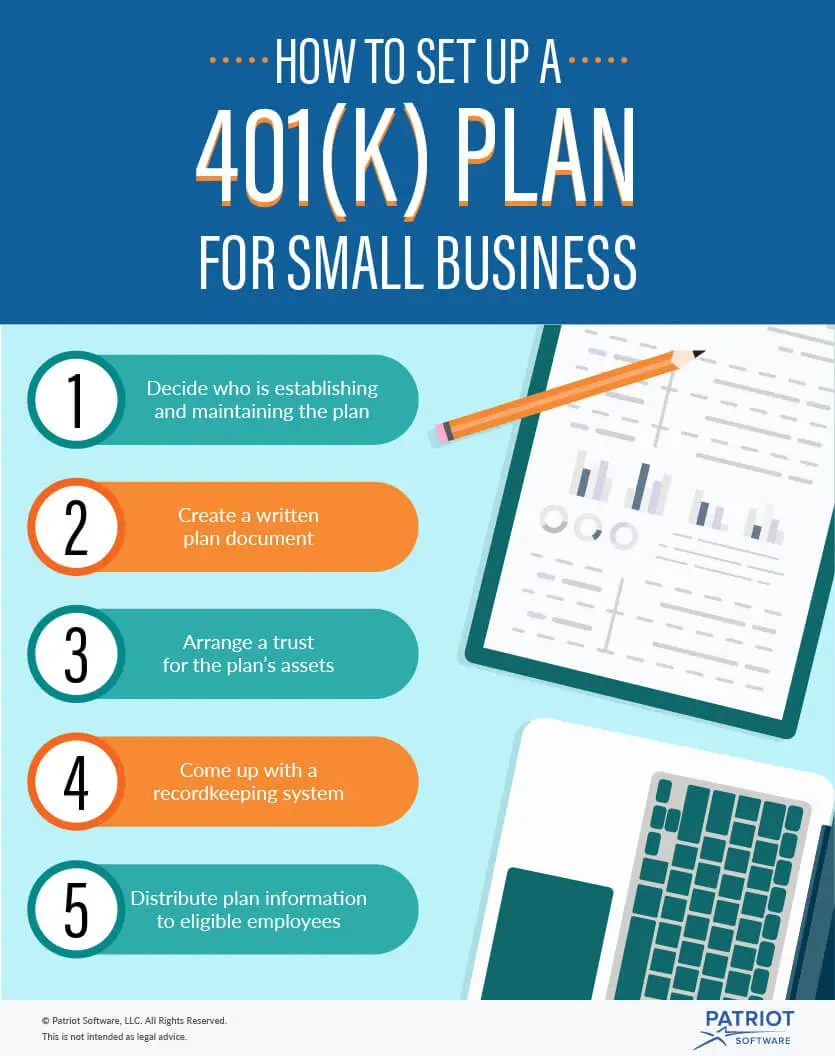

Disclose Information To Employees

Furthermore, you should disclose the 401k plan information to your small business employees. Create a summary of your plan that explains your employees rights and responsibilities as a 401k participant. For example, include when and how your employees can become eligible to sign up. You can also use this step to talk about when employees can receive benefits. In addition, list steps and requirements to file a claim and receive benefits. You should also provide your employees with the Employee Retirement Income Security Act description so they know what theyre legally entitled to. This way, they can start the retirement planning process and get the coverage they need. Definitely, disclose your small business 401k benefits for your employees.

There are several steps to set up a 401k plan for your small business employees. First, research your options to find the best 401k plan that suits your business. Next, choose a plan based on your contribution and vesting requirements. In addition, you should determine your policy details to create a custom 401k plan that meets your business requirements. You can also consider other benefits like loans and deduction contribution limits. Furthermore, disclose your policy information to your employees with full transparency. Follow this post to learn how to set up a 401k plan for your small business employees.

