Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

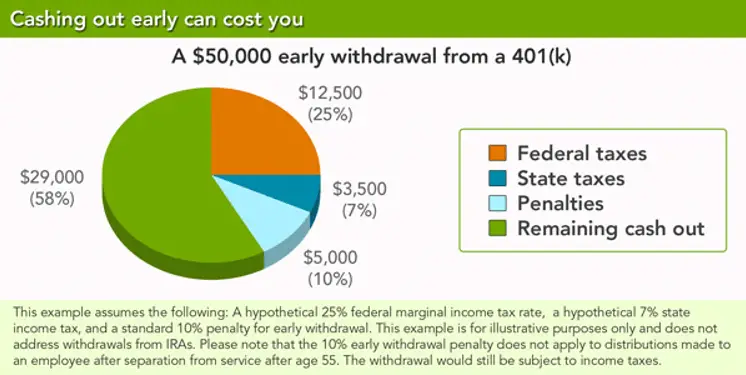

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

What Are The Minimums And Maximums For Online Cash Transfers

The minimum amount for a brokerage account transfer is $10. The maximum transfer into your Fidelity brokerage account is $100,000. The minimum amount for a Portfolio Advisory ServicesSM account transfer is $250. You cannot request to withdraw more than 25% of your Portfolio Advisory Services account’s net worth.

Retire With Peace Of Mind

Your withdrawal strategy matters in retirement. It can mean the difference between having funds to last you for the rest of your life or falling short. Itâs always best to research your options thoroughly and speak to a financial advisor to come up with a plan that works for you.

* Non-deposit investment products and services are offered through CUSO Financial Services, L.P. , a registered broker-dealer Member FINRA/SIPC and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2018.

You May Like: Can You Roll Over 403b To 401k

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Also Check: What Happens To My 401k When I Leave My Job

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Recommended Reading: When Can You Get Your 401k

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Automatic Enrollment Or Making Changes

Enrollment is Automatic for All Employees

Participation in the Supplemental Retirement and Savings Plan is automatic for all employees. You will automatically be enrolled to contribute 3% of your eligible compensation, as defined under the BU Retirement Plan, on a tax-deferred basis and your contribution will be invested in a Vanguard Target Date Fund closest to the year in which you will turn age 65. Your first contribution to the plan will commence in the month following your hire date.

You may change or stop your contribution at any time. You may also change the investment allocation of your contributions at any time.

Automatic Enrollment and BU Matching Contribution After Two Years of Service

Once you have completed two years of service with at least a nine-month assignment at 50% or more of a full-time schedule, you will be eligible to receive the University matching contributions to the Boston University Retirement Plan.

In addition, you will automatically be enrolled in the Supplemental Retirement and Savings Plan to contribute 3% of your eligible compensation as defined under the BU Retirement Plan on a tax-deferred basis if you are not already doing so when you complete two years of service. BU matches your contribution dollar-for-dollar up to 3% of your eligible compensation as defined under the BU Retirement Plan.

You may make the following changes at any time:

Read Also: How To Find 401k Balance

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Roll Over Your Assets To An Ira

For more retirement investment options and to maintain the tax-advantaged status of the account, roll your old 401 into an individual retirement account . You will have greater flexibility over access to your savings .1 Before-tax assets can roll over to a Traditional IRA while Roth assets can roll directly to a Roth IRA. Review the differences in investment options and fees between an IRA and your old and new employers 401 plans.

You May Like: How Do You Take Money Out Of 401k

Read Also: How To Get Money From 401k After Retirement

Contributing To Your Mit 401 Account

You contribute to your 401 account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of both. You may change your contribution preferences any time through Fidelity NetBenefits.

Your contributions are sent to Fidelity Investments at the end of each pay period. You may contribute as little as 1% and as much as 95% of your salary after amounts for Social Security and Medicare taxes and health and dental insurance have been subtracted. You may start, stop, or change your deferral or investment elections at any time.

Federal law limits the amount of your pay each year that may be recognized for determining your allowable contribution. In 2021, MIT can consider only the first $290,000 of pay for calculating your allowable contributions. This means that if your annual compensation exceeds $290,000, MIT Payroll will take 401 deductions from your pay until your pay for the year reaches $290,000, or one of the other 401 program limits has been reached .

Contribution limits

What MIT contributes to your 401 Plan

- MIT matches your 401 contributions dollar-for-dollar up to the first 5% of your MIT pay .

- MIT only contributes a match during months in which you have made a contribution

- The MIT match is provided pre-tax, and therefore is fully taxable when you withdraw your matching contributions from the plan, along with associated investment earnings.

When contributions are invested in your 401 account

Financial Hardship Withdrawal Process

- If you are married, your spouse must sign in the presence of a notary public.

