Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts. But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

For example, if youre rolling over $100,000 and youre in the 22% tax bracket, that means you have to come up with $22,000 cash to cover the taxes. Dont pull that money out of the investment itself!

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But before you roll over accounts, make sure to sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and how you can be prepared for it.

Roth Ira Or Roth : Which Is Better

Determining which account will best suit your needs depends on your current and future financial situations, as well as your own specific goals.

High earners who want to make contributions to retirement accounts each year should consider a Roth 401, because they have no income caps. Additionally, individuals who want to make large contributions can put more than three times the amount in a Roth 401 as in a Roth IRA.

Those who want more flexibility with their funds, including no required distributions, might lean toward a Roth IRA. This would be especially helpful if you want to leave the account to an heir. But Roth 401 accounts can be rolled over into a Roth IRA later in life anyway.

Am I Eligible To Invest In A Roth

To contribute to either a traditional or Roth IRA, you must have taxable compensation for that year. And Roths have additional restrictions on who can contribute: Single filers with a modified adjusted gross income less than $124,000 can contribute up to the maximum amount allowed for the year. If your MAGI is $139,000 or more , you cannot contribute to a Roth. Anything in between, you can contribute a reduced amount.

You can contribute to a traditional IRA, no matter what your MAGI is. But how much of your contributions are deductible depends on your MAGI and whether youre able to contribute to a retirement plan through your employer. If you do have a retirement plan at work, you can deduct the full amount up to the contribution limit, if your MAGI is $65,000 or less as a single filer, or $104,000 or less if youre married and filing jointly. Without an employer-sponsored option available to you, single filers have no income limits on how much they can deduct while joint filers with a MAGI of $206,000 or more get no deduction.

Don’t Miss: How Can I Use My 401k To Buy A House

Invest Aggressively Early Then Shift Your Savings Strategy

Speaking of investing early, Gen Z investors should try to practice aggressive investment strategies in their early days. When youre young and your investment account is small, setting up your investment portfolio for aggressive growth is wise to make big gains early.

As you get older, its wiser to shift your savings strategy to a more conservative one. This way, you wont lose most of your investment money due to market downswings just when you need it.

How Are They Different

| Employers provide a 401 to employees as a benefit | An IRA is an individual retirement account, so it belongs to you individually |

| Lowers your taxable income because most 401 contributions are made before taxes are taken out | Your traditional IRA contributions are made from your taxable earnings, you are then permitted to deduct the contributions from your income in certain situations |

| The employer selects the investment options offered in the plan | Typically offers a wider range of investment options than a 401 |

| The employer may match up to a certain percentage of your contribution | Isnt tied to your employer, so you dont get a match on your contributionhowever, you have more control and flexibility when and how you contribute |

| You may be able to roll over an old 401 from a previous job into the 401 at your current job | You can roll multiple outside accounts like old 401s or other IRAs into one IRA to simplify your savings |

Recommended Reading: How Do I Cancel My 401k With Fidelity

Can I Have A Roth 401k And A Roth Ira

Yes, you can have both a Roth 401k and a Roth IRA. Keep in mind the contribution limits for each account.

