Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

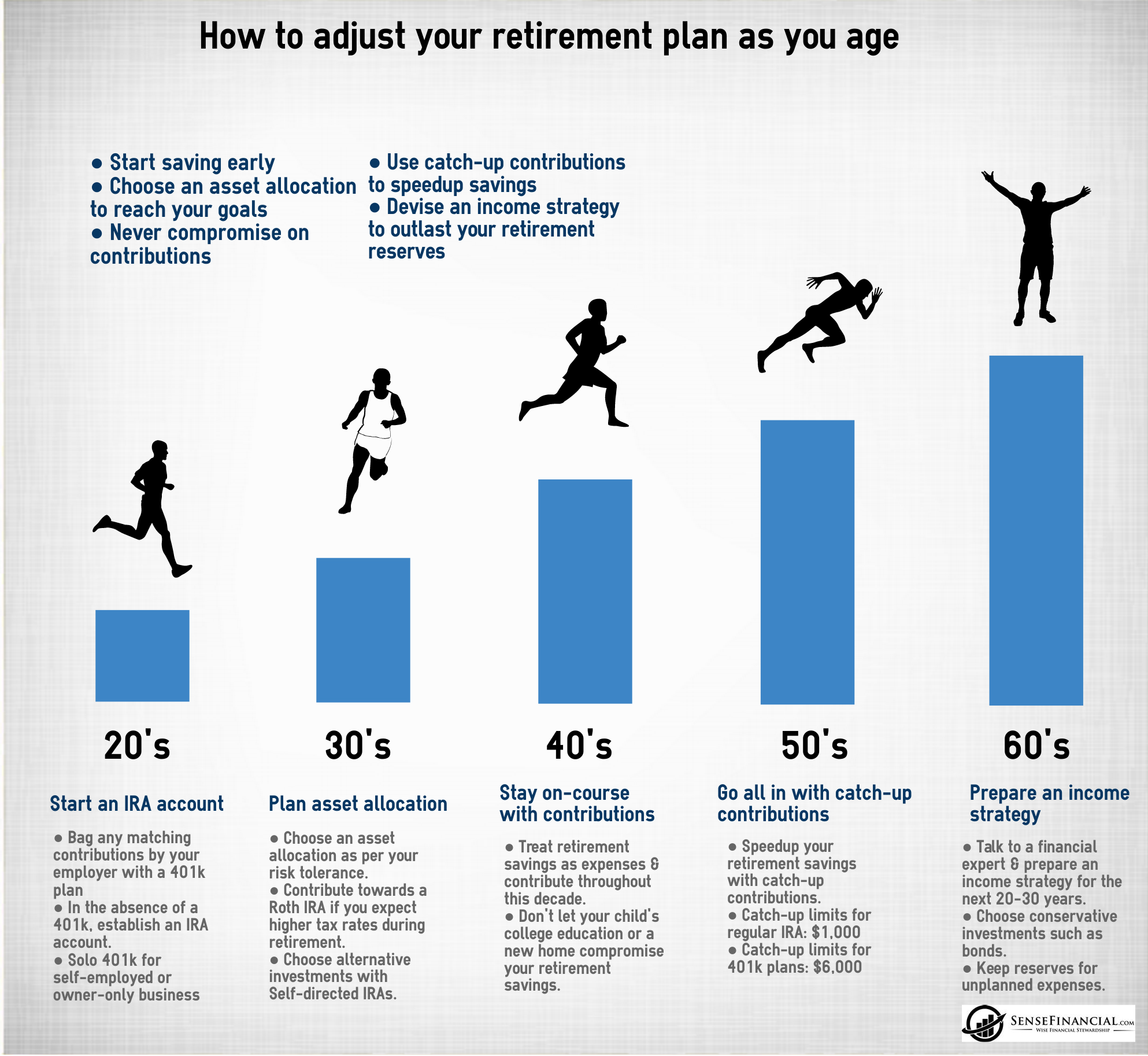

Retirement Savings In Your 30s

As in your 20s, saving for retirement may compete with other financial goals that youve asked your financial professional to help you plan for, like saving for a down payment for a house, paying for a graduate degree, or supporting a family.