- Mail completed forms and copies of your supporting documentation directly to Fidelity at the address on the form. Do not mail your Fidelity forms to Vanderbilt Human Resources.

Note: The Office of Benefits Administration no longer handles hardship distribution or loan request forms. Mail these forms directly to Fidelity to the address on the form.

You May Like: How To Transfer 401k Between Jobs

How To Apply For A Loan

Current faculty and staff who are a participant in the Plan, are eligible to take a loan against their voluntary, pre-tax account balance held at Fidelity . You may apply for a loan by calling Fidelity at 800.343.0860. Your application will specify the amount you wish to borrow and the duration of the loan, in whole months. If you are married, spousal consent is required.

Before requesting a loan, you should be aware of the general provisions of the loan program:

- You can have only one outstanding loan at any time.

- The minimum amount you can request is $1,000.

- You may not borrow more than 50% of your total balance in your Plan accounts reduced by your highest outstanding loan balance during the one-year period ending on the day before your new loan is made.

- The interest rate is the prime rate plus 1% The prime rate is determined using the rate published by Reuters and is updated quarterly.

- The term for repayment of the loan may not exceed 5 years , unless the loan is extended due to a leave of absence for military service.

- A $75.00 non-refundable loan application fee will be withdrawn from your account each time a loan is issued to you. A $25 loan maintenance fee will also apply to each loan.

- Loan repayments must be made monthly on a level repayment schedule through ACH debit from your bank account.

To learn more about or request a loan, log on to Fidelity NetBenefits at www.netbenefits.com/vanderbilt or call the Fidelity Retirement Service Center at 1.800.343.0860.

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Don’t Miss: Can I Have A Personal 401k

Because You Asked: How Long Does It Take To Cash Out 401k After Leaving Job

Not every job works out the way you might have hoped. Whatever your reason is for looking for a new employer, you’re probably wondering about cashing out your 401 k from your old job if you’re quitting before you reach retirement age. Depending on your individual retirement account, this may involve penalties.

This article discusses how long it might take for you to cash out your 401 k once you’ve left your job. It also goes over your possibilities for doing so and the different types of 401 k account you can have. If you don’t want to cash out the old account, you can generally transfer the money to a new 401 k plan or IRA account. It would help if you decided this based on any potential penalties and your investment options.