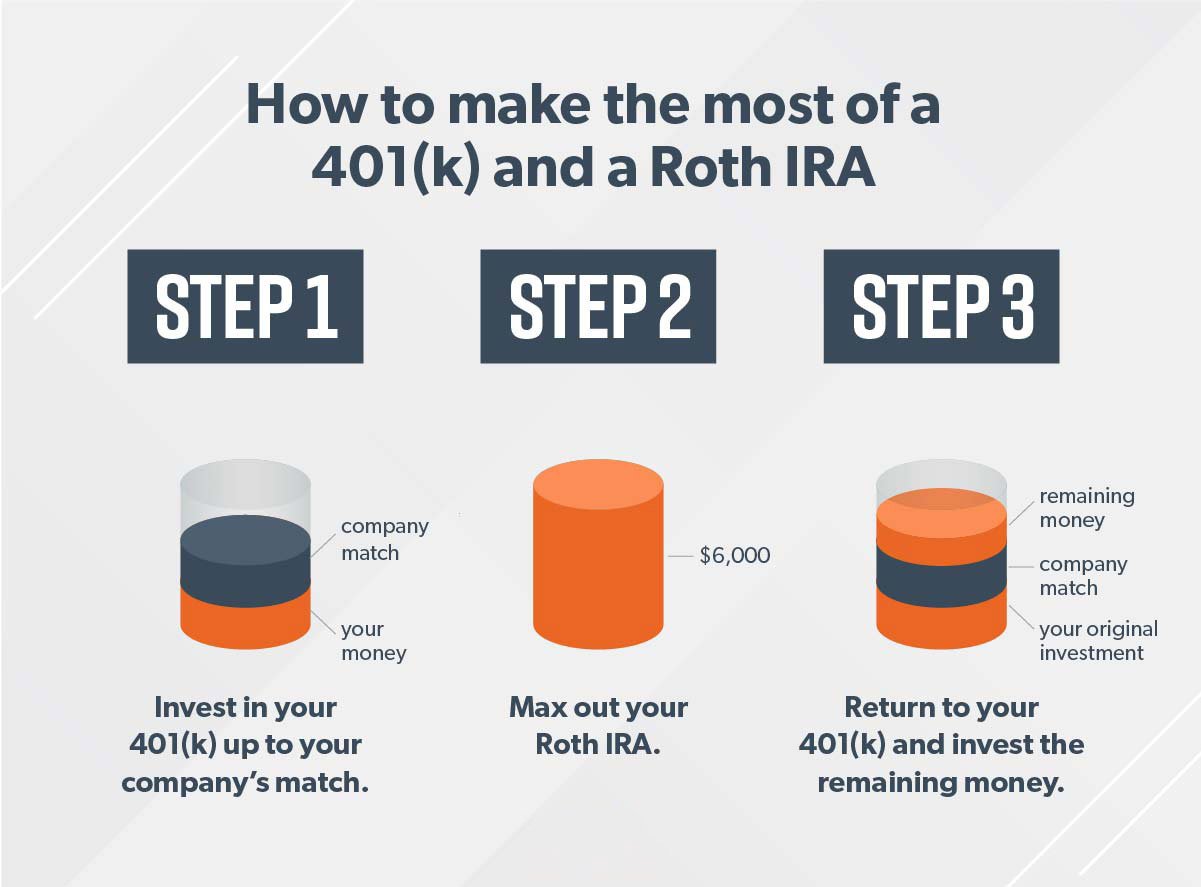

If you receive a Roth 401k option through your employer, heres one strategy to consider: contribute enough money to your Roth 401k to receive the company match, since this match represents a risk-free return on your investment. Then you can also open a Roth IRA and contribute any additional retirement money you have to this account in order to diversify your retirement savings.

When Can I Withdraw From My Roth Ira

You can withdraw anytime from a Roth IRA, but there may be some penalties.To avoid a potential 10% early withdrawal penalty, you should withdraw after the age of 59½ or once your Roth IRA account has been open for five years. You can withdraw early and avoid penalties if you are buying a home for the first time, have college expenses to pay for, or need to cover birth or adoption expenses.

Don’t Miss: How To Find Old 401k Money

How To Invest In Both Roth Ira & 401

When managed properly, having both a Roth IRA and 401 can be an excellent way to prepare for retirement. Get started by learning more about your 401 eligibility at work do you have to wait a year to open an account? Does your employer match, and how much? Which mutual funds are available to you? If you do receive employer contributions, many financial planners might tell you to start by opening and contributing to this account. After you have a 401 you can set up and contribute to a Roth IRA at the same time.

Making Roth Ira Contributions

As we mentioned earlier, no matter how old you are, you can continue to contribute to your Roth IRA as long as youre earning incomewhether you receive a salary as a staff employee or 1099 income for contract work.

This provision makes Roth IRAs ideal for semi-retirees who keep working a few days a week at the old firm, or retirees who keep their hand in doing occasional consulting or freelance jobs.

Don’t Miss: How Much Does A Solo 401k Cost

Should You Convert Your Traditional 401 To A Roth 401

The law now allows employees to convert funds from a traditional 401 plan to a Roth 401, if the plan allows it. About half of employers offer a Roth 401, according to 2017 data from Transamerica Center for Retirement Studies.

You’ll have to pay taxes in the year you convert, just as you would if you converted a traditional IRA to a Roth. Plus, a large conversion could bump you into a higher tax bracket. Note that unlike converting from a traditional IRA to a Roth, you can’t change your mind and undo a 401 conversion to a Roth.

Alternative To A 401 And A Roth Ira

Consider investing in a traditional IRA instead to supplement your 401 contributions if your income is too high for a Roth IRA.

You must still have taxable earnings in order to be eligible for a traditional IRA, but there’s no income limit. You could have both plans, even as a high earner. These accounts work like 401 accounts in that your contribution is either fully or partially deductible in the present. You pay taxes on the money you invest and on earnings upon withdrawal.

You can take a full deduction up to your IRA limit if you don’t also participate in a 401 or another retirement plan at work, or if you have a 401, but your modified AGI is $66,000 or less as a single filer in 2021. This increases to $105,000 or less as a married couple filing jointly when the spouse contributing to the IRA also has a work-related 401. In 2022, these limits increase to $68,000 and $109,000, respectively.

In 2021, you can claim a reduced deduction if your income is more than $66,000 , or more than $105,000 for a single filer or couple with a spouse enrolled in a 401 at work.

You don’t qualify for any deduction if you earn $76,000 or more as a single filer or $125,000 or more as a couple with a spouse enrolled in a 401 at work in 2021. These limits increase to $78,000 for single filers and $129,000 for couples in 2022.

Read Also: What Is Max 401k Contribution For 2021

Vs Roth Ira: An Overview

Both 401s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

Contributions to a 401 are pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free when in retirement.

In a perfect scenario, youd have both in which to put aside funds for retirement. However, before you decide, there are several rules, income limits, and contribution limits that investors should be aware of before deciding which retirement account works best for them.

