Calculating The Basic Penalty

Assume you have a 401 plan worth $25,000 through your current employer. If you suddenly need that money for an unforeseen expense, there is no legal reason you cannot simply liquidate the whole account. However, you are required to pay an additional $2,500 at tax time for the privilege of early access. This effectively reduces your withdrawal to $22,500.

There are certain exemptions that you can use to take a penalty-free withdrawal however, you will still owe taxes on that money. These are for immediate and heavy financial needs that constitute a hardship withdrawal. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary. These include:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence (such as losses from fires, earthquakes, or floods

You likely will not qualify for a hardship withdrawal if you hold other assets that could be drawn from, such as a bank account, brokerage account, or insurance policy, in order to meet your pressing needs.

Rolling Over Funds In A Roth 401

You can avoid taxation on your earnings if your withdrawal is for a rollover. If the funds are simply moving into another retirement plan or a spouse’s plan via direct rollover, no additional taxes are incurred.

If the rollover is not direct , the funds must be deposited in another Roth 401 or Roth IRA account within 60 days to avoid taxation.

When you do an indirect rollover, the portion of the distribution attributable to contributions cannot be transferred to another Roth 401 but it can be transferred into a Roth IRA. The earnings portion of the distribution can be deposited into either type of account.

How Much Are You Penalized For A 401k Early Withdrawal

On the surface, withdrawing funds from your 401k might not seem like a bad option under extenuating circumstances, but you could face penalties. Young adults are especially prone to early withdrawals because they figure they have plenty of time to replace lost funds.

If youre not experiencing a significant hardship, 401k early withdrawal probably isnt the right choice for you. Ultimately, you could lose a substantial portion of your retirement savings if you choose to withdraw your 401k early to use the money to make other risky financial moves. Below, lets delve further into the penalties that usually apply when you withdraw early.

Recommended Reading: Can I Open A Solo 401k

If You Withdraw The Money When You Retire

For traditional 401s, the money you withdraw is taxable as regular income like income from a job in the year you take it. You can begin withdrawing money from your traditional 401 without penalty when you turn age 59½. The rate at which your distributions are taxed will depend on what federal tax bracket you fall in at the time of your qualified withdrawal.

A few important points:

-

If youve retired, you have to start taking required minimum distributions from your account when you’re 72.

-

If you dont take the required minimum distribution when youre supposed to, the IRS can assess a penalty of 50% of the amount not distributed.

-

You can withdraw more than the minimum.

Take Out A Personal Loan

Theres also the option of taking out a personal loan to help deal with a temporary setback. Personal loans arent backed by any assets, which means lenders wont easily be able to take your house or car in the event you dont pay back the loan. But because personal loans are unsecured, they can be more difficult to get and the amount you can borrow will depend on variables such as your credit score and your income level.

If you think a personal loan is your best option, it may be a good idea to apply for one with a bank or credit union where you have an existing account. Youre more likely to get the loan from an institution that knows you and they might even give you some flexibility in the event you miss a payment.

Recommended Reading: How Much 401k By Age

What Is A 401 Early Withdrawal

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% penalty by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the penalty is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

Tips For Retirement Savings

- Taxes can be complicated, especially when it comes to retirement savings plans. Thats where a financial advisor can be invaluable. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Prefer to take a DIY approach to investing and retirement planning? You can start by using this retirement calculator to see if youre on pace for a comfortable retirement. If youd like to invest more to grow that nest egg, check out one of these brokerages where you can open an IRA. You might also use a robo-advisor, which generates an investment plan for you for less than youd pay a traditional advisor.

- If youre over the age of 50, take advantage of catch-up contributions. Catch-up contributions are a great way to boost your savings. Use SmartAssets retirement calculator to ensure youre saving enough to retire comfortably.

Don’t Miss: How Can I Borrow Against My 401k

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. This allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

It’s fairly easy to put money into a 401, but getting your money out can be a different story. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But 2022’s high inflation, rising interest rates and rocky stock market might have some investors itching to cash out early. However, if you do decide to make an early 401 withdrawal before that magical age, you could pay a steep price if you dont proceed with caution.

