Make It Easy To Enroll In Your Plan

The quick enrollment feature allows employees to sign up for a retirement plan in four clicks. When you integrate payroll, you can easily see who is eligible for your chosen retirement plan. This means you don’t have to track eligibility separately, saving you time to focus on your business.

How Long Does It Take For An Investment To Double In Value If It Is Invested At 5% Compounded Monthly

So about 92.77 months until the amount doubles. You can always use the NPER function in Excel to find the number of periods. I set this up in Excel with 100 as the present value and 200 as the future value .

How long does it take for an investment to double in value if it is invested at 3% compounded continuously?

Originally answered: How long does it take to double your money at 3 percent annual interest with monthly interest? A = P ^ n, where A = amount, P = capital r = interest rate in% per period and n = number of periods. It would take 277.60 months or 23.13 years for the school principal to double.

How long does it take for an investment to double in value if it is invested at compounded continuously?

The result is the approximate number of years it would take for your money to double. For example, if an investment program promises a cumulative return of 8% per year, it takes about nine years to double the money invested.

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

Read Also: Should I Rollover My 401k Into An Ira

Cut Off Date For Making Contributions To 401

Using a 401 plan to save for retirement allows you to put your savings on autopilot with automatic payroll deductions. In addition, you receive tax breaks for your contributions, and the earnings arent taxed until you take distributions from the account. However, to make sure youre on track for the retirement of your dreams, you need to keep tabs on your 401 balance from time to time. In addition to knowing your 401 balance, its also important for you to know how much of your account has vested, especially if youre considering changing jobs in the near future.

Where Has My 401 Gone

There are a few scenarios in which someone might lose track of their 401.

If you did a bit of job-hopping early in your career, you may have moved on and forgotten about your 401 plan. Or perhaps your company merged with another, but your 401 plan didnt transfer over. In other cases, you may have automatically enrolled in your companys 401 plan without realizing it.

You know all the paperwork from human resources you ignored? The information youre looking for probably was in there.

Regardless of why you lost track of a 401 plan, the good news is that whatever contributions you made no matter how long ago that may have been are yours to keep and always will be. Heres what you need to know to track down your old 401 and make it work in your favor again.

Don’t Miss: What’s The Maximum Contribution To A 401k

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

You may be allowed to leave your money in your old plan, but you might not want to.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Heres how to decide whether to keep your money in an old 401.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

Who Does Walmart Use For 401k

Simply go to WalmartOne.com/Enroll or WIRE and select I want to contribute to the Walmart 401 or Associate Share Purchase Plan. Or visit Benefits OnLine at Benefits.ml.com or call Merrill Lynch at 968-4015.

What happens to my 401k when I leave Walmart? You will no longer be able to fund the Walmart 401 plan after you split from the company. You cannot continue participating in the 401 plan after you cancel, but your account will remain on the plan until you receive a payout of all of your vested plan balance.

Recommended Reading: How To Take Out 401k Money For House

How Many People Have 401k Money

How many Americans have 401 s? In 2020 there were approximately 600,000 401 plans with approximately 60 million active subscribers and million former employees and retirees.

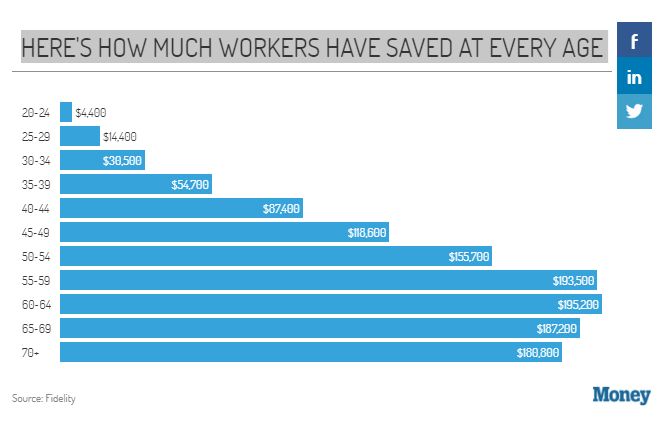

How much does the average person have in their 401k?

The average 401 balance is $ 106,478, according to Vanguards 2020 analysis of over 5 million plans. But most people havent saved that much for retirement. The median balance of 401 is $ 25,775, a better indicator of what Americans have been saving for retirement.

How many people have $1000000 in their 401k?

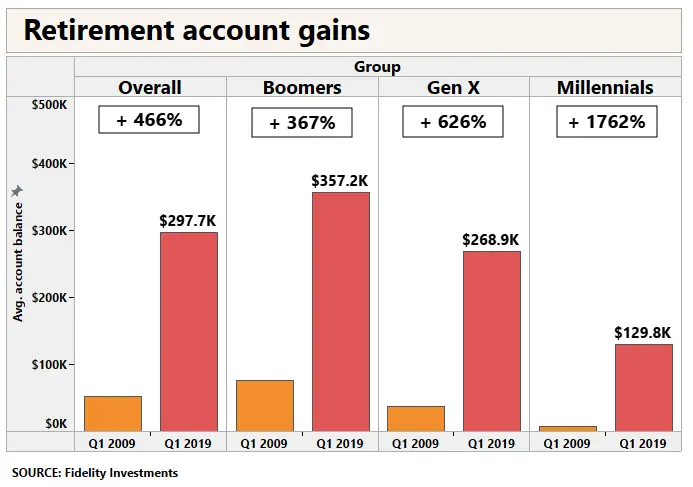

The number of 401 accounts with $ 1 million or more with Fidelity Investments rose 84% year over year to 412,000, while the number of seven-digit IRAs in the 12 months ended the second quarter, Fidelity said .

