Do Most Employers Match 401 Contributions

There are several variables to look at when trying to figure out whether or not a 401 plan is generous:

- Is the employer contributing anything?

- Is it a matching or a non-matching contribution?

- How much of your contribution is matched?

- Is the match capped?

Start with perhaps the simplest question: Should you expect your employer to contribute anything?

The answer is yes.

According to Vanguard plan provider), 51% of all plans provide just matching contributions and another 34% provide both matching and non-matching contributions.

In the latter scenario, the employer will contribute something on your behalf no matter what but you can increase that contribution if you direct some of your paycheck into the 401 plan to earn a match as well.

In total, 85% of 401 plans provide some form of matching contributions. Another 10% of plans provide just non-matching contributions.

What all this adds up to is that only 5% of 401 plans provide no form of employer contribution. If you are in one of those, you are in one of the least generous 401 plans around.

% 401 Program Match Explained

The 6% 401 match can mean several situations, and you should discuss in the HR department which one yours belongs to. The most common match of 6% 401 means that the employer will pay a certain percentage of your funds until the amount of your contribution for the year reaches 6%. That is, if your salary is $60,000 per year, you will pay $3,600 per year and the employer will increase the amount of your savings for the established match rate.

This is a common condition from the employer and even if you contribute 15% of the annual salary into your 401 account, the employer will increase only the first 6%. Therefore, never limit yourself to clarify with the employer all the conditions regarding the 401 match and match rate.

Simple 401 Limits In 2022

Employers offering a SIMPLE 401 allow employees to save up to $14,500 in 2022, which is up by $1,000 from 2021. Those age 50 and older may contribute another $3,000 for a total of $17,000.

Employers can contribute dollar-for-dollar up to 3% of a workers pay or contribute a flat 2% of compensation regardless of the employees own contributions. Employer 401 contributions are subject to an employee compensation cap of $305,000 for 2022.

Also Check: How Do You Transfer 401k To New Job

Make The Most Of A Company Retirement 401k Match

If you work for an organization that offers a 401k or retirement savings match, don’t pass it up.

Our favorite four-letter word? F-R-E-E. The best type of money is free money, are we right? It’s worth doing some due diligence to find hidden benefits and free money that could be available to you in the form of benefits from an organization you work for.

What Is An Employer 401 Match

A 401 is an employer-sponsored, tax-advantaged retirement account. Employers can both host employee contributions and make contributions to these accounts. Employer match programs allow employers to make contributions to an employees plan based on factors such as the employees salary and the employees contributions.

Many employers match a portion of the employees own contributions up to a certain dollar amount or percentage, and this is a powerful incentive for small companies wanting to attract and retain good employees. However, employer matching contributions are optional and at the discretion of an employer. That said, the majority of employers do provide some type of match . The average employer match is 4.7% of an employees salary.

Once employers set the rules for a match program, employees have guidelines about when and how they can access the plan. These matches form part of an employees total compensation package, along with access to a 401 account program and other benefits. It is advisable that employees should consider a potential employers contribution plan when evaluating a job offer. In fact, 88% of workers say a 401 is a must-have when theyre looking for a new job.

Don’t Miss: How To Roll Over 401k To Ira Vanguard

Traditional 401 Vs Roth 401

A traditional 401 is also an employer-sponsored retirement saving and investment account. Employers and employees both make contributions to 401s on an elective basis.

Employers may choose to match an employee’s contributions, up to a certain point. The money is then invested in various securities and mutual funds to grow until they are withdrawn, after retirement.