How Much Money Can You Use

One of the major differences between a 401 loan and a ROBS is the amount of money you can use. With a 401 loan, $50,000 is the maximum you can borrow. With a ROBS, on the other hand, $50,000 is the minimum you have to take out of your retirement account. Therefore, your choice between these two 401 business financing options will largely depend on the amount of money that you have in your retirement account and the percentage that youre willing to put toward your business.

Use A Robs To Finance Your Business

The second option you have for using a 401 to start a business is called ROBS, which, as we mentioned earlier, stands for rollovers as business startups. ROBS gives you another way to access retirement funds from a 401, IRA, or another eligible retirement account without having to pay income taxes and early withdrawal penalties.

Compared to a 401 loan, a ROBS offers more flexibility for entrepreneurs because theres no obligation that you have to remain employed in order to use this financing option. In fact, with a ROBS, you cannot use a retirement account from a current employer. This being said, however, doing a ROBS is also more complicated than taking a loan from your retirement plan.

To explain, with a ROBS, you first have to structure your business as a C-corporation. Then, you have to set up a new retirement plan under the C-corp. At that point, you can rollover the funds from your existing retirement plan into the new companyâs retirement plan. Finally, your new corporation sells stock to the retirement plan, and the company uses the proceeds from the sale as a source of capitalâwith one catchâyou canât pay ownersâ salaries from these funds.

Recommended Reading: How To Get My Walmart 401k

How To Start A Retirement Plan Toolkit

Starting a retirement plan is exciting. Its one of the most powerful savings tools the government gives business owners and employees. Complete the form below to download the small business retirement plan toolkit. Inside has important How-To Information, Tools to help you along the way, and Checklists.

What Are The Benefits Of A 401k Compared To Other Retirement Options

Compared to simplified employee pension individual retirement accounts and savings incentive match plans for employees , 401k plans have higher annual contribution limits. Thus, employees may be able to save more money in a shorter amount of time with a 401k, making it ideal for those who are older and short of their savings goals. It also allows employees to borrow money from their retirement savings accounts. SEP IRA and SIMPLE IRA plans do not.

Recommended Reading: What Should I Do With My 401k After Retirement

Competitive Ability To Recruit And Retain Talent

Retirement benefits are increasingly important to employees. According to a study by Accenture, 68% of workers worldwide ask during the job application process whether a company has a retirement plan like a 401, and 62% seriously consider the availability of such a plan when deciding whether to accept or remain in a job.

There can also be big financial benefits from a 401 in helping to retain and attract top talent and the associated cost savings and productivity gains, said Stuart Robertson, CEO of ShareBuilder 401k.

According to Robertson, research shows that replacing an employee costs 29% to 46% of an employees annual salary, depending on whether that employee is in a managerial position.

Its estimated that an employee who earns $50,000 a year can cost $14,500 on the low end to replace, he said. A 401 plan is a small price to pay, not only for retirement but also for building and keeping a great team.

Brian Halbert, founder of Halbert Capital Strategies, said his business clients have reported significant increases in worker loyalty and productivity when they added a 401 plan to their employee benefits packages.

The single largest benefit coming from a 401 is financially wise employees that have a zeal for working hard for their company, Halbert said. Oftentimes, we see the ROI in productivity and loyalty.

How Do I Start A 401k If My Employer Doesn’t Offer It

The most obvious replacement for a 401 is an individual retirement account . Since an IRA isn’t attached to an employer and can be opened by just about anyone, it’s probably a good idea for every workerwith or without access to an employer planto contribute to an IRA .

Can a single member LLC contribute to a solo 401k?

Yes you can invest both pretax and Roth solo 401k money in a single LLC. There would only be one member of the LLC because there is only one solo 401k with pretax and Roth money in different sub-accounts.

Can my LLC contribute to my retirement? On top of the LLC IRA contribution limits, you can include a 2 percent company contribution or 3 percent matching contribution. An old-school pension or defined benefit plan. These guarantee a set amount of money at retirement rather than depending on the market.

Can I contribute to a Solo 401k and an employer 401k? The solo allows you to pay yourself twice, both as the employer and as the employee. The employee contribution you can make is limited to $19,500. The employer portion is again limited to 25% of compensation. Added together, the employee and employer parts must be $58,000 or below.

