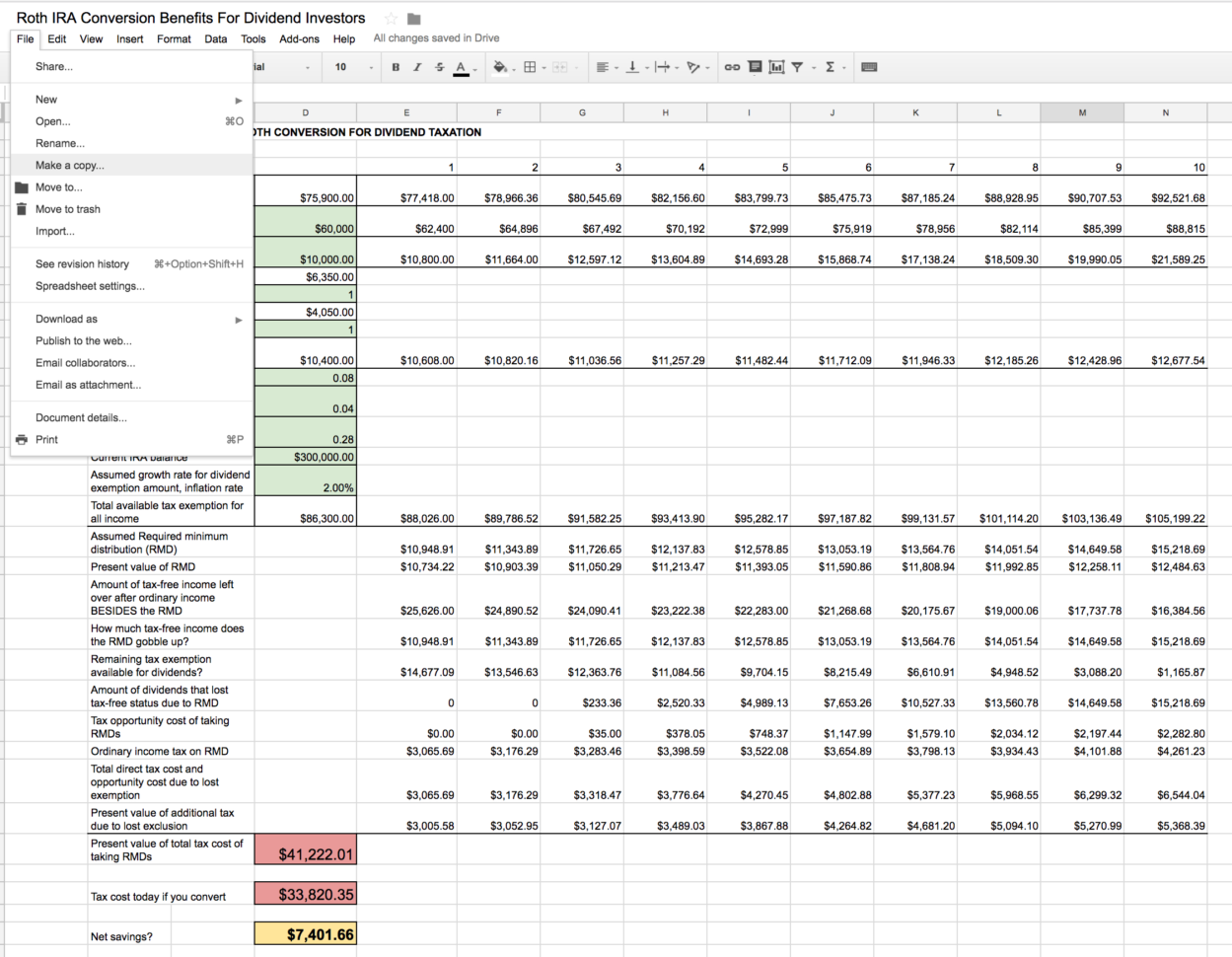

Calculating Income To Report On A Roth Conversion

The first step is to figure out your Roth conversion income. If youre converting deductible IRA funds, youd report the current value of the funds on the day you make the conversion as your income. Your basis in a deductible IRA is zero because you received a tax deduction for your savings contributions.

If youre converting nondeductible IRA funds, report as income the current value of the funds on the day you convert, less your basis. If you contributed $5,000 to a traditional IRA in 2016 and received no deduction for that contribution, your basis in those funds would be $5,000: $5,000 of income minus zero for the deduction.

Now lets say you decide to convert that IRA to a Roth two years later in 2018. The value is now $5,500. You would report $500 of income on your tax return: $5,500 current value minus the $5,000.