Here’s How To Divvy Up Your Retirement Savings

Forget about picking which stocks, mutual funds, or ETFs you might want to invest in. Figuring out which types of retirement accounts you should be funding, and in what order, can prompt a severe case of analysis paralysis all its own — especially if you’re one of the fortunate workers who have access to Roth IRAs, 401 plans, and health savings accounts.

You could list the pros and cons of 401s, HSAs, and Roth IRAs, and diagram the various IRS restrictions and tax implications associated with each of these accounts — and still be no closer to a decision about where to put your money.

Doing a personal analysis can be useful if it helps you get a better handle on your own situation. But if you’d prefer to start with a generally solid retirement contribution strategy for 2021, take a look at the framework below. It prioritizes contributions by account type in a waterfall format — meaning you’d start at the top and keep moving down the list until you’ve used up all the funds you have budgeted for retirement savings this year.

Also Check: Can You Have A Solo 401k And An Employer 401k

What Is An Ira Savings Account

An IRA savings account is a deposit account offered through a bank or savings and loan association that can be held within a traditional or Roth IRA. The advantage of this type of account is that it is insured by the Federal Deposit Insurance Corporation , a government-run agency that provides protection against losses if a bank or savings and loan association fails. The FDIC covers customer depositsup to $250,000 per account in most casesthat are held at FDIC-insured banks or savings and loan associations.

Contribution Limits For Roth Iras

For most households, the Roth IRA contribution limits in 2021 and 2022 will be the smaller of $6,000 or your taxable income. If you’re age 50 or older, you can make an additional $1,000 catch-up contribution.

Some may see a reduced contribution limit based on their modified AGI. If you make within $10,000 or $15,000 of the maximum modified AGI, you’ll have to do a little math.

- Take the maximum limit for your filing status and subtract your modified AGI.

- If you’re married filing jointly or separately and you lived with your spouse, take that number and divide by $10,000.

- Otherwise divide by $15,000.

- Multiply the resulting percentage by $6,000 . That’s your contribution limit for a Roth IRA.

For example, if you’re a married couple and you have a combined AGI of $200,000 in 2021, you’d:

- Subtract that amount from $206,000, the maximum AGI allowed to make any contribution. The result is $8,000.

- That number divided by $10,000 is 80%.

- 80% multiplied by $6,000 is $4,800. That’s the maximum amount you and your partner can each contribute to your Roth IRAs.

Importantly, the $6,000 contribution limit applies to all IRAs. The income limits for the Roth IRA apply only to Roth IRA contributions, so you could still contribute to a traditional IRA up to the $6,000 limit. Those contributions won’t be tax deductible, though, if your Roth contributions are limited by your income and you have a 401 at work.

Also Check: How Can I Find An Old 401k Account

You Can Afford To Contribute More Than You Can To An Ira

If you are under 50, you can only put $6,000 in an IRA, but up to $19,000 in a 401. After you turn 50, you can add an additional $1,000 to an IRA, but $6,000 more to your 401.

If $6,000 feels like a reach on its own, you may not want to contribute to a 401. But if a higher amount seems possible for you, it may be worth going for that 401 account.

How Much Should I Invest In A Roth 401

We recommend investing 15% of your income into retirement savings. If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth account. See? Investing for the future is easier than you thought!

Also Check: Why Cant I Take Money Out Of My 401k

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option. No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investing pro to open a Roth IRA. Just keep in mind that income limits do apply when you contribute to a Roth IRA.

Also Check: How To Find Lost 401k

Your Company May Offer A Roth Option

Many companies have added a Roth option to their 401 plans. After-tax money goes into the Roth, so you won’t see the immediate tax savings you get from contributing pretax money to a traditional plan. But your money will grow tax-free. account.)

For 2021, you can stash up to $19,500 a year, plus an extra $6,500 a year if you’re 50 or older, into a Roth 401. For 2022, workers can save $20,500 while those who are 50 and old can still contribute an extra $6,500. Contributions must be made by December 31 to count for the current tax year, and the limit applies to the total of your traditional and Roth 401 contributions. A Roth 401 is a good option if your earnings are too high to contribute to a Roth IRA.

Roth Ira Vs 401k Conclusion

Thats really as simply as I can answer the IRA vs 401K question.

Keep in mind that the maximum contributions for IRAs and 401Ks are completely separate and independent of each other. This is not an or choice. You can invest in both simultaneously, if youd like. In fact, Id encourage you to.

Also contributions to one dont count against the other. One happens to be with your employer and the other does not .

Also Check: Can I Rollover My 401k To A Roth Ira

Where Should I Invest After Maxing Out A Roth Ira And A 401

If you have access to a health savings account , this is a great and lesser-known third option for retirement investing. If you accumulate more money than you need for medical expenses in your HSA, you can withdraw this money for any reason with no penalty after age 65. You’ll just pay ordinary income tax on your withdrawals if you don’t use them for medical expenses. After that, you might want to look into standard, taxable investment accounts.