Late Repayment Is Potentially Costly

When you take a 401 loan, you pay no taxes on the amount received. However, if you don’t repay the loan on time, taxes and penalties may be due. Specifically, if the loan is not repaid according to the specific repayment terms, then any remaining outstanding loan balance can be considered a distribution. In that case, it becomes taxable income to you, and if you are not yet 59 1/2 years old, a 10% early withdrawal penalty tax will also apply.

If you leave employment while you have an outstanding 401 loan, your remaining loan balance is considered a distribution at that time, unless you repay it. However, you can avoid taking the tax hit by rolling over the outstanding balance into an IRA or another eligible retirement plan by the due date for filing your federal income tax return for the year in which the loan was characterized as a distribution.

What Not To Do

In the worst of scenarios, you’ll borrow from your retirement plan, fail to repay it and end up with your finances in even worse shape.

Don’t borrow if you’re planning on leaving. Whether you quit your job or you’re fired, you may need to repay the whole balance of your loan within 60 days or else the amount borrowed is considered a taxable distribution.

Don’t ignore your debt-to-income ratio. Treat your plan loan the way you would any other extension of credit. The classic rule of thumb is that no more than 36 percent of your gross monthly income should go toward servicing debt.

This is known as the debt-to-income ratio.

Don’t blow off your plan’s rules for loans. A 2016 study from Aon Hewitt revealed that six in 10 employers have said they’d take steps to curtail the leakage of assets from retirement plans. Those actions include limiting the number of loans available or the amount of money that’s eligible for borrowing.

Plans can also establish their own repayment and schedules, which you’ll need to follow.

“When you take a 401 loan, it comes out of payroll and reduces your take home pay,” said Cox. “Either you follow the payment schedule or you fully remit the balance due.”