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

You May Like: How To Calculate Employer 401k Match

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why it’s also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

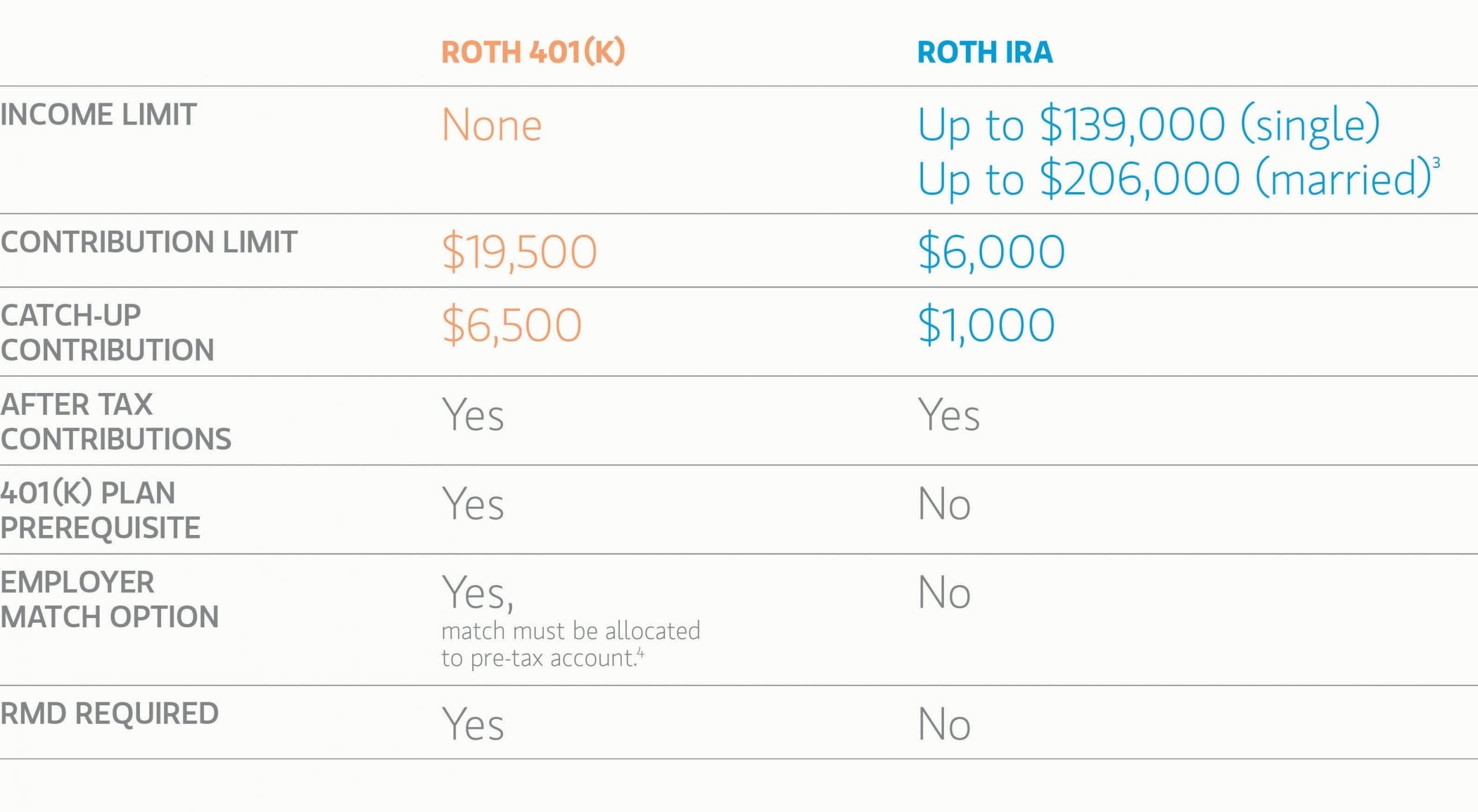

Confusion Of The Roths

Unlike the similarly named Roth IRA, the Roth 401 is different. A Roth IRA is an individual retirement account whereas a Roth 401 is part of and offered through an employer sponsored retirement plan.

This minor confusion might be an invisible obstacle for some employees, especially high-income earners who have been told they cannot contribute to a Roth.

High-income earners may be pleasantly surprised to hear they can contribute because a Roth 401 does not have income limits like a Roth IRA does. This means they now have access to a savings vehicle that can grow tax-free.

Additionally, since Roth 401 accounts follow traditional 401 contribution guidelines, the amount that can be saved per year is subject to 401 maximums. For example, in 2020, employees can contribute up to $19,500 in a Roth 401 and if the employee is 50 years old or older, they may make a catch-up contribution of up to $6,500, for a potential total annual contribution of $26,000.5

Also Check: How To Open A Personal 401k

Why Should You Consider A Roth Ira

Roth IRAs are a powerful variation on the traditional IRA from a tax perspective. Unlike a traditional IRA where you receive a tax deduction based off of your contributions up to the limit, Roth IRA contributions are made after tax dollars. This means the tax on the money in your Roth IRA is already paid, so there is no tax owing when you withdraw your money. Simply put, all the growth in a Roth IRA is tax-free. You will not pay capital gains on it in retirement as long as you keep to the qualified distribution guidelines.