Yet Millennials, who are now about 25 to 40 years old, are making progress in saving for retirement. The median household retirement savings for Millennials is about $68,000 versus about $26,000 for Generation Z, according to the nonprofit Transamerica Center for Retirement Studies® and its annual retirement study.5

So how much should you have saved as a 30-something? One theory suggests youll need retirement income of about 70 percent of what you earned annually pre-retirement, with Social Security benefits representing perhaps 40 percent of that amount and your savings representing the rest.6 So if you retire in your 60s and need to have 30 or so years’ worth of savings, youll want to have at least nine times your salary saved up by the time you retire.

Thanks to compounding growth, you may only need to have one to two times your salary saved for retirement when youre in your 30s.

The takeaway: As you earn raises and promotions, see if you can devote slightly more of your paycheck to your retirement account each year. Focus on budgeting so you can continue to make retirement savings a priority along with your other financial goals. And if you change jobs, remember to explore your retirement savings benefits at your new employer.

Don’t Miss: How Much Does 401k Cost Per Month

How Does A 401 Work When You Retire

Over the course of your working years, you diligently contribute to your 401 in preparation for retirement. But what happens once you actually get there? In short, itâs time to switch from saving your money to generating income with your savings.

So how does a 401 work when you retire? For starters, it can be an essential source of income when you exit the workforce. But before you start withdrawing money from your 401, itâs a good idea to build a plan to create your retirement income. Hereâs what you can expect from your 401 when you retire.

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

Recommended Reading: Can You Contribute To 401k And Roth Ira

Move Your Money To Your New Employer’s Plan

If you have a new employer offering a retirement plan, you may be able to transfer your savings into it.

- Your savings stay invested with the same tax advantages

- You might be able to roll in savings from other retirement plans

- You can make ongoing contributions.

- The investment options depend on what the plan offers.

- You may be able to take out a plan loan, or withdraw money before retirement under certain circumstances

Turning Your Savings Into Retirement Income

You’ll need to decide how you want to convert your savings and investments into retirement income. You should start thinking about these things before you retire so you can have a better understanding of what your options are and how much money you may have.

Some options include:

- converting an RRSP into a Registered Retirement Income Fund

- buying an annuity

- investing your money in other products, such as stocks or bonds

- withdrawing your savings as cash

You may be able to convert some of your retirement savings into income before you retire. This can help you transition from working to retiring.

Think about your other sources of retirement income before deciding how to use or invest your savings. Your other sources of retirement income can impact the amount of money you receive from government benefits and pensions that are based on your income.

For example, lets say you are a Canadian with a low income and receive the Guaranteed Income Supplement . If you withdraw a large amount of money from an RRSP or an RRIF, then you might not be considered low income for the next year. You may receive a lower GIS payment, or you could no longer be eligible for the GIS in that year.

If you think you may earn a low income when you retire and will qualify for the GIS, then a TFSA may be a better savings option for you than an RRSP.

You May Like: How Does Retirement Work With 401k

How Much Do I Need To Retire

How much you need in retirement will depend on how your income and expenses change when you retire. As a general rule, you’ll want to aim for at least 70-80% of your pre-retirement income for each year of your retirement. In retirement you may spend less money on savings, housing, tax, and transportation to work, but more on hobbies, utilities, and healthcare. Ask yourself when I retire will I need same amount of money I’m earning now or less? You could use a tool to figure out your ideal replacement ratio.

If The Maximum Is Out Of Your Reach Don’t Despair

Receiving the maximum Social Security benefit is something very few people will do. It takes decades of high earnings plus delayed gratification for what amounts to little more than bragging rights. Partly because of the formula Social Security uses to calculate benefits, higher-income folks face a seriously diminishing return on the taxes they paid into the system.

