How To Transfer A 401 To Ira

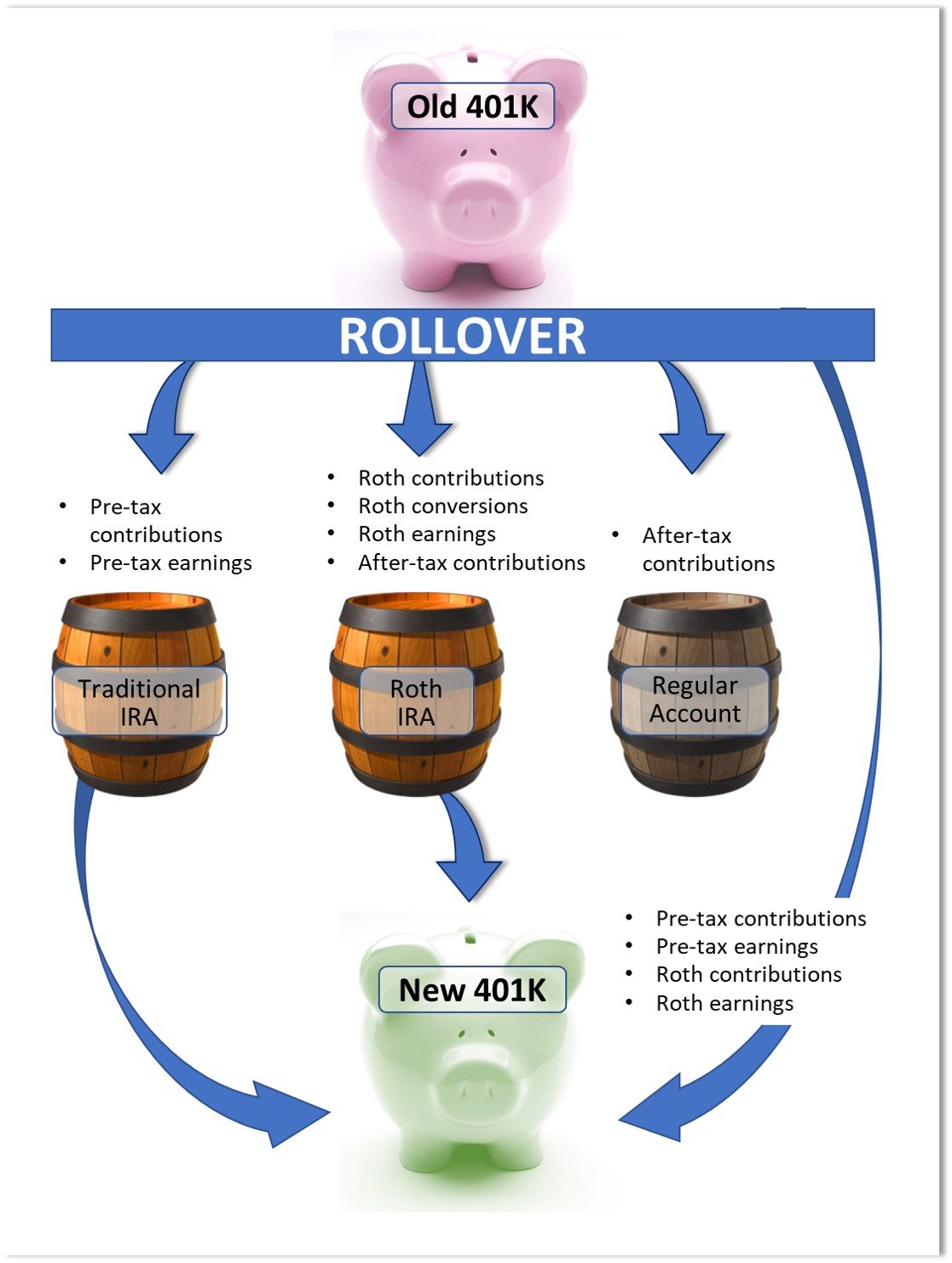

There are three steps to a rollover IRA.

If you have an existing IRA, you can transfer your balance into the IRA you have later consider opening a new account if that’s a concern for you). Traditional IRAs and Roth IRAs are the most popular types of individual retirement accounts. The main difference between them is their tax treatment:

-

Traditional IRAs can net you a tax deduction on contributions in the year they are made, but withdrawals in retirement are taxed. If you go this route, you won’t pay taxes on the rolled-over amount until retirement.

-

Roth IRAs dont offer an immediate tax deduction for contributions. Rolling into a Roth means youll pay taxes on the rolled amount, unless youre rolling over a Roth 401. The upside is that withdrawals in retirement are tax-free after age 59½.

Here are three things to consider:

If you want to keep things simple and preserve the tax treatment of a 401, a traditional IRA is an easy choice.

A Roth IRA may be good if you wish to minimize your tax bill in retirement. The caveat is that you’ll likely face a big tax bill today if you go with a Roth unless your old account was a Roth 401.

If you need cash from the rollover to foot the tax bill today, a Roth IRA could open you up to even more tax complications.

The choice often boils down to two options: an online broker or a robo-advisor.