While many people choose to take the deduction now and pay taxes on retirement savings when they withdraw funds in the future, this strategy is disadvantageous if you have income from other sources in retirement. If you have a 401, pension, investment portfolio, rental real estate, or simply choose to continue to work into your golden years, traditional IRA distributions can push you into paying more back in taxes than you would with a Roth IRA. As it is difficult to accurately picture your income sources decades in the future, there is a mechanism for converting a traditional IRA to a Roth IRA. Even though these conversions have a tax implication, it often makes sense to do it sooner than later if your income in retirement is looking to be higher than what youre currently making. If you arent sure, it is usually worth talking to a financial advisor about your unique situation.

In 2001 The Roth 401 Came Into Existence1 Since Then The After

Nearly 7 out of 10 retirement plans offer a Roth 401 option.2 Also, when a retirement plan has the Roth option, it opens the opportunity for plan sponsors to consider another design feature that allows participants to take advantage of an additional, often overlooked, tax strategy – the In-plan Roth Conversion.

Don’t Miss: Can I Roll My 401k Into A Self Directed Ira

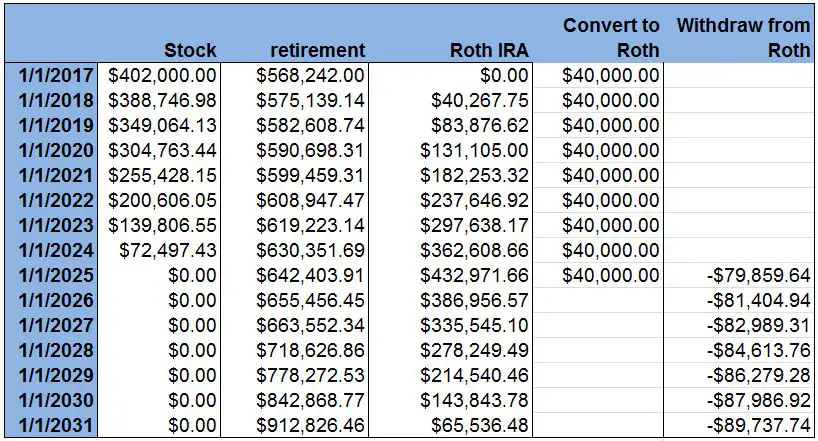

How To Reduce Tax

If you have a large 401 balance, you may get hit with a large tax bill after transferring it to a 401. But instead of rolling over the entire balance at once, you can make partial 401-to-Roth IRA conversions over a few years. Because youd be transferring smaller amounts at a time, youd owe less in taxes throughout.

Speak with an accountant or tax advisor about ways to minimize taxes on 401 to Roth IRA transfers.

Is A Backdoor Roth Ira Worth It

Yes. Roth IRAs don’t have required minimum distributions, which means you can leave your money in the account and let it grow. And the money you do withdraw isn’t taxable, which means you pay on the contributionsnot the distributions themselves. If you leave the money in a traditional IRA, any earnings are subject to taxes. Just make sure you know the rules so you don’t end up paying more than you save.

Read Also: How Do I Find My 401k Plan

Rollover To Ira: How To Do It In 4 Steps

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

A 401 rollover is a transfer of money from an old 401 to an individual retirement account or another 401. Youd most likely need to do a rollover when you leave a new job to start a new one, and if youre in this situation, you likely have a few options, such as rolling your old 401 into your new workplace 401, or cashing it out.

This article focuses on rolling a 401 over to an IRA, which is a great way to consolidate your retirement accounts and keep an eye on your investments.

Read Also: How Do You Pull Out Your 401k

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Also Check: How To Find Out If You Have A 401k Account

K Rollover To Roth Ira

The procedure to roll over your retirement savings from one account type to another is straightforward. Heres how to covert a 401k to a Roth IRA:

Learn More: 401k Rollover Rules

How To Reduce The Tax Hit

If you contributed more than the maximum deductible amount to your 401, you have some post-tax money in there. You may be able to avoid some immediate taxes by allocating the after-tax funds in your retirement plan to a Roth IRA and the pretax funds to a traditional IRA.

Alternatively, you can choose to split up your retirement money into two accounts: a traditional IRA and a Roth IRA. That will reduce the immediate tax impact.

This is going to take some number crunching. You should see a competent tax professional to determine exactly how the alternatives will affect your tax bill for the year.

H.R. 5376, the Build Back Better infrastructure bill, includes provisions that would reduce some benefits of Roth IRA conversions for all taxpayers starting in 2022. However, despite being passed by the U.S. House of Representatives in November 2021, the bill appears to have stalled in the U.S. Senate. It seems that, for now, Roth IRA conversions for high earners are safe.

Don’t Miss: How Do I Manage My 401k

You Want Lower Fees And More Investment Options

Because a 401 account is tied to an employer, it likely has a limited number of investment options, especially if the plan is administered by a small company.

For example, you might have access to only a small group of mutual funds with relatively high expense ratios, or fees. Many discount brokerages, on the other hand, offer index funds with expense ratios close to zero within self-directed IRA accounts.

In a 401, a lot of people feel like theyre handcuffed in terms of what they can own, says Hernandez. In most cases, in an IRA you have a lot more flexibility in what you can own.