» Dive deeper:What to do when the stock market is crashing

Also Check: What Happens To My 401k After I Quit

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. Before you take any money out, ask yourself an important question:

Do you actually need the money now?

Rather than putting money away, you are actually paying it forward.

If you are relatively early on in your career, you may be single and financially flexible. But your future self may be neither of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement.

Consider contributing to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Some people find the ease of access comforting.

Keep a few factors in mind:

- There are income limits on contributing to a Roth IRA.

- You will still be taxed if you withdraw the funds early or before the account has aged five years.

Withdrawal Taxes And Early Distributions

You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age. The account is designed to be part of your retirement plan, but circumstances come up where you cant avoid dipping into the money for other reasons. Down payments, emergency medical bills and education costs are a few examples of expenses some people pay with 401 funds.

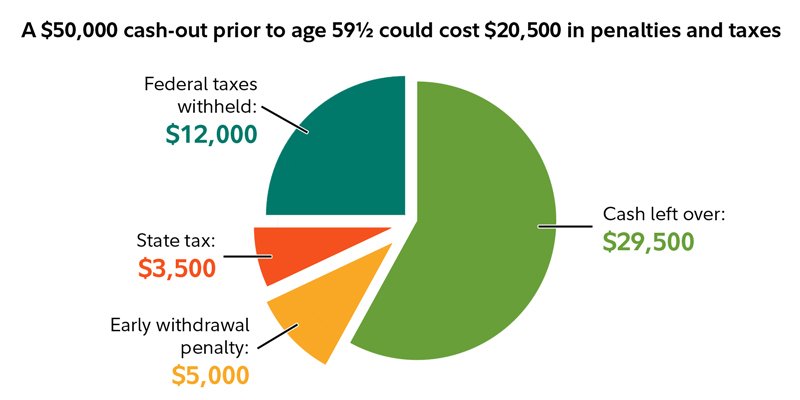

If this is the case for you, expect to pay a 10% penalty fee. This is on top of the income tax youll pay for withdrawing the funds. Remember, even if its paying for an emergency, its still counted for tax purposes as income. Youll want to run the numbers, adding the tax and penalty tax, to see if it makes sense to pull money out early. Its also important to factor in the opportunity cost of pulling your investments out of the market.

In some cases, there is an exception to the 10% additional tax. The IRS lists the circumstances where the tax doesnt apply. Losing your job at 55, or starting a SOSEPP plan are two examples. Youll still be on the hook for income taxes, of course.

Given the tax hit and opportunity cost of early withdrawals, its not ideal solution. Before you commit to a penalized withdrawal, consider if borrowing the money from your 401 might be a better solution.

Also Check: Can You Roll A 401k Into An Existing Ira

How Do Contributions And Earnings Affect Roth Ira Withdrawal Rules

When you contribute to a Roth IRA, you’re putting in after-tax money in other words, you’ve already paid income tax. As your contributions sit in the account, they earn interest.The Roth IRA withdrawal rules vary based on whether you’re taking out contributions or earnings. Since you’ve already paid tax on your contributions, you can take them out of the Roth IRA whenever you like. These withdrawals aren’t subject to penalties or additional taxes.Imagine that you’ve contributed $5,000 to a Roth IRA over 2 years, and the account is now worth $5,500. You can withdraw up to $5,000 at any time without paying taxes or fees. However, the same may not be true for the $500 you earned.That’s because the IRS has special rules for withdrawing Roth IRA earnings. There are two withdrawal options: qualified and non-qualified.

How Can I Avoid Paying Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Don’t Miss: Is There A Limit On Employer 401k Match

What Is The Cares Act 401k Withdrawal

COVID-19 brought financial hardship on millions of Americans and people worldwide. The United States Government recognized the hardship COVID-19 presented to individuals, and created the Cares 401k act.