How Many 401k Millionaires Are There

As a result, the number of 401 and IRA millionaires also hit new highs. The number of Fidelity 401 plans balancing $ 1 million or more rose to a record 412,000 in the second quarter of 2021. The number of IRA millionaires rose to 342,000, also an all-time high.

What Age Should You Be a 401,000 Millionaire? Recommended 401,000 Amounts by Age Middle-aged savers should be able to become 401,000 millionaires by around 50 years of age if they have reached their 401,000 and invested properly since they were 23.

Recommended Reading: How To Rollover 401k From Principal

What To Do With A Lost Retirement Account When You Find It

Once youve found a lost retirement account, what you do with it depends on what type of plan it is and where its located.

Old 401k balances can be rolled into your current employers plan or rolled into an IRA in a trustee-to-trustee transfer. You can also request a payout of the plan balance, but if you are under the age of 59.5, the payout will be subject to income taxes and a 10% penalty for early withdrawal.

If you find an old pension through the PBGC, youll have to go through a process to verify your identity. Once the PBGC has established that you are owed the benefits, you can apply for them at any time once youve reached retirement age.

Its not uncommon for former employees to leave funds in a former employers retirement plan, believing theyll get around to dealing with it later. Years pass by, and maybe youve forgotten about a few old accounts. Even if they didnt amount to much at the time, a few hundred dollars here and there combined with some market growth over the years just might add up to a nice addition to your retirement savings. Its worth a look!

What Is A Good Monthly Retirement Income

The average retirement income for seniors is about $ 24,000 however, the median income can be much higher. On average, seniors make between $ 2,000 and $ 6,000 a month. Older retirees tend to earn less than younger retirees. It is recommended that you save enough to replace 70% of your monthly income before retirement.

What is a comfortable monthly retirement income? With that in mind, assume that you will need around 80% of your early retirement income to cover your living expenses in retirement. In other words, if you are making $ 100,000 now, you will need about $ 80,000 a year on this principle.

Don’t Miss: How To Invest Money From 401k

How To Find Your 401 Statement From Pai

If you have a 401 account with PAi and are looking for your 401 statements,log into your account and click the View Statements quick link on the righthand side of the home page, or navigate to Documents > Statements. Youll see both current and past statements from this page, and you can also manage your statement delivery method if youd like to change how you receive your statements.

To create an on demand statement for a custom date range, scroll to the bottom of the Statements page and expand the On Demand section. From there, enter the beginning and end date and click View.

If you have both an employer account and an individual account, double check that you are signed in as a participant, not an Employer.

If You Find The Money

What to do with your 401 funds when you find the account largely depends on where you find it.

If the account resides in your employers plan, you do have the option to leave the money and the account there just note you can no longer contribute money to it.

To get back in the game with your sidelined 401, roll it over into an individual retirement account or a current employers 401 plan. That way you can put the fund money to work by investing in stocks, bonds and funds that appreciate in value and accumulate more money for your retirement, on a tax-efficient basis.

Recommended Reading: What Year Did 401k Start

Read Also: How To Switch 401k To Ira

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

What Happens To My 401k If I Quit My Job

If you leave a job, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. If you decide to roll over your money to an IRA, you can use any financial institution you choose you are not required to keep the money with the company that was holding your 401 .

You May Like: How To Transfer 401k To Different Company

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Don’t Miss: Should I Move My 401k To Bonds 2020

How To Find Out If You Had A 401

Keeping track of your 401 benefits is essential to retirement planning.

Saving enough money to retire often means taking advantage of multiple retirement savings accounts. Employers only match your 401 contributions while you are on the payroll. However, the money in your account still belongs to you after you leave your job. If you aren’t sure if you had a 401 with a previous employer, there are several ways to find out.

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

You May Like: What To Do With 401k When You Leave Your Job

A National Database To Find Forgotten 401s And Pensions Could Be On The Way But Savers Should Take Action Now To Locate Any Missing Retirement Accounts

At a time when many Americans are worried that they wont have enough money to retire comfortably, thousands have lost track of billions of dollars in savings.

There are more than 24 million forgotten 401 accounts containing some $1.35 trillion in assets, according to a report from Capitalize, which helps workers roll over their retirement plans when they change jobs. Companies are also holding on to billions in unpaid pension payments earned by former employees.

The problem is so widespread that Congress is considering legislation to address it. SECURE Act 2.0, which includes a wide range of benefits and protections for retirement savers , would create a national online lost-and-found database to help people track down these orphaned plans.

Brian Stivers, owner of Stivers Financial Services, in Knoxville, Tenn., says he typically meets one to two new clients a month who are in this situation. Most of the time, theyve changed jobs and forgotten about an old plan, usually because it had a small balance. Retirement plans are also misplaced when one spouse dies and the survivor is unaware of accounts with his or her former employers.

How To Find Old 401 Accounts

To corral all your accounts, you first must locate all your retirement plans. This is often the most time-consuming step in the process of organizing and streamlining your retirement portfolio, as youll sometimes have to do a bit of legwork to identify and find your old plans. The more jobs youve held, the more work youll need to do if you havent already rolled over those plans into other retirement accounts.

These suggestions can help you figure out how to find your 401k.

Read Also: How Do I Find Out What My 401k Balance Is