You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but there can be serious tax consequences.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Notify Fidelity That An Account Holder Has Died

Notify Fidelity immediately once an account holder has passed away. You can follow this link to get the ball rolling. Its not unusual for people to feel overwhelmed immediately after a loved one dies. Fidelity doesnt expect you to immediately start the closure process. But this will limit activity on the deceaseds accounts and ensure they stay secure until youre ready to continue the process. For this step, youll need the following information:

- Full name

- Social Security number

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

You May Like: Is Having A 401k Worth It

Contact Fidelity And Close Your Account

There are a few different ways to close your account. The most efficient way is to call Fidelity directly at 1-800-343-3548. You can speak to a representative that will guide you through the process of closing your account.

You can also log into your account online and transfer funds out of your account. Some people think just moving the funds out of the account is sufficient. However, you need to fully close the account. Leaving it open, even with a zero balance, leaves you at risk for fraudulent activity by an unauthorized user. You can send a message through the online chat to initiate the closing process.

Finally, you can visit a Fidelity branch in person. If you go that route, consider calling ahead to set up an appointment. That can make the process go much more quickly.

Placing Real Estate Investment Question:

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

Don’t Miss: How To Rollover 401k To New Employer

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Is Now A Good Time To Rebalance My 401k

At a minimum, you should rebalance your portfolio at least once a year, preferably on about the same date, Carey advises. You could also choose to do so on a more periodic basis, such as quarterly. An investor who rebalances quarterly would sell bonds and buy stocks to get back to a 60/40 portfolio mix.

Also Check: When You Leave A Job Where Does Your 401k Go

How Often Can You Reallocate 401k

Rebalancing How-To Financial planners recommend you rebalance at least once a year and no more than four times a year. One easy way to do it is to pick the same day each year or each quarter, and make that your day to rebalance. By doing this, you will distance yourself from the emotions of the market, Wray said.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Read Also: Is There A Limit On Employer 401k Match

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

You May Like: How To Avoid Taxes On 401k

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Investing In You And Your Future

After one year of service American will provide you with an employer contribution to your 401 account. The amount contributed will depend on your workgroup.

Team members with prior service or who transfer to American from one of its wholly owned subsidiaries will have their prior service at the subsidiary credited towards the one-year eligibility requirement and toward the service requirement for vesting full ownership of your 401 account balance.

American will contribute 16% of your eligible compensation to your 401 account up to the IRS limits. Participation is automatic, and you will be eligible for this nonelective company contribution* after completing one year of service.

If you do not have an investment election on file, your nonelective company contributions will be made to the Target Date Fund closest to the year you will turn age 65.

You are always 100% vested in your contributions, the nonelective company contributions and any associated earnings.

*A nonelective company contribution is a contribution to your 401 account that the company makes regardless of whether you are making your own contributions.

Flight Attendants receive a nonelective company contribution*, plus you are eligible to receive matching company contributions based on your eligible compensation. You become eligible to receive the following employer contributions after completing one year of service:

TWU-designated team members

Also Check: How Do I Take Money Out Of My Fidelity 401k

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Avoiding Roth Ira Charges

With Fidelity Roth IRAs, you can remove the original contributions without any penalties. Supposed you contributed $25,000 over some number of years and it grew to $27,500. You are permitted to withdraw the original $25,000 without any taxes or penalties, but not the $2,500 in growth. Withdraw that $2,500 and you have to pay 10 percent tax, with a few exceptions.

To avoid that tax, the account must be at least five years old. Besides that, you have to meet one of their listed requirements: The first to options are being at least 59½ years old or requiring the money due to a death or disability. You can also withdraw the $2,500 tax-free if you are at that age and need it for health insurance when unemployed, for medical expenses, qualified education expenses or a first-time home purchase.

U.S. News & World Report Money claims that as of 2020, account holders can also withdraw IRA money after having a child or adopting one. The IRS allows up to $5,000 without penalty, as long as it is taken with a year after the birth or adoption. This source also posts that military members who take an IRA distribution while serving may also be exempt, depending on the time served. There may be other exceptions if the withdrawals as done as a series of annuity payments or if it is an inherited IRA.

Read Also: How To Manage 401k In Retirement

Work With An Advisor For A Tailored Allocation Strategy

In addition to the above options, you can opt to have a financial advisor recommend a portfolio that is tailored to your needs. The advisor may or may not recommend any of the above 401 allocation strategies. If they pick an alternate approach, they will usually attempt to pick funds for you in a way that coordinates with your goals, risk tolerance, and your current investments in other accounts.

If you are married and you each have investments in different accounts, an advisor can be of great help in coordinating your choices across your household. But the outcome wont necessarily be betterand your nest egg wont necessarily be biggerthan what you can achieve through the first four 401 allocation approaches.

Also Check: How To Check How Much Is In Your 401k

How To Roll Over A 401 While Still Working

Your 401k contains cash for your golden years, but you may end up closing your account long before you quit work. You can close your account when you retire, change jobs and, in some instances, while still employed. When you terminate a 401k plan, though, you have to contend with taxes and penalties.