Simply put, the Cares Act 401k Withdrawal allows one to withdraw up to $100,000 from their 401k if they experienced financial hardship from the COVID-19 pandemic, penalty free. Penalty free doesnt mean you wont pay taxes though.

The money you withdrew will still be taxed at your normal income tax rate. However, you can do one of two options:

What Is The 595 Rule

Most Americans that are lucky enough to have money stashed away for retirement in an Individual Retirement Account are probably familiar with the age 59.5 rule, whereby a distribution from the IRA before that age will trigger not only taxes on the amount withdrawn, but a 10% penalty on early distributions.

Don’t Miss: Can I Move My 401k To A Self Directed Ira

How Much Tax Do You Pay On A 401k Withdrawal

Asked by: Danial Morissette I

When you take 401 distributions and have the money sent directly to you, the service provider is required to withhold 20% for federal income tax. 1 If this is too muchif you effectively only owe, say, 15% at tax timethis means you’ll have to wait until you file your taxes to get that 5% back.

How Much Is Taxed On 401k Early Withdrawal

The money you withdraw from your 401k is taxed at your normal taxable income rate. As mentioned above, this is in addition to the 10% penalty!

For example, if you are looking to withdraw $20,000 from your 401k, and your tax rate is 20%, expect to only take home $14,400. Heres the breakdown:

- $2,000 would go to the 10% penalty

- $3,600 would go to taxes

Don’t Miss: How To Transfer 401k Without Penalty

The High Price Of A 401 Withdrawal

Life has a way of throwing curve balls at us. And theyre great at draining us of our moneyespecially if were not prepared. Youve heard of Murphys Law, right? Anything that can go wrong will go wrong. Murphy is rude. He doesnt even knock when he shows uphe just kicks down the door!

The coronavirus pandemic is the biggest financial crisis that a lot Americans have ever seen. If youre scared right now about emergency expenses or paying down debt, you might be tempted to take money from your 401, especially considering the new loopholes in the CARES Act that Congress recently passed.

But is a 401 withdrawal a good idea? Lets jump into the details to find out.

Can I Withdraw From My 401k In 2021 Without Penalty

Although the initial payout provision of 401,000 that it will be

When do I have to pay taxes on coronavirus-related distributions?

Usually, your wages are counted pro rata over a three-year period, starting with the year in which you receive your paycheck. For example, if in 2020 you received a coronavirus-related distribution worth $ 9,000, you would report income of $ 3,000 in your federal tax return for 2020, 2021, and 2022. However, you can include the entire distribution in your payday income.

How do qualified individuals report coronavirus-related distributions regarding retirement plans?

If you are a qualified individual, you may designate any qualifying distribution as a Coronavirus-related distribution as long as the total amount indicated as Coronavirus-related distribution does not exceed $ 100,000. As mentioned earlier, a qualified individual may treat a distribution that meets the requirements to be a coronavirus-related distribution as such, whether or not a qualifying retirement plan treats the distribution as a coronavirus-related distribution. You must report a coronavirus-related distribution in your individual federal tax return for 2020. You must include the taxable portion of the distribution in your income proportionally over the 3-year period 2020, 2021 and 2022 unless you choose to include the entire amount in your income in 2020.

What is a coronavirus-related distribution?

Prev Post

Read Also: Can You Take From 401k To Buy A House

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

Taxes On 401 Withdrawals

Though taxes arenât required upfront for 401 contributions, it doesnât mean there arenât any tax obligations for 401s. The IRS collects their taxes when funds are withdrawn from 401s.

Tax is due on withdrawals from 401s whether they done before 59½ or after.

The tax rate that is applicable during the year the withdraw was done will be used to determine how much taxes will be. Again, if youâre still working when you withdraw from your 401, that amount will be added to the money you make from your job.

Once funds are withdrawn from a 401 account, the planâs administrator is triggered to file a 1099-R. This must be filed come tax time.

Also Check: What Should I Do With My 401k After Retirement