More from Personal Finance

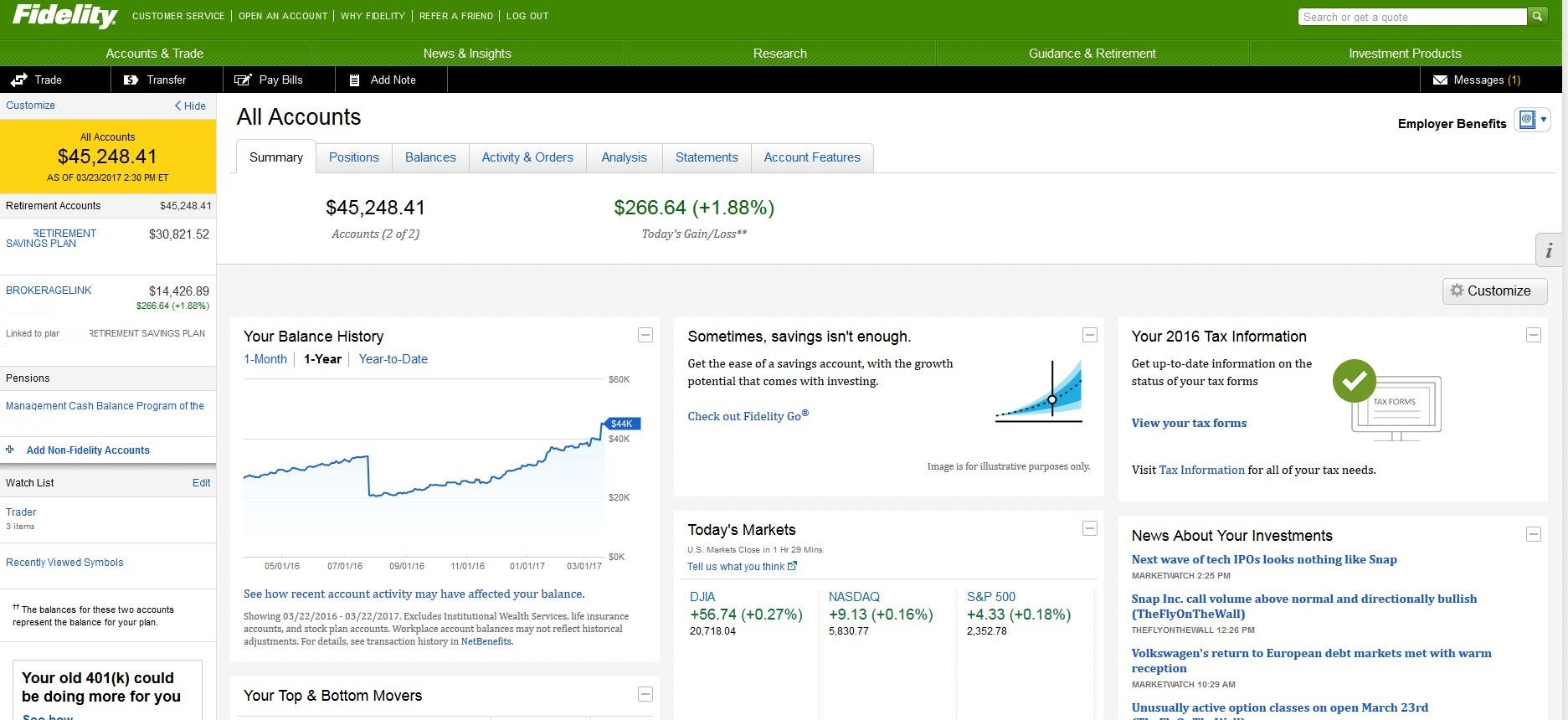

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

Don’t Miss: How Do I Transfer 401k To Ira

Pay Loan From Your Paycheck

If you have a 401 loan with your employer, you may be required to pay back the loan from your paycheck. Usually, the employer will automatically deduct loan payments directly from your salary before the money gets to you. This is the easiest way to pay the loan because you won’t have to do anything when the loan is due.

However, if you have an unpaid loan with a former employer, you must make payments when the loan is due. You can make periodic payments via check, or choose to make a lump-sum payment to clear the loan before the tax due date to avoid triggering taxes and a potential penalty.

How Much You Can Withdraw

You cant just withdraw as much as you want it must be the amount necessary to satisfy the financial need. That sum can, however, include whats required to pay taxes and penalties on the withdrawal.

The recent reforms allow the maximum withdrawal to represent a larger proportion of your 401 or 403 plan. Under the old rules, you could only withdraw your own salary-deferral contributionsthe amounts you had withheld from your paycheckfrom your plan when taking a hardship withdrawal. Also, taking a hardship withdrawal meant you couldn’t make new contributions to your plan for the next six months.

Under the new rules, you may, if your employer allows it, be able to withdraw your employers contributions plus any investment earnings in addition to your salary-deferral contributions. Youll also be able to keep contributing, which means youll lose less ground on saving for retirement and still be eligible to receive your employers matching contributions.

Some might argue that the ability to withdraw not just salary-deferral contributions but also employer contributions and investment returns is not an improvement to the program. Heres why.

Recommended Reading: How To Rollover 401k To Ira Td Ameritrade

Drawbacks To Using Your 401 To Buy A House

Even if it’s doable, tapping your retirement account for a house is problematic, no matter how you proceed. You diminish your retirement savingsnot only in terms of the immediate drop in the balance but in its future potential for growth.

For example, if you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could potentially grow to $54,000 in 25 years with a 7% annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,000 in 25 years, earning the same 7% return.

Circumstances When You Can Withdraw From A 401k If You Have An Outstanding Loan

Each 401 plan has different rules on 401 loans and 401 withdrawals. If your employerâs 401 plan allows employees to tap into their retirement money, you may be required to provide some proof to document that you are in an urgent financial need to get approved. The approval process is rigorous since allowing frivolous withdrawals puts the 401 plan at risk of losing its tax-favored status.

Some of the circumstances when you could withdraw money from your 401 plan if you have an unpaid loan include:

Roll Over 401 If You Have an Outstanding Loan

If you terminate employment with an outstanding 401 loan, you can rollover the money to an IRA or new employerâs 401. As long as the loan repayment was in good standing, the employer will rollover your retirement money net of the outstanding 401 loan. You will have until the tax due date to pay off the 401 loan balance.

For example, assume that you have a $50,000 vested 401 balance, including an outstanding 401 loan of $15,000. If you quit your job and request the plan sponsor to rollover the retirement savings to your new IRA, the plan sponsor will reduce the vested 401 balance by the $15,000 outstanding loan, and disburse the remaining $35,000 to your IRA. You will then have until the tax due date to come up with the $15,000 outstanding loan, after which you can rollover the $15,000 401 balance to your IRA.

Cash out 401 with an Outstanding Loan

Take a Second loan with an Outstanding Balance

Tags

You May Like: Can You Open A 401k On Your Own

Can You Borrow From Your 401

Plan offerings: Before you count on a loan, verify that you actually can borrow from your 401 under your plans rules. Not every plan allows loans its just an option that some employers offer and theres no requirement that says 401 plans need to have loans. Some companies prefer not to. Employers might want to discourage employees from raiding their retirement savings, or they may have other reasons. For example, they dont feel like processing loan requests and repayments. How do you find out if you can borrow from your 401 plan? Ask your employer, or read through your plans Summary Plan Description . If loans are not allowed, there might be other ways to get money out.

Former employees: 401 loans are generally only allowed while youre still employed. If you no longer work for the company, youd have to take a distribution from the plan instead. Former employees dont have any way to repay the loan: You cant make payments through payroll deduction because youre not on the payroll any more.

Risks Of Taking Out A 401 Loan

Before deciding to borrow money from your 401, keep in mind that doing so has its drawbacks.

You may not get one. Having the option to get a 401 loan depends on your employer and the plan they have set up. A 2020 study from retirement data firm BrightScope and the Investment Company Institute says that 78 percent of plans gave participants the option to borrow based on 2017 data. So you may need to seek funds elsewhere.