How Do 401 Matches Work

Every 401 plan is different, so youll have to check your employers plan for the details on exactly how yours works. But there are two common types of matches:

Partial matching

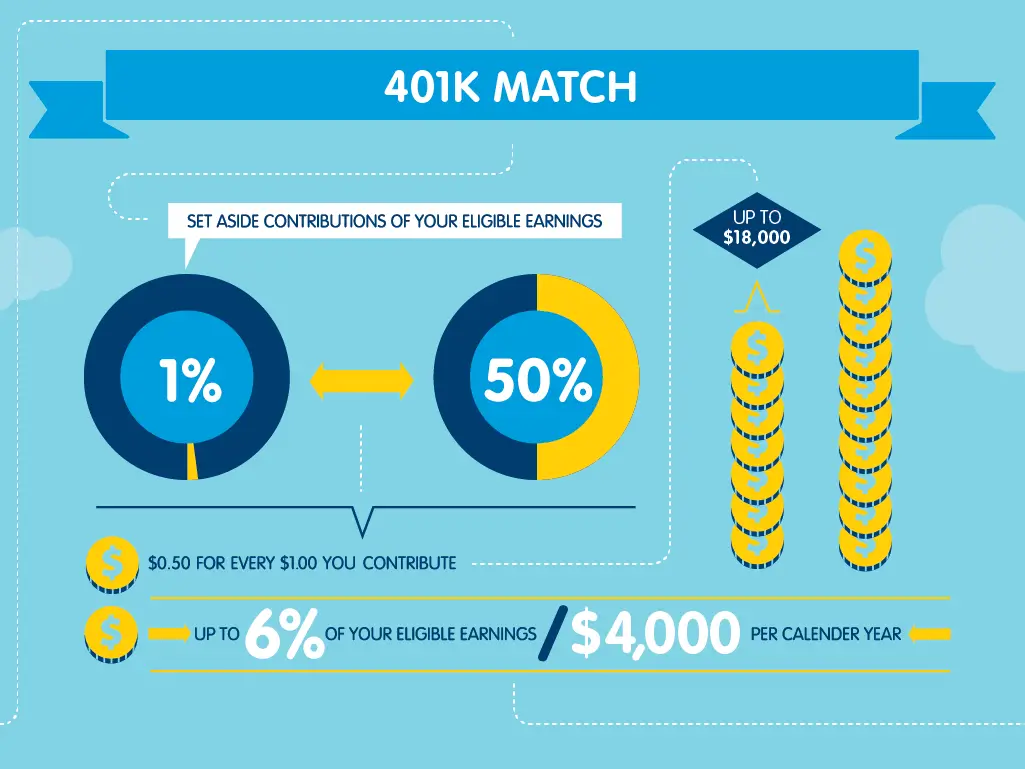

Your employer will match part of the money you put in, up to a certain amount. The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%. If you put in more, say 8%, they still only put in 3%, because thats their max.

Heads-up that you might see this written in a lot of different ways. 50 cents on the dollar up to 6%, 50% on the first 6%, 3% on 6% you get the picture. All various ways to describe a partial match.

Dollar-for-dollar matching

With a dollar-for-dollar match , your employer puts in the same amount of money you do again up to a certain amount. An example might be dollar-for-dollar up to 4% of your salary. In this case, if you put in 4%, they put in 4% if you put in 2%, they put in 2%. If you put in 6%, they still only put in 4%, because thats their max.

Don’t Miss: What Will My 401k Be Worth

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employers matching contributions.

Dont Miss: What Is An Ira Account Vs 401k

What To Do If You Cant Afford To Max Out

If you dont have room in your budget, rework your expenses. Where can you cut back? Look at your monthly expenses and your discretionary spending. Can you shop around for cheaper insurance, cut the cord on cable, or cut down your luxury spending on shopping, grooming, and other luxuries?

Figure out the amount you need to meet the employer match and play with your budget to make it work. Even if you have to sacrifice, your future self will thank you.

Recommended Reading: How To Check Your 401k Balance Online

Whats This Whole Employer Match Vesting Thing

A lot of employers use a vesting schedule for their 401 matches. Its a way to help them hedge their bets on you as an employee by reducing the amount of money theyd lose if you were to leave the company. Its also meant to give you a shiny incentive to stay.

A vesting schedule determines how much of your employers matching contributions you actually own, based on how long youve worked there. For example, if your employer contributions vest gradually over four years, then 25% of your employer contributions belongs to you after youve been there one year, 50% belongs to you after two years, 75% belongs to you after three years, and theyre all yours once you hit your fourth work anniversary.