Read Also: Can I Rollover 401k To Ira

Who Is Eligible For Solo 401 Plans

A common misconception about the solo 401 is that it can be used only by sole proprietors. In fact, the solo 401 plan may be used by any small businesses, including corporations, limited liability companies , and partnerships. The only limitation is that the only eligible plan participants are the business owners and their spouses, provided they are employed by the business.

A person who works for one company and participates in its 401 can also establish a solo 401 for a small business they run on the side, funding it with earnings from that venture. However, the aggregate annual contributions to both plans cannot collectively exceed the Internal Revenue Service -established maximums.

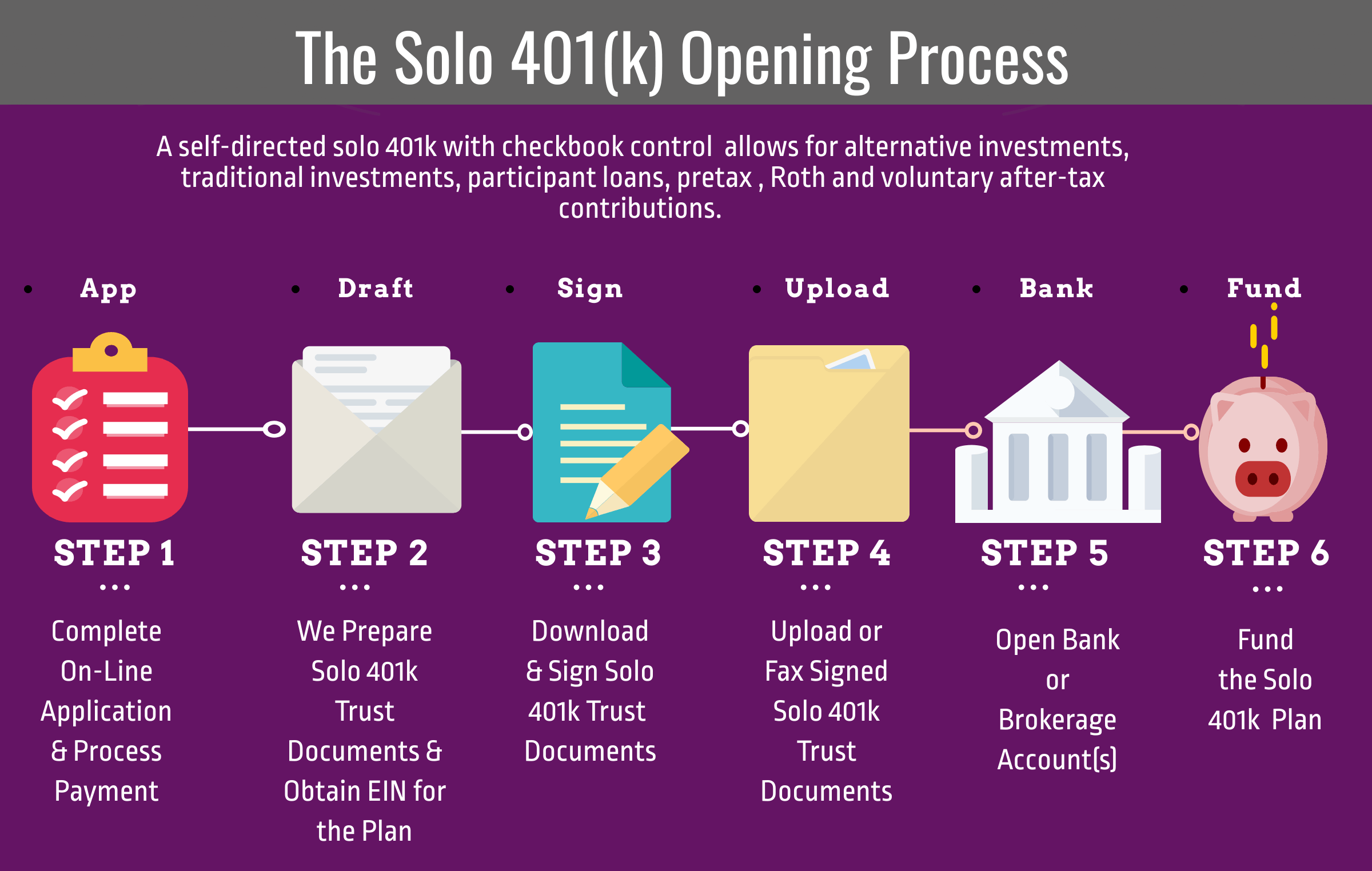

Arrange A Trust For The Plans Assets

One requirement for starting a 401 plan on your own is that you set up a trust to hold assets . This guarantees that only the participants and their beneficiaries can use the funds.

When arranging the trust, you need to select a trustee. Deciding on a trustee is an important part of establishing a plan, as they must handle contributions, plan investments, and distributions.

You May Like: How Do I Get A Loan From My Fidelity 401k

How Much Can You Borrow

With a 401 loan, the IRS has rules around how much money you can borrow from your retirement plan in any given year. You can borrow the lesser amount of:

- $50,000 or

- Half of your vested balance.

As an example, then, lets say you have $80,000 in your 401 account. The maximum you can borrow in a calendar year is half of that balanceâ$40,000. Lets say you borrow $10,000 from your 401 in January of the calendar year. After that, you find that you need more money in July. In July, you can borrow a maximum of $30,000.

Start Placing Investments Under The Solo 401k Funded Llc

After the LLC has been funded using solo 401k funds, future investments will be placed through the LLC bank account not the solo 401k bank account. Also, investments will be titled in the name of the LLC. If the LLC invests in real estate, for example, the funds for the purchased will flow from the LLC bank account to the seller, expenses and gains will also flow to the LLC bank account not the solo 401k bank account. However, once you are ready to dissolve the LLC or no longer wish to place investments via the solo 401k owned LLC, the funds will flow back to the solo 401k bank account. Also, solo 401k participant loans, and distributions such as required minimum distributions will need to be processed from the solo 401k bank account not the LLC bank account.