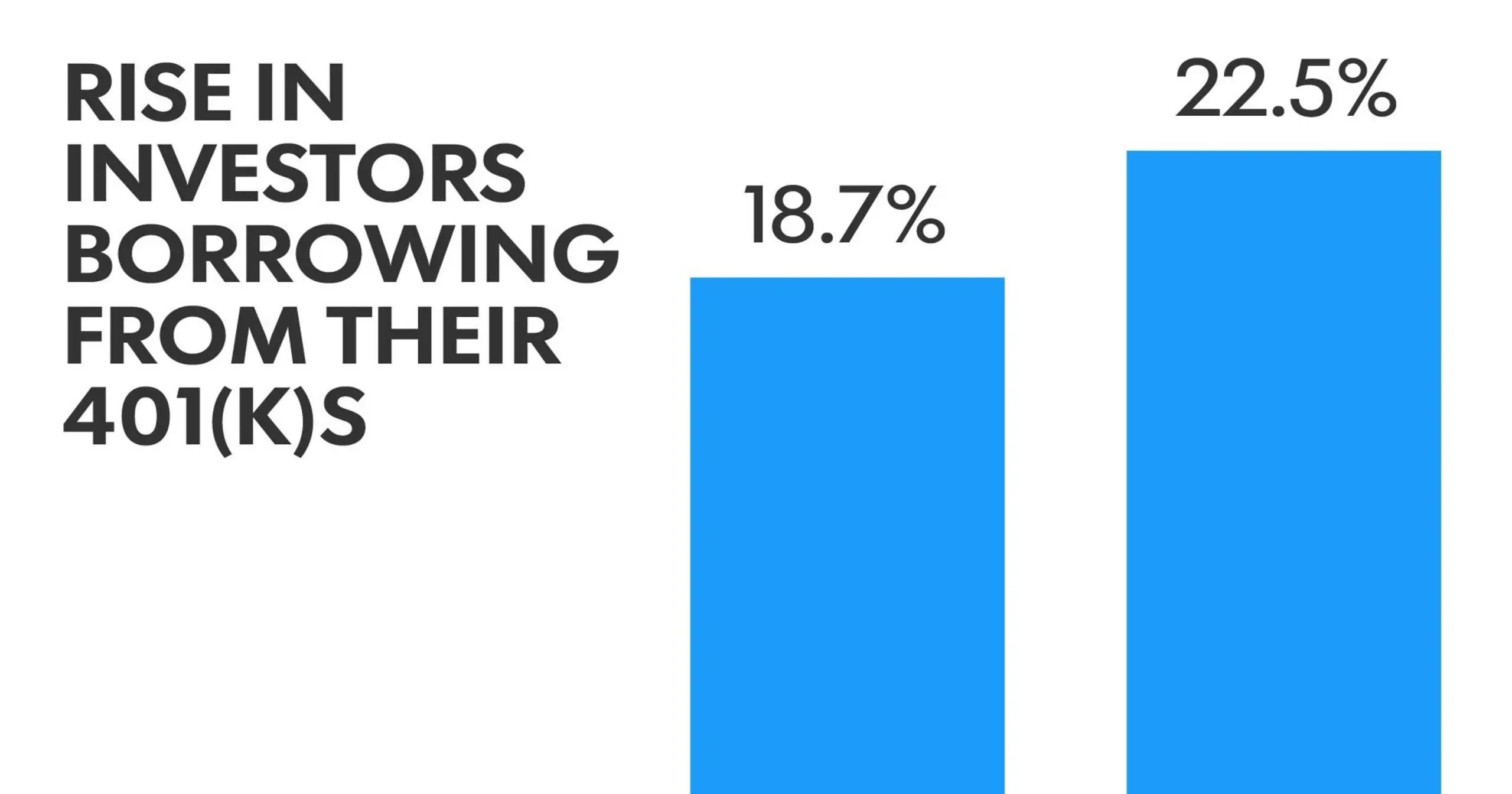

When You Can Borrow

Once you pull money out of your plan, those dollars no longer benefit from long-term market returns.

If you have a pool of emergency funds, it’s best to use that money first. If you’re managing debt, it’s even better to build that repayment into your budget.

Even your boss wants you to keep your hands off your retirement plan savings.

That said, here are three extreme cases that may warrant a 401 loan.

You have an immediate emergency.“Say that you need to meet the deductible on your high-deductible health-care plan, and you have no money in your health savings account,” said Aaron Pottichen, president of retirement services at CLS Partners in Austin, Texas.

He is referring to the tax-advantaged health savings account that individuals may use to cover qualified medical expenses. It’s also known as an HSA.

You have an urgent cash need, but your credit precludes you from obtaining a competitive interest rate. Ask yourself what you can repay in five years.

You need to pay off high-interest debt that’s hampering your long-term financial goals. This is the case if the interest rate on your 401 is lower than what your creditor is offering you.

“If you’re in ‘pay down debt mode,’ it’s all about what’s your cheapest interest rate and how fast can you get the debt down,” said Pottichen.

Read Also: How To See How Much Is In Your 401k

What Is The Compensation Plan For Employees With Higher Compensation

There are also additional contribution restrictions for employees that are highly compensated defined by the IRS for a 401k plan.

For an employee that is highly compensated, they meet one of these qualifications:

1. They have 5% ownership of the business sponsoring the plan at any point in the previous year. This 5% includes both individual holdings and that of relatives working for the company.

2. They earn more than the slated annual compensation limit by the IRS. For 2021, we have a limit of $130,000. There can also be a specification that states that the individual must be in the top 20% when it comes to compensation.

To maintain the ERISA directives, employees with higher compensation can make contributions from their salary that is 2% more than normal employees. Since the average employee contributes 5%, employees with higher compensation contribute 7%.

That might be a bit difficult since the limit is based on employees contributions and compensation. Also, when you fail to make contributions in the calendar year, you lose the chance to do so. And you will not know your actual contribution limit until the early part of another year.

It is best to contribute an amount that matches the standard contribution limit and let the administrator decide if it is more than you should contribute. When you do this, the excess will be returned to you, and you will owe income taxes on the entire amount. The principal and the earnings are inclusive.

Leave The Money Where It Is

Assuming your current employer allows it not all do you may decide to leave your 401 right where it is.

If the plan has top-notch, low-cost investment options, this might not be a bad choice.

Know that when leaving money behind in a 401, there may be restrictions on whether you can take a loan against that account or on the size of any pre-retirement withdrawals you might make so check the rules of the plan before making your final decision.

The decision to stay with your current plan, however, might not be yours to make if your balance is below $5,000. A majority of workplace plans will require that you transfer the balance elsewhere or cash it out, according to the most recent survey of workplace retirement plans by the Plan Sponsor Council of America.

If your balance is over $5,000 but your current plan doesn’t have great, low-cost investments, you might be better off transferring the money to another tax-advantaged retirement account .

The same is true if you already have several other existing retirement accounts at old employers.

“A really bad outcome is to have lots of little accounts scattered around. It’s easy to forget about them. It doesn’t let you appreciate how much you’ve really saved. And the odds of screwing something up gets higher,” said Anne Lester, the former head of retirement solutions at JP Morgan Asset Management who founded the Aspen Leadership Forum on Retirement Savings in partnership with AARP.

You May Like: How To Roll An Old 401k Into A New 401k