Theres another type of vesting schedule, called cliff vesting. This ones more of an all-or-nothing scenario. With a four-year cliff, 0% of the contributions are yours until you hit your fourth workiversary, then 100% of them are all yours, all at once.

All the contributions made after your vesting schedule ends are usually fully vested right away. Oh, and dont worry: 100% of the money you put in yourself is always fully vested.

Other 401 Employer Match Rules And Considerations

Beyond the annual combined limits for employer and employee contributions, employer match contributions are subject to some additional employer discretionary contribution rules. Nondiscrimination tests require that employer matches pass the Actual Contribution Percentage test, which is designed to see that contributions made to Highly Compensated Employees dont exceed contributions made to Non-Highly Compensated Employees by more than 125%. For more information on ACP tests, review this resource from the Internal Revenue Service.

Other 401 discretionary contribution rules allow employers some flexibility in how they implement an employer match. Employers are allowed to set up a vesting schedule for employer matches, which means employees will have to put in a certain amount of service before being eligible to collect the full employer match. This can take the form of up to 3 years in a cliff vesting schedule, or up to 6 years in a graded vesting schedule. Finally, employers have the option to require a certain number of hours worked in a year, or to require that employees work on the last day of the year in order to qualify for employer matching contributions.

Additional Business Considerations

For highly-compensated employees , which for 2021 is defined as an employee earning more than $130,000, employer contributions may be limited.

Employer contributions to employee 401 accounts are considered a business expense, and can help lower your businesss tax bill.

Don’t Miss: How To Check 401k Balance Adp

Does A 401k Match Contribution Make A Difference

Absolutely. A 401k match is the closest thing you can get to free money at your job. If you choose to not take advantage of a 401k match at your company, you are not taking advantage of one of the best ways to grow your money almost immediately.

Lets take someone with a 401k that has a salary of $50,000 per year. They decide to contribute 2% of their salary to their 401k. Because they decided to invest in diversified investments, well assume an average annual return of 7%. That 2% grows to around $97,000 over 30 years due to continued contributions and compounding.

Lets then take the same person who made the same decisions, but the company offers a dollar-for-dollar match on their 2% contribution. With all the same assumptions, the same person ends up with over $196,000 at the end of 30 years! Because the match came out of the companys pocket and not theirs, it didnt cost them a thing. How does 401k matching work when it comes to helping you retire easier? Everything helps, but it helps even more when it’s someone else’s money and not yours!

“For you yourselves know how you ought to imitate us, because we were not idle when we were with you, nor did we eat anyone’s bread without paying for it, but with toil and labor we worked night and day, that we might not be a burden to any of you.” 2 Thessalonians 3:7-8 ESV

Whats A Typical Employer Match To A 401

Ever wondered how employers calculate matched contributions? In 2018, Vanguard administered more than 150 distinct match formulas . With 71% of plans using it, the most popular formula is the single-tier formula, such as $0.50 per dollar on up to 6% of pay. Under this single-tier formula, an employee making $60,000 per year could get up to $1,800 in employer-matched contributions.

Here are the most common employer matching formulas per the Vanguard survey:

| Match Type | |

|---|---|

| Variable formula, based on age, tenure or similar vehicles | 2% |

There are literally hundreds of matching formulas out there, so contact your 401 plan administrator regarding the rules and specifics of the matching formula used by your employer.

-

The most common matching formula among Vanguard plan holders was $0.50 per dollar on the first 6% of pay.

-

The second most popular formula for employer matching contributions is $1.00 per dollar on the first 3% of pay and $0.50 on the next 2% of pay. Under this multi-tier formula, the same worker in our previous example would receive up to $2,400 in matching contributions.

Dont Miss: How Much Can You Put In Your 401k A Year

Also Check: Can I Withdraw From My 401k To Buy A House

What Is A 401k Company Match

A 401k company match is a percentage of your salary your employer will match. For example, if your employer will match 4% of your salary and you make $1,500 a week, your employer would match your contributions up to $60 a week if you contribute that much.

With your $60 contribution plus your employers contribution, thats $120 a week. It doesnt sound like much, but with compounding interest, youll see your earnings grow faster than you anticipated. $120 a week is $6,240 a year or $62,400 over ten years, and thats before interest. Its a good start to your retirement savings.