If I Roll My Account Into An American Funds Ira What Sales Charges Or Account Fees Will I Have To Pay

It depends. Generally, an amount already invested in American Funds can be rolled over into an American Funds IRA without paying any up-front sales charges. Any amount held in investments other than American Funds is subject to applicable sales charges.

A one-time $10 setup fee will be deducted from your account when you open an American Funds IRA. There is also an annual custodian fee .

Dont Miss: How Do You Get Money From 401k

How Do I Roll Over My 401 To An Ira

You have the option of rolling over a 401 to an IRA if you quit your work for any reason. This entails opening an account with a broker or other financial institution, as well as submitting the necessary documentation with your 401 administrator.

Any investments in your 401 will usually be sold. To avoid early withdrawal penalties, the money will be put into your new account or you will receive a cheque that you must deposit into your IRA within 60 days.

Read Also: How To Transfer 401k From Old Job

Roth 401 To Roth Ira Conversions

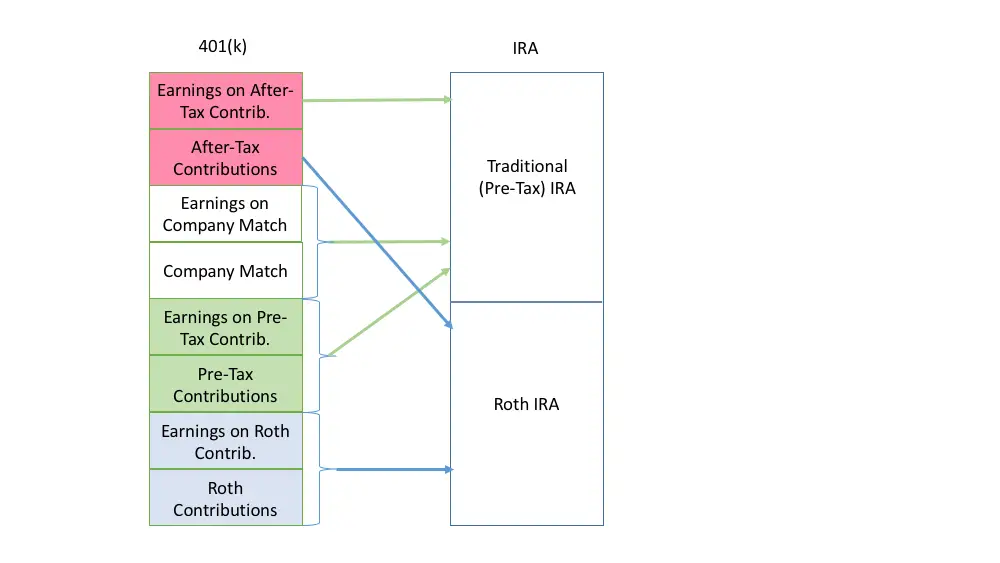

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

You should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

Read Also: Does Vanguard Have 401k Plans

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employers plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

Do I Need To Keep Form 5498

Because the custodian delivers a copy to both you and the IRS, you dont need to file this form with your tax return. However, its critical to double-check the document for flaws. Mari Adam, a certified financial planner in Boca Raton, Fla., has seen a number of errors that plan custodians have had to correct, including classifying an IRA contribution as a rollover . Another client combined numerous retirement plans and rolled them into an IRA, but the rollover was not reflected on the 5498.

If your tax return does not match the 5498 or 1099-R filed with the IRS, you may face an IRS investigation, Adam warns. She advises contacting the custodian as soon as possible and requesting that the custodian deliver a corrected form to the IRS.

Keep Form 5498 on hand in case you need to change custodians or look up information on previous donations. Normally, your custodian will keep these forms online for ten years, but if you change custodians or delete accounts, you may lose access to the online forms, Adam explains. Remember to complete Form 8606, which keeps track of the cumulative basis in your IRAs, if you make non-deductible IRA contributions, so you dont end up paying extra taxes when you withdraw the money. For further information, see Dont Throw Away These Tax Records.

Recommended Reading: How To Roll Over 401k To New Employer Vanguard

Where Is The Safest Place To Put Your Retirement Money

Although no investment is completely risk-free, there are five that are considered the safest to own . FDIC-insured bank savings accounts and CDs are common. Treasury securities are notes backed by the government.

Fixed annuities often have guarantees written into their contracts, and money market accounts are considered very low risk. Annuities are similar to insurance contracts in that they include some safeguards in the event that the insurance company fails.

The main goal of these vehicles is to keep your principal safe. The provision of interest revenue is a secondary goal. You wont earn huge returns from these options, but you also wont lose money.

What Do You Do With Your 401 When You Leave Your Job

You may change jobs several times throughout your career, which means you could end up with several retirement accounts. Some options you have for an old 401 include:

-

Doing a 401 rollover into an individual retirement account or a ROTH IRA at an online brokerage or a robo-advisor.

-

Rolling over your old 401 into a new employer’s 401 plan.

-

Keeping it with your former employer.

» Can you have a Roth IRA and a 401? Yes, but there’s more to it than that.