Recommended Reading: How To Get A Hardship Loan From My 401k

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

% Of Small Businesses Add A Discretionary Match

One of most effective ways a small business can persuade employees to contribute pre-tax or Roth salary deferrals to a 401 plan is by matching some portion of them. This is unsurprising when you consider an employer match is like a guaranteed return on salary deferrals – or free money.

Most employer matches that arent intended to meet safe harbor 401 requirements are discretionary in nature so small businesses have the option to make them or not. A discretionary match made to a traditional 401 plan must pass the ACP test to be considered nondiscriminatory, while a discretionary match made to a safe harbor plan can be exempt from the ACP test when certain conditions are met.

Also Check: What Happens To Your 401k When You Switch Jobs

Seven Reasons To Start A 401 Plan For Your Business This Year

If your business is on solid ground, now is the time to offer yourself and your employees one of the most powerful, if not the most powerful, way to save tax deferred. That of course is a 401 plan. Any size business can offer a 401 plan, be it you’re a self-employed, one-person shop or a business of a few or many employees.

So here are seven compelling reasons to take action and start a 401 plan for you and your business:

Wishing you a healthy and prosperous year.

Review The Investment Choices

The 401 is simply a basket to hold your retirement savings. What you put into that basket is up to you, within the limits of your plan. Most plans offer 10 to 20 mutual fund choices, each of which holds a diverse range of hundreds of investments that are chosen based on how closely they hew to a particular strategy or market index .

Here again, your company may choose a default investment option to get your money working for you right away. Most likely it will be a target-date mutual fund that contains a mix of investments that automatically rebalances, reducing risk the closer you get to retirement age. Thats a fine hands-off choice as long as youre not overpaying for the convenience, which leads us to perhaps the most important task on your 401 to-do list …

You May Like: Can You Transfer Your 401k Into Ira Without Getting Penalized

How Much Can Self Employed Contribute To 401k

How Much Can I Contribute To My Self-Employed 401 Plan? The IRS says you can contribute up to $54,000 in your tax-deferred Self-Employed 401 for 2017, a $1,000 increase from 2016. If youre at least age 50, then you can make an additional $6,000 catch-up contribution, which increases your limit to $60,000.