Recommended Reading: What Is The Best Fund To Invest In 401k

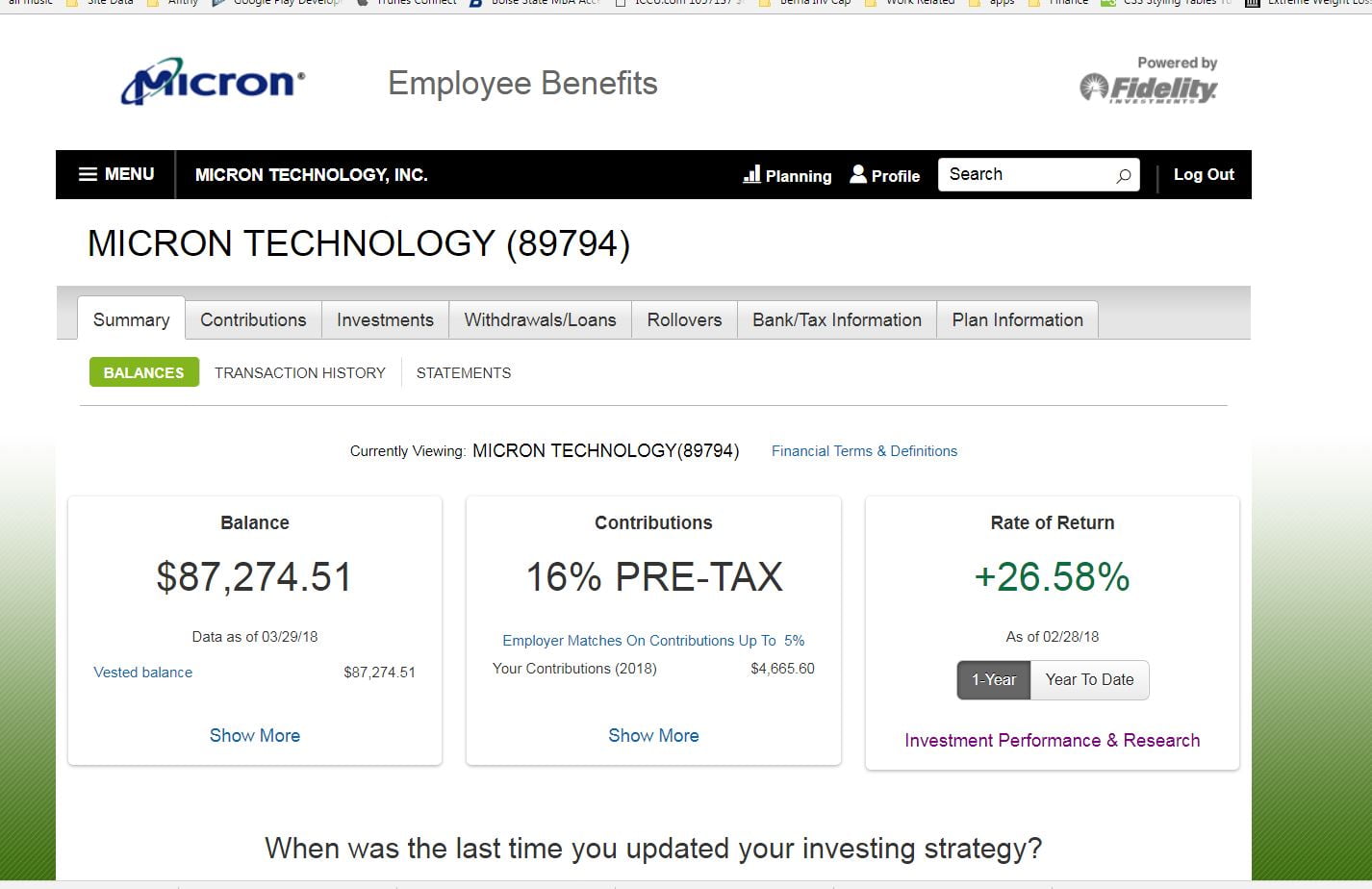

Your 401 Is A Big Part Of Your Retirement Savings But You Don’t Know The Last Time You Logged In

Effectively managing your investments and making the right financial decisions takes time, skill, and effort. Its not something you only need to do once. Your investment options change, the account needs to be rebalanced periodically, and as your 401 grows, you may benefit from a personalized investment mix rather than the age-based allocation in a target-date fund.

Regardless of whether you lack the time, desire, or investment acumen, the result is the same. Thankfully, it’s a solvable problem, and likely worth it have an advisor manage your retirement plan. Time is money, and theres a cost to delaying good financial decisions or extending poor ones, like keeping too much cash or putting off doing an estate plan.

Michael Solari Financial Advisor

You can certainly stop contributing to it when ever you’d like. However, most 401k plans will not allow you to roll it over until you either quit or retire. I wouldn’t recommend withdrawing it out because there are penalties that you will face.

My wife is a teacher in SC. My question is can she stop contributing to her 401k and once that is final can she then cash out her 401k? As of now, her only option is hardship, retiring or leaving her job. I thought this might be an option. If this is not, perhaps rolling it to a IRA and cashing out is an option.

Recommended Reading: How Can I Use My 401k To Pay Off Debt

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Roper St Francis Healthcare Retirement Plan

Whether your retirement is five or 50 years away, the Roper St. Francis Healthcare 403 retirement plan is a valuable teammate benefit and one of the most powerful ways to enhance your long-term financial well-being. We encourage you to invest in yourself and your future by participating in this plan through Fidelity Investments.

Your retirement savings plan is an important benefit, so you need the right information, resources, and support to help you make decisions with confidence. With more than 65 years of financial services experience, Fidelity can help you put a plan in place that balances the needs of your life today with your retirement vision for tomorrow.

How Do I Contact Fidelity Investments?

For service needs in addition to your RSFH Retirement Plan, stop by one of the Fidelity Investor Centers. To find the Investor Center nearest you, visit www.fidelity.com/branches/branch-locations.

How Do I Log-In To My Online Retirement Account?

If you already have a username and password with Fidelity, you can use your existing login information.

Why Save in the Roper St. Francis Healthcare Retirement Plan?

Who Is Eligible to Participate in the Retirement Plan?

Looking for More Ways to Boost Your Retirement Savings?

Here are just a few examples: *

How Do I Update My Name or Address on My Fidelity Investments Account?

How Do I Change My Investments?

Don’t Miss: Where Do I Go To Borrow From My 401k