You get $0.90 of the first dollar of your “average index monthly earnings” back in benefits, but only $0.15 of the last dollar, if your income is past the top bend point Social Security uses but below the cap. That means there isn’t all that much difference between what a generally high-income earner gets and what a person who absolutely maxes out the Social Security benefit gets. So if the absolute maximum is out of reach, rest assured that getting close is much easier than perfectly topping out the benefit.

As a result, your energy would likely be best served by focusing on the number of years of covered earnings you have and the age at which you start collecting benefits. By doing what you can on those factors, you’re likely to get a better return than trying to max out your salary for decades just to get a higher Social Security benefit.

You May Like: How To Check Your 401k Balance Online

What Is A Required Minimum Distribution

The government imposes penalties for making early withdrawals from retirement accounts. After a certain age, however, youre required to take some money out every year. A mandatory 401k withdrawal is called a required minimum distribution.

In general, 401k withdrawal rules from the IRS require you to start withdrawing money from your 401k by April 1 of the year following the year that you turn 70.5, and your age and account value determine the amount you must withdraw. If youre 70.5 or older and still working, you might be able to delay taking RMDs if your plan is sponsored by the company for which youre still working. Known as the still working exception, you can apply if you:

Related: How to Master Your 401k in Your 60s

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

Recommended Reading: What Age Can I Start Withdrawing From My 401k

After You Retire You Have An Important Choice To Make With Your 401 Account Here Are The Options Available Along With The Pros And Cons Of Each So You Can Determine Which Is Best For You

This article was updated on July 6, 2017, and was originally published on June 13, 2015.

If you’re planning to retire soon and have a 401 or similar employer-sponsored retirement plan, then you have an important question to answer: what happens with your retirement nest egg? You could choose to leave your money in the plan, take a lump sum payout or partial withdrawal, buy an annuity, or roll the money over to an IRA. All of these options have their pros and cons, so let’s see if we can figure out which is the best move for you.