Vesting And Employer 401 Contributions

Some 401 plans include a vesting schedule for employer contributions. With vesting, you must wait for a period of time before taking ownership of the 401 contributions made by your employer.

Note that most 401 plans let you start contributing to your account as soon as you join the company. Contributions that you make to your 401 account are always considered fully vestedthey are always 100% owned by you. Extended vesting periods only cover employer contributions.

According to Vanguard, 40% of 401 participants were in plans with immediate vesting of employer matching contributions. Smaller plans, meaning plans with fewer participants, used longer vesting schedules, with employees only becoming fully vested after five or six years.

If you have a 401 and your employer matches your contributions, be sure to ask about the vesting schedule. If your plan has a vesting schedule, you dont own your employers contributions to your 401 until you are fully vested. If you take a new job before that point, you could lose some or even all of your employers 401 contributions.

Also Check: How Many Loans Can I Take From My 401k

How Does 401k Matching Work

Does your new employer offer 401 matching? Find out how 401 matching works, and everything you need to know about this âfree moneyâ.

If you recently changed jobs or started a new job, your employer will set up a 401 retirement account for you. A 401 account allows employees to make tax-deferred contributions through elective deferrals. An employer may also offer 401 matching as part of the companyâs compensation plan to retain top employees in the company.

An employer with 401 matching makes contributions to the employeeâs 401 account, based on the amount contributed by the employee to the plan. The employer can offer either partial or full matching of your contributions, depending on the companyâs policy. The employee can get full ownership of the matched contributions either immediately or after a certain period, depending on the companyâs vesting schedule.

Taxes And Employer 401 Matching Contributions

You dont have to pay any income taxes on employer 401 matching contributions until you start making withdrawals.

Gross income includes wages, salaries, bonuses, tips, sick pay and vacation pay. Your own 401 contributions are pre-tax, but still count as part of your gross pay. However, your employers matching contributions do not count as income, said Joshua Zimmelman, president of Westwood Tax & Consulting.

Your employers matching contribution grows tax-deferred in a traditional 401, boosting your compounding returns over the years. You dont have to pay any taxes on the employer match until you start making withdrawals, said Zimmelman. Traditional 401 withdrawals are taxed as ordinary income at whatever tax bracket youre in when you make those withdrawals..

Don’t Miss: Can A Spouse Get Your 401k In Divorce

What Is 401 Matching

401 matching is when your employer makes contributions to your 401 on your behalf. It is called matching because the contributions your employer makes are based on employee contributions i.e. the contributions you make.

For example, you employer can offer a 100% match on up to 5% of your income. That means, for every dollar you contribute to your 401, up to 5% of your paycheck, your employer will also contribute one dollar.

100% Match on 4% of income at $50,000 salary.

| Your contribution | |

| $5,000 | $2,000 |

Once you contribute up to the matching limit, which in this example is 5% of your income, your employer stops contributing, but you can continue to contribute. That means that you want to contribute up to the matching limit if at all possible, to get the most value out of the match.

Employer matching plans can get complicated depending on your employer. Some employers offer graduated matching tiers, such as 100% match on the first 4% of income and a 50% match on the next 4%, giving you a 6% contribution if you make an 8% contribution.

100% Match on 3% and a 50% match on the next 3% of income at $50,000 salary.

| Your contribution |

| $2,250 |

Read the specifics of your plan to learn exactly how much your employer will contribute and how much you need to contribute to max out the benefit.

Importance Of Offering 401 Matching As A Benefit

The competition for talent is intense, and offering a 401 matching project can help you draw in and hold talent. Whenever workers are certain with their retirement investment funds, their work fulfillment and execution can increment.

Truth be told, 80% of non-retired Americans say they hope to depend on 401 or another retirement investment account as a source of retirement pay, as indicated by a Gallup survey. 62% of U.S. retired people, then again, say they depend on 401 or another retirement investment account as a source of retirement pay, as indicated by a similar Gallup survey. Matching contributions likewise offer a tax benefit for the business.

Read Also: How Much Income Will My 401k Generate