Solo 401. The self-employed 401 is good for sole proprietorships and partnerships and leaves room for a spouse to join. To qualify, you cant have any employees. If you hire your spouse, you can both contribute $53,000 each per year, and there is no annual paperwork until your account reaches $250,000. When youre 50 or older, you can each contribute $6,500 more per year. Contributions up to $18,000 are tax-deferred, and then you can contribute up to 25 percent of business profit-sharing. Funds are available for early withdrawals before age 59½ at a 10 percent penalty or through hardship loans.

Fund The Llc Using Self

After the LLC bank account has been opened, the next step is to fund with solo 401k funds. Funding the LLC bank account can be done by check or by wire, and the funds have to flow directly from the solo 4o1k bank account to the LLC bank account. If funding is done by check, the check will need to be made payable in the name of the LLC not your personal name.

Read Also: How To Switch 401k To Ira

New Tax Breaks And Other Developments Make Launching A Startup 401 Plan For Employees A More Viable Option For Small Businesses

- A 401 is an employer-sponsored savings plan that companies can offer to help employees save money for their retirement.

- Small businesses have always been permitted to set up a 401 plan for their employees, but new tax incentives and other changes make a startup 401 plan more attainable.

- Small business owners should look at a variety of factors, from fees and transparency to account-holder services and beyond, when shopping around for a startup 401 plan.

- This article is for small business owners who want to understand the basics of introducing a startup 401 plan.

Until recently, many small businesses shied away from offering a 401 plan to their employees based on financial constraints and other concerns. Fortunately for small business owners, startup 401 plans now lie within easier reach, thanks in large part to legislative changes and the increased availability of small business-oriented 401 plans. If you are considering offering a 401 retirement savings plan to your employees, it is important to understand what they are, how they work and how to go about starting one.

Maintaining 401k Plans For A Business

Most 401k plans are subject to the requirements of the IRC and the Employee Retirement Income Security Act , which provide minimum standards that protect individuals in retirement plans. Administering and maintaining plans that comply with these regulations ranges in difficulty from the moderate to the complex.

Don’t Miss: Can I Start My Own 401k Plan

How A Roth 401 Works

Like Roth IRAs, Roth 401s are funded with after-tax dollars. You don’t get any tax benefit for the money you put into the Roth 401, but when you begin to take distributions from the account, that money will be tax-free, as long as you meet certain conditions, such as holding the account for at least five years and being 59½ or older.

Traditional 401s, on the other hand, are funded with pretax dollars, providing you with an upfront tax break. But any distributions from the account will be taxed as ordinary income.

This basic difference can make the Roth 401 a good choice if you expect to be in a higher tax bracket when you retire than when you opened the account. That could be the case, for example, if you’re relatively early in your career or if tax rates shoot up substantially in the future.

How To Use Your 401 To Start A Business

If you plan on using a 401 to start a business, youll want to first consider the risk involved with utilizing your retirement savings for business financing. If you do decide this is the right option for you, you have three options for 401 business financing. If youre eligible, you can either use a 401 business loan, you can use rollovers as business startups , or you can take a distribution from your retirement account.

We dont have to tell you that financing your business is one of the biggest challenges of entrepreneurship, whether youre just starting out or looking to grow or buy an existing company. Although business loans work for many entrepreneurs, you might not like the idea of taking on debt, especially if you have funds of your own that you can bring to the business. In this case, however, the problem is that most people have personal savings tied up in investments or retirement accounts like 401s and individual retirement accounts .

If you have one of these retirement accounts, you might then be wondering how to use your 401 to start a business. Fortunately, there are ways to take cash out of a retirement account and invest the money in your business, though there is substantial risk involved.

Recommended Reading: How To Max Out 401k Calculator