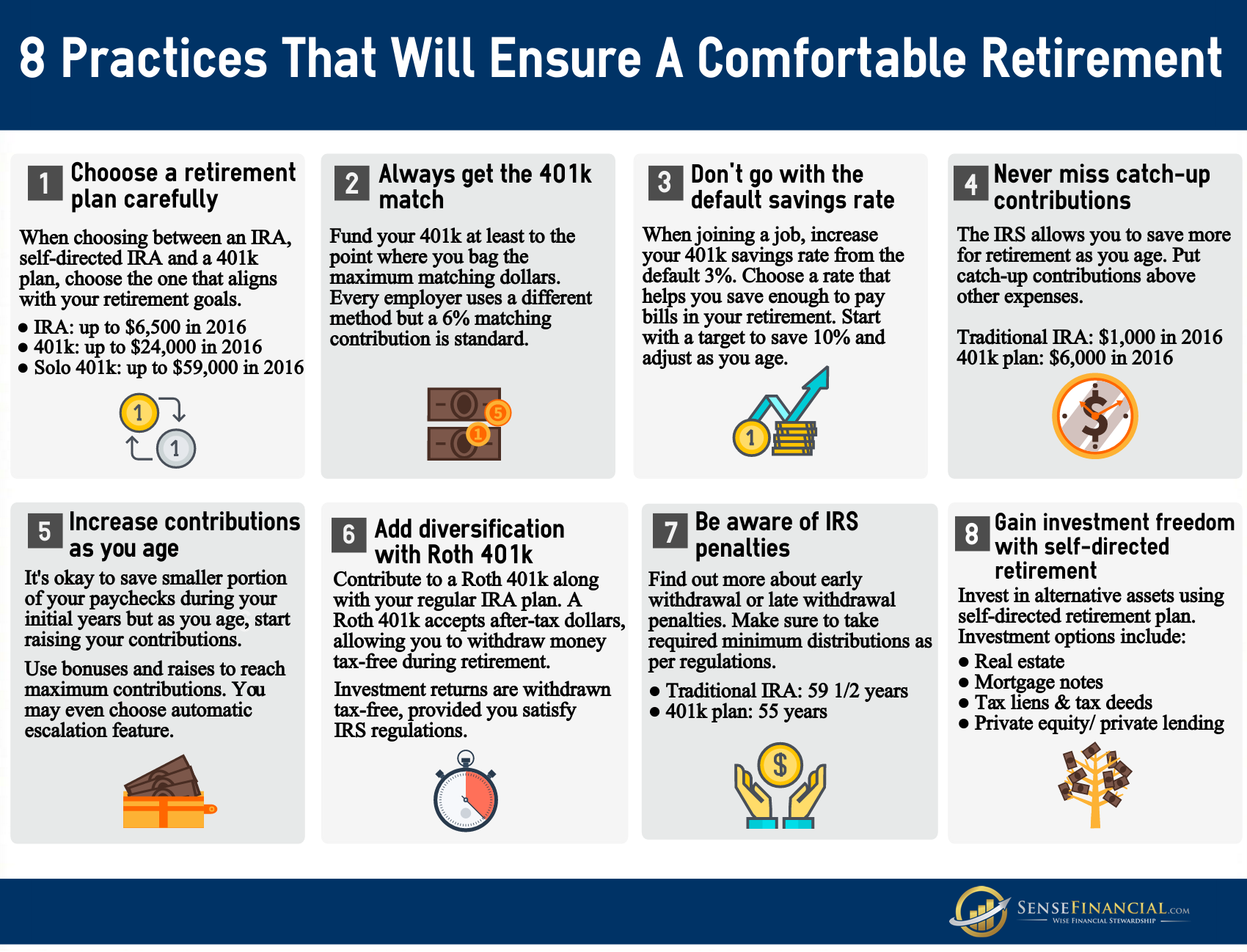

How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employer’s matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

Recommended Reading: Do I Have A 401k Out There

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Impact Of Inflation On Pensions And Savings

The amount you get from public pensions, like the Old Age Security pension and Canada Pension Plan, is protected against inflation. This means as the cost of living goes up, the value of your benefit goes up as well.

Not all employer pensions are protected against inflation. Ask your pension administrator or employer whether your pension is protected against inflation.

Personal savings and investments, such as mutual funds or guaranteed investment certificates , are usually not directly protected against inflation. Your savings need to grow by at least the rate of inflation. If not, the amount of things your savings can buy in the future will be less than what they can buy now.

For example, something bought for $100 in 2002 would cost $129.92 in 2016. If your income isn’t protected against inflation, you may have a hard time maintaining your lifestyle in retirement as the cost of goods and services increases.

Also Check: What Is The Penalty For Taking Money Out Of 401k

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you won’t run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

How To Handle Your 401 After You Retire

Workers spend decades of their careers saving up money for retirement, whether in their employer 401 plans or through other savings vehicles. Yet despite spending a lot of time and effort making sure they invest their retirement assets well, many people don’t have much insight on what to do with their 401s after they retire. Handling your 401 correctly in retirement is just as important as managing its growth during your career, and to help guide you through the choices you have, below you’ll find a list of the things you can do with your 401 account after you retire.

1. You can leave your 401 at your last employer and take distributions on demand. One choice that most workers have is to leave their 401 accounts at their final employer. You can then choose from a variety of distribution options, one of which is simply to take money out at will on request. In essence, this makes your 401 closely resemble IRAs over which you have complete control, except that rather than going to your financial institution to make withdrawals, you’ll likely have to go through your former employer’s HR department.

If you choose this route, bear in mind that 401 accounts are subject to minimum distribution requirements once you turn 70 1/2 years old. As long as you meet those requirements, though, you can generally be flexible about when and how much money you take, giving you latitude to spend when you need money.

Read Also: How To Borrow From Your 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Choose An Appropriate Brokerage Roboadvisor Or Bank And Open An Ira Account

Once you have answered this question, you can figure out which type of financial institution will be best for your needs. You can choose an appropriate brokerage or bank and open your IRA account.

While it is possible to withdraw the funds from your 401 and then open up an IRA, it is safer to do a direct rollover meaning you open an IRA first and then transfer your 401 money directly into the new account.

Don’t Miss: How Do I Get My 401k