You have limits. You might not be able to access as much cash as you need. The maximum loan amount is $50,000 or 50 percent of your vested account balance, whichever is less.

Old 401s dont count. If youre planning on tapping into a 401 from a company you no longer work for, youre out of luck. Unless youve rolled that money into your current 401 plan, you wont be able to use it.

You could pay taxes and penalties on it. If you dont repay your loan on time, the loan could turn into a distribution, which means you may end up paying taxes and bonus penalties on it.

Youll have to pay it back more quickly if you leave your job. If you change jobs, quit or get fired by your current employer, youll have to repay your outstanding 401 balance sooner than five years. Under the new tax law, 401 borrowers have until the due date of their federal income tax return to repay in such circumstances.

Recommended Reading: Can You Roll Your 401k Into An Ira

Ways To Help Manage A Margin Line Of Credit

To ensure that youre using margin prudently, it may be possible to manage your margin as a line of credit by employing the following strategies:

- Have a plan. You should never borrow more than you can comfortably repay. Think about a process for taking out the loan and ensuring that it aligns with your financial situation, and consider how youll respond in the event of various market conditions. Among other things, you should know how much your account can decline before being issued a margin call. Find out more on managing margin calls

- Set aside funds. Identify a source of funds to contribute to your margin account in the event that your balance approaches the margin maintenance requirement. This can be anything from cash in another account to investments elsewhere in your portfolio .

- Monitor your account frequently. Consider setting up alerts to notify you when the value of your investments declines by an amount where you need to start thinking about the possibility of a margin call.

- Pay interest regularly. Interest charges are automatically posted to your account monthly. Its important to have a plan for reducing your margin balance to minimize the interest amount youre charged which you can do by selling a security or depositing cash into your account.

Take A New 401 Loan With The New Employer

If you left your employer and you had an outstanding loan- and you are unable to keep up with the loan payments, you can take a new loan with your new employer to pay off the old loan. In this case, you could take a 401 loan that is equivalent to the outstanding balance of the old 401 loan. The new employer will deduct loans payments automatically from your paycheck.

You May Like: Which Is Better 401k Or Ira

Repaying The 401 Loan

You should make payments at least quarterly, but commonly, this interval is manageable as you’ll repay your loan through payroll deductions. The longest repayment term allowed is five years, though there are exceptions. Some 401 plans do not allow you to contribute to the plan for a certain period after you take out a loan.

If you lose your job while you have an outstanding 401 loan, you may need to repay the balance in full or risk having it be categorized as an early distribution, which can result in both taxes owed and a penalty from the IRS.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Recommended Reading: How Do You Find Lost 401k Accounts

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

It’s Sometimes Possible To Get A Tax Deduction But That May Not Be Worth It

The government allows you to claim a tax deduction if your 401 or other retirement plan has lost value, but there are rules you must follow. First, you must have basis. In this case, basis refers to nondeductible contributions you’ve made. Deductible contributions — those that reduce your taxable income for the year — do not count. You haven’t paid any taxes on that money so far, so the government is not going to give you a tax deduction on the amount you lost.

You also must close all retirement accounts of the same type in order to calculate the loss. So if you’re trying to claim a loss on your 401, you must close all of your 401s. Then you total your nondeductible contributions and the current value of the accounts, and you can write off the difference if the current value of the accounts is lower.

But this is inconvenient for two reasons. First, if you withdraw money from your 401 before age 59 1/2, you pay a 10% early-withdrawal penalty. This may negate some of the benefit you get from writing off the loss. Second, if you take the money out of your 401, you’re giving up the tax advantages it offers and your money will no longer grow as quickly unless you invest it in something else.

For these reasons, it’s not wise to claim a tax deduction on a 401 loss unless you’re older than 59 1/2 and plan to use the money to cover your retirement expenses in the near future anyway. Otherwise, try one of the suggestions above.

Read Also: What Is The Contribution Limit For 401k

Leaving Work With An Unpaid Loan

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don’t, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. While this scenario is an accurate description of tax law, it doesn’t always reflect reality.

At retirement or separation from employment, many people often choose to take part of their 401 money as a taxable distribution, especially if they are cash-strapped. Having an unpaid loan balance has similar tax consequences to making this choice. Most plans do not require plan distributions at retirement or separation from service.

People who want to avoid negative tax consequences can tap other sources to repay their 401 loans before taking a distribution. If they do so, the full plan balance can qualify for a tax-advantaged transfer or rollover. If an unpaid loan balance is included in the participant’s taxable income and the loan is subsequently repaid, the 10% penalty does not apply.

The more serious problem is to take 401 loans while working without having the intent or ability to repay them on schedule. In this case, the unpaid loan balance is treated similarly to a hardship withdrawal, with negative tax consequences and perhaps also an unfavorable impact on plan participation rights.