You May Like: What Is Max 401k Contribution For 2021

A Rollover Of Retirement Plan Assets To An Ira Is Not Your Only Option

A rollover of retirement plan assets to an IRA is not your only option. Carefully consider all of your available options which may include but not be limited to keeping your assets in your former employer’s plan rolling over assets to a new employer’s plan or taking a cash distribution . Prior to a decision, be sure to understand the benefits and limitations of your available options and consider factors such as differences in investment related expenses, plan or account fees, available investment options, distribution options, legal and creditor protections, the availability of loan provisions, tax treatment, and other concerns specific to your individual circumstances.

What Are Your Investment Options With A Rollover Ira

Once youve made the decision to do a 401 Rollover into an IRA, the next decision is how you want to invest your account.

If you plan to engage in self-directed investing, buying and selling individual stocks, options, funds, bonds, real estate investment trusts and other securities, it will come down to selecting the broker to hold your IRA with.

Popular investment brokers that offer nearly unlimited investments and charge no trading fees on many of them include:

|

Product |

|---|

|

on Noble Gold website |

If you prefer to invest in mutual funds or ETFs, Vanguard may be the broker of choice.

They offer trading in stocks and other securities but they do charge trading fees on those.

However, they offer thousands of fee-free ETFs and mutual funds for you to invest in.

Given that Vanguard funds are found in most professionally managed portfolios, you can take that as a hint of how good their funds are.

Choosing a Managed Option: Robo-advisors

If you want a fully managed IRA account, you can opt for a robo-advisor.

Theyll create a portfolio of stocks, bonds and other asset classes for you, based on your risk tolerance, investment goals and time horizon.

After that, theyll fully manage the portfolio for you, including reinvestment of dividends, and periodic rebalancing to make sure your portfolio maintains its target allocations.

Popular robo-advisors include:

Betterment and Wealthfront will manage your IRA for a fee of just 0.25% per year .

You May Like: How To Take Money From 401k Without Penalty

Roth Ira Income Limits

Anyone can contribute to a traditional IRA, but the IRS imposes an income cap on eligibility for a Roth IRA. Fundamentally, the IRS does not want high-earners benefiting from these tax-advantaged accounts. In 2021 and 2022, the annual contribution limit for IRAs is $6,000or $7,000 if you are age 50 or older.

The income caps are adjusted annually to keep up with inflation. In 2021, the phaseout range for a full annual contribution for single filers is a modified adjusted gross income ranging from $125,000 to $140,000 for a Roth IRA. For , the phaseout begins at $198,000, with an overall limit of $208,000.

In 2022, the income phaseout range for taxpayers making contributions to a Roth IRA increases to $129,000 to $144,000 for singles and heads of households. For married couples filing jointly, the income phaseout range is increased to $204,000 to $214,000.

And this is why, if you have a high income, you have another reason to roll over your 401 to a Roth IRA. Roth income limitations do not apply to this type of conversion. Anyone, regardless of income, is allowed to fund a Roth IRA via a rolloverin fact, it is one of the only ways. The other way is converting a traditional IRA to a Roth IRA, also known as a backdoor conversion.

Each year, investors may choose to divide their funds across traditional and Roth IRA accounts, as long as their income is below the Roth limits. But the maximum allowable contribution limits remains the same.

Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether you’d rather have your investments managed for you, or you’d rather do it yourself.

-

If you’re not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

Don’t Miss: Can You Withdraw Your 401k If You Quit Your Job

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Things To Consider Before Making The Switch

Before you decide to rollover a 401 into an IRA, there are a few things you should consider:

You May Like: How Do I Open A 401k Account

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

You May Like: Can Business Owners Have A 401k

The Tax Consequences Of 401 Rollovers Depend On The Option You Pick

Employees who participate in their company 401 plans have a few options available when they leave the company. The tax consequences depend on which option they choose. The rules that govern this type of transaction can be complex and, in some cases, restrictive. It is important to understand these rules to avoid costly tax errors that can substantially disrupt your retirement plan.

You May Like: Can You Withdraw Your 401k When You Leave A Company

Can I Roll My Retirement Assets Directly Into A Roth Ira

Yes. After-tax or Roth contributions from an employers plan can be rolled over directly into a Roth IRA tax free. If you roll over non-Roth assets to a Roth IRA, while you may not be required to withhold taxes, the amount rolled over will be included in your gross income for federal and/or state income tax purposes.

Talk to your financial professional about your options.

You May Like: What Is An Ira Account Vs 401k

Decide Which Type Of Ira Account You Want

A rollover IRA can be either a traditional IRA or a Roth IRA. You can roll tax-deferred accounts into Roth accounts, but not vice versa.

It’s generally better to move like to like roll over a plan into an account with the same tax status. If you have a traditional 401, you can roll it into a traditional IRA without owing any taxes on the amount . Likewise, you can move a Roth 401 into a Roth IRA tax-free.

However, if you roll money from a traditional 401 into a Roth IRA , you’ll be on the hook for income taxes for that sum because the 401 was funded with pre-tax money, remember, and a Roth is funded with after-tax dollars. But after that, the money will grow tax-free, and you won’t owe any taxes on withdrawals during retirement.

You May Like: When Can You Rollover A 401k Into An Ira